To file a renters insurance claim, you need to provide a completed claim form, a detailed inventory of damaged or stolen items, and proof of ownership such as receipts or photos. Include a police report for theft claims and any repair estimates or invoices for property damage. Timely submission of these documents ensures a smoother claims process and faster reimbursement.

What Documents are Needed for Renters Insurance Claims?

| Number | Name | Description |

|---|---|---|

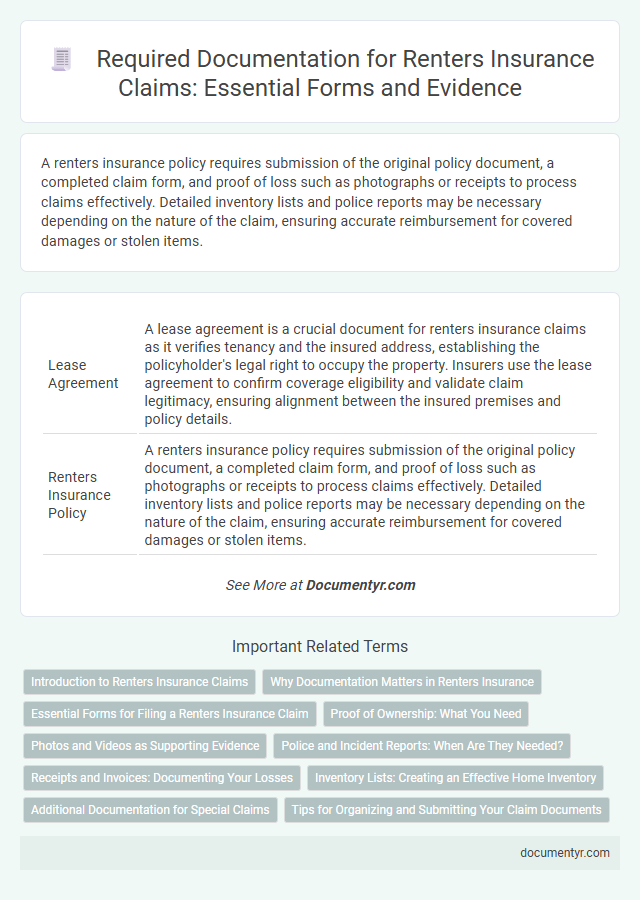

| 1 | Lease Agreement | A lease agreement is a crucial document for renters insurance claims as it verifies tenancy and the insured address, establishing the policyholder's legal right to occupy the property. Insurers use the lease agreement to confirm coverage eligibility and validate claim legitimacy, ensuring alignment between the insured premises and policy details. |

| 2 | Renters Insurance Policy | A renters insurance policy requires submission of the original policy document, a completed claim form, and proof of loss such as photographs or receipts to process claims effectively. Detailed inventory lists and police reports may be necessary depending on the nature of the claim, ensuring accurate reimbursement for covered damages or stolen items. |

| 3 | Claim Form | The claim form is a critical document for renters insurance claims, requiring detailed information about the loss, policyholder, and covered property. Accurate completion of the claim form, along with supporting documents such as proof of loss and photos, ensures a smoother claim processing. |

| 4 | Police Report (if applicable) | Renters insurance claims require critical documents including the police report, which is essential for theft, vandalism, or property damage incidents to verify the claim's legitimacy and provide official documentation. Policyholders should also provide a detailed inventory of damaged or stolen items, proof of ownership, and any repair estimates to streamline the claims process. |

| 5 | Inventory List of Damaged/Lost Items | An inventory list of damaged or lost items for renters insurance claims should include detailed descriptions, purchase dates, original costs, and estimated values or repair costs. Photographs, receipts, and serial numbers enhance claim accuracy and expedite the reimbursement process. |

| 6 | Photos/Videos of Damaged Property | Photos and videos of damaged property provide critical visual evidence for renters insurance claims, documenting the extent and specific details of the loss. Insurers rely on these images to verify damage, assess claim validity, and expedite the reimbursement process. |

| 7 | Proof of Ownership (receipts, invoices, appraisals) | Proof of ownership is crucial for renters insurance claims and typically includes receipts, invoices, and professional appraisals that verify the existence and value of the insured personal property. Providing detailed documentation such as purchase dates, item descriptions, and value assessments ensures faster claim processing and accurate reimbursement. |

| 8 | Repair/Replacement Estimates | Repair and replacement estimates from licensed contractors or certified professionals are essential documents for renters insurance claims to validate the cost of damages or lost property. These detailed estimates help insurers assess the claim value accurately and expedite the approval process. |

| 9 | Communication Records (emails, letters with landlord or insurance) | Effective renters insurance claims require comprehensive communication records, including emails and letters exchanged with both the landlord and the insurance company, to validate the claim details and timeline. These documents serve as critical evidence supporting the incident report, damage assessment, and policy compliance during the claims process. |

| 10 | Witness Statements (if applicable) | Witness statements provide crucial third-party verification of the incident, enhancing the credibility of renter insurance claims. Including detailed, signed statements can expedite the claims process by corroborating timelines, damages, and circumstances surrounding the event. |

| 11 | Emergency Services Report (fire department, etc.) | To support renters insurance claims, submitting an Emergency Services Report, such as a fire department statement, is crucial for verifying the incident's occurrence and extent of damage. These official reports provide detailed documentation necessary for claim validation and expedite the assessment process. |

| 12 | Bank Statements (for proof of value/transactions) | Bank statements serve as critical evidence in renters insurance claims by verifying the purchase date and value of personal property lost or damaged. Insurers rely on these documents to confirm transactions, ensuring accurate claim assessments and timely reimbursements. |

| 13 | Temporary Housing Receipts (if Additional Living Expenses claimed) | Temporary housing receipts are essential for renters insurance claims involving Additional Living Expenses (ALE) to verify costs incurred during displacement. Submit detailed invoices or receipts for hotel stays, short-term rentals, or alternative accommodations to ensure proper reimbursement under the policy terms. |

| 14 | Proof of Loss Document | The Proof of Loss document is essential for renters insurance claims, detailing the date, cause, and extent of the loss along with a comprehensive list of damaged or stolen items. Insurers require this form, often supported by receipts, photos, and police reports, to validate and process the claim efficiently. |

| 15 | Identification (ID, driver’s license) | For renters insurance claims, providing valid identification such as a government-issued ID or driver's license is essential to verify the policyholder's identity and expedite the claims process. Insurers require these documents to prevent fraud and ensure claims are accurately matched to the correct account. |

Introduction to Renters Insurance Claims

Filing a renters insurance claim requires specific documents to ensure a smooth and timely process. Understanding what paperwork is essential helps protect your belongings and receive appropriate compensation.

- Proof of Loss - A detailed inventory of damaged or stolen items including descriptions, purchase dates, and values.

- Policy Information - A copy of your renters insurance policy outlining coverage limits and conditions.

- Supporting Evidence - Photos, videos, or receipts that validate the claim and demonstrate the extent of damage or loss.

Gathering these documents prepares you for an efficient renters insurance claims experience.

Why Documentation Matters in Renters Insurance

Proper documentation is essential for renters insurance claims because it provides concrete proof of ownership and the extent of damage or loss. Detailed records, including photos, receipts, and inventory lists, help expedite the claims process and ensure accurate reimbursement. Clear documentation reduces disputes and supports the policyholder's case, making claims smoother and more efficient.

Essential Forms for Filing a Renters Insurance Claim

Filing a renters insurance claim requires specific documents to ensure a smooth process. Essential forms include a completed claim form, proof of loss, and a copy of the lease agreement.

Supporting documents such as photos of the damaged property, receipts for purchased items, and a police report if applicable, strengthen the claim. It's important to provide detailed inventory lists to verify stolen or damaged belongings. Contacting your insurance agent promptly helps clarify any additional documentation needed for your renters insurance claim.

Proof of Ownership: What You Need

Proof of ownership is essential for renters insurance claims to verify the items lost or damaged. Receipts, credit card statements, photos, or videos showing the belongings serve as strong evidence. Keep detailed records and inventories of personal property to streamline the claims process.

Photos and Videos as Supporting Evidence

What documents are essential for renters insurance claims? Clear photos and videos of the damaged property provide crucial evidence for claim approval. These visual records help validate the extent of the loss and support the written documentation submitted to the insurer.

Police and Incident Reports: When Are They Needed?

Police and incident reports are crucial documents for renters insurance claims when the loss involves theft, vandalism, or other criminal activities. These reports provide official documentation that verifies the event and supports the legitimacy of the claim.

Insurance companies often require a police or incident report to process claims related to stolen or damaged property. Filing these reports promptly ensures that your claim is not delayed or denied due to lack of evidence.

Receipts and Invoices: Documenting Your Losses

Receipts and invoices are essential documents when filing renters insurance claims because they provide proof of ownership and value of your personal property. These records help the insurance adjuster verify the items lost or damaged during the covered event.

Keep original or digital copies of receipts and invoices for all significant purchases, including furniture, electronics, and valuables. Detailed documentation speeds up the claims process and increases the likelihood of a full reimbursement for your losses.

Inventory Lists: Creating an Effective Home Inventory

Creating an effective home inventory is essential for renters insurance claims. Detailed and organized documentation speeds up the reimbursement process and ensures accurate coverage.

- Comprehensive Listing - Include all personal property with descriptions, purchase dates, and values to support claim accuracy.

- Photographic Evidence - Capture clear photos or videos of each item to provide visual proof during claim submissions.

- Secure Storage - Keep the inventory list and supporting documents in a safe, accessible place such as a digital cloud or external hard drive.

Additional Documentation for Special Claims

Filing renters insurance claims requires specific documentation to ensure a smooth process. Special claims often need additional paperwork beyond the standard proof of loss and identification.

- Police Report - Required for claims involving theft or vandalism to validate the incident.

- Repair Estimates - Necessary for damage claims to verify the cost of restoring or replacing property.

- Medical Records - Important for injury-related claims to document treatment and expenses.

What Documents are Needed for Renters Insurance Claims? Infographic