Flood insurance applications typically require proof of property ownership, such as a deed or mortgage statement, and detailed information about the property's location and construction. Applicants must also provide elevation certificates prepared by a licensed surveyor to assess flood risk accurately. Additionally, supporting documents like photographs of the property and prior flood loss history are often necessary to complete the application process.

What Documents are Needed for Flood Insurance Application?

| Number | Name | Description |

|---|---|---|

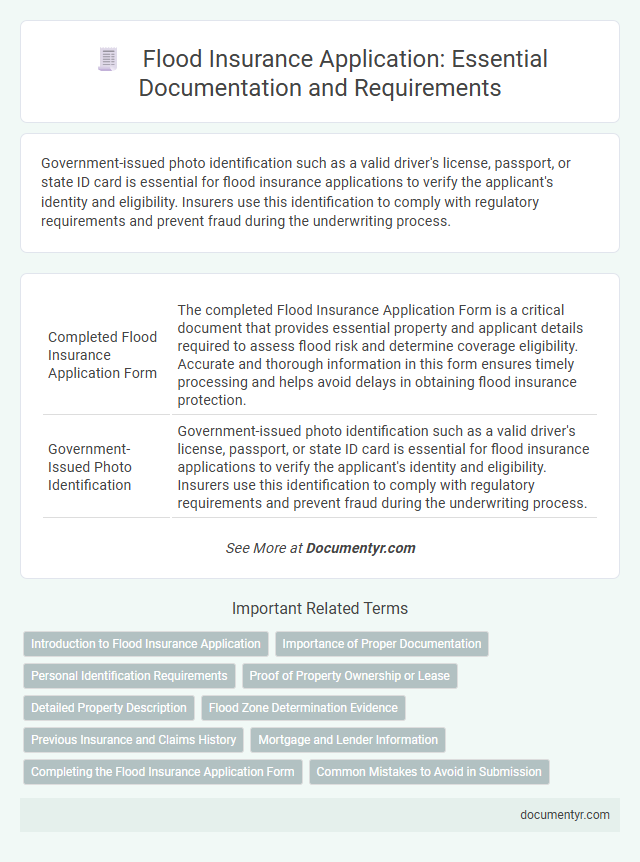

| 1 | Completed Flood Insurance Application Form | The completed Flood Insurance Application Form is a critical document that provides essential property and applicant details required to assess flood risk and determine coverage eligibility. Accurate and thorough information in this form ensures timely processing and helps avoid delays in obtaining flood insurance protection. |

| 2 | Government-Issued Photo Identification | Government-issued photo identification such as a valid driver's license, passport, or state ID card is essential for flood insurance applications to verify the applicant's identity and eligibility. Insurers use this identification to comply with regulatory requirements and prevent fraud during the underwriting process. |

| 3 | Proof of Property Ownership (Deed, Title, Mortgage Statement) | Proof of property ownership is essential for a flood insurance application and typically includes documents such as a deed, title, or mortgage statement, which verify legal ownership and eligibility for coverage. These documents ensure the insurer accurately identifies the insured property and assesses risk based on ownership details. |

| 4 | Elevation Certificate | An Elevation Certificate is a critical document for a flood insurance application, providing precise measurements of a property's elevation relative to the base flood elevation to assess flood risk accurately. This certificate, typically prepared by a licensed surveyor or engineer, helps determine premium rates and eligibility for certain policy discounts under the National Flood Insurance Program (NFIP). |

| 5 | Flood Zone Determination Letter | A Flood Zone Determination Letter is essential for a flood insurance application as it verifies the property's flood risk based on FEMA maps and local floodplain data. This document ensures accurate assessment of coverage needs and premium rates by identifying whether the property lies within a high-risk flood zone. |

| 6 | Recent Property Tax Assessment | A recent property tax assessment is a crucial document for flood insurance applications as it verifies the current value and ownership of the property, ensuring accurate risk evaluation. This assessment helps insurers determine the appropriate coverage and premium by reflecting the latest property details reported to local tax authorities. |

| 7 | Proof of Residency or Occupancy (Utility Bill, Lease Agreement) | Proof of residency or occupancy, such as a recent utility bill or a valid lease agreement, is essential for a flood insurance application to verify the insured property's address. These documents help insurers assess risk accurately and confirm eligibility for flood coverage based on the property's location. |

| 8 | Photos of Property (Exterior and Interior) | Flood insurance applications require clear photos of the property's exterior and interior to document its current condition and assess flood risk accurately. Providing recent images of foundation, walls, utilities, and any existing damage helps insurers evaluate eligibility and determine appropriate coverage levels. |

| 9 | Previous Insurance Policy Documents (if applicable) | Previous insurance policy documents are essential for flood insurance applications as they provide proof of coverage history and help assess risk accurately. These documents typically include prior flood insurance declarations, claims records, and policy endorsements, which streamline underwriting and premium determination. |

| 10 | Mortgage Lender Information | Flood insurance applications require detailed mortgage lender information, including the lender's name, address, and loan number, to verify the loan's compliance with floodplain management regulations. Providing accurate mortgage lender details ensures proper policy issuance and helps streamline the approval process for federally mandated flood insurance coverage. |

| 11 | Property Survey or Site Plan | A Property Survey or Site Plan is essential for a flood insurance application, providing detailed information on the property's layout, boundaries, and elevation relative to flood zones. Accurate elevation data from these documents helps insurers determine flood risk and calculate appropriate premium rates. |

| 12 | Building Plans or Blueprints | Building plans or blueprints are essential documents for a flood insurance application as they provide detailed information about the property's structure, including foundation elevation, materials, and design features critical for flood risk assessment. Insurers use these plans to evaluate vulnerability to flood damage and determine accurate premium rates. |

| 13 | Contact Information of Applicant | Flood insurance applications require accurate contact information from the applicant, including full name, phone number, email address, and physical mailing address to ensure proper communication and verification. Providing updated contact details helps expedite policy processing and enables timely notifications regarding coverage status and claims. |

| 14 | Proof of Loss History (if any) | Proof of Loss History documents, including previous flood damage claims and corresponding settlement paperwork, are essential for accurately assessing risk in flood insurance applications. These records help insurers evaluate prior flood incidents, determine premiums, and verify eligibility for coverage. |

Introduction to Flood Insurance Application

What documents are needed for a flood insurance application? Flood insurance applications require specific documentation to assess risk accurately. Providing the correct paperwork ensures timely processing and appropriate coverage.

Importance of Proper Documentation

Proper documentation is crucial when applying for flood insurance to ensure accurate risk assessment and policy approval. Missing or incorrect documents can lead to delays or denial of coverage.

- Proof of Property Ownership - Confirming ownership establishes eligibility for flood insurance coverage on the specific property.

- Flood Risk Information - Details about the property's location in relation to flood zones help determine premium rates and coverage limits.

- Previous Flood Claims - Records of past flood damage claims affect underwriting decisions and policy conditions.

Personal Identification Requirements

When applying for flood insurance, personal identification is a crucial requirement to verify the applicant's identity. Acceptable documents typically include a government-issued photo ID such as a driver's license or passport.

Applicants may also need to provide proof of residency, like utility bills or a mortgage statement, to confirm the insured property's location. These documents help ensure eligibility and accurate policy issuance for flood insurance coverage.

Proof of Property Ownership or Lease

Proof of property ownership or lease is essential when applying for flood insurance. Providing accurate documentation ensures a smooth application process and verifies your eligibility.

- Property deed - This legal document confirms you own the property and is a primary form of ownership proof for insurance purposes.

- Lease agreement - If you are renting, a valid lease agreement shows your right to occupy the property and is necessary for coverage consideration.

- Title report - This report provides detailed information about the property ownership history and any existing liens, supporting your ownership claim.

Detailed Property Description

A detailed property description is essential for a flood insurance application to accurately assess risk and coverage. This includes the property's exact address, construction type, elevation, and any flood mitigation measures in place. Providing clear and comprehensive information helps insurers determine proper premium rates and ensure adequate protection.

Flood Zone Determination Evidence

Flood insurance applications require specific documentation to verify eligibility and assess risk accurately. One crucial document is flood zone determination evidence, which identifies the property's location relative to flood hazard zones.

Flood zone determination evidence typically includes official flood maps from the Federal Emergency Management Agency (FEMA) or a licensed surveyor's report. This evidence confirms whether the property lies within a Special Flood Hazard Area (SFHA) or a low-to-moderate risk zone. Accurate flood zone data helps insurers set premiums and coverage limits based on potential flood risk.

Previous Insurance and Claims History

When applying for flood insurance, providing previous insurance policy documents is essential to verify coverage history and ensure accurate risk assessment. Detailed records of past flood claims help insurers evaluate the applicant's claim frequency and potential risk level. These documents together facilitate a faster approval process and accurate premium calculation.

Mortgage and Lender Information

Flood insurance applications require specific documents to verify your mortgage and lender details. Accurate information ensures proper coverage and compliance with lender requirements.

- Mortgage Statement - Shows current loan balance and lender information needed for insurance verification.

- Lender Contact Information - Essential for the insurance company to communicate and confirm the mortgage status.

- Loan Number - Identifies your mortgage account uniquely during the application process.

Providing complete mortgage and lender documentation speeds up approval for flood insurance coverage.

Completing the Flood Insurance Application Form

| Document | Description | Purpose |

|---|---|---|

| Completed Flood Insurance Application Form | Official form provided by the insurance company or the National Flood Insurance Program (NFIP). | Captures applicant details, property information, and coverage requirements. |

| Property Deed or Title | Legal document proving ownership of the property to be insured. | Verifies eligibility and validates property address on application form. |

| Flood Risk Map or Elevation Certificate | Elevation certificate completed by a licensed surveyor or flood zone map. | Determines flood risk level and influences premium rates and coverage options. |

| Photo Identification | Government-issued ID such as driver's license or passport. | Confirms identity of the applicant submitting the flood insurance application form. |

| Mortgage Information | Details about existing mortgage lender and loan account number, if applicable. | Required for policies tied to mortgage agreements and to coordinate billing. |

| Previous Flood Insurance Policy Documents | Copies of prior flood insurance certificates or claims history. | Assists in verifying coverage continuity and calculating risk assessment. |

| Proof of Payment | Receipt or confirmation of payment for the flood insurance premium. | Confirms that the application process is complete and coverage has started. |

What Documents are Needed for Flood Insurance Application? Infographic