Essential documents for car insurance claims include the insurance policy, vehicle registration, driver's license, and a detailed accident report or police report. Photographs of the damage, repair estimates, and medical reports, if applicable, support the claim process. Timely submission of these documents ensures a smoother and faster settlement.

What Documents are Needed for Car Insurance Claims?

| Number | Name | Description |

|---|---|---|

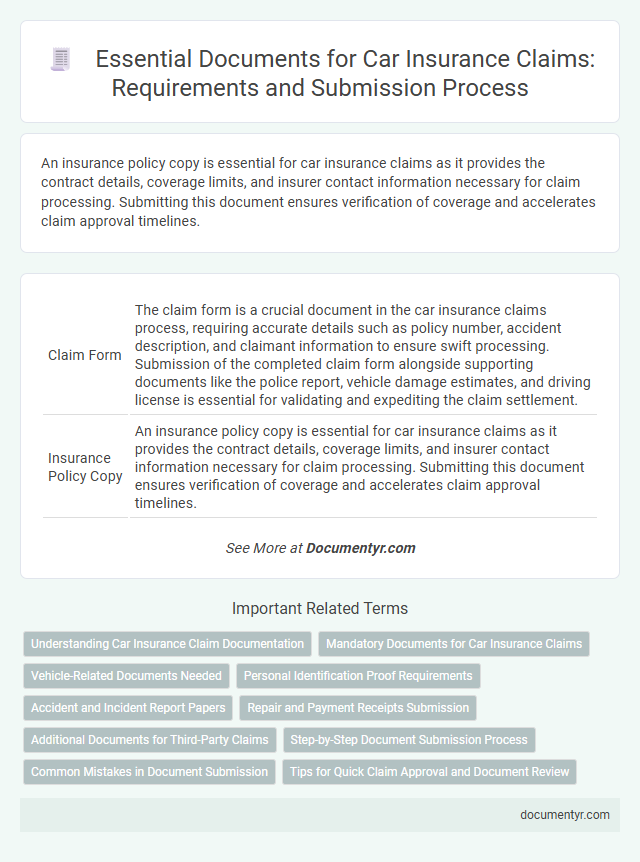

| 1 | Claim Form | The claim form is a crucial document in the car insurance claims process, requiring accurate details such as policy number, accident description, and claimant information to ensure swift processing. Submission of the completed claim form alongside supporting documents like the police report, vehicle damage estimates, and driving license is essential for validating and expediting the claim settlement. |

| 2 | Insurance Policy Copy | An insurance policy copy is essential for car insurance claims as it provides the contract details, coverage limits, and insurer contact information necessary for claim processing. Submitting this document ensures verification of coverage and accelerates claim approval timelines. |

| 3 | Vehicle Registration Certificate (RC) | The Vehicle Registration Certificate (RC) is a crucial document for car insurance claims as it verifies the ownership and registration details of the insured vehicle. Insurers require the RC to process claims efficiently, ensuring the vehicle involved matches the policy information. |

| 4 | Driving License | A valid driving license is a crucial document required for processing car insurance claims, serving as proof of the insured driver's legal authorization to operate the vehicle. Insurance companies verify the driving license details to confirm the claimant's eligibility and assess the claim accurately. |

| 5 | FIR/Police Report | A First Information Report (FIR) or police report is crucial for car insurance claims as it officially documents the accident details and establishes liability. Submitting this report along with the claim form ensures accurate processing and prevents claim rejection due to fraudulent or incomplete information. |

| 6 | Repair Estimates | Repair estimates play a critical role in car insurance claims by providing detailed cost assessments from authorized garages or service centers, essential for validating damage and confirming claim amounts. Accurate and itemized repair estimates help insurance adjusters determine the extent of coverage and ensure timely claim processing under the policy terms. |

| 7 | Photographs of Damage | Photographs of damage play a crucial role in car insurance claims by providing visual evidence of the vehicle's condition after an accident. High-quality images capturing all affected areas from multiple angles help expedite claim processing and support accurate damage assessment by insurance adjusters. |

| 8 | Previous Insurance Details (if applicable) | Previous insurance details, such as policy number, coverage type, and claim history, are essential for processing car insurance claims, as they help verify continuous coverage and assess claim eligibility. Providing these documents expedites claim approval and prevents potential coverage gaps or duplicate claims. |

| 9 | No Trace Report (for theft claims) | For car insurance theft claims, submitting a No Trace Report issued by the police is crucial to verify the vehicle's stolen status and support the claim process. This report, alongside the insurance policy, vehicle registration, and FIR (First Information Report), forms the core documentation required to expedite claim approval. |

| 10 | Medical Reports (in case of injury) | Medical reports are essential for car insurance claims involving injuries, as they provide detailed evidence of the nature and extent of the harm suffered, supporting the legitimacy of the claim. These documents typically include hospital records, doctor's evaluations, diagnostic test results, and treatment plans, which insurers use to assess compensation amounts accurately. |

| 11 | Discharge Summary (if hospitalized) | A Discharge Summary is essential for car insurance claims involving hospitalization, as it provides detailed medical information such as diagnosis, treatment, and duration of stay, which insurers require to validate the claim. This document supports the assessment of medical expenses and injury severity, ensuring accurate and timely claim processing. |

| 12 | Proof of Identity | Proof of identity is essential for car insurance claims, typically requiring a government-issued ID such as a driver's license or passport to verify the claimant's identity. Providing accurate identity documents helps streamline the claims process and prevents fraudulent activities. |

| 13 | Proof of Address | Providing a valid Proof of Address, such as a utility bill, bank statement, or rental agreement dated within the last three months, is essential for processing car insurance claims to verify the policyholder's residency. Insurers require this document to ensure correspondence accuracy and confirm eligibility tied to the insured location. |

| 14 | Tax Payment Receipt | A tax payment receipt is essential for car insurance claims as it verifies the vehicle's legal registration and tax compliance, ensuring eligibility for claim processing. Insurance companies require this document to confirm the insured car meets government tax obligations, preventing claim denials due to unpaid taxes. |

| 15 | No Objection Certificate (NOC) | For car insurance claims, the No Objection Certificate (NOC) issued by the financing bank or the previous insurer is crucial to initiate the claim process, especially if the vehicle was under a loan or transferred ownership. The NOC confirms that the lender has no pending claims on the insured vehicle, enabling the insurer to process repairs or settlements without legal encumbrances. |

| 16 | Invoice of Vehicle Purchase | The invoice of vehicle purchase serves as a crucial document in car insurance claims, providing proof of ownership and establishing the vehicle's value at the time of purchase. Insurance companies use this invoice to verify claim authenticity and accurately assess compensation based on the original purchase price. |

| 17 | Transfer Papers (if applicable) | Transfer papers are essential for car insurance claims when the vehicle ownership has changed recently, ensuring the insurer recognizes the rightful claimant. These documents confirm legal ownership transfer, enabling smooth processing of claims related to accidents or damages post-transfer. |

Understanding Car Insurance Claim Documentation

Understanding the documents needed for car insurance claims is essential for a smooth and efficient process. Proper documentation ensures that claims are processed quickly and accurately.

A valid car insurance policy document is the primary requirement for filing a claim. You must also provide a copy of the vehicle registration, the police report (if applicable), and photographs of the damage. Additionally, an estimate or invoice from the repair shop and a completed claim form are necessary to support your claim.

Mandatory Documents for Car Insurance Claims

```htmlWhat documents are mandatory for car insurance claims? Essential documents include the completed claim form and a copy of your valid car insurance policy. Proof of identity and the vehicle's registration certificate must also be submitted to process the claim efficiently.

```Vehicle-Related Documents Needed

| Document | Description |

|---|---|

| Vehicle Registration Certificate (RC) | Proof of vehicle ownership required to verify the insured vehicle's details. |

| Driving License | Valid license of the person driving the vehicle at the time of the incident. |

| Insurance Policy Document | Copy of the car insurance policy to confirm coverage details and policy number. |

| Damage Assessment Report | Official report detailing the extent of damage to the vehicle, usually prepared by an authorized surveyor. |

| First Information Report (FIR) | Police report filed in case of theft, accident, or other incidents affecting the vehicle. |

| Repair Estimates or Invoices | Detailed quotation or receipts from authorized garages for vehicle repairs. |

| Vehicle Photographs | Clear images of the damaged vehicle illustrating the extent of damage for claim validation. |

Personal Identification Proof Requirements

Personal identification proof is a crucial requirement for processing car insurance claims accurately. You must provide valid documents to verify your identity and ownership details.

- Government-issued ID - A passport, driver's license, or national ID card serves as proof of your identity.

- Vehicle Registration Certificate - This document confirms ownership and registration details of the insured car.

- Insurance Policy Document - The original or a copy of your car insurance policy demonstrates the coverage and policyholder information.

Submitting these identification proofs promptly helps ensure a smooth and timely claim settlement process.

Accident and Incident Report Papers

For car insurance claims, submitting accurate accident and incident report papers is crucial. These documents typically include the police report, which details the circumstances of the accident, and a completed claim form from the insurance provider. Ensuring these reports are precise and promptly filed helps streamline the claims process and supports coverage verification.

Repair and Payment Receipts Submission

Submitting repair and payment receipts is essential for processing car insurance claims efficiently. These documents serve as proof of expenses incurred during vehicle repair.

You must provide original receipts from authorized repair shops detailing the work performed and costs. Accurate and complete submission of these receipts ensures timely reimbursement and claim approval.

Additional Documents for Third-Party Claims

For car insurance claims, essential documents include the insurance policy, a copy of the driver's license, and the vehicle registration. Additional documents are required for third-party claims, such as the third party's vehicle and identity proofs, along with a duly filled claim form. Police reports and repair estimates are also necessary to process third-party insurance claims efficiently.

Step-by-Step Document Submission Process

Submitting the correct documents is essential for a smooth car insurance claim process. Knowing the required paperwork helps avoid delays and ensures quick claim settlement.

- Accident Report - Submit a detailed accident report, including police or traffic authority documentation, to verify the incident.

- Insurance Policy Copy - Provide a copy of your car insurance policy to confirm coverage details and policyholder information.

- Vehicle Registration Document - Include your car's registration certificate to establish ownership and vehicle identity.

- Driving License - Attach a valid driving license matching the policyholder's name to prove legal driving status.

- Claim Form - Complete and sign the insurer's claim form accurately to initiate the claim process.

- Repair Estimate - Provide an estimate from a certified garage or service center outlining the repair costs.

- Photographs of Damage - Submit clear images of the vehicle damage to support the claim and facilitate assessment.

- Medical Reports (if applicable) - Include any medical certificates or reports if personal injuries occurred during the accident.

Common Mistakes in Document Submission

Submitting the correct documents is crucial for a smooth car insurance claim process. Common mistakes in document submission often lead to delays or claim rejection.

- Incomplete Documentation - Missing essential papers like the accident report, insurance policy copy, or vehicle registration can delay claim processing.

- Incorrect Information - Errors in personal or vehicle details on submitted forms may result in claim denial or the need for resubmission.

- Poor Quality Copies - Blurry, unclear, or damaged document copies hinder verification and prolong the approval timeline.

What Documents are Needed for Car Insurance Claims? Infographic