Small businesses applying for commercial auto insurance must provide a variety of documents to ensure proper coverage, including a valid business license, vehicle registration, and proof of vehicle ownership. Detailed information about each driver, such as their license number and driving history, is essential to assess risk accurately. Additionally, businesses should submit a list of all vehicles used for commercial purposes and evidence of any prior commercial auto insurance policies.

What Documents Does a Small Business Need for Commercial Auto Insurance?

| Number | Name | Description |

|---|---|---|

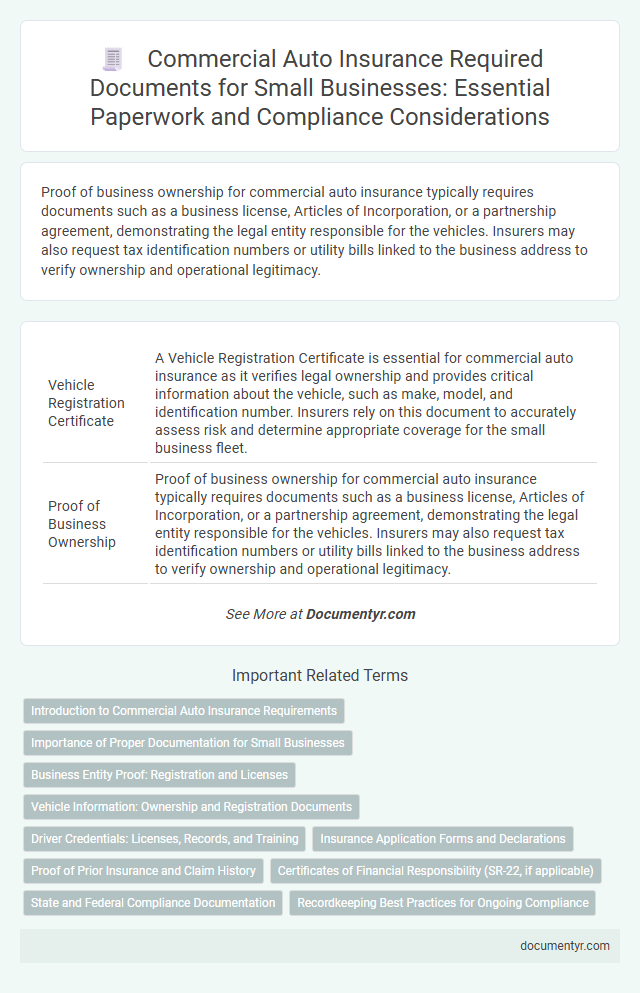

| 1 | Vehicle Registration Certificate | A Vehicle Registration Certificate is essential for commercial auto insurance as it verifies legal ownership and provides critical information about the vehicle, such as make, model, and identification number. Insurers rely on this document to accurately assess risk and determine appropriate coverage for the small business fleet. |

| 2 | Proof of Business Ownership | Proof of business ownership for commercial auto insurance typically requires documents such as a business license, Articles of Incorporation, or a partnership agreement, demonstrating the legal entity responsible for the vehicles. Insurers may also request tax identification numbers or utility bills linked to the business address to verify ownership and operational legitimacy. |

| 3 | Driver’s Licenses of All Drivers | Commercial auto insurance for small businesses requires valid driver's licenses for all drivers listed on the policy, ensuring compliance with legal regulations and accurate risk assessment. These licenses must be current, properly classified for the vehicle type, and verifiable to avoid coverage issues or claim denials. |

| 4 | Vehicle Title | A small business must provide the vehicle title as a primary document when applying for commercial auto insurance, as it proves ownership and ensures accurate policy coverage. The vehicle title contains essential information such as the vehicle identification number (VIN), owner details, and lienholder data, which insurers use to assess risk and validate the insured asset. |

| 5 | Proof of Insurance History | Small businesses seeking commercial auto insurance must provide proof of insurance history, including past policy declarations and claims records, to demonstrate risk management and coverage consistency. This documentation helps insurers assess liability exposure and premium rates accurately. |

| 6 | Business Tax ID (EIN) | A Business Tax ID (EIN) is essential for commercial auto insurance as it verifies the legal identity of the business applying for the policy. Insurers use the EIN to confirm business legitimacy and facilitate accurate policy records and claims processing. |

| 7 | Commercial Auto Insurance Application | A small business must submit key documents for a Commercial Auto Insurance application, including a completed application form, vehicle registration, driver information with valid licenses, and proof of business ownership. Detailed records of vehicle usage, prior insurance history, and safety training certifications improve underwriting accuracy and coverage options. |

| 8 | Vehicle Maintenance Records | Vehicle maintenance records are essential for commercial auto insurance as they demonstrate the regular upkeep and safety of a business's fleet, potentially lowering premiums and reducing claim risks. Insurers require detailed maintenance logs, including service dates, repairs, and inspections, to assess vehicle condition and ensure compliance with policy requirements. |

| 9 | List of Authorized Drivers | A comprehensive list of authorized drivers is essential for commercial auto insurance, detailing each individual's full name, driver's license number, and driving history to accurately assess risk. Insurers require this documentation to ensure proper coverage and to prevent unauthorized use of the insured vehicles. |

| 10 | Lease or Loan Agreement (if applicable) | Small businesses applying for commercial auto insurance must provide a Lease or Loan Agreement to verify ownership or financing details of the vehicles insured. This document ensures accurate risk assessment and proper coverage by confirming the terms, duration, and liability responsibilities associated with leased or financed vehicles. |

| 11 | Proof of Address for Business Location | Proof of address for the business location is essential for commercial auto insurance as it verifies the primary operational site, impacting policy eligibility and premium rates. Acceptable documents typically include utility bills, lease agreements, or official business correspondence that clearly display the business name and physical address. |

| 12 | Fleet Inventory List (if multiple vehicles) | A comprehensive fleet inventory list detailing each vehicle's make, model, year, VIN, and usage is essential for small businesses seeking commercial auto insurance. This document streamlines risk assessment and ensures accurate premium calculations by providing insurers with precise vehicle information. |

| 13 | Previous Insurance Policy Declarations | Previous insurance policy declarations provide a detailed record of coverage limits, claims history, and premium information essential for underwriting commercial auto insurance for small businesses. These documents enable insurers to assess risk accurately and determine appropriate policy terms. |

| 14 | Motor Vehicle Records (MVR) | Motor Vehicle Records (MVR) are essential for small businesses seeking commercial auto insurance, as they provide detailed driving histories of employees who operate company vehicles, helping insurers assess risk accurately. Maintaining up-to-date MVRs ensures compliance with underwriting requirements and aids in selecting qualified drivers to reduce liability and premium costs. |

| 15 | Business Financial Statements | Small businesses must provide detailed business financial statements, including balance sheets and profit and loss statements, to demonstrate financial stability and support the commercial auto insurance application process. These documents offer insurers critical insight into the company's fiscal health, influencing premium rates and coverage options. |

| 16 | Certificate of Incorporation or Partnership Agreement | Small businesses must provide a Certificate of Incorporation or a Partnership Agreement as key documents to establish legal entity status when applying for commercial auto insurance. These documents verify business ownership and structure, which insurers use to assess risk and validate policyholder eligibility. |

Introduction to Commercial Auto Insurance Requirements

Commercial auto insurance safeguards your small business vehicles against liabilities and damages. Understanding the required documents is essential for a smooth application process.

- Proof of Vehicle Ownership - Documentation such as registration or title that verifies your business owns or leases the vehicles to be insured.

- Driver Information - Details about employees or individuals who will operate the vehicles, including driving history and license status.

- Business Details - Official business documents like your Employer Identification Number (EIN) and operating license to validate your business identity.

Importance of Proper Documentation for Small Businesses

| Document | Description | Importance for Small Businesses |

|---|---|---|

| Business Registration Documents | Proof of legal business operations, such as articles of incorporation or a business license. | Validates the legitimacy of your business, necessary for insurance underwriting. |

| Vehicle Titles and Registrations | Official documents proving ownership and registration of commercial vehicles. | Confirms the vehicles covered by the policy and prevents coverage disputes. |

| Driver Information | Details of employees who will operate the commercial vehicles, including driver's licenses and driving records. | Ensures that authorized and qualified drivers are insured, reducing risk exposure. |

| Existing Insurance Policies | Copies of current or prior auto insurance policies and claims history. | Provides insurers with risk assessment data for accurate premium calculation. |

| Vehicle Usage Details | Information on how and when the vehicles are used for business purposes. | Helps determine appropriate coverage types and limits based on operational risks. |

| Financial Records | Documents reflecting the business's financial stability, such as tax returns or profit and loss statements. | Supports insurer evaluation of business viability and claims-paying ability. |

Proper documentation is critical for securing adequate commercial auto insurance. It helps small businesses demonstrate compliance, mitigate risks, and obtain tailored coverage that protects assets and employees. Ensuring You have the correct paperwork ready can streamline the application process and avoid potential coverage gaps.

Business Entity Proof: Registration and Licenses

Small businesses must provide specific documents to secure commercial auto insurance, ensuring legal and operational compliance. Proof of business entity registration and licenses is crucial for validating the legitimacy of the company.

- Business Registration Certificate - Confirms the official establishment and name of the business with state authorities.

- Business Licenses - Demonstrates authorization to operate specific commercial activities within local or state jurisdictions.

- Employer Identification Number (EIN) - Serves as a federal tax identification that verifies the business as a registered entity for insurance purposes.

Providing these documents helps insurers assess risk accurately and ensures the business meets regulatory insurance requirements.

Vehicle Information: Ownership and Registration Documents

What vehicle ownership and registration documents are required for your small business's commercial auto insurance? Your policy provider needs proof of ownership to verify that your business legally owns the vehicles used for operations. Registration documents confirm the vehicles are properly registered and meet state requirements.

Driver Credentials: Licenses, Records, and Training

Commercial auto insurance for small businesses requires thorough documentation of driver credentials to ensure eligibility and risk assessment. Driver licenses must be valid, up-to-date, and compliant with state regulations relevant to the commercial vehicle classification.

Driving records provide essential insights into a driver's history, including accidents, violations, and claims, which impact insurance rates and coverage. Proof of driver training programs, especially for specialized or heavy vehicles, can enhance safety profiles and reduce premiums for your business.

Insurance Application Forms and Declarations

Commercial auto insurance requires specific documentation to process your application accurately. Insurance application forms capture essential details about the business and vehicles involved.

Declarations pages summarize coverage limits, deductibles, and insured parties, providing a clear overview of the policy. These documents are crucial for verifying the terms and ensuring proper coverage for small business vehicles.

Proof of Prior Insurance and Claim History

Securing commercial auto insurance for your small business requires specific documentation to verify your insurance background and claim history. Proof of prior insurance and a detailed claim history play crucial roles in the underwriting process.

- Proof of Prior Insurance - This document verifies the coverage history of your business vehicles, demonstrating your insurance experience and risk management to the insurer.

- Claim History Report - A detailed record of past claims filed provides insight into the frequency and severity of incidents involving your business vehicles.

- Insurance Loss Runs - These reports summarize your claim activity over a specified period, helping insurers assess potential future risks and premium calculations.

Certificates of Financial Responsibility (SR-22, if applicable)

Small businesses must provide specific documents when applying for commercial auto insurance, including vehicle registration and proof of ownership. Certificates of Financial Responsibility, such as the SR-22 form, are required if your business has certain driving violations or legal obligations. These certificates verify that your business maintains the minimum liability coverage mandated by state law.

State and Federal Compliance Documentation

Small businesses seeking commercial auto insurance must provide proof of state vehicle registration and valid driver's licenses to meet state compliance requirements. Federal regulations often require a Motor Carrier (MC) number or USDOT number for businesses operating across state lines. Maintaining copies of vehicle inspection reports and proof of financial responsibility, such as liability insurance certificates, ensures both state and federal compliance for commercial auto coverage.

What Documents Does a Small Business Need for Commercial Auto Insurance? Infographic