College students applying for renters insurance typically need to provide proof of identity, such as a driver's license or student ID, along with their current lease agreement to verify residency. Insurance providers often require an inventory or list of personal belongings to assess coverage needs accurately. A payment method and contact information must also be submitted to complete the application and maintain the policy.

What Documents Does a College Student Need for Renters Insurance?

| Number | Name | Description |

|---|---|---|

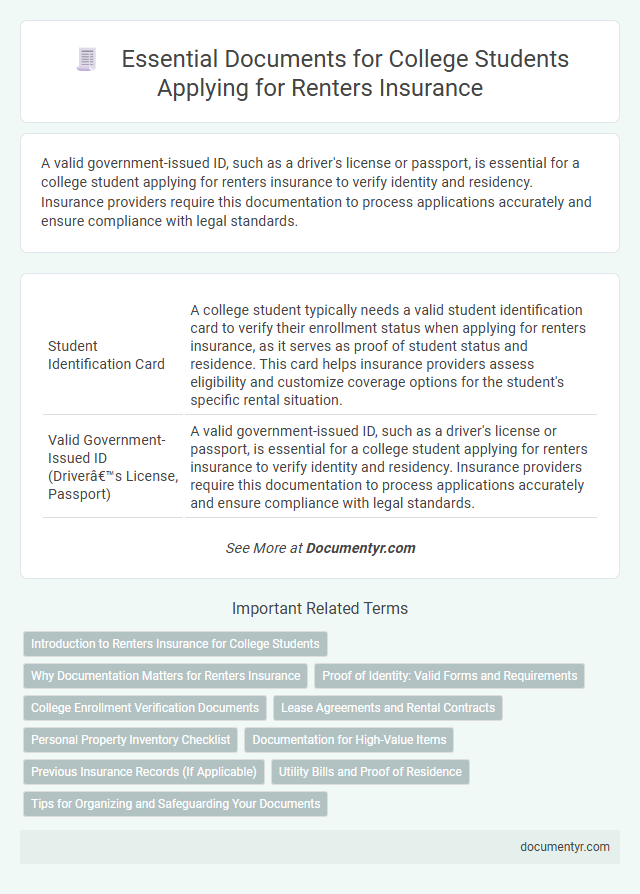

| 1 | Student Identification Card | A college student typically needs a valid student identification card to verify their enrollment status when applying for renters insurance, as it serves as proof of student status and residence. This card helps insurance providers assess eligibility and customize coverage options for the student's specific rental situation. |

| 2 | Valid Government-Issued ID (Driver’s License, Passport) | A valid government-issued ID, such as a driver's license or passport, is essential for a college student applying for renters insurance to verify identity and residency. Insurance providers require this documentation to process applications accurately and ensure compliance with legal standards. |

| 3 | Proof of Enrollment (College Acceptance Letter, Current Class Schedule) | College students seeking renters insurance must provide proof of enrollment, which typically includes a college acceptance letter or a current class schedule to validate their student status. These documents help insurers verify eligibility and tailor coverage options based on the student's residence and academic affiliation. |

| 4 | Lease Agreement or Rental Contract | A college student applying for renters insurance must provide a copy of the lease agreement or rental contract as proof of tenancy and address verification. This document outlines the rental terms and helps insurers assess the risk and coverage requirements accurately. |

| 5 | Proof of Residence (Utility Bill, Dorm Assignment Letter) | College students applying for renters insurance must provide proof of residence, which can include a recent utility bill or a dorm assignment letter to verify their living location. These documents are essential for insurers to confirm the insured property and assess coverage eligibility accurately. |

| 6 | Inventory List of Personal Belongings | A detailed inventory list of personal belongings is essential for college students applying for renters insurance, as it helps accurately document valuable items such as electronics, clothing, and textbooks for claim purposes. Including receipts, photos, and descriptions in the inventory ensures precise coverage and faster claim processing in case of theft or damage. |

| 7 | Receipts or Proof of Ownership for Valuable Items | College students applying for renters insurance need to provide receipts or proof of ownership for valuable items such as electronics, jewelry, and furniture to ensure accurate coverage limits. These documents help validate replacement costs and streamline claims processing in case of theft or damage. |

| 8 | Contact Information for Landlord or Property Manager | College students applying for renters insurance typically need to provide the contact information of their landlord or property manager to verify residency and rental terms. Accurate details such as the landlord's full name, phone number, and email address help insurers assess risk and confirm lease agreements. |

| 9 | Previous Insurance Policy (if applicable) | College students applying for renters insurance should provide their previous insurance policy documents to verify continuous coverage and facilitate accurate premium calculations. Submitting prior policy details helps insurers assess risk history and may qualify students for loyalty discounts or streamlined approval processes. |

| 10 | Application Form for Renters Insurance | College students applying for renters insurance need to complete an application form that includes personal identification details, property information, and coverage preferences. This form often requires documentation such as proof of student status, a list of valuable personal belongings, and the rental agreement to verify the insured residence. |

| 11 | Emergency Contact Information | College students applying for renters insurance should provide emergency contact information, including full names, phone numbers, and relationship details, to ensure timely communication during claims or emergencies. Insurers often require this data to verify policyholder security and facilitate quick response in case of accidents or property damage. |

| 12 | Proof of Income or Financial Aid (if requested) | College students applying for renters insurance may need to provide proof of income, such as recent pay stubs or bank statements, or documentation of financial aid, including award letters or scholarship confirmation, to validate their ability to pay premiums. Insurance providers use these documents to assess financial stability and determine appropriate coverage options and payment plans. |

| 13 | Roommate Information (if sharing the policy) | College students sharing a renters insurance policy must provide detailed roommate information, including full names, contact details, and their specific coverage roles to ensure the policy accurately reflects all insured individuals. Insurers may also require documentation of each roommate's financial responsibility and identification to verify eligibility and allocate liability appropriately. |

| 14 | Parental Consent (if under legal age, as required) | College students under the legal age typically need parental consent documented through a signed form or letter to obtain renters insurance, ensuring legal authorization for the policy. Insurers may also require proof of the parent's or guardian's identity and relationship to the student to validate this consent. |

Introduction to Renters Insurance for College Students

```htmlWhat documents does a college student need to get renters insurance? Renters insurance protects your personal belongings and provides liability coverage while living off-campus. Having the right documents helps speed up the application process and ensures proper coverage tailored to a student's needs.

```Why Documentation Matters for Renters Insurance

College students seeking renters insurance must provide key documents such as a valid student ID, proof of enrollment, and a lease agreement. These documents verify the student's identity, residency, and eligibility, enabling accurate risk assessment by insurers. Proper documentation ensures smooth claims processing and protects students' personal belongings effectively.

Proof of Identity: Valid Forms and Requirements

Proof of identity is a critical requirement when applying for renters insurance as a college student. Insurers need to verify your identity to ensure the validity of your application and protect against fraud.

- Government-Issued ID - A valid driver's license or state ID card is commonly accepted to confirm your full name and date of birth.

- Student Identification - A current college or university ID helps verify your enrollment status and residence location.

- Social Security Number - Providing your social security number assists insurers in conducting background checks and ensuring accurate record-keeping.

College Enrollment Verification Documents

College enrollment verification documents are essential for obtaining renters insurance as they confirm your student status. Insurance providers require proof to offer policy options tailored to college students.

- Enrollment Verification Letter - A formal document from your college confirming your current enrollment status and full-time or part-time status.

- Student ID Card - An official identification card issued by the educational institution displaying your name, photo, and enrollment year.

- Transcript or Class Schedule - Recent academic records or class schedules that validate your active participation in the college term.

Submitting accurate college enrollment verification documents streamlines the renters insurance application process and ensures eligibility for student discounts.

Lease Agreements and Rental Contracts

| Document Type | Description | Importance for Renters Insurance |

|---|---|---|

| Lease Agreement | A formal contract between the tenant and landlord outlining the terms and conditions of renting a property, including rental period, monthly rent, and responsibilities. | Serves as proof of residence and verifies your legal agreement to rent the property. Insurers use this to confirm eligibility and determine coverage specifics. |

| Rental Contract | A legal document similar to the lease agreement that specifies rental terms, tenant obligations, and property details. It may include additional clauses related to property use. | Substantiates occupancy and rental responsibilities. Essential for the insurance provider to understand your rental situation and assess policy requirements accurately. |

Personal Property Inventory Checklist

A Personal Property Inventory Checklist is essential for renters insurance claims, helping you document your belongings accurately. This checklist should include detailed descriptions, purchase dates, and estimated values of your items. Keeping copies of receipts and photographs enhances the accuracy of the inventory and speeds up the claims process.

Documentation for High-Value Items

College students seeking renters insurance must provide specific documentation to ensure adequate coverage. Proof of identity, current address, and a detailed list of personal belongings form the foundation of the application process.

For high-value items such as electronics, jewelry, or sports equipment, detailed documentation is essential. Receipts, appraisals, and photographs help validate the item's value and support claims in case of damage or theft.

Previous Insurance Records (If Applicable)

Previous insurance records can streamline the process of obtaining renters insurance for college students. These documents provide the insurer with a clear history of your coverage and claims.

Having proof of prior insurance helps validate your responsibility as a renter and may result in better policy terms. Keep copies of any past renters or related insurance policies when applying for new coverage.

Utility Bills and Proof of Residence

Utility bills serve as critical documents for verifying your residence when applying for renters insurance. These bills typically include electricity, water, or gas statements that confirm your living address.

Proof of residence is essential to establish that you occupy the rental property, which can be demonstrated through official mail or lease agreements alongside utility bills. Insurance providers require this documentation to process your renters insurance policy accurately. Ensuring that these documents are current and match your application information prevents delays and denial of coverage.

What Documents Does a College Student Need for Renters Insurance? Infographic