Homeowners need essential documents such as a completed flood insurance application form, a copy of the property's deed or mortgage statement, and a recent mortgage or tax bill. Proof of occupancy, a detailed property description including flood zone designation, and photos of the property may also be required. Accurate documentation ensures a smooth application process and proper coverage under the flood insurance policy.

What Documents Does a Homeowner Need for Flood Insurance Application?

| Number | Name | Description |

|---|---|---|

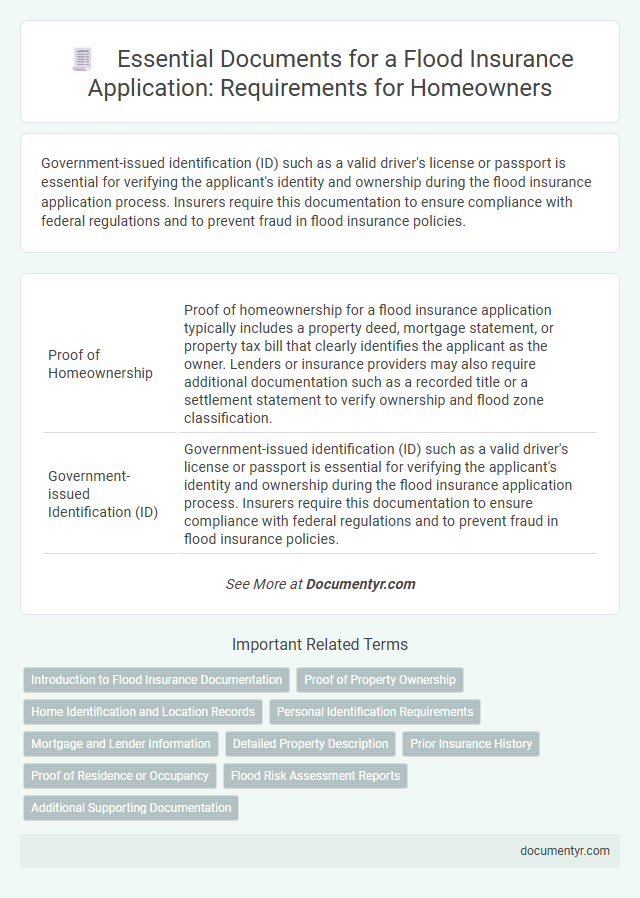

| 1 | Proof of Homeownership | Proof of homeownership for a flood insurance application typically includes a property deed, mortgage statement, or property tax bill that clearly identifies the applicant as the owner. Lenders or insurance providers may also require additional documentation such as a recorded title or a settlement statement to verify ownership and flood zone classification. |

| 2 | Government-issued Identification (ID) | Government-issued identification (ID) such as a valid driver's license or passport is essential for verifying the applicant's identity and ownership during the flood insurance application process. Insurers require this documentation to ensure compliance with federal regulations and to prevent fraud in flood insurance policies. |

| 3 | Property Deed or Title | A property deed or title is essential for a flood insurance application as it legally verifies ownership and establishes the insured property's location in a flood-prone area. INSURANCE providers require this documentation to assess risk accurately and determine proper coverage for the homeowner. |

| 4 | Mortgage Statement | A mortgage statement is essential for a flood insurance application as it verifies the property's address and confirms the homeowner's financial interest, which lenders require for coverage approval. This document ensures accurate policy underwriting by providing proof of ownership and outstanding loan details. |

| 5 | Property Tax Assessment | A homeowner applying for flood insurance must provide the latest property tax assessment to verify the property's value and location in a designated flood zone. This document helps insurers accurately assess flood risk and determine the appropriate premium for comprehensive coverage. |

| 6 | Proof of Residency (Utility Bill or Lease Agreement) | Homeowners applying for flood insurance must provide proof of residency, typically a recent utility bill or lease agreement, to verify the property's occupancy and eligibility. These documents help insurers confirm the insured location's address and establish the applicant's legitimate residence for accurate risk assessment. |

| 7 | Elevation Certificate | A homeowner needs an Elevation Certificate to apply for flood insurance, as it provides critical information about the property's elevation relative to the base flood elevation, influencing premium rates and coverage eligibility. This document, often prepared by a licensed surveyor, verifies flood risk and helps the insurer accurately assess the flood insurance policy cost. |

| 8 | Flood Zone Determination Document | A Flood Zone Determination Document is essential for a flood insurance application, as it verifies the property's flood risk based on FEMA flood maps and local elevation data. This document helps insurers assess premium rates accurately and ensures compliance with federal flood insurance requirements. |

| 9 | Previous Insurance Policies (if applicable) | Homeowners applying for flood insurance should provide copies of previous insurance policies, especially prior flood insurance coverage, to demonstrate their insurance history and risk management. These documents help insurers assess eligibility, premiums, and continuity of coverage under the National Flood Insurance Program (NFIP) or private flood insurance providers. |

| 10 | Photographs of Property (Interior and Exterior) | Photographs of the property's interior and exterior serve as critical evidence for flood insurance applications, documenting existing conditions and any pre-existing damage to accurately assess risk and determine coverage. High-quality, clear images of all vulnerable areas, including basements and ground floors, help insurers validate the property's flood resilience and expedite the approval process. |

| 11 | Appraisal Report | A homeowner needs to provide a detailed Appraisal Report when applying for flood insurance, which includes the property's market value and structural information essential for accurate risk assessment. This report helps insurers determine appropriate coverage limits and premiums based on flood risk and property characteristics. |

| 12 | Building Plans or Blueprints (if available) | Homeowners applying for flood insurance should provide building plans or blueprints to accurately assess the property's structural features and flood risk. These documents help insurers determine proper coverage levels and premium rates based on the home's construction specifics and elevation details. |

| 13 | Certificate of Occupancy | A homeowner must provide a Certificate of Occupancy when applying for flood insurance to verify that the property complies with local building codes and is safe for habitation. This document ensures the insurer that the home meets all regulatory requirements, reducing risk and potentially lowering insurance premiums. |

| 14 | Recent Repair and Renovation Records | Recent repair and renovation records are essential for a flood insurance application, as they provide proof of improvements that may mitigate flood risks and influence premium rates. Including detailed invoices, contractor receipts, and compliance certificates ensures accurate assessment of the property's current condition and flood resilience. |

| 15 | Contact Information (Homeowner and Agent) | A homeowner applying for flood insurance must provide accurate contact information, including full name, phone number, email address, and residential address to ensure proper communication and policy management. Agent contact details such as the insurance agent's name, agency, phone number, and email address are essential for processing the application and facilitating claims. |

Introduction to Flood Insurance Documentation

What documents are required for a flood insurance application? Flood insurance documentation helps verify property details and assess risk levels. Your accurate submission speeds up the approval process significantly.

Proof of Property Ownership

Proof of property ownership is a critical document required when applying for flood insurance. It verifies your legal right to insure the home against flood risks.

- Deed or Title - This official document shows you hold legal ownership of the property.

- Mortgage Statement - Provides evidence of your financial interest in the home, supporting ownership claims.

- Property Tax Bill - Confirms your responsibility for property taxes, linking you directly to the property.

Submitting accurate ownership documentation helps ensure a smooth flood insurance application process.

Home Identification and Location Records

Home identification and location records are essential for a flood insurance application. These documents verify the exact address and structural details of the insured property.

Common records include property deeds, tax assessments, and building permits. Accurate identification ensures proper risk assessment and policy issuance by flood insurance providers.

Personal Identification Requirements

Homeowners must provide specific personal identification documents when applying for flood insurance to verify their identity and property ownership. This step ensures the application process is accurate and compliant with insurance regulations.

- Government-issued ID - A valid driver's license or passport is required to confirm the homeowner's identity.

- Proof of Property Ownership - Documents such as a property deed or mortgage statement demonstrate legal ownership of the insured property.

- Social Security Number - This is necessary for identity verification and to facilitate processing within federal flood insurance programs.

Mortgage and Lender Information

When applying for flood insurance, providing accurate mortgage and lender information is crucial. These details help verify your property's financial obligations and risk assessment.

Your flood insurance application requires the lender's name, address, and contact information. Mortgage account numbers and loan details should also be included. This information ensures proper communication between your insurer and lender for policy processing.

Detailed Property Description

A detailed property description is essential for a successful flood insurance application. It ensures accurate risk assessment and premium calculation.

- Property Address - The exact location of the home is required to evaluate flood risk based on flood maps.

- Construction Details - Information on building materials, foundation type, and elevation influences flood damage potential.

- Square Footage - The size of the home helps determine the coverage amount and insurance cost.

Prior Insurance History

| Document Type | Description |

|---|---|

| Previous Flood Insurance Policy | Proof of past coverage helps verify risk history and continuity for flood insurance applications. |

| Claims History Report | Details on prior flood-related claims provide insights into risk exposure and claim patterns. |

| Homeowner's Insurance Declarations Page | Shows existing property insurance details, including any prior flood endorsements or exclusions. |

| Certificates of Prior Insurance | Formal verification of past insurance policies with effective dates and coverage limits. |

| Proof of Lapse or Non-Coverage | Documents establishing any periods without flood insurance help assess risk gaps. |

| Inspection or Adjustment Reports | Reports from previous insurers related to flood damage assessments contribute to risk evaluation. |

Proof of Residence or Occupancy

Proof of residence or occupancy is essential when applying for flood insurance. This document verifies that the home is your primary or secondary residence, ensuring accurate risk assessment.

Common forms of proof include utility bills, lease agreements, or property tax statements. These documents confirm your connection to the property, which helps in the underwriting process.

Flood Risk Assessment Reports

Flood risk assessment reports are crucial documents in a homeowner's flood insurance application. These reports detail the property's susceptibility to flooding based on geographical and historical data. Insurance providers rely on these assessments to accurately determine coverage requirements and premiums.

What Documents Does a Homeowner Need for Flood Insurance Application? Infographic