When applying for disability insurance benefits, essential documents include medical records detailing the diagnosis and treatment, work history to establish employment status, and proof of income for benefit calculation. Additionally, submitting a completed application form and any relevant statements from healthcare providers helps expedite the claims process. Accurate and comprehensive documentation supports a smoother evaluation and faster approval of disability benefits.

What Documents are Needed for Disability Insurance Benefits Application?

| Number | Name | Description |

|---|---|---|

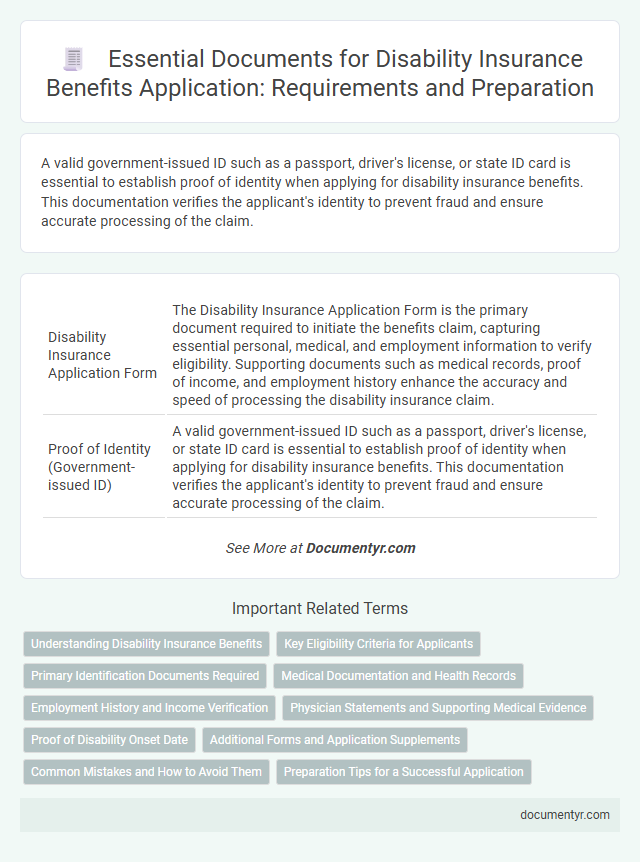

| 1 | Disability Insurance Application Form | The Disability Insurance Application Form is the primary document required to initiate the benefits claim, capturing essential personal, medical, and employment information to verify eligibility. Supporting documents such as medical records, proof of income, and employment history enhance the accuracy and speed of processing the disability insurance claim. |

| 2 | Proof of Identity (Government-issued ID) | A valid government-issued ID such as a passport, driver's license, or state ID card is essential to establish proof of identity when applying for disability insurance benefits. This documentation verifies the applicant's identity to prevent fraud and ensure accurate processing of the claim. |

| 3 | Social Security Number (SSN) or Card | The Social Security Number (SSN) or Social Security card is a crucial document required for disability insurance benefits applications to verify identity and eligibility. Providing accurate SSN information ensures proper processing and prevents delays in benefit determination. |

| 4 | Proof of Age (Birth Certificate, Passport) | Proof of age is a critical document for disability insurance benefits applications, typically requiring an official birth certificate or a valid passport as verification. These documents confirm the applicant's identity and age, ensuring eligibility and accuracy in the processing of disability claims. |

| 5 | Proof of Citizenship or Legal Residency | Essential documents for disability insurance benefits application include proof of citizenship such as a U.S. birth certificate, U.S. passport, or naturalization certificate, and evidence of legal residency like a permanent resident card (green card) or valid visa. These documents verify the applicant's legal status and eligibility for disability insurance programs. |

| 6 | Medical Records or Medical Reports | Medical records or medical reports are essential documents for disability insurance benefits applications as they provide detailed evidence of the applicant's medical condition, diagnosis, treatment history, and prognosis. These documents must include physician statements, test results, hospital records, and any specialist evaluations that demonstrate the severity and impact of the disability on daily functioning. |

| 7 | Physician’s Statement or Attending Physician Statement (APS) | The Physician's Statement or Attending Physician Statement (APS) is a critical document required for disability insurance benefits applications, providing detailed medical evidence from the treating physician that supports the claim of disability. This statement typically includes diagnosis, treatment history, prognosis, and the impact of the disability on the insured's ability to work, ensuring accurate assessment of eligibility and benefit entitlement. |

| 8 | Recent Pay Stubs or Proof of Income | Recent pay stubs or proof of income are essential for a disability insurance benefits application as they verify your current earnings and employment status. These documents help insurers assess your eligibility and calculate benefit amounts based on your actual income. |

| 9 | Employer Statement or Employment Verification Letter | The Employer Statement or Employment Verification Letter is crucial for disability insurance benefits applications, providing proof of current employment status, job duties, and income details. This document helps insurers verify eligibility and assess the extent of disability relative to job requirements, ensuring accurate benefits determination. |

| 10 | Job Description or Workplace Duties Statement | A detailed job description or workplace duties statement is crucial for disability insurance benefits applications as it outlines the essential tasks and physical demands of your employment. Insurers require this documentation to assess the extent to which your disability prevents you from performing your occupational responsibilities, directly influencing claim approval. |

| 11 | Tax Returns (Recent Years) | Recent tax returns, typically from the past two to three years, serve as critical documentation for disability insurance benefits applications by verifying income history and eligibility. Providing accurate and complete tax records ensures proper assessment of your financial status and supports claim approval. |

| 12 | Bank Account Information (for Direct Deposit) | Bank account information is essential for disability insurance benefits application to ensure direct deposit payments are processed accurately and promptly. Applicants must provide a voided check or a statement showing the bank's routing and account numbers, along with the account holder's name and type of account. |

| 13 | Authorization to Release Medical Information | The Authorization to Release Medical Information is a crucial document needed for disability insurance benefits application, allowing the insurer to access medical records that verify the claimant's disability status. This authorization must be signed and dated to ensure compliance with privacy laws and facilitate timely processing of the claim. |

| 14 | Workers’ Compensation Records (if applicable) | Workers' Compensation Records are essential for disability insurance benefits applications as they provide documented proof of workplace injuries and medical treatments related to the claim. Including detailed accident reports, medical evaluations, and compensation payment history strengthens the application's validity and expedites benefit approval. |

| 15 | Award Letters from Other Benefit Programs (Social Security, Veterans Affairs, etc.) | Award letters from other benefit programs such as Social Security Disability Insurance (SSDI) or Veterans Affairs (VA) serve as critical documentation in disability insurance benefits applications, providing verified evidence of disability status and prior approvals. Including these award letters streamlines the review process by confirming eligibility and supporting the claimant's medical and financial circumstances. |

| 16 | Marriage Certificate (if claiming under spouse’s policy) | A Marriage Certificate is essential for disability insurance benefits applications when claiming under a spouse's policy, serving as legal proof of the spousal relationship. This document verifies eligibility and ensures that benefits are accurately assigned to the rightful claimant. |

| 17 | Power of Attorney or Guardianship Documents (if applicable) | Power of Attorney or Guardianship Documents must be submitted when applying for disability insurance benefits on behalf of another individual to prove legal authority to act on their behalf. These documents ensure authorized decision-making and handling of claims, streamlining the verification process with insurance providers. |

| 18 | Proof of Termination (if recently unemployed) | Proof of termination for disability insurance benefits application typically includes a formal termination letter, employment contract showing end date, or a separation agreement, which validates the claimant's recent unemployment status. Providing these documents ensures compliance with insurer requirements and supports verification of eligibility within the policy terms. |

Understanding Disability Insurance Benefits

Applying for disability insurance benefits requires specific documents to verify your eligibility and medical condition. Accurate documentation ensures a smoother evaluation process by the insurance provider.

Key documents include medical records, proof of income, and a completed disability insurance claim form. Your healthcare provider's detailed reports play a crucial role in supporting your application.

Key Eligibility Criteria for Applicants

Applying for disability insurance benefits requires submitting specific documents that verify your eligibility and medical condition. Key eligibility criteria include proof of disability, medical records, and evidence of employment history.

Essential documents commonly needed are a completed application form, physician's reports, and income statements. Meeting these requirements ensures a smoother evaluation process for disability insurance benefits.

Primary Identification Documents Required

| Document Type | Description | Purpose |

|---|---|---|

| Government-Issued Photo ID | Valid driver's license, state ID card, or passport | Verifies applicant's identity through official government documentation |

| Social Security Card | Original or certified copy of Social Security card | Confirms applicant's Social Security number required for benefits processing |

| Birth Certificate | Certified copy of birth certificate | Establishes date of birth and citizenship status |

| Proof of Residence | Utility bill, lease agreement, or bank statement with current address | Verifies current residence to ensure eligibility within coverage area |

| Legal Status Documents (if applicable) | Permanent resident card, visa, or other immigration documents | Establishes lawful presence in the country for claim eligibility |

Medical Documentation and Health Records

What medical documentation is required for a disability insurance benefits application? Medical records must clearly detail the diagnosis, treatment history, and prognosis from healthcare providers. These documents serve as critical evidence to substantiate the disability claim.

Why are detailed health records important in the application process? Comprehensive health records provide insurers with objective proof of the applicant's medical condition and its impact on daily functioning. This information helps determine eligibility and the extent of disability benefits awarded.

Employment History and Income Verification

To apply for disability insurance benefits, submit detailed employment history records that include job titles, employment dates, and descriptions of duties. Income verification requires pay stubs, tax returns, and W-2 forms to accurately assess your earnings. Gathering these documents ensures a smoother application process and proper evaluation of your disability claim.

Physician Statements and Supporting Medical Evidence

Applying for disability insurance benefits requires specific documentation to verify your condition and eligibility. Physician statements and supporting medical evidence are critical components of this process.

- Physician Statement - A detailed report from your treating doctor outlining your diagnosis, treatment, and functional limitations.

- Medical Records - Comprehensive documentation including hospital visits, test results, imaging scans, and specialist consultations.

- Functional Capacity Evaluation - An assessment that demonstrates how your disability impacts your ability to perform work-related activities.

Proof of Disability Onset Date

Proof of disability onset date is crucial when applying for disability insurance benefits. Providing accurate documentation ensures timely processing and verification of your claim.

- Medical Records - Detailed reports from your healthcare provider establish the exact date your disability began.

- Employer Documentation - Records such as injury reports or absence notifications confirm work-related disability onset dates.

- Personal Statements - Written declarations describing symptoms and their onset can support the established timeline.

Submitting clear proof of disability onset date helps avoid delays in receiving your benefits.

Additional Forms and Application Supplements

When applying for disability insurance benefits, certain additional forms and application supplements may be required to support your claim. These documents often include medical reports, employer statements, and detailed questionnaires about your condition and daily activities. Providing comprehensive supplementary information helps ensure accurate assessment and timely processing of your disability benefits application.

Common Mistakes and How to Avoid Them

Applying for disability insurance benefits requires careful preparation and accurate documentation. Mistakes in submitting the necessary documents can delay or jeopardize your claim.

- Incomplete Medical Records - Missing or outdated medical documentation is a common error that can lead to claim denial.

- Incorrect Application Forms - Using the wrong forms or failing to fill them out properly causes processing delays.

- Omitting Work History Details - Neglecting to provide complete employment information reduces the likelihood of approval.

What Documents are Needed for Disability Insurance Benefits Application? Infographic