Small businesses need key documents for liability insurance, including a detailed business description, proof of ownership or lease agreements, and financial records like tax returns or profit and loss statements. Certificates of prior insurance coverage and any existing contracts with vendors or clients may also be required to assess risk accurately. Having these documents organized ensures a smoother application process and helps customize the coverage to meet specific business needs.

What Documents Does a Small Business Need for Liability Insurance?

| Number | Name | Description |

|---|---|---|

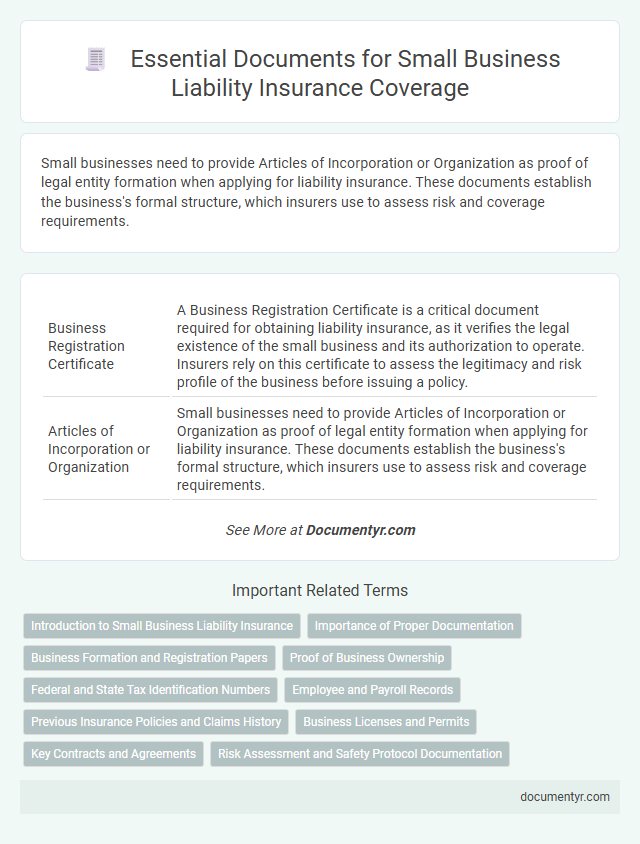

| 1 | Business Registration Certificate | A Business Registration Certificate is a critical document required for obtaining liability insurance, as it verifies the legal existence of the small business and its authorization to operate. Insurers rely on this certificate to assess the legitimacy and risk profile of the business before issuing a policy. |

| 2 | Articles of Incorporation or Organization | Small businesses need to provide Articles of Incorporation or Organization as proof of legal entity formation when applying for liability insurance. These documents establish the business's formal structure, which insurers use to assess risk and coverage requirements. |

| 3 | Employer Identification Number (EIN) | A small business needs to provide its Employer Identification Number (EIN) when applying for liability insurance as it serves as a unique identifier for tax purposes and verifies the business's legitimacy. Insurance companies use the EIN to assess risk factors related to the business's operations and ensure compliance with legal requirements. |

| 4 | Business License | A valid business license is a crucial document required for obtaining small business liability insurance, as it verifies the legal authorization to operate within a specific jurisdiction. Insurers rely on this license to assess the legitimacy and compliance status of your business when underwriting liability insurance policies. |

| 5 | Proof of Address | Small businesses must provide proof of address documents such as a utility bill, lease agreement, or business license when applying for liability insurance to verify the physical location of their operations. Accurate proof of address ensures the insurer correctly assesses risk and validates the business's eligibility for coverage. |

| 6 | Financial Statements | Small businesses need to provide accurate financial statements such as balance sheets, income statements, and cash flow statements when applying for liability insurance to demonstrate their financial stability and risk profile. These documents help insurers assess the business's ability to cover potential claims and determine appropriate coverage limits and premiums. |

| 7 | Tax Returns | Small businesses typically need to provide recent tax returns, such as IRS Form 1040 Schedule C or corporate tax filings, to verify financial stability and business income when applying for liability insurance. These documents help insurers assess risk and determine appropriate coverage levels and premiums. |

| 8 | Previous Insurance Policies | Small businesses seeking liability insurance must provide previous insurance policies to demonstrate their claims history and coverage limits, which helps insurers assess risk accurately. These documents typically include past liability insurance declarations, claims reports, and renewal notices to verify continuous coverage and loss experience. |

| 9 | Claims History Report | A small business needs a Claims History Report to provide detailed records of past liability claims, which insurers use to assess risk and determine policy terms. This report typically includes dates, types of claims, outcomes, and any settlements or payouts, ensuring accurate underwriting and premium calculation. |

| 10 | Risk Assessment Report | A comprehensive Risk Assessment Report is crucial for small businesses seeking liability insurance, detailing potential hazards and safety measures to minimize claims. Insurers rely on this report to evaluate business risks accurately, influencing coverage terms and premium costs. |

| 11 | Employee Roster | A comprehensive employee roster is essential for small business liability insurance, detailing each employee's full name, role, and employment status to accurately assess risk and coverage needs. Insurers use this document to verify payroll data, calculate premiums, and ensure compliance with policy requirements. |

| 12 | Certificates of Training or Compliance | Small businesses need Certificates of Training or Compliance as proof that employees have completed necessary safety courses relevant to their industry, which can reduce liability risks. These documents are essential for validating adherence to regulatory standards and can be required by insurers during the liability coverage application process. |

| 13 | Contracts with Clients or Vendors | Contracts with clients or vendors serve as critical documentation for small businesses seeking liability insurance, clearly outlining the scope of work, responsibilities, and terms that help assess risk exposure. Insurers often require these contracts to evaluate potential liabilities and ensure that the business has legally binding agreements minimizing coverage disputes. |

| 14 | Asset Inventory List | A detailed asset inventory list is essential for small businesses when applying for liability insurance, as it provides insurers with a clear record of physical assets and their values to accurately assess risk and determine coverage limits. This list typically includes equipment, machinery, furniture, and technology, ensuring comprehensive protection against potential liability claims related to business operations. |

| 15 | Safety Policies and Procedures | Small businesses need detailed safety policies and procedures documentation to secure liability insurance, as these records demonstrate risk management and compliance with industry standards. Comprehensive safety manuals, employee training records, and incident reporting protocols are essential to reduce potential claims and lower premium costs. |

| 16 | Professional Licenses (if applicable) | Small businesses must provide valid professional licenses as part of their liability insurance application to demonstrate compliance with industry regulations and establish credibility. These licenses verify qualifications and are essential for coverage eligibility in professions such as healthcare, legal services, and construction. |

| 17 | Lease or Property Deeds | Small businesses must provide lease agreements or property deeds to validate ownership or rental rights as part of their liability insurance application, ensuring accurate risk assessment. These documents confirm the business's legal occupancy and liability boundaries, essential for underwriting comprehensive coverage. |

| 18 | Vehicle Registration (if applicable) | Small businesses seeking liability insurance must provide current vehicle registration documents for any company-owned vehicles to verify ownership and ensure coverage eligibility. Accurate vehicle registration details enable insurers to assess risk and determine appropriate liability protection terms. |

| 19 | Proof of Ownership for Equipment | Small businesses must provide proof of ownership for equipment to secure liability insurance, which typically includes purchase receipts, invoices, or titles demonstrating legal possession. These documents verify the business's assets, ensuring accurate coverage and risk assessment by insurance providers. |

| 20 | Loss Run Reports | Small businesses need loss run reports, which provide detailed claims history essential for assessing liability insurance risk and premiums. These documents help insurers evaluate past losses to tailor coverage and ensure accurate policy pricing. |

Introduction to Small Business Liability Insurance

Small business liability insurance protects entrepreneurs from financial losses due to lawsuits or claims. Obtaining this coverage requires submitting specific documents that prove business operations and risks. Understanding these essential documents helps streamline the application process and secure adequate protection.

Importance of Proper Documentation

Proper documentation is essential when applying for liability insurance for your small business. It ensures accurate risk assessment and helps avoid delays in the claims process. Maintaining organized records protects your business by providing clear proof of compliance and coverage.

Business Formation and Registration Papers

Small businesses require specific documentation to secure liability insurance, particularly documents related to business formation and registration. These papers verify the legal existence of the business and its operational legitimacy.

- Articles of Incorporation or Organization - Official documents filed with the state that establish the legal formation of a corporation or LLC, necessary for proving business identity to insurers.

- Business License - A government-issued permit that confirms the business is authorized to operate in a particular jurisdiction, often required by insurance providers to validate legitimacy.

- Employer Identification Number (EIN) - A federal tax ID issued by the IRS that identifies the business for tax purposes, often requested by insurers as part of the application process for liability coverage.

Proof of Business Ownership

| Document | Description |

|---|---|

| Proof of Business Ownership | Essential for liability insurance, this document verifies Your legal right to operate the business. Common forms include business licenses, articles of incorporation, partnership agreements, or a DBA ("Doing Business As") certificate. Insurers require this proof to assess ownership legitimacy and ensure coverage aligns with rightful owners. |

| Business License | Issued by government authorities, this license confirms Your business is authorized to operate within specific regulations and jurisdictions. |

| Articles of Incorporation or Organization | Official formation documents filed with the state that establish the business entity legally and outline ownership structure. |

| Partnership Agreement | Legal contract between business partners detailing ownership percentages, roles, and responsibilities. |

| DBA Certificate | Proof that Your business operates under a trade name different from the legal owner's name. |

Federal and State Tax Identification Numbers

Small businesses require specific documentation to obtain liability insurance, including Federal and State Tax Identification Numbers. These identification numbers verify the business's legal status and ensure accurate record-keeping.

The Federal Tax Identification Number, also known as the Employer Identification Number (EIN), is issued by the IRS and used for tax reporting purposes. State Tax Identification Numbers vary by state and are essential for state-level tax compliance and insurance verification.

Employee and Payroll Records

Employee and payroll records are essential documents for obtaining liability insurance for a small business. These records provide detailed information about your workforce and compensation, helping insurers assess risk accurately.

Documents should include employee names, job titles, and dates of employment. Payroll records must detail wages, hours worked, and tax withholdings. Accurate and up-to-date employee and payroll records support the underwriting process and ensure proper coverage limits.

Previous Insurance Policies and Claims History

What previous insurance policies and claims history are required for small business liability insurance? Insurance providers typically ask for detailed records of any past liability coverage your business has held. Providing comprehensive documentation of claims history helps assess risk and determine accurate premium rates.

Business Licenses and Permits

Small businesses must provide specific documentation to secure liability insurance, with business licenses and permits being crucial. These documents verify legal operation and compliance with local regulations.

- Business Licenses - Official approval from local or state authorities that allows a business to operate legally.

- Special Permits - Required for businesses in regulated industries such as food service or construction, ensuring adherence to safety and health standards.

- Renewal Proof - Documentation showing that business licenses and permits are current and valid, which insurers require for coverage.

Submitting accurate business licenses and permits supports a smooth liability insurance application process.

Key Contracts and Agreements

Small businesses require specific documents to secure liability insurance effectively. Key contracts and agreements play a crucial role in demonstrating the scope of your operations and risk management practices.

Essential documents include client contracts, vendor agreements, and lease agreements. These documents help insurers assess liabilities and tailor coverage according to your business needs.

What Documents Does a Small Business Need for Liability Insurance? Infographic