Business liability insurance applications require key documents such as the completed application form, proof of business ownership or registration, and detailed descriptions of business operations to assess risk accurately. Financial statements provide insight into the company's stability, while prior insurance records and claims history help underwriters evaluate potential liabilities. Including employee information and safety protocols further supports a thorough risk assessment for tailored coverage options.

What Documents are Necessary for Business Liability Insurance Applications?

| Number | Name | Description |

|---|---|---|

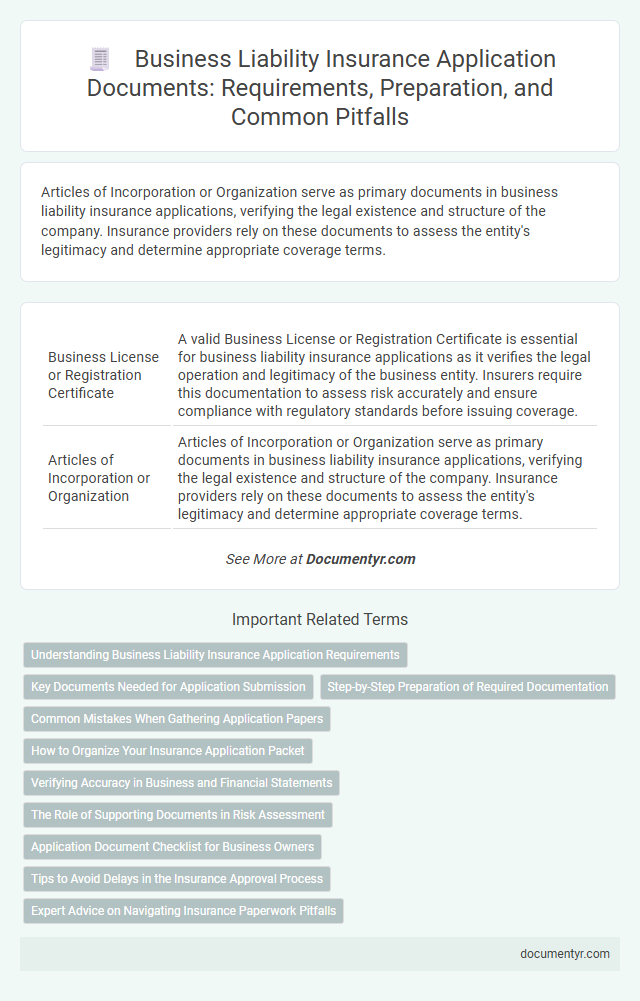

| 1 | Business License or Registration Certificate | A valid Business License or Registration Certificate is essential for business liability insurance applications as it verifies the legal operation and legitimacy of the business entity. Insurers require this documentation to assess risk accurately and ensure compliance with regulatory standards before issuing coverage. |

| 2 | Articles of Incorporation or Organization | Articles of Incorporation or Organization serve as primary documents in business liability insurance applications, verifying the legal existence and structure of the company. Insurance providers rely on these documents to assess the entity's legitimacy and determine appropriate coverage terms. |

| 3 | Employer Identification Number (EIN) | An Employer Identification Number (EIN) is a critical document required for business liability insurance applications, serving as a unique identifier for your business entity with the IRS. Insurers use the EIN to verify the legitimacy and tax status of the business, making it essential for processing and validating your insurance coverage request. |

| 4 | Previous Insurance Policies (if applicable) | Previous insurance policies, including declarations pages and claims history, are essential documents for business liability insurance applications to evaluate risk and coverage continuity. Insurers assess these records to determine premium rates and identify any prior claims or coverage gaps that could impact policy approval. |

| 5 | Claims History Report or Loss Runs | A Claims History Report or Loss Runs are essential documents for business liability insurance applications, providing a detailed record of past claims and losses to assess risk accurately. Insurers rely on these reports to evaluate the frequency, severity, and nature of prior claims, impacting premium rates and policy terms. |

| 6 | Financial Statements (Profit & Loss, Balance Sheet) | Business liability insurance applications require comprehensive financial statements, including detailed Profit & Loss statements and Balance Sheets, to assess the company's financial stability and risk exposure accurately. Insurers rely on these documents to evaluate the business's revenue streams, liabilities, assets, and overall financial health, ensuring appropriate coverage and premium determination. |

| 7 | Detailed Business Description | A detailed business description is essential for business liability insurance applications, outlining the nature of operations, products or services offered, number of employees, and location(s) to accurately assess risk exposure. Comprehensive information about business activities helps insurers determine appropriate coverage limits and premiums tailored to the company's specific liability profile. |

| 8 | List of Business Owners/Partners | A comprehensive business liability insurance application requires a detailed list of all business owners and partners, including their full names, ownership percentages, and roles within the company to accurately assess risk. Providing official identification documents such as government-issued IDs alongside partnership agreements and business formation documents ensures verification and expedites the underwriting process. |

| 9 | Employee Information and Payroll Records | Business liability insurance applications require detailed employee information, including names, job titles, and roles to assess risk exposure accurately. Comprehensive payroll records must be provided to verify wage totals and employment classifications, ensuring proper premium calculations and policy coverage. |

| 10 | Risk Management Procedures/Manuals | Comprehensive business liability insurance applications require detailed risk management procedures and manuals outlining safety protocols, employee training, incident reporting, and loss prevention strategies. These documents demonstrate the company's commitment to minimizing risks and are critical for insurers to assess coverage eligibility and premium rates. |

| 11 | Contracts with Clients or Vendors | Contracts with clients or vendors are essential documents for business liability insurance applications as they outline the scope of work, responsibilities, and risk allocation. Insurers use these contracts to assess potential liability exposures and determine appropriate coverage limits and premiums. |

| 12 | Leases or Property Agreements | Leases or property agreements serve as crucial documentation in business liability insurance applications, as they verify the insured premises and outline responsibilities related to property use and maintenance. Insurers evaluate these agreements to assess potential risks and ensure coverage aligns with the terms of the lease. |

| 13 | Certificates of Good Standing | Certificates of Good Standing are essential documents for business liability insurance applications, verifying that a company complies with state regulations and is legally authorized to operate. Insurers often require this certificate to assess the business's legitimacy and reduce risk before approving coverage. |

| 14 | Equipment and Inventory Lists | Equipment and inventory lists are essential documents for business liability insurance applications as they provide detailed descriptions and valuations of the physical assets at risk. Accurate and up-to-date records help insurers assess potential liabilities and determine appropriate coverage limits, minimizing gaps in protection. |

| 15 | Professional Certifications or Licenses | Professional certifications or licenses relevant to your industry serve as critical documents when applying for business liability insurance, demonstrating your compliance with regulatory standards and professional competence. Insurers often require verified copies of these credentials to assess risk accurately and determine appropriate coverage terms for professional liability protection. |

| 16 | Proof of Address | Proof of address documents required for business liability insurance applications typically include recent utility bills, lease agreements, or bank statements that clearly display the business's physical location. Insurers use these documents to verify the legitimacy of the business address and assess risk accurately. |

| 17 | Safety Inspection Reports | Safety inspection reports provide essential evidence of compliance with regulatory standards and demonstrate a proactive approach to hazard management, significantly enhancing the credibility of a business liability insurance application. These documents help insurers assess risk levels accurately and may lead to more favorable premium rates or coverage terms. |

| 18 | Current Marketing Materials | Current marketing materials for business liability insurance applications typically require submission of a completed application form, proof of business ownership or registration, financial statements, details of existing insurance policies, and a comprehensive list of any prior claims or losses. These documents ensure accurate risk assessment and underwriting by providing insights into business operations, financial stability, and historical liability exposure. |

| 19 | Organizational Chart | An organizational chart is essential for business liability insurance applications as it clearly outlines the company's structure, identifying key roles and responsibilities that impact risk assessment. Insurers use this document to evaluate management hierarchy and accountability, which helps determine appropriate coverage levels and premiums. |

| 20 | Insurance Application Form | The insurance application form is essential for business liability insurance, requiring detailed information about the business operations, employee count, and prior claims history. Accurate completion of this form ensures proper risk assessment and coverage customization by the insurer. |

Understanding Business Liability Insurance Application Requirements

Business liability insurance applications require specific documents to verify your business operations and risk exposure. Commonly requested documents include business licenses, financial statements, and proof of previous insurance coverage.

Insurance providers also typically need details about your business assets, employee information, and safety protocols. Proper documentation ensures an accurate assessment of risk and helps secure appropriate coverage.

Key Documents Needed for Application Submission

Applying for business liability insurance requires specific documentation to ensure accurate risk assessment and policy issuance. Key documents demonstrate the nature of the business and its operational risks.

Business licenses and permits verify legal operation within the industry. Financial statements provide insight into the company's stability and revenue streams. Additionally, prior insurance policies and claims history outline risk exposure and past incidents.

Step-by-Step Preparation of Required Documentation

Preparing the necessary documents for a business liability insurance application involves gathering comprehensive details about your business operations and risk factors. Key documents include business licenses, proof of ownership, and detailed descriptions of your services or products.

Financial statements and prior insurance records establish the company's stability and claim history, critical for underwriting. Additionally, employee information and premises details support accurate risk assessment and policy customization.

Common Mistakes When Gathering Application Papers

| Necessary Documents for Business Liability Insurance Applications | Common Mistakes When Gathering Application Papers |

|---|---|

|

|

How to Organize Your Insurance Application Packet

Organizing your business liability insurance application packet requires gathering key documents such as your business license, financial statements, and proof of existing insurance policies. Include detailed descriptions of your operations and any risk management procedures to provide a clear risk profile. A well-organized packet facilitates faster processing and reduces the chances of application delays or requests for additional information.

Verifying Accuracy in Business and Financial Statements

Verifying accuracy in business and financial statements is crucial when applying for business liability insurance. Insurers rely on precise documentation to assess risk and determine coverage terms.

- Business License - Confirms the legal operation status of the business for underwriting purposes.

- Financial Statements - Includes balance sheets and profit and loss statements to evaluate the financial health and risk profile.

- Tax Returns - Validates reported income and expenses, ensuring consistency with financial disclosures.

Accurate verification of these documents helps prevent application delays and potential coverage denials.

The Role of Supporting Documents in Risk Assessment

Business liability insurance applications require specific documents such as a completed application form, proof of business operations, and financial statements. Supporting documents play a crucial role in risk assessment by providing detailed insights into the nature and scale of your business activities. These documents help insurers evaluate potential risks and determine appropriate coverage and premium rates.

Application Document Checklist for Business Owners

Business liability insurance requires specific documents to ensure proper coverage and risk assessment. Gathering the correct paperwork accelerates the application process and prevents delays.

- Completed Application Form - This form collects essential business details, ownership information, and coverage requirements.

- Financial Statements - Profit and loss statements or balance sheets demonstrate the business's financial health to assess risk.

- Previous Insurance Policies - Documentation of prior liability coverage helps insurers evaluate claims history and underwriting needs.

Tips to Avoid Delays in the Insurance Approval Process

What documents are necessary for business liability insurance applications? Essential documents include a completed application form, proof of business ownership, and financial statements. Providing accurate and up-to-date information ensures a smoother approval process.

How can businesses avoid delays when submitting liability insurance applications? Organize and submit all required documents, such as risk assessments and previous insurance policies, promptly. Clear and complete documentation helps insurance providers evaluate the application faster.

Why is it important to verify document accuracy before applying? Errors or missing information in documents like licenses or tax identification can cause processing delays. Double-checking details helps prevent unnecessary back-and-forth with the insurer.

What role do risk management records play in the insurance approval process? Including safety procedures and employee training records demonstrates proactive risk management. This evidence can accelerate approval and potentially reduce premiums.

How does timely communication with the insurance agent impact the application process? Responding quickly to requests for additional information or clarifications keeps the process moving efficiently. Maintaining clear communication avoids potential delays in approval.

What Documents are Necessary for Business Liability Insurance Applications? Infographic