Pet insurance claims typically require essential documents such as a completed claim form, itemized veterinary invoices, and proof of payment. Veterinary records detailing the diagnosis and treatment may also be necessary to support the claim. Ensuring all documentation is accurate and submitted promptly helps facilitate a smooth and timely reimbursement process.

What Documents are Needed for Pet Insurance Claims?

| Number | Name | Description |

|---|---|---|

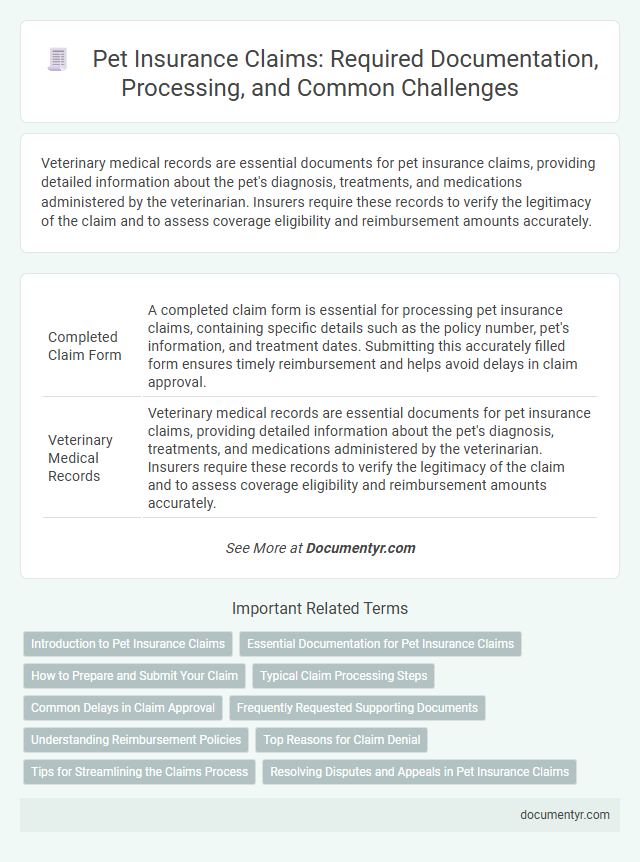

| 1 | Completed Claim Form | A completed claim form is essential for processing pet insurance claims, containing specific details such as the policy number, pet's information, and treatment dates. Submitting this accurately filled form ensures timely reimbursement and helps avoid delays in claim approval. |

| 2 | Veterinary Medical Records | Veterinary medical records are essential documents for pet insurance claims, providing detailed information about the pet's diagnosis, treatments, and medications administered by the veterinarian. Insurers require these records to verify the legitimacy of the claim and to assess coverage eligibility and reimbursement amounts accurately. |

| 3 | Itemized Invoice from Veterinarian | An itemized invoice from the veterinarian is essential for pet insurance claims as it details the specific treatments, medications, and services provided, ensuring accurate reimbursement. This document must clearly list dates of service, individual costs, and veterinarian's credentials to validate the claim and prevent processing delays. |

| 4 | Proof of Payment/Receipts | Pet insurance claims require proof of payment or receipts to validate expenses incurred for veterinary treatments, medications, and services provided. Detailed receipts must include the date of service, provider information, itemized charges, and proof of payment to ensure accurate claim processing. |

| 5 | Diagnosis Report | A detailed diagnosis report from a licensed veterinarian is essential for pet insurance claims, providing documented evidence of the pet's medical condition, treatments, and prognosis. This report supports the claim by validating the necessity and extent of veterinary care received. |

| 6 | Prescription Receipts | Prescription receipts are essential documents for pet insurance claims, providing proof of medication prescribed by a licensed veterinarian and confirming treatment details. These receipts ensure accurate reimbursement by verifying the cost and legitimacy of prescribed drugs under the pet insurance policy. |

| 7 | Adoption or Purchase Records | Pet insurance claims require detailed adoption or purchase records to verify ownership and eligibility, including adoption certificates or sales receipts with the date, breeder or shelter information, and pet details such as breed, age, and microchip number. These documents ensure timely processing of claims by confirming the insured pet's identity and acquisition source. |

| 8 | Policyholder Identification | Policyholders must provide valid identification documents such as a government-issued photo ID, policy number, and proof of address to verify their identity when submitting pet insurance claims. These documents ensure accurate processing and prevent fraudulent claims related to the insured pet. |

| 9 | Insurance Policy Number | Submitting pet insurance claims requires the insurance policy number as a primary document to verify coverage and process the claim efficiently. This unique identifier links the claim to the insured policy, ensuring accurate assessment and reimbursement. |

| 10 | Referral Letter (if applicable) | Pet insurance claims typically require a detailed referral letter from a licensed veterinarian when specialist treatment or advanced diagnostics are necessary. This referral letter must include the pet's diagnosis, recommended treatment plan, and the specialist's contact information to ensure claim approval. |

| 11 | Treatment Plan (if ongoing care) | A detailed treatment plan from your veterinarian is essential for pet insurance claims involving ongoing care, outlining the diagnosis, prescribed treatments, and expected duration. This documentation helps insurers assess the necessity and coverage eligibility for continuous medical interventions. |

| 12 | Laboratory Test Results | Laboratory test results are essential documents for pet insurance claims as they provide verified medical evidence of your pet's health condition and diagnosis. Insurers require detailed lab reports to process claims accurately and ensure coverage for treatments related to specific illnesses or injuries. |

| 13 | Explanation of Benefits (EOB) | An Explanation of Benefits (EOB) is a crucial document for pet insurance claims, detailing the services provided, the amount billed, and the portion covered by the insurer. Pet owners should submit the EOB along with veterinary invoices and medical records to ensure accurate and timely reimbursement. |

| 14 | Accident Report (if applicable) | Submitting pet insurance claims requires a detailed accident report if the claim involves injury from an accident, providing crucial information such as the date, time, location, and circumstances of the incident. This report must be accompanied by veterinary records, proof of payment, and the insurance policy details to ensure a comprehensive evaluation of the claim. |

| 15 | History of Vaccinations and Preventative Care | Submitting pet insurance claims requires detailed documentation, including the pet's complete history of vaccinations and preventative care records to verify ongoing health maintenance. Accurate vaccination dates, types, and proof of regular preventative treatments help expedite claim processing and ensure coverage eligibility. |

Introduction to Pet Insurance Claims

Pet insurance claims require specific documentation to ensure smooth processing and reimbursement. Understanding the necessary documents helps you submit claims efficiently and avoid delays.

- Claim Form - A completed claim form provides essential details about your pet and the treatment received.

- Veterinary Invoices - Official invoices from your veterinary clinic must detail the services and costs incurred.

- Medical Records - Comprehensive medical records support the diagnosis and treatment claims made for your pet.

Essential Documentation for Pet Insurance Claims

Submitting a pet insurance claim requires specific documentation to ensure a smooth and timely process. Proper preparation of these documents helps avoid delays and increases the likelihood of reimbursement.

- Proof of Ownership - Providing adoption papers or purchase receipts verifies that the pet is insured under your policy.

- Veterinary Records - Detailed medical reports and treatment notes from your vet support the legitimacy of the claimed illness or injury.

- Receipts and Invoices - Accurate billing statements show the costs incurred for treatments, medications, or surgeries related to the claim.

Having all essential documents organized and complete speeds up the approval of your pet insurance claim.

How to Prepare and Submit Your Claim

| Required Documents | Description |

|---|---|

| Completed Claim Form | Official form provided by the insurance company, filled out with accurate policy and incident details. |

| Itemized Veterinary Bills | Detailed invoices showing services rendered, dates, and costs related to the pet's treatment. |

| Medical Records | Comprehensive records from the veterinarian covering diagnosis, treatment, and prescribed medications. |

| Proof of Payment | Receipts or statements demonstrating payment for veterinary services. |

| Pet Identification | Documents verifying the pet's identity, such as microchip information or registration papers. |

| Additional Documentation | Supplementary documents requested by the insurer, like photos or special reports. |

| How to Prepare and Submit Your Claim | |

| Gather All Necessary Documents | Collect all required paperwork promptly to avoid delays in processing. |

| Complete Claim Form Accurately | Fill out the claim form with precise information matching policy details and treatment dates. |

| Attach Supporting Documents | Include all veterinary bills, medical records, and proof of payment to substantiate the claim. |

| Submit Through Approved Channels | Send the claim using methods accepted by the insurer, such as online portals, mail, or email. |

| Keep Copies for Records | Maintain copies of every document submitted for future reference and follow-up. |

Typical Claim Processing Steps

To file a pet insurance claim, you need to provide the veterinary invoice, a completed claim form, and proof of payment. Typical claim processing steps include submitting these documents, verification by the insurance provider, and claim approval or denial. Your prompt and accurate submission ensures faster reimbursement for veterinary expenses.

Common Delays in Claim Approval

Pet insurance claims require specific documents to ensure smooth processing. Commonly needed items include the completed claim form, veterinary bills, medical records, and proof of payment.

Delays in claim approval often result from missing or incomplete documentation. Submitting all required paperwork promptly helps avoid unnecessary hold-ups.

Frequently Requested Supporting Documents

Submitting a pet insurance claim requires specific documents to verify the treatment and ensure coverage eligibility. Insurance providers commonly request detailed paperwork to process claims efficiently.

- Veterinary Bills - Itemized receipts showing services rendered, dates, and costs are essential for claim approval.

- Medical Records - Detailed health records, including diagnosis and treatment notes, support the claim's validity.

- Claim Form - A completed and signed insurance claim form provides necessary policy and incident details.

Understanding Reimbursement Policies

Submitting accurate documentation is crucial for pet insurance claims reimbursement. Common required documents include the veterinary invoice, proof of payment, and a detailed medical report outlining diagnosis and treatment. Understanding your insurer's reimbursement policies helps ensure timely and full compensation for your pet's medical expenses.

Top Reasons for Claim Denial

Submitting the correct documents is crucial for a successful pet insurance claim. Commonly required documents include the claim form, veterinary invoices, medical records, and proof of payment.

Top reasons for claim denial often involve incomplete documentation and pre-existing conditions not covered by the policy. Failure to provide detailed medical records or missing receipts can result in rejection of the claim.

Tips for Streamlining the Claims Process

What documents are needed for pet insurance claims? Ensure you have your pet's medical records and detailed invoices from the veterinary clinic. These documents provide essential proof of treatment and expenses for a smooth claim process.

How can you streamline the pet insurance claims process? Keep copies of all receipts and vet reports organized and submit claims promptly after treatment. Clear and complete documentation speeds up approval and reimbursement times effectively.

What Documents are Needed for Pet Insurance Claims? Infographic