To obtain pet insurance reimbursement, submit the original itemized veterinary invoice detailing the services provided, including diagnosis and treatment codes. Include proof of payment, such as a receipt or bank statement, to verify the transaction. Some insurers may also require a completed claim form and a medical history of your pet to process the reimbursement efficiently.

What Documents are Required for Pet Insurance Reimbursement?

| Number | Name | Description |

|---|---|---|

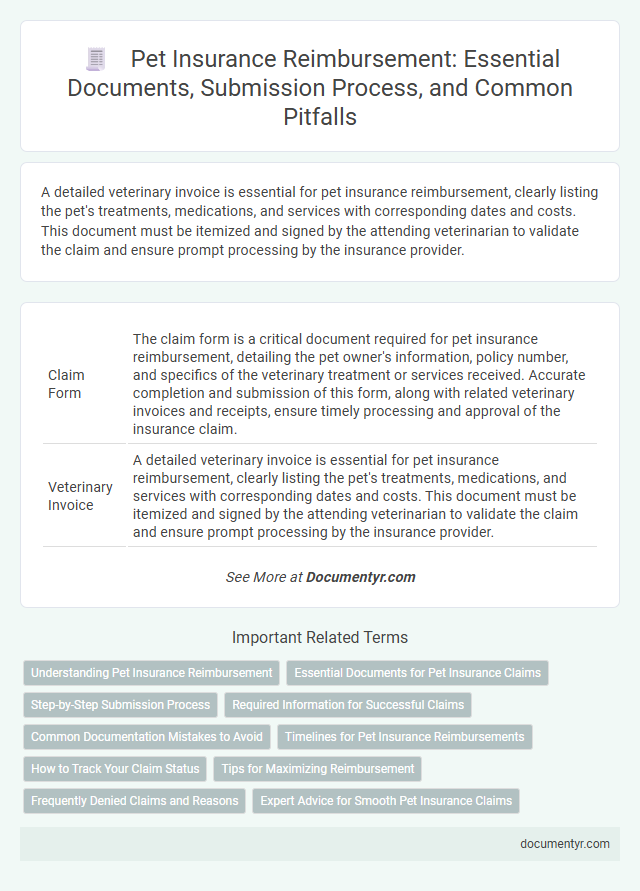

| 1 | Claim Form | The claim form is a critical document required for pet insurance reimbursement, detailing the pet owner's information, policy number, and specifics of the veterinary treatment or services received. Accurate completion and submission of this form, along with related veterinary invoices and receipts, ensure timely processing and approval of the insurance claim. |

| 2 | Veterinary Invoice | A detailed veterinary invoice is essential for pet insurance reimbursement, clearly listing the pet's treatments, medications, and services with corresponding dates and costs. This document must be itemized and signed by the attending veterinarian to validate the claim and ensure prompt processing by the insurance provider. |

| 3 | Payment Receipt | Payment receipts are essential documents for pet insurance reimbursement as they provide proof of the veterinary services paid. These receipts must clearly include the date of service, itemized costs, and payment method to ensure successful claim processing and timely reimbursement. |

| 4 | Detailed Medical Records | Detailed medical records are essential for pet insurance reimbursement as they provide comprehensive documentation of the diagnosis, treatment, and veterinary visits necessary for claim approval. These records typically include itemized invoices, vaccination history, lab results, and veterinarian notes proving the legitimacy and extent of the pet's medical care. |

| 5 | Itemized Treatment Summary | An itemized treatment summary is essential for pet insurance reimbursement as it provides a detailed breakdown of veterinary services, including dates, procedures performed, and associated costs. This document enables insurance providers to verify the legitimacy of the claim and accurately process reimbursements based on the specific treatments rendered. |

| 6 | Diagnostic Test Results | Diagnostic test results, including lab reports, imaging scans, and pathology findings, are essential documents for pet insurance reimbursement as they verify the diagnosis and medical necessity of treatments. Submitting detailed and accurate diagnostic reports ensures faster claims processing and higher approval rates from insurance providers. |

| 7 | Prescription Receipts | Prescription receipts must clearly display the medication name, dosage, prescribing veterinarian's name, and the purchase date to qualify for pet insurance reimbursement. Submitting these detailed receipts along with the claim form ensures faster processing and approval of your veterinary expenses. |

| 8 | Proof of Pet Ownership | Proof of pet ownership is a critical document for pet insurance reimbursement, typically requiring a veterinary certificate, adoption papers, or registration documents such as a pet license or microchip information. Insurers use these documents to verify the insured pet's identity and confirm eligibility for coverage before processing claims. |

| 9 | Policyholder Identification | Policyholder identification for pet insurance reimbursement requires submitting a government-issued ID, proof of address, and the original insurance policy documents. Providing accurate policyholder details such as name, policy number, and contact information ensures prompt and accurate claim processing. |

| 10 | Pet’s Vaccination Records | Pet insurance reimbursement requires submission of comprehensive vaccination records documenting all administered vaccines, including dates, vaccine types, and veterinarian details; these records validate the pet's preventive care and eligibility for coverage. Immunization histories must be clear and up-to-date to support claims and ensure timely reimbursement from the insurance provider. |

| 11 | Referral Letters (if applicable) | For pet insurance reimbursement, a referral letter from a licensed veterinarian is required if specialist treatment is involved, detailing the necessity of the referral and the pet's medical condition. This document ensures that claims related to specialized care are validated and processed efficiently by the insurance provider. |

| 12 | Discharge Summary (if hospitalized) | For pet insurance reimbursement, a detailed discharge summary from the veterinary hospital is essential if your pet was hospitalized, as it provides a comprehensive record of the diagnosis, treatment, and duration of stay. This document validates the claims by outlining the medical procedures performed and supports the reimbursement process effectively. |

| 13 | Explanation of Charges | A detailed Explanation of Charges (EOC) from your veterinarian is essential for pet insurance reimbursement, outlining itemized services, treatments, and associated costs. This document validates claims by providing transparent billing information that aligns with your insurance policy's coverage criteria. |

| 14 | Surgery Reports (if applicable) | Surgery reports are essential documents for pet insurance reimbursement as they provide detailed information about the procedure, including the diagnosis, surgical intervention, and the veterinarian's assessment. Insurers rely on these reports to verify the claim and ensure that the surgery was necessary and covered under the policy terms. |

| 15 | Pre-authorization Letter (if required) | Pet insurance reimbursement often requires submitting a pre-authorization letter, which confirms prior approval from the insurer for specific veterinary treatments or procedures. This document is crucial to ensure the claim is processed smoothly and covers the eligible expenses as per the policy terms. |

Understanding Pet Insurance Reimbursement

Understanding pet insurance reimbursement requires submitting the correct documents to ensure timely claims processing. Essential documents typically include the original veterinary invoice and a detailed receipt.

Proof of payment such as a credit card statement or bank confirmation may be necessary to verify the transaction. You should also provide a completed claim form specifying the treatment and dates of service.

Essential Documents for Pet Insurance Claims

| Document Type | Description |

|---|---|

| Itemized Veterinary Bills | Detailed invoices showing treatments, services, and medications provided to the pet. These bills must indicate the date of service and costs. |

| Proof of Payment | Receipts or bank statements confirming that the veterinary bills were paid in full. |

| Claim Form | Completed and signed claim submission form provided by the insurance company. This form collects information about the pet, policy details, and incident. |

| Medical Records | Copies of medical reports, diagnostic test results, or treatment notes from the veterinarian supporting the claim. |

| Proof of Ownership | Documents showing ownership, such as registration papers or adoption certificates, to verify the insured pet's identity. |

| Policy Documents | Copies of your pet insurance policy and declaration page, outlining coverage and limits to confirm eligibility for reimbursement. |

| Additional Supporting Evidence | Photos, videos, or additional veterinarian statements that substantiate the claim, especially in cases of accidents or injuries. |

Step-by-Step Submission Process

Submitting documents for pet insurance reimbursement requires careful preparation and organization to ensure quick processing. Understanding the step-by-step submission process helps pet owners avoid delays and maximize their claim success.

- Collect the itemized veterinary bills - These must detail services provided, dates of treatment, and costs incurred to verify the claim.

- Include the completed claim form - Accurately fill out the insurance provider's form with your pet and policy details for proper identification.

- Attach proof of payment - Provide receipts or credit card statements as evidence that the veterinary services were paid in full.

Required Information for Successful Claims

Submitting the correct documents is essential for pet insurance reimbursement. Providing clear and complete information ensures your claim is processed smoothly.

- Itemized Veterinary Invoice - This document must detail all services, treatments, and medications provided to your pet, including dates and costs.

- Proof of Payment - Receipts or bank statements showing you have paid the veterinary bills are required for claim validation.

- Claim Form - A completed and signed claim form with your pet's details and policy information is necessary for processing.

Ensuring all required documents are accurate and submitted promptly speeds up reimbursement approval.

Common Documentation Mistakes to Avoid

To ensure smooth pet insurance reimbursement, submit itemized veterinary bills, proof of payment, and a completed claim form. Common documentation mistakes include missing signatures, unclear receipts, and incomplete medical records. You can avoid delays by double-checking all documents for accuracy and completeness before submission.

Timelines for Pet Insurance Reimbursements

Timely submission of documents is crucial for pet insurance reimbursement. Typically, you must file your claims within 90 days of the veterinary service date to ensure coverage eligibility.

Required documents usually include the original itemized veterinary invoice, a completed claim form, and proof of payment. Some insurance providers may also request medical records or a diagnosis summary from the vet. Meeting these timeline requirements helps avoid delays and guarantees faster claim processing.

How to Track Your Claim Status

What documents are required for pet insurance reimbursement? Submit the itemized veterinary invoice and a completed claim form provided by your insurer. Keep copies of all medical records and receipts to ensure a smooth reimbursement process.

How to track your pet insurance claim status? Most insurance providers offer online portals or mobile apps where you can monitor claim progress in real-time. Alternatively, you can contact customer service via phone or email for updates on your reimbursement status.

Tips for Maximizing Reimbursement

Submitting the correct documents is essential for a smooth pet insurance reimbursement process. Organize all necessary paperwork carefully to maximize your claim success.

- Itemized Veterinary Bills - Provide clear, detailed invoices showing treatments, dates, and costs.

- Claim Form Completion - Accurately fill out all required fields on the insurer's reimbursement claim form.

- Proof of Payment - Include receipts or bank statements confirming payment for veterinary services.

- Medical Records - Attach veterinary records documenting diagnosis and treatment specifics.

- Policy Information - Reference your pet insurance policy number and coverage details.

Frequently Denied Claims and Reasons

Pet insurance reimbursement requires submitting specific documents such as the itemized veterinary bill, a completed claim form, and proof of payment. Accurate and complete documentation ensures a smoother claims process and faster reimbursement.

Frequently denied claims often result from missing or incomplete paperwork, such as unsigned forms or lack of detailed treatment descriptions. Common reasons include submitting invoices without itemized services, pre-existing condition exclusions, and failure to meet policy requirements.

What Documents are Required for Pet Insurance Reimbursement? Infographic