To qualify for homeowners insurance discounts, key documents typically required include proof of home security systems, such as alarm or surveillance certificates, and evidence of safety upgrades like smoke detectors or storm-resistant windows. Insurers may also request a recent home inspection report to verify the condition and maintenance of the property. Providing detailed documentation of home improvements and risk-reducing features helps maximize available policy discounts.

What Documents are Needed for Homeowners Insurance Discounts?

| Number | Name | Description |

|---|---|---|

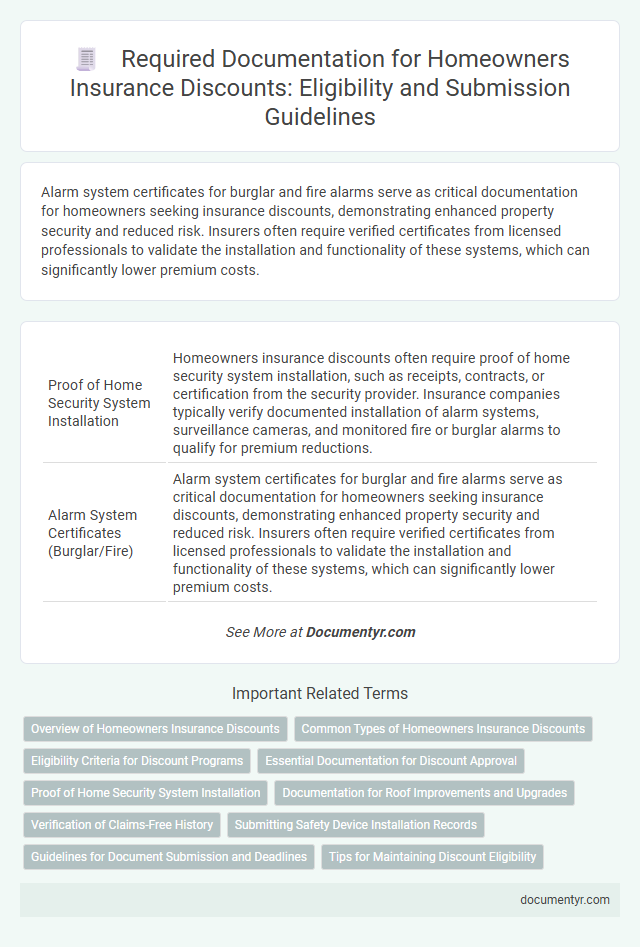

| 1 | Proof of Home Security System Installation | Homeowners insurance discounts often require proof of home security system installation, such as receipts, contracts, or certification from the security provider. Insurance companies typically verify documented installation of alarm systems, surveillance cameras, and monitored fire or burglar alarms to qualify for premium reductions. |

| 2 | Alarm System Certificates (Burglar/Fire) | Alarm system certificates for burglar and fire alarms serve as critical documentation for homeowners seeking insurance discounts, demonstrating enhanced property security and reduced risk. Insurers often require verified certificates from licensed professionals to validate the installation and functionality of these systems, which can significantly lower premium costs. |

| 3 | Recent Home Inspection Report | A recent home inspection report is essential for homeowners insurance discounts as it provides detailed information on the property's condition, highlighting safety features and potential risks. Insurers use this report to assess the home's risk level accurately, often resulting in reduced premiums for well-maintained or upgraded homes. |

| 4 | Roof Certification Report | A Roof Certification Report provides detailed information about the age, condition, and materials of your roof, which insurers use to evaluate risk and qualify homeowners for insurance discounts. Submitting this document can significantly reduce premiums by demonstrating that the roof meets safety and durability standards. |

| 5 | Proof of Impact-Resistant Roofing | Proof of impact-resistant roofing for homeowners insurance discounts typically requires providing manufacturer certification, installation receipts, or inspection reports confirming compliance with industry standards such as ASTM or UL 2218. Insurers may also request photos or on-site assessments to verify the roofing material's impact resistance and eligibility for premium reductions. |

| 6 | Proof of Upgraded Plumbing/Electrical Systems | Providing documented proof of upgraded plumbing and electrical systems, such as receipts from licensed contractors or inspection certificates, is essential for qualifying for homeowners insurance discounts. Insurance companies often require these records to verify improvements that reduce risk and enhance home safety. |

| 7 | Utility Bills (Energy-Efficient Upgrades) | Utility bills demonstrating energy-efficient upgrades, such as reduced electricity or gas consumption, play a crucial role in qualifying for homeowners insurance discounts by proving the implementation of cost-saving and environmentally friendly improvements. Insurance providers often require recent utility statements to verify the effectiveness of upgrades like solar panels, energy-efficient HVAC systems, or insulation enhancements to offer premium reductions. |

| 8 | Wind Mitigation Inspection Report | A Wind Mitigation Inspection Report is essential for securing homeowners insurance discounts, as it provides a detailed assessment of a property's wind resistance features including roof shape, roof-to-wall connections, and window protection. Insurers rely on this report to evaluate risk accurately and offer premium reductions for homes with enhanced wind-resistant construction elements. |

| 9 | Proof of Fire Sprinkler System | Homeowners insurance discounts often require proof of a fire sprinkler system, which can include installation certificates, inspection reports, or photos verifying the system's compliance with local fire safety codes. Providing these documents demonstrates risk reduction, enabling insurers to offer lower premium rates based on enhanced property protection. |

| 10 | Gated Community Residence Verification | Proof of residence within a gated community, such as a homeowners association (HOA) certificate or a deed specifying property location, is essential for homeowners insurance discounts. Insurers require verified documentation to confirm the gated community status, as it often reduces risk factors like theft and vandalism. |

| 11 | Claims-Free Certificate | A Claims-Free Certificate is a crucial document for homeowners insurance discounts, proving a policyholder's history of no claims and demonstrating risk reduction to insurers. Providing this certificate can significantly lower premium costs by validating a clean insurance record. |

| 12 | Proof of Membership (HOA, Community Organizations) | Proof of membership in a Homeowners Association (HOA) or recognized community organizations often qualifies policyholders for homeowners insurance discounts by demonstrating risk mitigation through collective maintenance and security measures. Insurers commonly require official membership certificates or statements from the HOA as part of the documentation to verify eligibility for these premium reductions. |

| 13 | Evidence of Bundled Policies | Evidence of bundled policies for homeowners insurance discounts typically includes proof of active coverage from multiple insurance lines, such as auto and home insurance, under the same provider. Documentation such as current policy declarations pages or billing statements demonstrating concurrent policies is essential to qualify for multi-policy discount savings. |

| 14 | Proof of Recent Renovations/Upgrades | Proof of recent renovations or upgrades such as receipts, contractor invoices, or inspection reports can validate home improvements that qualify for homeowners insurance discounts. These documents demonstrate enhanced safety features or structural reinforcements, which help insurers assess reduced risk and apply premium reductions accordingly. |

| 15 | Age Verification for Senior Discount | To qualify for a homeowners insurance senior discount, insurers typically require age verification documents such as a valid driver's license, passport, or state-issued ID card confirming the policyholder is 55 years or older. Providing these official documents expedites the discount approval process and ensures compliance with underwriting guidelines. |

| 16 | Proof of Smoke Detector Installation | Proof of smoke detector installation for homeowners insurance discounts typically requires a dated receipt or invoice from a certified installer, or a signed declaration confirming the presence and functionality of smoke detectors in the home. Insurers may also request a recent home inspection report or photographs verifying the placement and operational status of the smoke detection devices. |

| 17 | Carbon Monoxide Detector Certification | Homeowners insurance discounts often require submission of a valid carbon monoxide detector certification to verify installation and compliance with local safety regulations. Providing this certification demonstrates enhanced safety measures, potentially lowering the insurance premium by reducing risk factors associated with carbon monoxide exposure. |

| 18 | Proof of Backup Generator Installation | Providing official receipts and installation certificates from licensed electricians confirms the presence of a backup generator, qualifying homeowners for insurance discounts. Homeowners should also submit inspection reports or photos proving the generator's operational status to maximize discount eligibility. |

| 19 | Flood-Proofing Documentation | Flood-proofing documentation, including engineering reports, elevation certificates, and compliance certificates demonstrating adherence to flood-resistant building standards, is essential for homeowners insurance discounts. These documents validate flood mitigation measures, enabling insurers to assess reduced risk and offer premium reductions. |

| 20 | Military or First Responder Identification | Military or first responder identification, such as an active duty military ID or official first responder badge, is essential for homeowners insurance discounts that target these groups. Insurers typically require proof of current service status alongside standard documents like a policy application and property details to validate eligibility for discounted rates. |

Overview of Homeowners Insurance Discounts

Homeowners insurance discounts require specific documents to verify eligibility and secure lower premiums. Understanding the necessary paperwork streamlines the discount approval process.

Common discounts include security system verification, claim history records, and proof of home upgrades.

- Security System Documentation - Certificates or service agreements confirm the presence of burglary alarms or fire protection systems.

- Claims History Report - A record from previous insurers demonstrates responsible claim behavior, qualifying for no-claims discounts.

- Home Upgrade Receipts - Proof of renovations such as new roofing, wiring, or plumbing supports eligibility for discounts linked to improved property safety.

Common Types of Homeowners Insurance Discounts

Homeowners seeking insurance discounts must provide specific documents to qualify for common types of homeowners insurance discounts. Proof of safety features, such as smoke detectors, burglar alarms, or deadbolt locks, often requires inspection reports or receipts from certified installers. Documentation of home updates like a new roof, plumbing, or electrical system upgrades is essential, usually verified by contractor invoices or inspection certificates.

Eligibility Criteria for Discount Programs

| Document Type | Purpose | Eligibility Criteria for Discounts |

|---|---|---|

| Home Security System Certification | Proof of installed monitored security devices | Homes equipped with professionally monitored alarms often qualify for security discounts |

| Fire and Smoke Detector Receipts | Verification of functioning fire safety equipment | Properties with updated, interconnected fire detection systems meet criteria for fire safety discounts |

| Updated Roof Inspection Report | Assessment of roof condition and materials | Newer roofs or those made with fire-resistant or impact-resistant materials may earn discounts |

| Proof of Renovations or Upgrades | Documentation of home improvements enhancing safety or durability | Upgrades like reinforced doors, storm shutters, or updated electrical systems increase eligibility |

| Claims History Report | Record of previous insurance claims on the property | Homes with a history of few or no claims often qualify for good homeowner discounts |

| Proof of Bundled Policies | Documentation showing multiple insurance policies with the same provider | Combining home and auto insurance can result in multi-policy discounts |

| Occupancy Verification | Documents proving primary residence status | Your primary residence status can impact eligibility for owner-occupied discounts |

Essential Documentation for Discount Approval

Essential documentation for homeowners insurance discounts includes proof of home security systems, such as alarm installation certificates or monitoring service contracts. You must also provide updated home inspection reports and receipts for recent home improvements that enhance safety or reduce risk. Insurance companies require these documents to verify eligibility and apply the appropriate discount to your policy.

Proof of Home Security System Installation

Proof of home security system installation is essential for qualifying for homeowners insurance discounts. Insurers require documentation to verify the presence and functionality of the security measures installed.

- Installation Receipt - A detailed invoice from the security provider demonstrates the installation date and system type.

- Certification or Inspection Report - Official certification or inspection ensures the security system meets insurer standards.

- System Activation Proof - Documentation showing the security system is active and monitored can increase discount eligibility.

Documentation for Roof Improvements and Upgrades

Insurance companies often require specific documentation to verify roof improvements and upgrades for homeowners insurance discounts. Proper records can demonstrate enhanced protection and reduce risk assessment.

Documents needed usually include detailed receipts or invoices from licensed contractors showing the type of materials used and date of installation. A roof certification or inspection report confirming the quality and condition of the roofing work is essential. Photos before and after the upgrades may further support your claim for discounts.

Verification of Claims-Free History

Verification of a claims-free history is essential for securing homeowners insurance discounts. Insurers require specific documents to confirm that you have not filed recent claims.

- Claims history report - A detailed record from your previous insurer showing no claims filed within a designated period.

- Insurance declarations page - Official documentation outlining your coverage and confirming your claims-free status.

- Letter from previous insurer - A formal statement verifying that you maintained a clean claims record during the policy term.

Providing these documents accurately can help you qualify for significant homeowners insurance discounts based on your claims-free history.

Submitting Safety Device Installation Records

Submitting safety device installation records is essential for qualifying for homeowners insurance discounts. These documents provide proof that your home is equipped with security and fire prevention measures.

Common records include receipts or certificates for smoke detectors, burglar alarms, and deadbolt locks. Insurance companies often verify these installations to evaluate the risk and offer lower premiums.

Guidelines for Document Submission and Deadlines

Homeowners insurance discounts require specific documents such as proof of home safety features, security system installation, and previous claims history. Submitting accurate and complete paperwork ensures eligibility for premium reductions.

Guidelines for document submission include providing clear copies of receipts, inspection reports, and certification forms within the insurer's specified timeframe. Missing deadlines or incomplete documents can result in denial of discounts, so timely submission is crucial.

What Documents are Needed for Homeowners Insurance Discounts? Infographic