A landlord needs several key documents for rental property insurance, including a completed insurance application, proof of property ownership, and current lease agreements. Detailed property information, such as photos, inspection reports, and maintenance records, helps verify the condition and value of the rental unit. Financial documents like income statements and prior insurance policies may also be required to assess risk and coverage needs accurately.

What Documents Does a Landlord Need for Rental Property Insurance?

| Number | Name | Description |

|---|---|---|

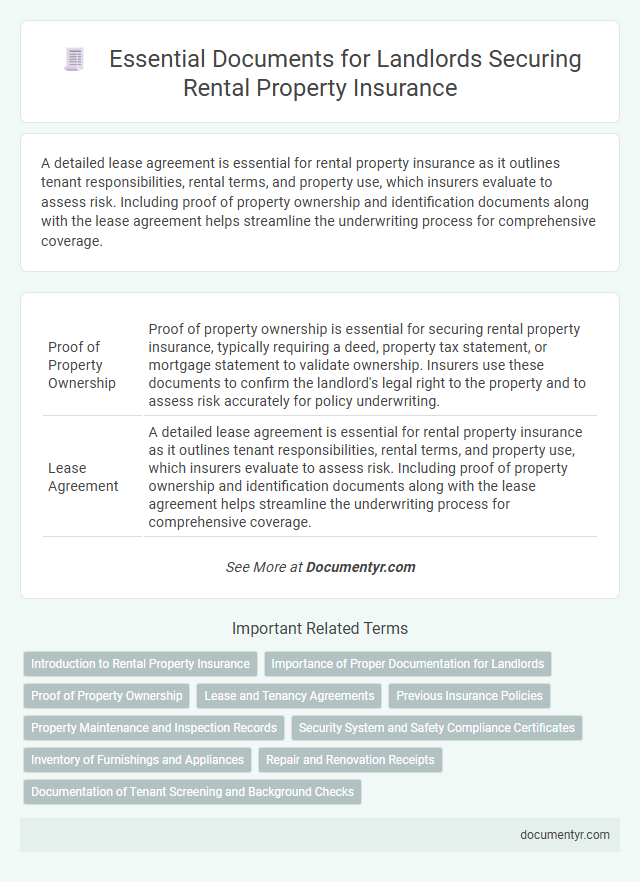

| 1 | Proof of Property Ownership | Proof of property ownership is essential for securing rental property insurance, typically requiring a deed, property tax statement, or mortgage statement to validate ownership. Insurers use these documents to confirm the landlord's legal right to the property and to assess risk accurately for policy underwriting. |

| 2 | Lease Agreement | A detailed lease agreement is essential for rental property insurance as it outlines tenant responsibilities, rental terms, and property use, which insurers evaluate to assess risk. Including proof of property ownership and identification documents along with the lease agreement helps streamline the underwriting process for comprehensive coverage. |

| 3 | Property Deed | A landlord must provide the property deed as a critical document for rental property insurance to verify legal ownership and establish the insured asset. This deed details the property's boundaries, type, and ownership history, which insurance companies use to assess risk and coverage needs accurately. |

| 4 | Mortgage Statement | A mortgage statement is essential documentation for landlords seeking rental property insurance as it verifies ownership and outstanding loan details, which insurers require to assess risk accurately. This document helps insurance providers determine coverage limits and conditions based on the property's financial obligations and value. |

| 5 | Property Inspection Report | A detailed Property Inspection Report is essential for rental property insurance as it provides a comprehensive assessment of the property's condition, identifying potential risks and necessary repairs. This document helps insurers accurately determine coverage needs and premiums based on the property's current state and risk profile. |

| 6 | Property Appraisal Report | A comprehensive Property Appraisal Report is essential for rental property insurance, as it provides an accurate valuation and detailed condition assessment, helping insurers determine appropriate coverage and premiums. This document typically includes market value, structural integrity, and recent improvements, ensuring the landlord secures adequate protection against potential risks. |

| 7 | Recent Utility Bills | Recent utility bills serve as essential proof of occupancy and property address verification when applying for rental property insurance, ensuring accurate risk assessment by insurers. These documents help confirm consistent utility usage, which supports the legitimacy of the rental property and aids in preventing fraudulent claims. |

| 8 | Government-issued ID | A government-issued ID, such as a driver's license or passport, is essential for landlords applying for rental property insurance as it verifies identity and legal ownership. Insurance providers require this documentation to prevent fraud and ensure policy accuracy. |

| 9 | Tenancy Schedule | A Tenancy Schedule is a crucial document for rental property insurance, detailing each tenant's lease terms, rental payment dates, and occupancy status, which helps insurers assess risk accurately. It ensures all tenants are accounted for and supports claims processing by providing clear, up-to-date tenant information. |

| 10 | Rent Roll | A detailed rent roll is essential for rental property insurance as it provides a comprehensive record of all tenants, lease terms, and rental income, helping insurers assess the property's income stability and risk profile. This document supports accurate premium calculations and validates coverage needs by demonstrating the property's cash flow and tenancy status. |

| 11 | Previous Insurance Policies | Previous insurance policies are essential documents for rental property insurance as they provide a detailed history of coverage, claims, and risk mitigation measures. These records help insurers assess underwriting risks, set accurate premiums, and tailor policies to the landlord's specific property needs. |

| 12 | Building Plans or Blueprints | Building plans or blueprints are essential documents for rental property insurance, providing detailed structural information that helps insurers assess risk accurately and determine appropriate coverage. These documents outline the property's construction materials, layout, and dimensions, enabling precise valuation and tailored policy terms. |

| 13 | Property Inventory List | A detailed property inventory list is essential for rental property insurance as it documents all items within the rental unit, providing proof of ownership and condition for accurate claims processing. This list should include descriptions, purchase dates, values, and photographs of all furnishings, appliances, and fixtures to ensure comprehensive coverage and minimize disputes during claim settlements. |

| 14 | Maintenance Records | Maintenance records are essential documents for rental property insurance, as they provide evidence of property upkeep and help demonstrate risk management to insurers. Detailed logs of repairs, inspections, and regular maintenance reduce the likelihood of coverage disputes and can lead to lower insurance premiums. |

| 15 | Eviction Notices (if applicable) | Eviction notices are crucial documents for rental property insurance as they provide evidence of tenant disputes that may impact claim assessments or risk evaluations. Insurers often require copies of eviction notices to verify tenant compliance and potential liabilities associated with the rental property. |

| 16 | Fire Safety Certificates | Landlords must provide valid Fire Safety Certificates to secure rental property insurance, demonstrating compliance with local fire safety regulations and reducing risks. These certificates are essential for insurers to assess fire hazard mitigation measures and ensure tenant safety. |

| 17 | Electrical Safety Certificates | Electrical Safety Certificates are essential documents required by landlords to validate that the property's electrical installations comply with national safety standards, significantly reducing the risk of fire hazards. Insurance providers often mandate these certificates to assess potential risks before approving rental property insurance coverage. |

| 18 | Gas Safety Certificates | Gas Safety Certificates are essential documents landlords must provide when obtaining rental property insurance, proving compliance with legal requirements for gas appliance safety. Insurers often require valid certificates to assess risk accurately and ensure the property meets safety standards, minimizing potential liabilities related to gas installations. |

| 19 | Photographs of Property | Photographs of the rental property provide essential visual evidence to accurately assess its condition and value for insurance purposes. Clear, dated images of the interior and exterior help expedite claims processing and support coverage verification in case of damage or loss. |

| 20 | Business License (if applicable) | A valid business license is essential for landlords seeking rental property insurance as it verifies the legal operation of rental activities and reassures insurers of compliance with local regulations. Insurance providers often require a current business license to process claims and offer tailored coverage options specific to commercial rental properties. |

| 21 | Disclosure Statements | Disclosure statements for rental property insurance must include detailed information on property ownership, insurance history, and any past claims to accurately assess risk. These documents help insurers determine coverage terms and premiums while ensuring compliance with local regulations. |

| 22 | HOA Documents (if applicable) | HOA documents, including the association's master insurance policy, bylaws, and financial statements, are essential for landlords to provide when obtaining rental property insurance to demonstrate coverage overlap and ensure proper liability protection. These documents help insurers assess risk related to shared property components and common areas, influencing policy terms and premiums. |

| 23 | Tax Assessment Notice | A Tax Assessment Notice is essential for rental property insurance as it verifies property ownership and provides accurate property value information required for premium calculations. Insurers rely on this document to assess risk and ensure proper coverage limits based on the property's assessed value. |

| 24 | Flood Zone Certificate (if applicable) | A Flood Zone Certificate is a critical document for landlords seeking rental property insurance in flood-prone areas, as it verifies the property's location relative to FEMA-designated flood zones. Insurers require this certificate to assess flood risk accurately and determine appropriate coverage and premiums. |

Introduction to Rental Property Insurance

Rental property insurance safeguards landlords against financial loss due to property damage, liability claims, and lost rental income. Understanding required documentation helps streamline the insurance application process and ensures proper coverage.

- Proof of Property Ownership - Documents like a deed or title verify legal ownership of the rental property.

- Property Details - Information on the property's address, construction type, and age assists insurers in risk assessment.

- Previous Insurance Records - Past insurance policies and claim history support underwriting decisions and premium calculations.

Importance of Proper Documentation for Landlords

| Document Type | Description | Importance for Rental Property Insurance |

|---|---|---|

| Property Deed | Legal proof of ownership of the rental property. | Confirms landlord's ownership, a prerequisite for insurance policy issuance. |

| Lease Agreement | Contract between landlord and tenant outlining rental terms. | Demonstrates the property's rental status, impacting coverage needs and risk assessment. |

| Previous Insurance Policies | Records of past insurance coverage and claims history. | Helps insurers evaluate risk and establish appropriate premiums. |

| Property Inspection Reports | Assessment documents detailing current condition and safety of the property. | Essential for risk evaluation, helping to identify potential hazards and reduce claims. |

| Photographs of Property | Images documenting the property's condition and key features. | Supports valuation accuracy and expedites claims processing in case of damage. |

| Proof of Mortgage (if applicable) | Documentation showing outstanding mortgage obligations on the property. | Required by insurers to understand financial liabilities tied to the property. |

| Identification Documents | Government-issued ID such as driver's license or passport. | Verify identity of the landlord to prevent fraud and ensure valid contract signing. |

Proof of Property Ownership

Proof of property ownership is a critical document required for obtaining rental property insurance. It verifies your legal rights to insure the property and ensures correct policy coverage.

- Title Deed - The official document that establishes and records your ownership of the real estate.

- Property Tax Statement - A recent tax bill showing your name as the property owner, supporting your legal claim to the property.

- Mortgage Statement - Documentation from your lender confirming your ownership status and financial interest in the property.

Lease and Tenancy Agreements

Lease and tenancy agreements are essential documents for securing rental property insurance. These agreements provide proof of the rental arrangement and outline the terms between the landlord and tenant.

Insurers require these documents to assess risk and verify occupancy details. Your lease agreement helps demonstrate the legal relationship necessary for coverage eligibility.

Previous Insurance Policies

What previous insurance policies are necessary for obtaining rental property insurance? Providing prior insurance documents helps insurers assess risk and verify your coverage history. These policies can demonstrate your experience and responsibility in managing rental property risks.

Property Maintenance and Inspection Records

Landlords need to provide property maintenance and inspection records when applying for rental property insurance. These documents demonstrate the property's condition and help insurers assess risk accurately. Well-maintained records can lead to better coverage options and lower premiums.

Security System and Safety Compliance Certificates

Landlord rental property insurance requires specific documents to verify security measures and safety compliance. Security system certifications and safety compliance certificates are essential to demonstrate the property's protection standards.

Security system documents include installation verification, monitoring agreements, and maintenance records. Safety compliance certificates cover fire alarms, smoke detectors, and building code adherence. These documents help insurers assess risk and provide accurate coverage for your rental property.

Inventory of Furnishings and Appliances

Documenting an inventory of furnishings and appliances is essential for securing rental property insurance. This inventory helps assess the value and condition of items covered under the policy.

- Detailed inventory list - A comprehensive record of all furniture and appliances included in the rental property ensures accurate insurance coverage.

- Photographic evidence - Photos of furnishings and appliances support claims by visually verifying the property's contents and conditions.

- Purchase receipts or appraisals - Providing proof of value for high-cost items helps establish their worth for insurance purposes.

Maintaining an updated inventory facilitates smoother claims and protects your investment in the rental property.

Repair and Renovation Receipts

Repair and renovation receipts are essential documents for securing rental property insurance. These receipts provide proof of improvements and maintenance carried out on the property.

Insurance companies use these records to assess the value and condition of your rental property. Keeping detailed receipts ensures accurate coverage and faster claims processing in case of damage.

What Documents Does a Landlord Need for Rental Property Insurance? Infographic