To file a travel insurance reimbursement claim, you need to provide the original travel insurance policy, proof of payment for the trip, and detailed receipts for any expenses incurred due to the claim event. Additionally, submitting official reports such as medical certificates, police reports, or airline documentation that verify the incident is essential. Clear and accurate documentation ensures faster processing and approval of your reimbursement request.

What Documents are Needed for Travel Insurance Reimbursement?

| Number | Name | Description |

|---|---|---|

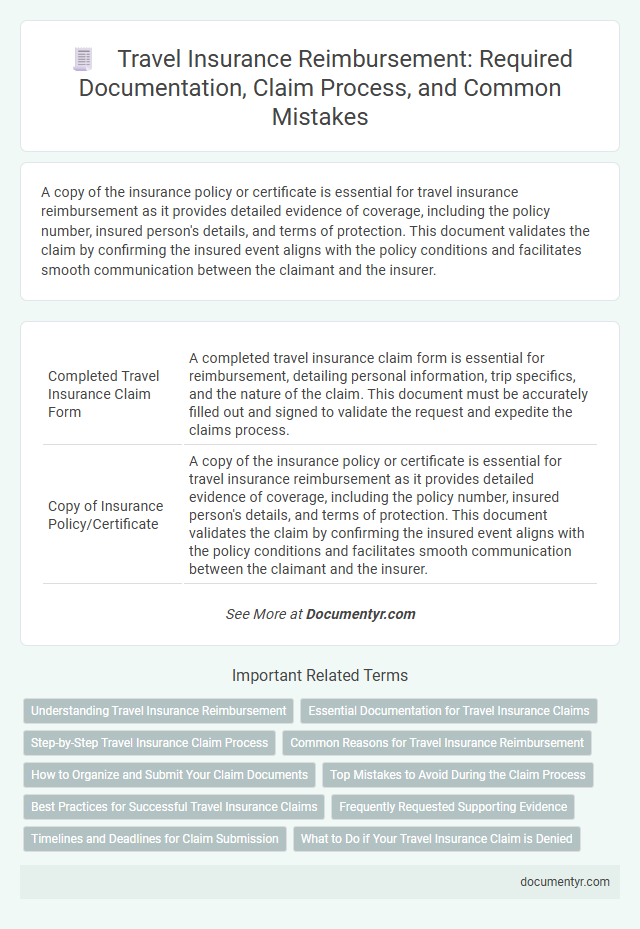

| 1 | Completed Travel Insurance Claim Form | A completed travel insurance claim form is essential for reimbursement, detailing personal information, trip specifics, and the nature of the claim. This document must be accurately filled out and signed to validate the request and expedite the claims process. |

| 2 | Copy of Insurance Policy/Certificate | A copy of the insurance policy or certificate is essential for travel insurance reimbursement as it provides detailed evidence of coverage, including the policy number, insured person's details, and terms of protection. This document validates the claim by confirming the insured event aligns with the policy conditions and facilitates smooth communication between the claimant and the insurer. |

| 3 | Proof of Travel (e.g., flight tickets, boarding passes) | Submitting travel insurance reimbursement requires providing proof of travel such as original flight tickets, boarding passes, and itinerary details to verify the trip dates and destinations. Insurers rely on these documents to confirm the insured event occurred during the covered travel period, facilitating accurate claims processing. |

| 4 | Proof of Payment for Trip (receipts, invoices) | Proof of payment for trip expenses, such as original receipts and detailed invoices, is essential for travel insurance reimbursement claims to verify the amount paid and the services purchased. These documents must clearly itemize dates, amounts, and payee information to ensure accurate processing and confirmation of covered losses. |

| 5 | Passport Copy | A clear, valid passport copy is essential for travel insurance reimbursement as it verifies your identity and travel dates, helping insurers confirm your trip details. Including a passport copy alongside your claim form and other supporting documents like boarding passes or medical reports speeds up the approval process and prevents claim delays. |

| 6 | Visa Copy (if applicable) | A visa copy is crucial for travel insurance reimbursement when the policy requires proof of entry authorization to the destination country, as it verifies eligibility for coverage based on travel dates and location. Submitting an accurate visa copy alongside the insurance claim ensures faster processing and prevents claims denial related to non-compliance with travel authorization prerequisites. |

| 7 | Proof of Loss Statement | A Proof of Loss Statement is a critical document for travel insurance reimbursement, detailing the circumstances and extent of the loss or damage incurred during the trip. Insurers require this statement, along with receipts, medical reports, and claim forms, to validate and process compensation claims efficiently. |

| 8 | Medical Reports (for medical claims) | For travel insurance reimbursement related to medical claims, submit detailed medical reports including physician's diagnosis, treatment records, hospital discharge summaries, and prescription details. Accurate and comprehensive medical documentation ensures faster claim processing and validates the necessity of expenses incurred during the trip. |

| 9 | Hospital Bills & Medical Receipts | Hospital bills and medical receipts are essential documents required for travel insurance reimbursement, providing proof of expenses incurred during treatment abroad. Accurate itemization and clear dates on these documents facilitate a smooth claims process and verify the authenticity of medical services received. |

| 10 | Police Report (for theft/loss/accident) | To process travel insurance reimbursement for theft, loss, or accidents, submitting a detailed police report is essential as it serves as primary evidence validating the incident. This official document should include the date, location, and description of the event, helping insurers efficiently verify and approve claims. |

| 11 | Damaged/Lost Baggage Report | To file a travel insurance reimbursement for damaged or lost baggage, policyholders must submit the original damaged/lost baggage report issued by the airline or transport provider as primary proof of the incident. Supporting documents typically include the travel insurance claim form, proof of travel (such as boarding passes and tickets), original purchase receipts for the lost or damaged items, and any correspondence related to the baggage claim. |

| 12 | Airline Property Irregularity Report (PIR) | The Airline Property Irregularity Report (PIR) is a critical document required for travel insurance reimbursement related to lost, delayed, or damaged baggage claims and must be obtained directly from the airline at the time of the incident. Submitting the PIR alongside the insurance claim form and proof of travel enhances the likelihood of a successful reimbursement by providing official verification of the property irregularity. |

| 13 | Receipts for Replacement Items (baggage delay/loss) | Receipts for replacement items are essential for travel insurance reimbursement in cases of baggage delay or loss, providing proof of purchase for necessary clothing, toiletries, and essential expenses incurred during the delay period. These receipts must clearly show the date, item description, and cost, aligning with the insurer's policy limits and guidelines to ensure successful claim processing. |

| 14 | Proof of Relationship (death/critical illness claims) | For travel insurance reimbursement in cases of death or critical illness claims, a certified proof of relationship such as a birth certificate, marriage certificate, or legal guardianship papers is essential to validate the claimant's eligibility. Insurers require these documents to confirm the beneficiary's connection to the insured, ensuring proper claim processing and authorization. |

| 15 | Death Certificate (if applicable) | For travel insurance reimbursement related to a claim involving death, the original or certified copy of the death certificate is a mandatory document to verify the event and initiate the claim process. This document must clearly state the cause and date of death, aligning with the claim details to ensure compliance with policy requirements. |

| 16 | Proof of Delay/Cancellation (airline letter, hotel confirmation, etc.) | To secure travel insurance reimbursement for delay or cancellation, submit essential documents such as the official airline letter confirming the delay or cancellation and hotel confirmation showing any affected bookings. Additional paperwork like boarding passes, receipts for non-refundable expenses, and communication records with service providers strengthens your claim by verifying the disruption's impact. |

| 17 | Refund Statements from Service Providers | Refund statements from service providers serve as critical documentation for travel insurance reimbursement, verifying the cancellation or alteration of pre-paid services such as accommodations, flights, or tours. Insurers require these statements to confirm the amount refunded and validate the claim's legitimacy, ensuring accurate and timely processing of the travel insurance payout. |

| 18 | Copy of canceled bookings (hotel, tours, etc.) | Submit copies of canceled bookings such as hotel reservations, tours, and transportation to validate travel insurance reimbursement claims. These documents serve as proof of non-refundable expenses incurred due to trip cancellations or interruptions. |

| 19 | Proof of Additional Expenses (accommodation, meals during delay) | To claim travel insurance reimbursement for additional expenses such as accommodation and meals incurred during travel delays, submit original receipts, invoices, or bills clearly showing dates and amounts paid. Documentation should include proof of the delay from the carrier or service provider to validate the claim and ensure coverage compliance. |

| 20 | Bank Statements or Credit Card Statements | Bank statements or credit card statements are essential for travel insurance reimbursement as they provide verifiable proof of payments for travel-related expenses such as flights, accommodations, and emergency services. Insurers require these financial documents to validate claims, confirm transaction dates, and ensure the legitimacy of the reimbursed costs. |

| 21 | Authorization Letter (if someone claims on your behalf) | An Authorization Letter is required for travel insurance reimbursement when a claim is filed by someone other than the insured, explicitly granting permission to act on their behalf. This letter must include the insured's signature, personal details, policy number, and the claimant's identification information to ensure verification and prevent fraud. |

Understanding Travel Insurance Reimbursement

Understanding travel insurance reimbursement requires submitting specific documents to validate your claim. Proper documentation ensures a smooth and timely reimbursement process.

Commonly required documents include the original insurance policy, proof of travel such as flight tickets, and medical reports if applicable. Receipts and invoices for any expenses incurred during the trip are also essential for reimbursement.

Essential Documentation for Travel Insurance Claims

Submitting a complete set of documents is crucial for a successful travel insurance reimbursement. Essential documentation verifies your claim and expedites the reimbursement process.

- Completed Claim Form - This form provides necessary personal and trip details to process the reimbursement.

- Proof of Travel - Documents like flight tickets, boarding passes, or hotel receipts confirm your travel dates and destinations.

- Receipts and Bills - Original receipts for expenses related to medical treatment, cancellations, or lost belongings support the reimbursement claim.

Step-by-Step Travel Insurance Claim Process

To file a travel insurance reimbursement, you need essential documents such as the completed claim form, medical reports, and original receipts for expenses. Proof of travel like flight tickets and a copy of the insurance policy are also required.

Start the travel insurance claim process by filling out the claim form accurately. Submit all required documents including medical certificates and proof of payment promptly. Keep copies of everything submitted to ensure smooth communication with the insurance provider.

Common Reasons for Travel Insurance Reimbursement

| Common Reasons for Travel Insurance Reimbursement | Required Documents |

|---|---|

| Trip Cancellation |

- Original or electronic receipt of booked trip - Proof of cancellation from the airline or service provider - Medical certificate or official document explaining reason for cancellation |

| Medical Emergency Abroad |

- Hospital or clinic bills - Medical reports and prescriptions - Proof of payment for medical services |

| Lost or Delayed Baggage |

- Baggage claim report from the airline or transportation company - Receipts for essential replacement items - Proof of delay or loss confirmation |

| Trip Interruption |

- Travel itinerary showing change in plans - Receipts related to additional transportation or accommodation - Documentation supporting the reason for interruption, e.g., medical reports |

| Travel Delay |

- Official delay confirmation from airline or transport provider - Receipts for food, accommodation, or transportation expenses during delay |

How to Organize and Submit Your Claim Documents

What documents are needed for travel insurance reimbursement? A detailed claim requires your travel itinerary, proof of payment, and a completed claim form. Receipts for expenses, medical reports, and police reports must be organized and submitted carefully.

How to organize and submit your claim documents? Start by categorizing all papers by type and date for easy reference. Submit your claim through the insurance provider's online portal or by mail, ensuring copies of all documents are included and originals are retained.

Top Mistakes to Avoid During the Claim Process

When filing a travel insurance reimbursement claim, essential documents include the completed claim form, original receipts for expenses, medical reports, and proof of travel such as boarding passes. Common mistakes to avoid are submitting incomplete or illegible documents, missing deadlines for claim submission, and failing to provide detailed explanations for incurred expenses. Ensuring accuracy and thorough documentation improves the chances of a successful and timely reimbursement.

Best Practices for Successful Travel Insurance Claims

Submitting a travel insurance claim requires careful documentation to ensure a smooth reimbursement process. Knowing which documents to prepare can significantly increase the chances of claim approval.

- Policy Document - The original travel insurance policy outlining coverage details and terms is essential.

- Proof of Travel - Flight tickets, boarding passes, and hotel reservations verify the trip details and dates.

- Receipts and Invoices - Official bills for medical treatments, cancellations, or other covered expenses support the claim amount.

Organizing these documents clearly and submitting them promptly supports a successful travel insurance claim.

Frequently Requested Supporting Evidence

Travel insurance reimbursement requires specific documents to process your claim efficiently. Frequently requested supporting evidence includes the original insurance policy, proof of travel such as flight tickets or hotel bookings, and detailed receipts for expenses incurred. Medical reports or accident reports may also be necessary depending on the nature of your claim.

Timelines and Deadlines for Claim Submission

Travel insurance reimbursement requires submitting specific documents such as the completed claim form, original receipts, medical reports, and proof of travel arrangements. Timely submission of these documents is critical to ensure a smooth claim process.

Most insurance companies set a deadline ranging from 30 to 90 days from the date of the incident for claim submission. Missing these timelines can result in claim denial or delayed processing, emphasizing the importance of adhering to policy deadlines.

What Documents are Needed for Travel Insurance Reimbursement? Infographic