Key documents required for an international life insurance application typically include a valid passport or government-issued ID, proof of residence such as a utility bill, and completed medical records or health questionnaires to assess risk. Applicants may also need to provide financial statements or proof of income to determine the coverage amount and payment capacity. Some insurers require a medical exam report or blood test results to evaluate the applicant's health status comprehensively.

What Documents Are Necessary for International Life Insurance Application?

| Number | Name | Description |

|---|---|---|

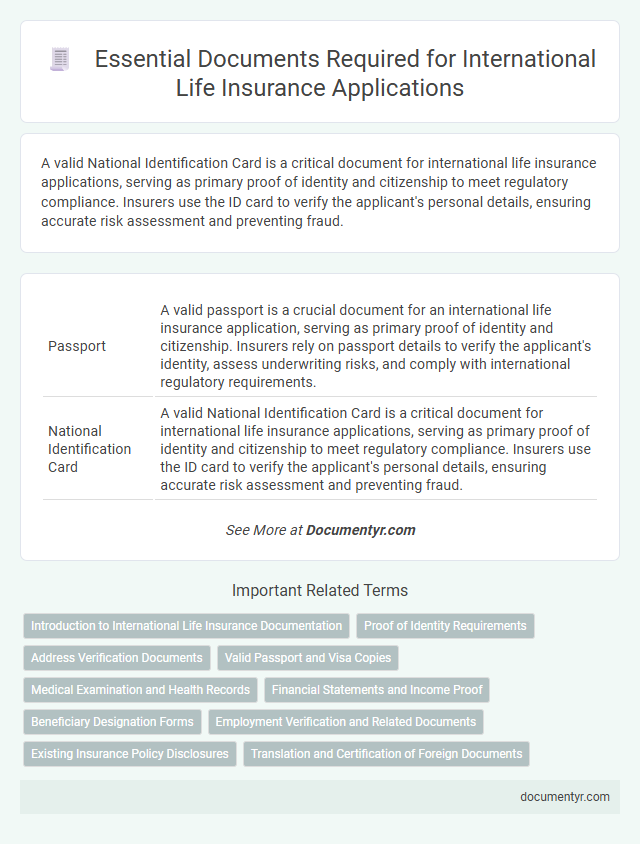

| 1 | Passport | A valid passport is a crucial document for an international life insurance application, serving as primary proof of identity and citizenship. Insurers rely on passport details to verify the applicant's identity, assess underwriting risks, and comply with international regulatory requirements. |

| 2 | National Identification Card | A valid National Identification Card is a critical document for international life insurance applications, serving as primary proof of identity and citizenship to meet regulatory compliance. Insurers use the ID card to verify the applicant's personal details, ensuring accurate risk assessment and preventing fraud. |

| 3 | Proof of Address (Utility Bill, Bank Statement) | Proof of address is a critical document for international life insurance applications, typically evidenced by recent utility bills or bank statements dated within the last three months. These documents must clearly display the applicant's name, current residential address, and consistent information to verify identity and residency for underwriting and regulatory compliance. |

| 4 | Birth Certificate | A birth certificate is a fundamental document required for international life insurance applications, serving as official proof of identity and age. Insurers use this document to verify the applicant's personal details, ensuring accurate risk assessment and policy issuance. |

| 5 | Income Proof (Pay Slips, Tax Returns) | Income proof is crucial in international life insurance applications to verify financial stability and determine appropriate coverage amounts; essential documents include recent pay slips and tax returns, which provide detailed records of earnings and tax compliance. Providing accurate income documentation helps insurers assess risk and ensures that the policy aligns with the applicant's financial status. |

| 6 | Employment Verification Letter | An Employment Verification Letter is crucial for international life insurance applications as it confirms the applicant's current job status, income, and stability, which are essential for risk assessment. This document typically includes the employer's contact information, job title, duration of employment, and monthly or annual salary, helping insurers accurately evaluate the policyholder's eligibility and premium rates. |

| 7 | Medical Examination Report | The medical examination report is a critical document required for international life insurance applications, providing detailed health information to assess risk accurately. It typically includes results from physical exams, blood tests, and medical history evaluations conducted by a licensed healthcare professional. |

| 8 | Health Questionnaire | The Health Questionnaire is a crucial document in international life insurance applications, requiring detailed information about medical history, current health status, and any ongoing treatments. Accurate completion of this questionnaire helps insurers assess risk and determine eligibility, premiums, and coverage terms effectively. |

| 9 | Beneficiary Identification Documents | Beneficiary identification documents required for international life insurance application typically include a government-issued photo ID such as a passport or national ID card, proof of relationship to the insured like a birth or marriage certificate, and sometimes additional documentation such as a Social Security number or tax identification number to verify identity and eligibility. Insurers may also request notarized copies of these documents to ensure authenticity and comply with anti-money laundering regulations. |

| 10 | Existing Insurance Policy Details (if applicable) | For an international life insurance application, providing existing insurance policy details is essential to assess coverage overlaps and ensure accurate underwriting. These documents typically include current policy statements, coverage amounts, policy numbers, and expiration dates to streamline the approval process and prevent redundant coverage. |

| 11 | Visa or Residency Permit (if applicable) | A valid visa or residency permit is essential for international life insurance applications, as it verifies the applicant's legal status in the host country. Insurers require these documents to assess eligibility, confirm residency, and comply with local regulations. |

| 12 | Financial Statement or Bank Reference | A comprehensive financial statement is essential for an international life insurance application, providing detailed proof of income, assets, liabilities, and overall financial stability. A bank reference letter further validates the applicant's financial history and reliability by confirming account status, average balances, and transaction conduct. |

| 13 | Travel History or Itinerary (if required) | Travel history or a detailed itinerary is often required for international life insurance applications to assess risk based on recent and planned travel to high-risk regions. Providing accurate documentation such as airline tickets, visa stamps, and travel itineraries helps insurers evaluate exposure to potential hazards and determine appropriate policy terms and premiums. |

| 14 | Application Form | The international life insurance application form requires accurate personal details, including full name, date of birth, nationality, and contact information, as well as comprehensive health history and lifestyle disclosures. Supporting documents such as valid identification, proof of address, medical reports, and financial statements are essential to verify the information provided in the application form. |

| 15 | Signed Consent or Declaration Forms | Signed consent or declaration forms are essential documents for international life insurance applications as they verify the applicant's authorization for background checks, medical examinations, and data sharing with reinsurers. These forms ensure compliance with legal and privacy regulations, facilitating smooth processing and underwriting of the insurance policy. |

| 16 | Marriage Certificate (if applicable) | A marriage certificate is a crucial document for international life insurance applications when the policyholder is married, as it verifies marital status and may impact beneficiary designations and premium calculations. Insurers require this certificate to confirm spousal rights and ensure accurate coverage details in compliance with international underwriting standards. |

| 17 | Power of Attorney (if applicable) | When applying for international life insurance, a notarized Power of Attorney is necessary if the applicant designates an agent to act on their behalf, ensuring legal authorization for decision-making and policy management. This document must comply with the insurer's jurisdictional requirements and typically requires authentication or apostille for cross-border validity. |

Introduction to International Life Insurance Documentation

International life insurance applications require specific documentation to verify the identity, health, and financial status of the applicant. Proper documentation ensures a smooth approval process and compliance with international regulations.

Common documents include a valid passport, medical records, and proof of income or assets. These documents help insurers assess risk and determine appropriate coverage for global policyholders.

Proof of Identity Requirements

Proof of identity is a critical component of an international life insurance application. These documents verify the applicant's identity to comply with global regulatory standards.

- Government-Issued ID - A valid passport or national ID card is required to confirm personal details and citizenship.

- Photograph Verification - Recent passport-sized photographs help match the applicant's physical appearance to the submitted identity documents.

- Additional Photo IDs - Driver's licenses or residency cards may be requested to support identity verification.

Providing accurate proof of identity ensures a smooth and compliant life insurance application process internationally.

Address Verification Documents

Address verification documents are crucial for international life insurance applications. Commonly accepted documents include utility bills, bank statements, and government-issued ID cards showing your current address.

These documents must be recent, typically within the last three months, to ensure accuracy. Providing valid address verification helps streamline the underwriting process and confirms your residency status effectively.

Valid Passport and Visa Copies

What documents are necessary for an international life insurance application? A valid passport is essential as it serves as the primary proof of identity and nationality. Visa copies are also required to confirm the applicant's legal status and duration of stay in the foreign country.

Medical Examination and Health Records

Applying for international life insurance requires specific medical documentation to assess risk accurately. Medical examination results and comprehensive health records play a critical role in this evaluation process.

- Medical Examination Report - This report includes results from physical exams, blood tests, and other diagnostic procedures necessary to evaluate your current health status.

- Detailed Health Records - Records from your primary care provider and specialists outline your medical history, chronic conditions, and past treatments, providing insurers with essential background information.

- Physician's Statement - A formal statement from your doctor summarizes your health profile and any significant medical concerns relevant to underwriting standards.

Financial Statements and Income Proof

Applying for international life insurance requires thorough financial documentation to assess risk accurately. Financial statements and income proof form the core of this verification process.

- Certified Financial Statements - These documents provide a detailed overview of your financial health, including assets, liabilities, and net worth.

- Income Proof - Payslips, tax returns, or bank statements serve as evidence of consistent income streams necessary for underwriting.

- Bank Statements - Recent bank statements confirm liquidity and regular income deposits essential for evaluating financial stability.

Beneficiary Designation Forms

Beneficiary designation forms are essential documents for an international life insurance application. These forms specify the individuals or entities entitled to receive the policy benefits upon the insured's death. Accurate completion of beneficiary designation forms ensures clear benefit distribution and prevents legal disputes.

Employment Verification and Related Documents

Employment verification is a critical component of an international life insurance application. Your income stability and job status help insurers assess risk and determine appropriate coverage and premiums.

Common employment verification documents include recent pay stubs, employment letters, and tax returns. Self-employed applicants may need to provide business licenses and financial statements. These documents confirm your earnings and job security, ensuring a smooth application process.

Existing Insurance Policy Disclosures

When applying for international life insurance, applicants must disclose any existing insurance policies. Providing accurate details about current coverage helps insurers assess risk and avoid duplication. Essential documents include policy statements, coverage amounts, and beneficiary information related to existing insurance.

What Documents Are Necessary for International Life Insurance Application? Infographic