Seniors applying for supplemental Medicare plans need to provide essential documents such as their Medicare card, proof of residency, and identification like a driver's license or passport. Documentation of income and any current health insurance coverage may also be required to determine eligibility and coverage options. Keeping these documents organized helps streamline the application process and ensures accurate plan selection.

What Documents Does a Senior Need for Supplemental Medicare Plans?

| Number | Name | Description |

|---|---|---|

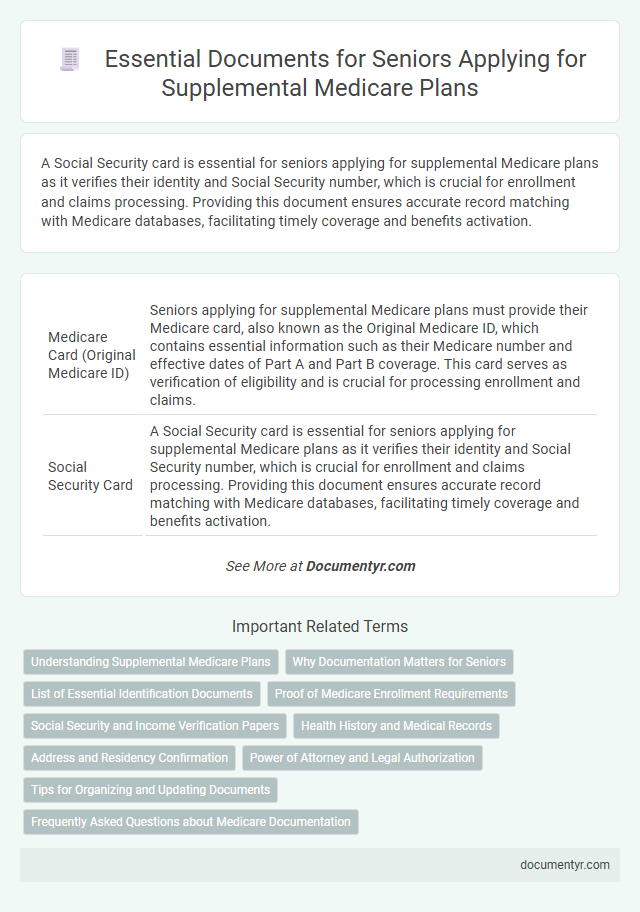

| 1 | Medicare Card (Original Medicare ID) | Seniors applying for supplemental Medicare plans must provide their Medicare card, also known as the Original Medicare ID, which contains essential information such as their Medicare number and effective dates of Part A and Part B coverage. This card serves as verification of eligibility and is crucial for processing enrollment and claims. |

| 2 | Social Security Card | A Social Security card is essential for seniors applying for supplemental Medicare plans as it verifies their identity and Social Security number, which is crucial for enrollment and claims processing. Providing this document ensures accurate record matching with Medicare databases, facilitating timely coverage and benefits activation. |

| 3 | Photo Identification (Driver’s License, State ID) | Seniors applying for supplemental Medicare plans must provide valid photo identification such as a driver's license or state-issued ID to verify their identity and residency. These documents ensure accurate enrollment and prevent fraud while streamlining the coverage approval process. |

| 4 | Proof of Age (Birth Certificate, Passport) | Seniors applying for supplemental Medicare plans must provide proof of age, typically through official documents such as a birth certificate or passport. These documents verify eligibility and ensure accurate policy enrollment for supplementary healthcare coverage. |

| 5 | Proof of Citizenship or Legal Residency (Naturalization Certificate, Permanent Resident Card) | Seniors applying for supplemental Medicare plans must provide proof of citizenship or legal residency, typically in the form of a naturalization certificate or a permanent resident card. These documents verify eligibility and ensure compliance with federal Medicare enrollment requirements. |

| 6 | Supplemental Insurance Application Form | Seniors seeking supplemental Medicare plans must complete a Supplemental Insurance Application Form, which requires personal identification details, Medicare information, and health history. This form is essential for verifying eligibility, processing coverage options, and ensuring the supplemental plan adequately addresses individual healthcare needs. |

| 7 | Proof of Address (Utility Bill, Lease Agreement) | Seniors applying for supplemental Medicare plans must provide proof of address to verify residency, commonly accepted documents include recent utility bills or lease agreements showing the applicant's name and current address. Submitting accurate proof of address helps ensure eligibility and smooth processing of supplemental Medicare coverage benefits. |

| 8 | Current Health Insurance Policy Information | Seniors applying for supplemental Medicare plans must provide current health insurance policy information, including details on existing Medicare coverage, policy numbers, and plan types. This documentation ensures accurate assessment of eligibility, coverage gaps, and potential benefits for effective supplemental plan selection. |

| 9 | Medicaid Card (if applicable) | Seniors applying for supplemental Medicare plans must provide a valid Medicaid card as proof of eligibility when applicable, ensuring coordination between state Medicaid benefits and Medicare coverage. This document verifies dual eligibility, facilitating access to cost-sharing reductions and expanded healthcare services. |

| 10 | Power of Attorney/Legal Guardianship Documents (if applicable) | Seniors applying for supplemental Medicare plans must provide Power of Attorney or legal guardianship documents if a designated representative manages their healthcare decisions. These documents verify the authority of the representative to act on behalf of the senior, ensuring proper handling of enrollment and claims processes. |

| 11 | Prescription Drug List (for Medicare Part D) | Seniors applying for supplemental Medicare plans must provide a detailed Prescription Drug List to accurately enroll in Medicare Part D coverage, ensuring all current medications, dosages, and pharmacies are documented. This list helps insurance providers tailor prescription drug benefits and avoid coverage gaps or formulary exclusions. |

| 12 | Income Verification (Tax Return, SSA-1099) | Seniors applying for supplemental Medicare plans must provide income verification documents such as recent tax returns and the SSA-1099 form to accurately assess eligibility and premium costs. These documents confirm gross income from all sources, including Social Security benefits, ensuring the correct calculation of plan subsidies or additional charges. |

| 13 | Bank Information (for premium payments) | Seniors applying for supplemental Medicare plans must provide bank information, including account number and routing number, to facilitate automatic premium payments. Ensuring accurate and up-to-date bank details helps avoid missed payments and maintains continuous coverage. |

Understanding Supplemental Medicare Plans

Supplemental Medicare Plans, also known as Medigap, help cover costs not included in Original Medicare, such as copayments, coinsurance, and deductibles. Understanding these plans is crucial for seniors seeking comprehensive healthcare coverage beyond basic Medicare benefits.

To apply for Supplemental Medicare Plans, seniors typically need to provide proof of Medicare Part A and Part B enrollment. Important documents include a copy of the Medicare card, proof of residency, and identification like a driver's license or state ID. You may also need to submit medical records or health questionnaires depending on the plan provider's requirements.

Why Documentation Matters for Seniors

Senior citizens must provide specific documents to enroll in supplemental Medicare plans, including proof of Medicare Part A and Part B coverage, identification, and sometimes income verification. These documents ensure accurate plan selection and assist in determining eligibility for additional benefits.

Proper documentation matters because it helps prevent delays or denials in coverage, ensuring seniors receive the care and support they are entitled to without interruption. Providing the right paperwork protects your access to essential healthcare services and avoids potential financial risks.

List of Essential Identification Documents

Seniors applying for supplemental Medicare plans must provide specific identification documents to verify their eligibility and coverage. These documents ensure accurate processing and help avoid delays in plan enrollment.

- Medicare Card - Displays the senior's Medicare number and confirms current enrollment in Medicare Part A and Part B.

- Proof of Age - Typically a birth certificate or driver's license used to verify the applicant's age for eligibility purposes.

- Proof of Residence - Utility bills or lease agreements that establish the senior's state residency for plan selection and pricing.

- Social Security Card - Confirms the senior's Social Security number, which supports identity verification and eligibility checks.

- Income Verification - Tax returns or benefit statements to determine eligibility for assistance programs tied to supplemental plans.

Providing these essential identification documents facilitates a smooth application process for supplemental Medicare plans.

Proof of Medicare Enrollment Requirements

What documents does a senior need to provide as proof of Medicare enrollment for supplemental Medicare plans? Seniors must present their Medicare card showing Part A and Part B enrollment. This card serves as the primary proof required by insurers to verify eligibility for supplemental coverage.

Social Security and Income Verification Papers

Seniors applying for Supplemental Medicare Plans must provide Social Security documentation, such as their Social Security card or a recent statement from the Social Security Administration. Income verification papers, including recent tax returns, pay stubs, or pension award letters, are essential to determine eligibility and plan costs. These documents ensure accurate assessment of benefits and help seniors select the most suitable Supplemental Medicare Plan.

Health History and Medical Records

When applying for supplemental Medicare plans, providing accurate health history and medical records is essential. These documents help insurers assess your coverage needs and tailor the plan accordingly.

- Health History Summary - A detailed record of past and current medical conditions helps determine eligibility and appropriate coverage options.

- Medical Records - Comprehensive documentation from your healthcare providers supports claims of pre-existing conditions and ongoing treatments.

- Prescription History - A list of medications and dosages assists in evaluating your healthcare requirements under the supplemental plan.

Address and Residency Confirmation

| Document Type | Description | Purpose | Examples |

|---|---|---|---|

| Proof of Address | Official documents verifying the senior's current residential address. | Confirm residency to qualify for regional supplemental Medicare plan offerings and ensure accurate plan allocation. | Utility bills (electricity, water, gas), bank statements, lease agreements, mortgage statements, government correspondence. |

| Residency Confirmation | Documents proving the senior physically resides within the allowed service area of the supplemental Medicare plan. | Validate eligibility for specific regional benefits, pricing, and services offered through a Medicare Supplement Insurance plan. | Driver's license with address, state-issued ID cards, voter registration cards, property tax statements, official mail addressed to residence. |

Power of Attorney and Legal Authorization

Senior citizens applying for supplemental Medicare plans must provide specific documents to verify their eligibility and legal authority. A valid Power of Attorney (POA) form is essential if someone else is handling the application on their behalf, granting legal permission to make decisions. Legal authorization documents ensure the appointed individual can manage insurance matters effectively and comply with Medicare regulations.

Tips for Organizing and Updating Documents

Organizing and updating documents for supplemental Medicare plans is essential for seniors to ensure smooth enrollment and claims processing. Proper document management helps avoid delays and confusion when accessing healthcare benefits.

- Keep copies of your Medicare card - This essential document proves eligibility and is required for all supplemental plan applications.

- Maintain a list of current prescriptions - A detailed medication list supports selecting a plan that covers your specific drug needs.

- Regularly update personal information - Ensure address, contact, and income details are current to prevent enrollment errors and eligibility issues.

What Documents Does a Senior Need for Supplemental Medicare Plans? Infographic