Filing a homeowners insurance claim requires essential documents such as a detailed claim form, proof of homeownership, and a comprehensive inventory of damaged or lost items with photos or videos as evidence. Receipts, repair estimates, and a police or fire report may also be necessary to support the claim. Ensuring all relevant documents are accurate and organized helps expedite the processing and settlement of the claim.

What Documents are Necessary for Filing a Homeowners Insurance Claim?

| Number | Name | Description |

|---|---|---|

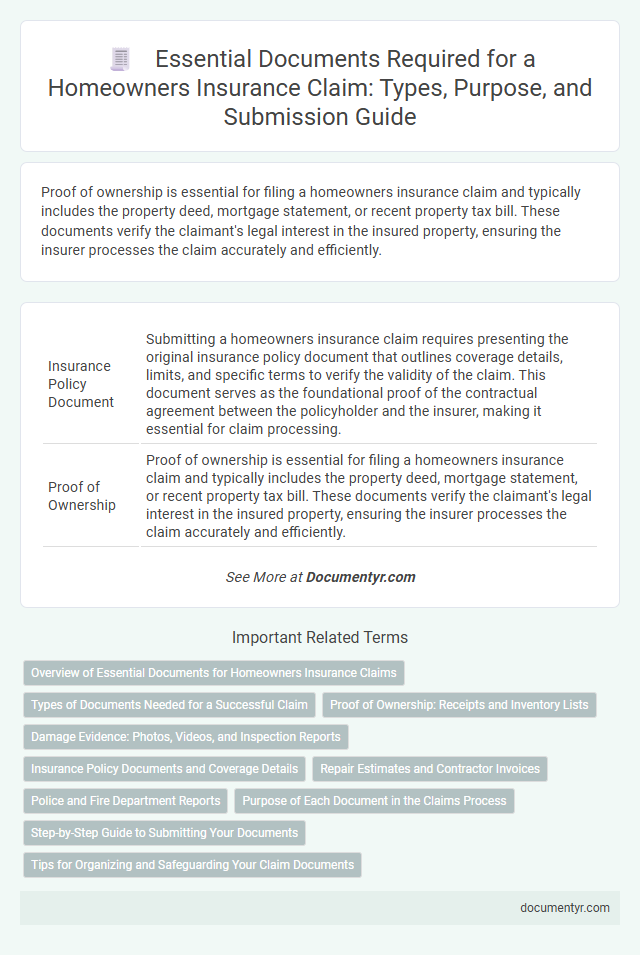

| 1 | Insurance Policy Document | Submitting a homeowners insurance claim requires presenting the original insurance policy document that outlines coverage details, limits, and specific terms to verify the validity of the claim. This document serves as the foundational proof of the contractual agreement between the policyholder and the insurer, making it essential for claim processing. |

| 2 | Proof of Ownership | Proof of ownership is essential for filing a homeowners insurance claim and typically includes the property deed, mortgage statement, or recent property tax bill. These documents verify the claimant's legal interest in the insured property, ensuring the insurer processes the claim accurately and efficiently. |

| 3 | Proof of Loss Form | The Proof of Loss form is a crucial document required for filing a homeowners insurance claim, detailing the extent of damages and itemizing lost or damaged property. Including accurate receipts, photographs, and repair estimates alongside the completed form ensures a smoother claims process and supports the validation of your claim. |

| 4 | Police Report (if applicable) | A police report is essential for filing homeowners insurance claims involving theft, vandalism, or other criminal activities, providing official documentation that supports the incident's legitimacy. Insurers rely on this report to verify details and expedite claim processing, making it a critical piece of evidence for claim approval. |

| 5 | Photos of Damage | Photos of damage are essential documents when filing a homeowners insurance claim, providing visual evidence that supports the extent and nature of the loss to your property. High-quality images clearly showing the affected areas help insurance adjusters assess the claim accurately and expedite the approval and settlement process. |

| 6 | Repair Estimates | Repair estimates from licensed contractors are essential documents for filing a homeowners insurance claim, as they provide a detailed assessment of the damages and projected costs for restoration. Insurance companies rely on these estimates to verify the extent of the loss and determine the claim payout accurately. |

| 7 | Receipts for Repairs or Replacement | Receipts for repairs or replacement are essential documents when filing a homeowners insurance claim, providing proof of the costs incurred to restore damaged property or replace lost items. These receipts help substantiate the claim amount, ensuring accurate reimbursement based on the documented expenses. |

| 8 | Inventory List of Damaged or Lost Items | An inventory list of damaged or lost items is essential for filing a homeowners insurance claim, detailing each item's description, purchase date, value, and receipts or photos for proof. This comprehensive documentation helps expedite the claims process and ensures accurate compensation. |

| 9 | Contact Information of Witnesses | Accurate contact information of witnesses, including full names, phone numbers, and email addresses, is crucial for validating homeowners insurance claims. Insurance adjusters rely on witness statements to corroborate the incident details and expedite the claim processing. |

| 10 | Contractor’s Assessment Report | A contractor's assessment report is crucial for a homeowners insurance claim, providing a detailed evaluation of the property damage and repair costs for accurate claim processing. This report, often prepared by a licensed contractor, helps insurers verify the extent of the damage and supports the justification for the claim amount. |

| 11 | Claim Form | The claim form is a crucial document for filing a homeowners insurance claim, requiring detailed information about the policyholder, incident date, and description of damages. Accurate completion and submission of the claim form expedite the processing and validation of coverage for repair or replacement costs. |

| 12 | Appraisal Reports | Appraisal reports are essential documents for filing a homeowners insurance claim as they provide a professional evaluation of the property's value and damages. These reports help insurers assess the accurate replacement cost or actual cash value, ensuring a fair claim settlement. |

| 13 | Mortgage Statement | A mortgage statement is a critical document required when filing a homeowners insurance claim as it verifies ownership and provides important financial details related to the property. Insurers use this statement to confirm the mortgage lender's interest and ensure the claim processing aligns with the terms of the loan. |

| 14 | Communication Records with Insurer | Communication records with the insurer, including emails, phone call logs, and written correspondence, are essential documents for filing a homeowners insurance claim as they provide evidence of timely reporting and claim details. Maintaining organized communication documentation helps ensure accurate claim processing and supports the policyholder in case of disputes or follow-ups during the claims investigation. |

| 15 | Temporary Accommodation Receipts | Temporary accommodation receipts are essential documents for filing a homeowners insurance claim, as they provide proof of additional living expenses incurred due to property damage or loss. Insurers require these receipts to verify the necessity and cost of alternate housing during the repair or rebuilding period. |

Overview of Essential Documents for Homeowners Insurance Claims

| Document Type | Description |

|---|---|

| Policy Declaration Page | Shows coverage details, policy number, and insured property information, essential for verifying your insurance contract. |

| Proof of Ownership | Receipts, titles, or bills of sale that confirm ownership of the damaged or lost property. |

| Claim Form | Official form provided by the insurance company to initiate the claims process. |

| Damage Documentation | Photographs, videos, or repair estimates that clearly outline the extent of property damage. |

| Police or Incident Report | Report from authorities if the claim involves theft, vandalism, or other criminal activities. |

| Receipts for Temporary Repairs | Proof of emergency repairs to prevent further damage, necessary for reimbursement consideration. |

| Inventory of Damaged Items | Detailed list of affected personal belongings including descriptions, values, and purchase dates. |

| Correspondence with Insurance Company | Copies of any letters, emails, or notes from phone calls related to the claim process. |

Types of Documents Needed for a Successful Claim

Filing a homeowners insurance claim requires specific documentation to ensure a smooth process. Gathering all necessary documents helps verify the claim accurately and expedites settlement.

- Insurance Policy - This document outlines your coverage details and serves as proof of your homeowners insurance contract.

- Damage Documentation - Photos or videos of the property damage provide visual evidence supporting the claim statement.

- Repair Estimates and Receipts - Written quotes from contractors and receipts for emergency repairs validate the cost of damages.

Proof of Ownership: Receipts and Inventory Lists

Proof of ownership is crucial when filing a homeowners insurance claim. Receipts and detailed inventory lists serve as essential evidence of your belongings and property.

Receipts provide documentation of the purchase date and value of items, confirming their ownership. Inventory lists offer a comprehensive record of possessions, helping to ensure accurate claim processing.

Damage Evidence: Photos, Videos, and Inspection Reports

Filing a homeowners insurance claim requires thorough documentation to support the damage reported. Damage evidence such as photos, videos, and inspection reports plays a critical role in verifying the extent of the loss.

- Photos - Clear images capture the visible damage to structures, belongings, and affected areas to provide visual proof for the claim.

- Videos - Video recordings offer a comprehensive view of the damage in context, demonstrating severity and scope beyond still images.

- Inspection Reports - Professional assessments detail the damage observed by qualified inspectors, lending credibility and technical support to your claim.

Providing detailed and accurate damage evidence helps expedite the claims process and increases the likelihood of a fair settlement.

Insurance Policy Documents and Coverage Details

Filing a homeowners insurance claim requires specific documents to ensure a smooth process. The most essential documents include your insurance policy and detailed coverage information.

Your insurance policy documents outline the terms, conditions, and limits of your coverage. Coverage details specify what perils and damages are covered, helping to validate your claim. Having these documents ready accelerates claim approval and provides clarity on the extent of your protection.

Repair Estimates and Contractor Invoices

Repair estimates from licensed contractors are essential for validating the cost and scope of damages when filing a homeowners insurance claim. Contractor invoices provide proof of completed work and incurred expenses, supporting the claim's accuracy. These documents help expedite the claims process by offering clear, itemized evidence of necessary repairs and associated costs.

Police and Fire Department Reports

When filing a homeowners insurance claim, police and fire department reports play a crucial role in validating the incident. These official documents provide detailed accounts of damage caused by theft, fire, or other emergencies, strengthening the claim's credibility.

Insurance companies rely on these reports to assess the extent and cause of the loss accurately. Submitting complete and accurate police or fire reports expedites the claims process and improves the likelihood of successful compensation.

Purpose of Each Document in the Claims Process

What documents are necessary for filing a homeowners insurance claim? A detailed inventory of damaged property helps establish the extent of loss and supports your claim's validity. The insurance policy itself clarifies coverage specifics, ensuring accurate assessment by the insurer.

Why is a proof of loss form important in the homeowners insurance claims process? This document itemizes the stolen or damaged items and provides an official record of your claim. It serves as a critical reference for the adjuster to verify and quantify the losses.

How do photographs and videos assist with your homeowners insurance claim? Visual evidence offers clear documentation of property damage before repair or replacement begins. These files reduce disputes and help expedite claim approval by providing concrete proof of damage.

What role does a repair estimate play in filing a homeowners insurance claim? Contractor or professional appraisals provide cost projections for fixing damages. These estimates guide the insurer in approving funds aligned with actual repair expenses.

Why is a police report necessary when filing your homeowners insurance claim? This document records theft or vandalism incidents, confirming the event to your insurer. It helps validate claims involving criminal activity and strengthens your case for compensation.

Step-by-Step Guide to Submitting Your Documents

Filing a homeowners insurance claim requires specific documentation to ensure a smooth process. Organizing these documents correctly speeds up claim approval and settlement.

- Gather the Policy Number - Locate your homeowners insurance policy number to accurately identify your coverage details.

- Collect Incident Documentation - Include photos, videos, and a detailed description of the damage or loss incurred.

- Prepare Proof of Ownership - Provide receipts, purchase records, or appraisals for damaged or lost items.

- Complete the Claim Form - Fill out the insurer's claim form thoroughly with all required personal and incident information.

- Submit Supporting Reports - Attach police reports, fire department reports, or contractor estimates related to the incident.

- Keep Copies of All Documents - Retain copies of every document submitted for your records and future reference.

What Documents are Necessary for Filing a Homeowners Insurance Claim? Infographic