Small businesses require specific documents for workers' compensation insurance, including proof of business registration, payroll records, and employee details such as job titles and salaries. Employers must also provide completed application forms and prior claims history if applicable, ensuring accurate risk assessment. Maintaining up-to-date safety protocols and injury reports further supports compliance and effective policy management.

What Documents Does a Small Business Need for Workers’ Compensation Insurance?

| Number | Name | Description |

|---|---|---|

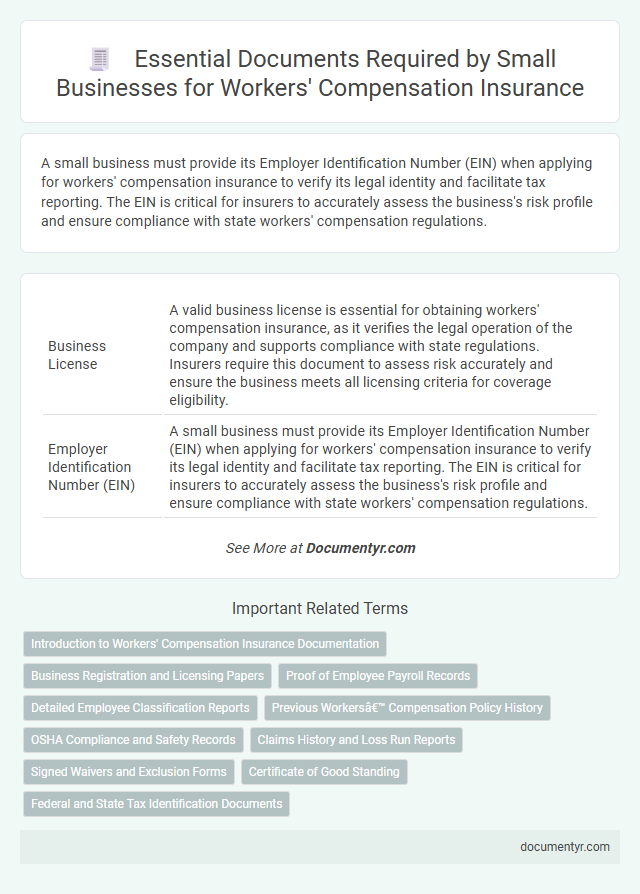

| 1 | Business License | A valid business license is essential for obtaining workers' compensation insurance, as it verifies the legal operation of the company and supports compliance with state regulations. Insurers require this document to assess risk accurately and ensure the business meets all licensing criteria for coverage eligibility. |

| 2 | Employer Identification Number (EIN) | A small business must provide its Employer Identification Number (EIN) when applying for workers' compensation insurance to verify its legal identity and facilitate tax reporting. The EIN is critical for insurers to accurately assess the business's risk profile and ensure compliance with state workers' compensation regulations. |

| 3 | Payroll Records | Payroll records are essential for workers' compensation insurance as they provide accurate data to calculate premiums based on employee wages and classifications. Maintaining detailed payroll documentation ensures compliance with state regulations and facilitates seamless claims processing. |

| 4 | Employee Roster/List | A comprehensive employee roster listing full names, job titles, hire dates, and classification codes is essential for acquiring workers' compensation insurance for small businesses. This document verifies payroll accuracy and risk classification, ensuring appropriate premium calculations and policy compliance. |

| 5 | Workers’ Job Descriptions | Workers' job descriptions are essential documents for small businesses applying for workers' compensation insurance because they detail specific duties, physical requirements, and potential hazards associated with each role, enabling accurate risk assessment. Insurers rely on these descriptions to classify jobs properly, determine appropriate premium rates, and ensure compliance with regulatory standards. |

| 6 | Previous Insurance Certificates | Previous insurance certificates provide crucial proof of prior workers' compensation coverage, helping insurers assess risk and determine premiums accurately for small businesses. Maintaining organized records of these certificates ensures smooth policy transitions and compliance with state regulations. |

| 7 | Loss Run Reports | Small businesses need to provide Loss Run Reports when applying for workers' compensation insurance, as these documents detail historical claims and loss history essential for risk assessment. Accurate Loss Run Reports enable insurers to evaluate the business's claims frequency and severity, influencing premium rates and coverage terms. |

| 8 | Tax Identification Documents | Small businesses must provide their Employer Identification Number (EIN) or Social Security Number (SSN) as tax identification documents when applying for workers' compensation insurance to verify legal and tax status. These documents ensure proper reporting and compliance with state and federal tax regulations related to employee coverage. |

| 9 | Articles of Incorporation or Organization | Small businesses must provide Articles of Incorporation or Organization to verify their legal structure when applying for workers' compensation insurance. This document establishes the company's existence and ownership, which insurers use to assess risk and determine coverage requirements. |

| 10 | Ownership Information | Small businesses need to provide ownership information such as legal business name, type of ownership (e.g., sole proprietorship, partnership, corporation), and the names and addresses of all owners or partners when applying for workers' compensation insurance. Accurate ownership documentation ensures proper policy issuance and compliance with state regulations. |

| 11 | Safety Program Documentation | Small businesses must maintain comprehensive safety program documentation to meet workers' compensation insurance requirements, including written safety policies, training records, hazard assessments, and incident reports. These documents demonstrate proactive risk management and compliance with regulatory standards, helping to reduce claims and insurance premiums. |

| 12 | OSHA Logs (if applicable) | Small businesses seeking workers' compensation insurance must provide OSHA Logs if they are required to maintain them under OSHA regulations, documenting workplace injuries and illnesses to demonstrate compliance and risk management. Accurate and up-to-date OSHA Logs help insurers assess the business's safety record and determine appropriate coverage and premiums. |

| 13 | Independent Contractor Agreements (if applicable) | Small businesses must maintain accurate Independent Contractor Agreements to clarify the scope of work and liability coverage under workers' compensation insurance, ensuring contractors are properly classified and exclusions are managed. These agreements help insurers assess risk and determine premiums while providing legal protection in cases of workplace injury related to independent contractors. |

| 14 | Subcontractor Certificates of Insurance (if applicable) | Small businesses must collect Subcontractor Certificates of Insurance to verify that subcontractors maintain adequate workers' compensation coverage, protecting both parties from liability. These certificates serve as proof of insurance and ensure compliance with legal requirements, minimizing risk exposure in construction or contracted projects. |

| 15 | Financial Statements | Small businesses need to provide accurate financial statements, including balance sheets and income statements, to determine appropriate workers' compensation insurance premiums based on payroll and risk exposure. These documents help insurers assess the company's financial stability and ensure compliance with state regulations for worker coverage. |

| 16 | Proof of Location/Lease Agreement | Small businesses must provide proof of location, such as a lease agreement or property deed, to validate the premises where employees work for workers' compensation insurance. This documentation ensures accurate risk assessment and policy underwriting by confirming the covered business address. |

Introduction to Workers' Compensation Insurance Documentation

| Document Type | Description | Purpose |

|---|---|---|

| Business Registration Documents | Includes articles of incorporation, business license, or registration certificates | Verifies the legal entity applying for workers' compensation insurance |

| Employer Identification Number (EIN) | Federal tax identification number assigned by the IRS | Confirms tax status and business identity during insurance processing |

| Payroll Records | Detailed employee wage reports and hours worked | Determines premium calculation based on employee wages and classification |

| Employee Information | List of employees including job titles and duties | Assists in assessing risk and establishing appropriate coverage levels |

| Previous Workers' Compensation Insurance Records | Certificates of insurance and claims history from prior policies | Provides underwriting insights and claims risk evaluation |

| Safety and Training Records | Documentation of workplace safety programs and employee training sessions | Demonstrates commitment to reducing workplace injuries and influencing premiums |

| State-Specific Forms | Mandatory forms required by state insurance departments | Ensures compliance with state regulations and valid policy issuance |

Business Registration and Licensing Papers

Small businesses must provide valid business registration documents to obtain workers' compensation insurance. These papers verify the company's legal existence and eligibility.

Licensing papers related to the specific industry are crucial for compliance and risk assessment. Insurers require these documents to ensure the business operates within state regulations.

Proof of Employee Payroll Records

Small businesses need to provide proof of employee payroll records when applying for workers' compensation insurance. These records demonstrate the total wages paid to employees, which directly influence premium calculations. Accurate payroll documentation ensures compliance with insurance requirements and prevents coverage disputes.

Detailed Employee Classification Reports

Small businesses must provide detailed employee classification reports when applying for workers' compensation insurance. These reports categorize employees based on job duties and risk levels, which directly impact insurance premiums.

Accurate classification ensures the insurer correctly assesses the potential hazards associated with each employee's role. Detailed reports include job descriptions, payroll amounts, and hours worked for every classification. This documentation helps prevent underpayment or overpayment of premiums and ensures compliance with state regulations.

Previous Workers’ Compensation Policy History

Small businesses must provide their previous workers' compensation policy history when applying for new coverage. This history includes details such as policy dates, coverage limits, and records of claims filed. Insurers use this information to assess risk and determine accurate premium rates.

OSHA Compliance and Safety Records

What documents does a small business need for workers' compensation insurance related to OSHA compliance and safety records? You must gather OSHA compliance certificates and detailed safety inspection reports. Maintaining accurate safety records demonstrates your commitment to workplace safety and helps streamline the insurance process.

Claims History and Loss Run Reports

Small businesses applying for workers' compensation insurance must provide specific documentation to verify their claims history and assess risk accurately. Claims history and loss run reports are essential for underwriting and determining premium costs.

- Claims History Report - This document details previous workers' compensation claims filed by the business, including claim dates, types, and resolutions.

- Loss Run Report - Provided by the insurer, this report summarizes the financial losses and claim trends over a specified period for the business.

- Incident and Accident Records - These records support claims history by offering detailed accounts of workplace injuries or incidents contributing to insurance claims.

Signed Waivers and Exclusion Forms

Small businesses must provide specific documentation to secure workers' compensation insurance coverage. Signed waivers and exclusion forms play a crucial role in defining employee eligibility and coverage limits.

- Signed Waivers - These documents confirm that employees voluntarily acknowledge the risks associated with certain job tasks and waive specific claims against the employer.

- Exclusion Forms - Used to identify individuals or job roles exempt from workers' compensation coverage, helping to clarify who is not eligible for benefits.

- Legal Compliance - Properly executed waivers and exclusion forms ensure the business complies with state laws and reduces potential disputes during claims processing.

Certificate of Good Standing

Small businesses must provide specific documents to secure workers' compensation insurance, with the Certificate of Good Standing being a crucial element. This certificate verifies the business's legal status and compliance with state regulations.

- Certificate of Good Standing - Confirms the business is legally registered and authorized to operate in the state.

- Proof of Business Registration - Documents like Articles of Incorporation or a business license that establish the entity's legitimacy.

- Employee Information - A detailed list of employees including job titles and payroll to assess insurance risk.

Providing a Certificate of Good Standing helps insurance providers confirm the business's legitimacy and eligibility for workers' compensation coverage.

What Documents Does a Small Business Need for Workers’ Compensation Insurance? Infographic