To cancel auto insurance, you typically need to provide a written cancellation request along with your policy number and personal identification. Some insurers may require proof of a new insurance policy or vehicle sale documents to process the cancellation. Confirm specific requirements with your insurance provider to ensure a smooth cancellation process.

What Documents are Needed for Auto Insurance Cancellation?

| Number | Name | Description |

|---|---|---|

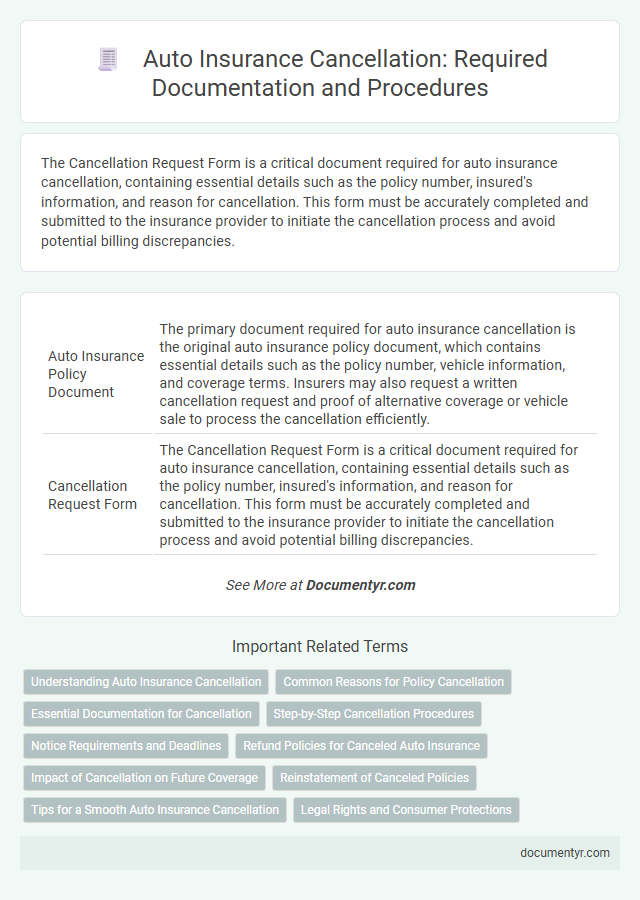

| 1 | Auto Insurance Policy Document | The primary document required for auto insurance cancellation is the original auto insurance policy document, which contains essential details such as the policy number, vehicle information, and coverage terms. Insurers may also request a written cancellation request and proof of alternative coverage or vehicle sale to process the cancellation efficiently. |

| 2 | Cancellation Request Form | The Cancellation Request Form is a critical document required for auto insurance cancellation, containing essential details such as the policy number, insured's information, and reason for cancellation. This form must be accurately completed and submitted to the insurance provider to initiate the cancellation process and avoid potential billing discrepancies. |

| 3 | Proof of New Insurance Coverage (if applicable) | Proof of new insurance coverage typically required for auto insurance cancellation includes a valid policy declaration page or an official letter from the new insurance provider confirming active coverage, ensuring continuous protection and regulatory compliance. Submitting these documents helps avoid potential penalties and validates the cancellation request with the current insurer. |

| 4 | Written Cancellation Letter | A written cancellation letter is essential for auto insurance cancellation, specifying the policy number, effective cancellation date, and policyholder's signature to ensure proper processing by the insurer. Including detailed personal identification documents and proof of alternative insurance coverage can further streamline the cancellation request. |

| 5 | Identification Document (Driver’s License or State ID) | To cancel auto insurance, an official identification document such as a valid driver's license or state ID is required to verify the policyholder's identity. Insurance companies use these documents to prevent fraud and ensure that only authorized individuals can request policy cancellation. |

| 6 | Vehicle Registration Certificate | The Vehicle Registration Certificate (VRC) is a critical document required for auto insurance cancellation as it serves to verify vehicle ownership and registration details. Insurance providers demand the original VRC or a duly certified copy to process cancellation requests, ensuring the policyholder's identity and vehicle information match their records. |

| 7 | Proof of Policy Payment (Receipts/Invoices) | Proof of policy payment, such as receipts or invoices, is essential for auto insurance cancellation to verify that all premiums have been fully paid and to avoid any outstanding balance disputes. These documents provide official confirmation of payment history, ensuring a smooth cancellation process with the insurance provider. |

| 8 | Odometer Disclosure (if required) | Auto insurance cancellation may require submission of specific documents, including the odometer disclosure statement if mandated by state regulations, to verify the vehicle's mileage at the time of policy termination. This document helps ensure accurate record-keeping and may affect premium adjustments or refunds during the cancellation process. |

| 9 | Refund Request Form (if applicable) | To cancel auto insurance and request a refund, submit the Refund Request Form along with your policy number and cancellation date. Including proof of new coverage or the vehicle's sale documentation may be necessary to process the refund promptly. |

| 10 | Signature Authorization Form | A Signature Authorization Form is essential for auto insurance cancellation, serving as documented proof that the policyholder consents to terminate the coverage. This form must be signed and submitted to the insurance company to validate the cancellation request and avoid any potential disputes or unauthorized policy continuation. |

Understanding Auto Insurance Cancellation

Understanding auto insurance cancellation requires knowing the necessary documents to ensure a smooth process. Insurance providers often require proof of policy termination or a new insurance policy before accepting cancellation requests.

Common documents needed include a formal cancellation request letter and a copy of the existing insurance policy. Some insurers may also ask for a confirmation of a new auto insurance policy to avoid coverage gaps.

Common Reasons for Policy Cancellation

Auto insurance cancellation requires submitting specific documents such as a written cancellation request, proof of a new insurance policy, or a lien release if the vehicle is sold. Common reasons for policy cancellation include non-payment of premiums, providing false information, and significant changes to the vehicle or driver's eligibility. Understanding the necessary paperwork ensures a smooth cancellation process and protects your financial interests.

Essential Documentation for Cancellation

To cancel auto insurance, providing the correct documents ensures a smooth process. Essential paperwork confirms your request and helps avoid unnecessary charges.

Typically, you need your insurance policy number and a formal cancellation request, either written or through your insurer's online portal. Proof of new insurance coverage or vehicle sale documents may be required to validate the cancellation. Keep copies of all submitted documents for your records and future reference.

Step-by-Step Cancellation Procedures

Canceling auto insurance requires submitting specific documents to ensure a smooth process. Understanding the step-by-step procedures helps avoid delays and complications.

- Insurance Policy Document - Provide your current auto insurance policy for reference and verification purposes.

- Cancellation Request Form - Complete and submit a formal cancellation request form as required by your insurer.

- Proof of New Insurance - Submit evidence of replacement insurance coverage to avoid coverage gaps.

Notice Requirements and Deadlines

To cancel auto insurance, primary documents include a formal written cancellation request and the original insurance policy. Many insurers require a specific cancellation form provided by the company to process the request.

Notice requirements typically mandate submitting the cancellation request at least 10 to 30 days before the intended termination date. Missing these deadlines can result in continued premium charges or delayed cancellation processing.

Refund Policies for Canceled Auto Insurance

| Required Documents for Auto Insurance Cancellation | Details |

|---|---|

| Cancellation Request Form | Official document submitted to the insurer requesting policy termination. |

| Original Insurance Policy | Proof of existing coverage, needed to verify policy details and process cancellation. |

| Proof of New Insurance (if applicable) | Evidence of a replacement policy to avoid coverage gaps; mandatory in some states. |

| Vehicle Registration Document | Confirms the insured vehicle's identity and ownership. |

| Identification Proof | Valid government-issued ID verifying the policyholder's identity. |

| Refund Policies for Canceled Auto Insurance | |

| Pro-Rated Refund | Refund amount is calculated based on the unused portion of the premium after cancellation date. |

| Cancellation Fees | Some insurers charge administrative fees which are deducted from the refund. |

| Short-Rate Penalty | Refund may be reduced if cancellation happens before policy expiry as a penalty for early termination. |

| Processing Time | Refunds typically processed within 15 to 30 business days post-cancellation confirmation. |

| No Refund Situations | Policies paid in full for a short term may not qualify for refunds, depending on insurer terms. |

Impact of Cancellation on Future Coverage

When canceling auto insurance, it is essential to provide specific documents to ensure proper processing. Understanding the impact of cancellation on future coverage helps in making informed decisions.

- Cancellation Request Form - A formal written request submitted to the insurer to initiate the cancellation process.

- Proof of New Insurance - Documentation confirming continuous coverage to avoid gaps in insurance protection.

- Policy Number and Personal Identification - Necessary for verifying the policyholder's identity and policy details during cancellation.

Canceling auto insurance without proper documentation can affect future coverage options and lead to higher premiums.

Reinstatement of Canceled Policies

What documents are needed for auto insurance cancellation and reinstatement? You typically need to provide the original cancellation notice, proof of payment for any outstanding premiums, and a completed reinstatement application form. Some insurers may also require a valid driver's license and vehicle registration to process the reinstatement of canceled policies.

Tips for a Smooth Auto Insurance Cancellation

To cancel your auto insurance smoothly, prepare essential documents such as your policy number, a written cancellation request, and proof of new insurance if applicable. Keep a copy of your cancellation confirmation for your records to avoid any disputes. Notify your insurance company in advance to prevent lapses in coverage and potential fees.

What Documents are Needed for Auto Insurance Cancellation? Infographic