Small businesses need several key documents to secure general liability insurance, including a detailed business description, proof of ownership or lease agreements, and financial statements to demonstrate operational stability. Additionally, providing information such as previous insurance policies, risk management protocols, and any relevant licenses or permits helps insurers accurately assess coverage needs. Maintaining updated documentation ensures smooth processing of claims and compliance with policy requirements.

What Documents Does a Small Business Need for General Liability Insurance?

| Number | Name | Description |

|---|---|---|

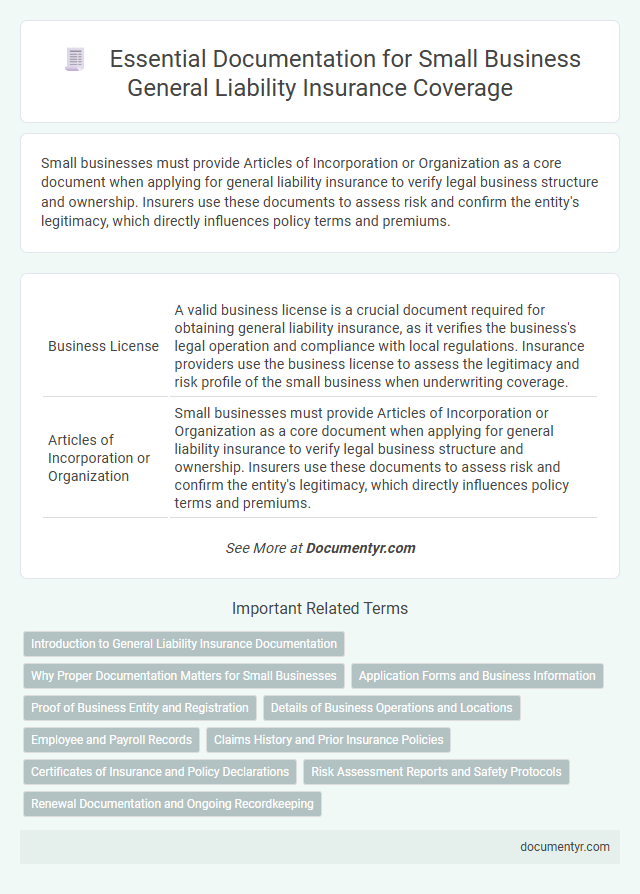

| 1 | Business License | A valid business license is a crucial document required for obtaining general liability insurance, as it verifies the business's legal operation and compliance with local regulations. Insurance providers use the business license to assess the legitimacy and risk profile of the small business when underwriting coverage. |

| 2 | Articles of Incorporation or Organization | Small businesses must provide Articles of Incorporation or Organization as a core document when applying for general liability insurance to verify legal business structure and ownership. Insurers use these documents to assess risk and confirm the entity's legitimacy, which directly influences policy terms and premiums. |

| 3 | Federal Employer Identification Number (EIN) | A Federal Employer Identification Number (EIN) is a crucial document required for obtaining general liability insurance as it uniquely identifies a small business for tax and legal purposes. Insurers use the EIN to verify the business's legitimacy and ensure proper policy underwriting. |

| 4 | Proof of Address | Small businesses must provide proof of address, such as a utility bill, lease agreement, or business license, to obtain general liability insurance. This documentation verifies the business location, which insurers use to assess risk and determine policy terms and premiums. |

| 5 | Previous Insurance Policies (if applicable) | Previous insurance policies provide critical information about a small business's claims history and coverage limits, which insurers use to assess risk for general liability insurance. Documentation such as past policy declarations, claims records, and loss runs is essential to ensure accurate underwriting and competitive premium pricing. |

| 6 | Loss Run Reports | Small businesses need to provide Loss Run Reports, which detail their historical claims and losses, to help insurers assess risk for general liability insurance. These documents offer crucial insights into past claims frequency, severity, and patterns, directly impacting premium calculations and coverage terms. |

| 7 | Financial Statements | Small businesses need to provide financial statements such as balance sheets, income statements, and cash flow statements when applying for general liability insurance to accurately assess risk and determine premiums. These documents demonstrate the company's financial stability, revenue streams, and potential exposure to liabilities, aiding insurers in underwriting decisions. |

| 8 | Payroll Records | Payroll records are essential documents for small businesses applying for general liability insurance, as they provide accurate data on employee wages, hours worked, and job classifications that influence premium calculations. Insurers analyze payroll information to assess risk exposure and determine appropriate coverage limits, making detailed and up-to-date payroll documentation critical for obtaining accurate quotes and policy terms. |

| 9 | List of Business Owners and Officers | A small business must provide a comprehensive list of business owners and officers, including their full names, titles, and contact information, to secure general liability insurance. Insurers use this data to assess risk exposure and verify the responsible parties associated with the business operations. |

| 10 | Description of Business Operations | A detailed Description of Business Operations is essential for obtaining general liability insurance, as it outlines the nature, scope, and activities of the small business, helping insurers assess risk accurately. This document includes information such as types of products or services offered, business location, number of employees, and typical customer interactions. |

| 11 | Certificates of Occupancy | Small businesses must provide a valid Certificate of Occupancy to secure General Liability Insurance, as it verifies the property's compliance with local building codes and suitability for the intended business use. Insurers use this document to assess risk and ensure the premises meet safety standards before issuing a policy. |

| 12 | Contracts or Lease Agreements | Small businesses must provide contracts or lease agreements to demonstrate operational risks and liability exposures when applying for general liability insurance. These documents help insurers assess the scope of business activities and potential third-party claims related to property use and service delivery. |

| 13 | Employee List and Job Descriptions | A detailed employee list with job descriptions is essential for small businesses applying for general liability insurance, as it helps insurers assess risk exposure based on roles and responsibilities. Accurate documentation of employee roles enables tailored coverage options and ensures compliance with underwriting requirements. |

| 14 | Inventory List | A detailed inventory list is essential for obtaining general liability insurance for a small business as it helps insurers assess the value and risks associated with the business assets. This list should include descriptions, quantities, and values of all physical items to ensure accurate coverage and claim processing. |

| 15 | Equipment List | A detailed equipment list is essential for small businesses seeking general liability insurance, as it provides insurers with accurate information about the tools and machinery used in daily operations, helping to assess risk properly. Including serial numbers, purchase dates, and current market values in the equipment list ensures precise coverage and can expedite claims processing in case of damage or loss. |

| 16 | Tax Identification Number (TIN) | A Tax Identification Number (TIN) is essential for small businesses applying for general liability insurance as it verifies the legal identity of the business entity. Insurers use the TIN to assess risk, process applications, and track policy information efficiently. |

| 17 | Copies of Subcontractor Agreements (if used) | Small businesses seeking general liability insurance must provide copies of subcontractor agreements to verify the scope of work and liability coverage obligations. These documents clarify responsibilities and ensure that subcontractors carry appropriate insurance, reducing risk exposure for the primary insured. |

| 18 | Vendor or Supplier Agreements | Vendor or supplier agreements are crucial documents for securing general liability insurance as they outline the scope of services, liability clauses, and indemnification responsibilities that affect risk assessment. Insurers require these agreements to evaluate potential exposure and ensure the business's operations comply with liability coverage requirements. |

| 19 | Safety Manuals or Employee Handbooks | Small businesses need to provide Safety Manuals or Employee Handbooks that detail workplace safety protocols and employee responsibilities as part of their general liability insurance documentation. These documents demonstrate the business's commitment to risk management and help insurers assess potential liability exposures. |

| 20 | Claims History Reports | Small businesses need to provide detailed claims history reports that document any previous liability claims or incidents to accurately assess risk for general liability insurance. These reports typically include dates, types of claims, outcomes, and any settlements or judgments to help insurers determine appropriate coverage and premiums. |

Introduction to General Liability Insurance Documentation

What documents does a small business need for general liability insurance? Small businesses must prepare specific paperwork to secure general liability coverage effectively. Proper documentation ensures accuracy in risk assessment and smooth application processing.

Which forms are essential when applying for general liability insurance? Key documents include a detailed business description, proof of business ownership, and prior insurance records if available. Financial statements and safety protocols may also be required to evaluate liability risks thoroughly.

Why Proper Documentation Matters for Small Businesses

Proper documentation is essential for securing general liability insurance for your small business. It ensures accurate risk assessment and smooth claims processing.

- Business License - Validates your legal operation and is often required by insurers.

- Financial Statements - Demonstrates your business's financial health and stability to the insurer.

- Previous Insurance Policies - Provides historical risk data, aiding in accurate premium calculation.

Maintaining thorough documents protects your business by facilitating timely and fair insurance coverage decisions.

Application Forms and Business Information

Small businesses applying for general liability insurance must complete specific application forms provided by the insurer. These forms gather essential details about the business operations and risk factors.

Accurate business information, including legal structure, industry type, and annual revenue, is critical to determine appropriate coverage. Insurers also require details about the number of employees and any previous claims history.

Proof of Business Entity and Registration

Proof of business entity and registration is essential when applying for general liability insurance for a small business. This documentation typically includes a copy of the business license, articles of incorporation, or a certificate of formation. Providing these documents verifies the legal existence of the business and its compliance with local regulations, which insurers require to assess risk accurately.

Details of Business Operations and Locations

Obtaining general liability insurance for a small business requires detailed documentation of business operations and the locations involved. Insurers use this information to assess risk and determine policy terms.

- Detailed Business Description - Provide a comprehensive summary of daily operations, products or services offered, and the nature of customer interactions to clarify liability exposures.

- Business Location Addresses - List all physical locations where the business operates, including offices, retail spaces, warehouses, or temporary job sites, as these impact coverage scope and risk evaluation.

- Operational Hours and Activities - Submit information about business hours and specific activities conducted at each location to help insurers understand potential risk periods and operational hazards.

Employee and Payroll Records

| Document Type | Details | Importance for General Liability Insurance |

|---|---|---|

| Employee Records | Includes employee personal information, job titles, hire dates, and work classifications. | Helps insurers assess risk levels related to employee roles and workplace hazards, influencing policy terms and premiums. |

| Payroll Records | Records of wages, hours worked, and payroll taxes for all employees. | Used to verify payroll estimates, which impact premium calculations based on total exposure to employee-related risks. |

| Employment Agreements | Contracts outlining job responsibilities, terms of employment, and workplace policies. | Clarifies responsibilities and risk management practices, supporting accurate insurance underwriting. |

| Workplace Safety Training Documentation | Records of safety training sessions attended by employees. | Demonstrates commitment to risk reduction, potentially lowering liability exposure and insurance costs. |

To secure general liability insurance for your small business, maintaining thorough employee and payroll documentation is essential. These records allow insurers to properly evaluate your risk profile and offer tailored coverage options.

Claims History and Prior Insurance Policies

Small businesses must provide detailed claims history to secure general liability insurance, as insurers assess risk based on past incidents. Accurate records of prior insurance policies demonstrate the business's coverage continuity and help in evaluating policy terms. These documents collectively influence premium rates and coverage limits tailored to the business's risk profile.

Certificates of Insurance and Policy Declarations

Small businesses require specific documents to apply for general liability insurance. Certificates of Insurance verify current coverage and are essential for contracts and partnerships.

Policy Declarations detail the terms, coverage limits, and insured parties within the insurance contract. You must keep these documents accessible to ensure smooth claims processing and compliance.

Risk Assessment Reports and Safety Protocols

Small businesses must prepare specific documentation to secure general liability insurance efficiently. Risk assessment reports and safety protocols play crucial roles in this process.

- Risk Assessment Reports - Detailed evaluations of potential hazards help insurers understand your business's exposure to risks.

- Safety Protocols - Written procedures for workplace safety demonstrate your commitment to reducing accidents and liabilities.

- Incident History Documentation - Records of past accidents or claims provide insight into your business's risk profile and claims management.

What Documents Does a Small Business Need for General Liability Insurance? Infographic