Professional liability insurance applications require key documents such as proof of professional licenses, detailed resumes or CVs, and prior claims history. Detailed policy or contract agreements demonstrating scope of work and risk exposure are often necessary for accurate underwriting. Financial statements and client lists may also be requested to assess potential liability and coverage needs.

What Documents are Necessary for Professional Liability Insurance Applications?

| Number | Name | Description |

|---|---|---|

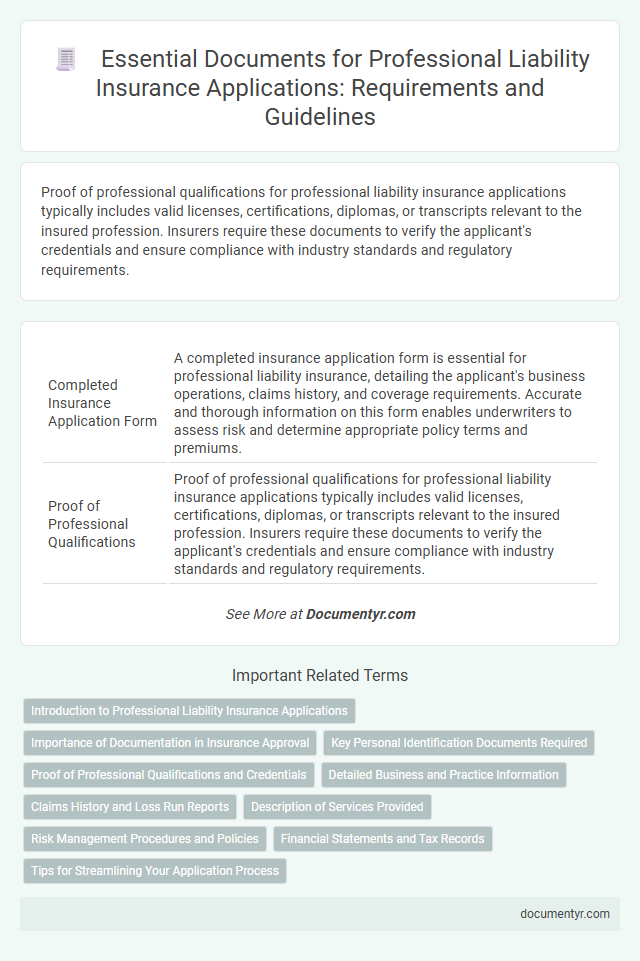

| 1 | Completed Insurance Application Form | A completed insurance application form is essential for professional liability insurance, detailing the applicant's business operations, claims history, and coverage requirements. Accurate and thorough information on this form enables underwriters to assess risk and determine appropriate policy terms and premiums. |

| 2 | Proof of Professional Qualifications | Proof of professional qualifications for professional liability insurance applications typically includes valid licenses, certifications, diplomas, or transcripts relevant to the insured profession. Insurers require these documents to verify the applicant's credentials and ensure compliance with industry standards and regulatory requirements. |

| 3 | Resume or Curriculum Vitae | A detailed Resume or Curriculum Vitae highlighting professional qualifications, work history, and relevant experience is essential for professional liability insurance applications to accurately assess risk exposure. Insurers use this document to verify the applicant's expertise, track record, and any potential claims history linked to their professional activities. |

| 4 | Copy of Business License | A copy of the business license is essential for professional liability insurance applications as it verifies the legal authorization to operate and confirms the legitimacy of the business. Insurers use this document to assess the risk profile and ensure compliance with regulatory requirements before issuing coverage. |

| 5 | Details of Services Provided | Professional liability insurance applications require detailed documentation of services provided, including comprehensive descriptions of all professional activities, client interactions, and the scope of work performed. Accurate records of contracts, project timelines, and any risk management procedures implemented are essential to assess potential exposures and underwriting criteria effectively. |

| 6 | Claims History Report (Loss Runs) | A Claims History Report, also known as Loss Runs, is essential for professional liability insurance applications as it details past claims, settlements, and losses, helping insurers assess risk accurately. This report typically includes dates, amounts paid, and open claim statuses, ensuring transparency and enabling tailored policy terms. |

| 7 | Risk Management Policies | Professional liability insurance applications require comprehensive risk management policies that detail preventative measures, incident response protocols, and staff training programs to mitigate potential liabilities. These documents demonstrate an organization's commitment to minimizing professional risks, which insurers evaluate to determine coverage terms and premiums. |

| 8 | Copies of Existing Insurance Policies | Copies of existing insurance policies, including current professional liability coverage, proof of claims history, and declarations pages, are necessary for accurate risk assessment in professional liability insurance applications. Providing detailed policy information helps insurers verify coverage limits, exclusions, and prior claims to tailor the appropriate protection and premium. |

| 9 | Financial Statements | Professional liability insurance applications typically require audited financial statements, including balance sheets, income statements, and cash flow statements, to assess the applicant's financial stability and risk exposure. These documents provide insurers with critical insights into the company's fiscal health, helping to determine appropriate coverage limits and premiums. |

| 10 | Client Contracts or Engagement Letters | Client contracts or engagement letters are essential documents for professional liability insurance applications as they detail the scope of services, terms, and responsibilities, helping insurers assess risk exposure. These documents provide evidence of the professional relationship and clarify the extent of coverage needed for potential claims. |

| 11 | Certificates of Incorporation or Organization | Certificates of Incorporation or Organization serve as primary documents verifying the legal formation and registration of a business entity for professional liability insurance applications. Insurers rely on these certificates to confirm the applicant's legal status, which directly impacts risk assessment and policy issuance. |

| 12 | Employee Roster and Roles | A detailed employee roster listing names, job titles, and roles is essential for professional liability insurance applications to assess risk exposure accurately. Insurance providers use this documentation to evaluate the qualifications and responsibilities of each employee, ensuring appropriate coverage limits and policy terms. |

| 13 | Marketing Materials or Brochures | Marketing materials or brochures are essential documents for professional liability insurance applications as they provide detailed information about the services offered and help insurers assess risk exposure. These documents must clearly outline the scope of professional activities, disclaimers, and client communications to ensure accurate underwriting and appropriate coverage terms. |

| 14 | Regulatory or Industry Certifications | Professional Liability Insurance applications typically require regulatory licenses, industry certifications, and proof of compliance with relevant professional standards to verify expertise and legitimacy. Documentation such as state-issued professional licenses, certification from recognized industry bodies, and records of ongoing education or training courses are crucial in the underwriting process. |

| 15 | Details of Disciplinary Actions or Legal Proceedings | Documents detailing any past or current disciplinary actions, lawsuits, claims history, and settlements are necessary for professional liability insurance applications, as insurers assess risk based on these legal proceedings. Providing court records, attorney correspondence, and regulatory board findings ensures transparency and supports accurate underwriting decisions. |

Introduction to Professional Liability Insurance Applications

Professional liability insurance protects professionals against claims of negligence or errors in their services. Understanding the required documents streamlines your application process for adequate coverage.

- Proof of Identity - Valid identification verifies the applicant's identity and professional credentials.

- Professional Qualifications - Certifications, licenses, or degrees demonstrate your expertise in the relevant field.

- Prior Insurance Records - Previous insurance history helps assess risk and coverage needs accurately.

Importance of Documentation in Insurance Approval

Professional liability insurance applications require comprehensive documentation to verify your qualifications, business practices, and risk exposure. Essential documents include proof of professional credentials, business financial statements, past claims history, and detailed descriptions of services provided. Proper documentation ensures accurate risk assessment, streamlines the approval process, and protects both the insurer and insured from future disputes.

Key Personal Identification Documents Required

When applying for professional liability insurance, key personal identification documents are essential to verify the applicant's identity and professional credentials. These typically include a valid government-issued ID such as a passport or driver's license, proof of professional licenses or certifications, and recent professional resumes or CVs. Insurers use these documents to assess eligibility and ensure coverage accuracy for the specific profession.

Proof of Professional Qualifications and Credentials

Proof of professional qualifications and credentials is a critical requirement for professional liability insurance applications. This documentation verifies the applicant's expertise and eligibility to provide specialized services.

Commonly required documents include diplomas, certifications, licenses, and membership letters from recognized professional bodies. These records help insurers assess risk and determine appropriate coverage terms.

Detailed Business and Practice Information

| Document | Purpose | Details Required |

|---|---|---|

| Business Description | Clarifies the nature of professional services offered | Detailed explanation of business activities, scope of services, and specialties |

| Practice History | Verifies experience and operational timeline | Start date of practice, previous locations, and major changes in service offerings |

| Organizational Structure | Identifies business type and ownership details | Information on legal entity type (e.g., sole proprietorship, partnership, corporation), ownership percentages |

| Licenses and Certifications | Confirms professional qualifications and regulatory compliance | Copies of current professional licenses, certifications, and registration documents |

| Revenue and Client Information | Assesses business scale and client demographics | Annual revenue figures, client categories, and average contract size |

| Risk Management Procedures | Demonstrates measures to reduce potential liability | Implementation of quality control processes, staff training records, incident response plans |

Claims History and Loss Run Reports

Claims history and loss run reports are critical documents for professional liability insurance applications. These documents provide detailed records of previous claims, helping insurers assess risk accurately.

- Claims History - A detailed record of past claims filed by the applicant, essential for evaluating potential liabilities.

- Loss Run Reports - Comprehensive reports from previous insurers outlining claim amounts, dates, and outcomes.

- Importance for Underwriting - Accurate claims history and loss runs enable underwriters to determine appropriate coverage and premium rates.

Description of Services Provided

The description of services provided is a critical component in professional liability insurance applications. It helps insurers assess the scope of professional activities and the potential risks involved.

- Detailed Service Overview - A comprehensive outline of all professional services offered by the applicant to clarify risk exposure.

- Scope of Work - Specifics about the tasks and responsibilities included in the service to define coverage limits.

- Client Interaction Details - Information on how services are delivered and client relationships managed to evaluate liability factors.

Providing an accurate description of services ensures the insurer can tailor coverage to the applicant's professional risks effectively.

Risk Management Procedures and Policies

What documents are necessary to demonstrate risk management procedures and policies for professional liability insurance applications? Insurers require detailed documentation of your risk management strategies to assess potential liabilities accurately. Providing comprehensive policy manuals, training records, and incident response plans helps validate your commitment to minimizing professional risks.

Financial Statements and Tax Records

Financial statements are critical documents for professional liability insurance applications because they provide a clear picture of the applicant's financial health and risk exposure. These statements typically include balance sheets, income statements, and cash flow statements.

Tax records such as recent tax returns and supporting documentation help insurers verify income and assess financial stability. Accurate tax records reduce the risk of fraudulent claims and ensure appropriate premium pricing. Providing organized and up-to-date financial documents accelerates the application process and improves the chances of approval.

What Documents are Necessary for Professional Liability Insurance Applications? Infographic