To process a life insurance beneficiary payout, essential documents typically include the original death certificate, the completed claim form provided by the insurance company, and a valid beneficiary identification proof such as a passport or driver's license. The insurance provider may also require the policy document and, in some cases, legal documents like a will or probate papers to verify beneficiary status. Ensuring all these documents are accurate and submitted promptly helps facilitate a smooth and timely payout process.

What Documents are Needed for Life Insurance Beneficiary Payout?

| Number | Name | Description |

|---|---|---|

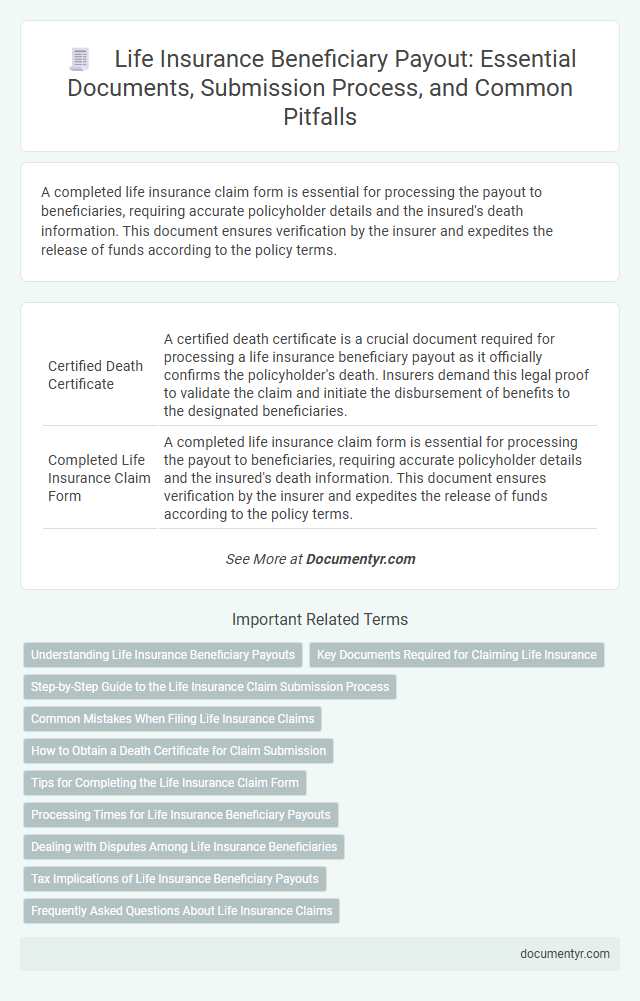

| 1 | Certified Death Certificate | A certified death certificate is a crucial document required for processing a life insurance beneficiary payout as it officially confirms the policyholder's death. Insurers demand this legal proof to validate the claim and initiate the disbursement of benefits to the designated beneficiaries. |

| 2 | Completed Life Insurance Claim Form | A completed life insurance claim form is essential for processing the payout to beneficiaries, requiring accurate policyholder details and the insured's death information. This document ensures verification by the insurer and expedites the release of funds according to the policy terms. |

| 3 | Policyholder’s Life Insurance Policy Document | The policyholder's life insurance policy document is essential for verifying the terms and identifying the designated beneficiaries for the payout process. This document must be submitted along with a certified death certificate to initiate the beneficiary claim and ensure a smooth disbursement of the insurance proceeds. |

| 4 | Beneficiary’s Proof of Identity (Government-issued ID or Passport) | For a life insurance beneficiary payout, the beneficiary must provide a government-issued ID or passport as proof of identity to verify their entitlement. This documentation ensures accurate processing and prevents fraudulent claims during claim settlement. |

| 5 | Beneficiary’s Proof of Relationship (if applicable) | Life insurance beneficiary payouts require proof of the beneficiary's relationship to the insured, which typically includes documents such as a birth certificate, marriage certificate, or legal adoption papers. These documents help verify the beneficiary's entitlement and ensure the claim is processed accurately and promptly. |

| 6 | Beneficiary’s Social Security Number or Tax Identification Number | The beneficiary's Social Security Number (SSN) or Tax Identification Number (TIN) is essential for processing a life insurance payout as it verifies identity and ensures accurate tax reporting to the IRS. Insurers require this information to prevent fraud and comply with federal regulations related to beneficiary claims and disbursements. |

| 7 | Medical Records (if required for claim investigation) | Medical records may be required for a life insurance beneficiary payout to verify cause of death and assess claim validity during the insurance company's investigation. Providing accurate and complete medical documentation ensures timely processing and reduces the risk of claim denial. |

| 8 | Autopsy Report or Coroner’s Report (if applicable) | A life insurance beneficiary payout often requires submission of an autopsy report or coroner's report when the death was sudden, suspicious, or unexplained, as these documents verify cause and circumstances of death. These official medical examiner reports are crucial for insurers to confirm eligibility and process claims accurately. |

| 9 | Funeral Home Statement (if applicable) | A funeral home statement is required for life insurance beneficiary payouts to verify expenses related to the decedent's funeral and burial services, ensuring accurate claim processing. This document acts as proof of costs incurred and supports the beneficiary's request for reimbursement or direct payment of funeral-related expenses. |

| 10 | Trust Documents (if beneficiary is a trust) | For a life insurance beneficiary payout involving a trust, essential documents include the trust agreement outlining the terms and beneficiaries, a certificate of trust verifying its validity, and the trust's Tax Identification Number (TIN). Insurers may also require a copy of the death certificate and FORM 709 (if applicable) to process the claim efficiently. |

| 11 | Letters of Administration or Probate (if payout to estate) | Letters of Administration or Probate are essential documents required for a life insurance beneficiary payout when the policy proceeds are directed to the deceased's estate. These legal documents verify the executor or administrator's authority to manage the estate, enabling the insurance company to release funds accurately and securely. |

| 12 | Assignment or Power of Attorney Documents (if claim filed by legal representative) | For life insurance beneficiary payouts filed by a legal representative, submitting power of attorney documents or assignment papers is essential to verify authorized claim handling. These documents establish the representative's legal authority to receive benefits on behalf of the beneficiary, ensuring claim legitimacy and processing accuracy. |

| 13 | Bank Account Information (for payout processing) | For life insurance beneficiary payout, providing accurate bank account information such as account number, bank name, and branch details is essential to ensure timely and secure fund transfer. Beneficiaries must submit a cancelled check or bank statement along with the claim form to verify account authenticity and facilitate seamless disbursement. |

| 14 | Notarized Affidavit (if required by insurer) | To secure a life insurance beneficiary payout, a notarized affidavit may be required by the insurer to verify the claimant's identity and relationship to the insured. This legally certified document ensures authenticity and helps prevent fraudulent claims during the benefit distribution process. |

| 15 | Original Policy Amendments or Riders | Original policy amendments or riders are essential documents for a life insurance beneficiary payout, as they confirm any changes or additional coverage beyond the base policy. These documents must be submitted alongside the primary insurance policy and claim form to validate the beneficiary's entitlement and ensure accurate disbursement. |

Understanding Life Insurance Beneficiary Payouts

Understanding life insurance beneficiary payouts involves knowing the key documents required to process the claim efficiently. Typically, the insurance company will need the original policy document, a certified copy of the death certificate, and a completed claim form. You may also need to provide proof of identity and any additional documents specified by the insurer to ensure a smooth payout process.

Key Documents Required for Claiming Life Insurance

Claiming a life insurance beneficiary payout requires submitting specific documents to verify the claim and ensure smooth processing. These key documents establish identity, death occurrence, and the legitimacy of the beneficiary.

- Original Life Insurance Policy Document - This serves as proof of the policyholder's coverage and includes the terms for payout.

- Death Certificate - Official government-issued documentation confirming the insured person's death is mandatory for claim validation.

- Proof of Identity of Beneficiary - Valid identification such as a passport or driver's license confirms the legitimate claimant.

- Claimant's Statement or Claim Form - A completed claim form signed by the beneficiary initiates the payout process.

- Medical Records or Cause of Death Certificate - Sometimes required to verify the cause and circumstances of death, especially in cases of disputed claims.

Step-by-Step Guide to the Life Insurance Claim Submission Process

Filing a life insurance claim requires precise documentation to ensure a smooth beneficiary payout. Understanding the necessary documents and the claim submission process reduces delays and complications.

- Death Certificate - An official death certificate must be submitted to verify the insured person's passing.

- Claim Form - The beneficiary must complete and sign the insurer's claim form accurately.

- Policy Document - Providing a copy of the original life insurance policy helps confirm the coverage details and beneficiary designation.

- Identification Proof - Valid government-issued ID of the beneficiary establishes their identity for the claim.

- Proof of Relationship - Documents such as birth or marriage certificates may be needed to prove the beneficiary's connection to the insured.

Submitting these documents promptly with the insurer accelerates the beneficiary payout process in life insurance claims.

Common Mistakes When Filing Life Insurance Claims

| Document | Description | Common Mistakes |

|---|---|---|

| Death Certificate | Official certificate issued by a government agency confirming the date and cause of death. | Submitting an unofficial copy or a copy with errors can delay the payout. |

| Life Insurance Policy | The original or certified copy of the policy showing coverage details. | Failing to provide the exact policy or losing it can create processing delays. |

| Claim Form | Form provided by the insurer that must be filled accurately by the beneficiary. | Incomplete or incorrect information often leads to claim rejection or delays. |

| Proof of Identity | Government-issued identification such as a driver's license or passport. | Using expired or unclear ID documents can hinder claim verification. |

| Proof of Relationship | Documents such as birth certificates, marriage certificates, or affidavits proving beneficiary status. | Omitting these documents or providing mismatched information is a common error. |

| Medical Records | Sometimes required if claims involve contestability or specific causes of death. | Not supplying requested medical documentation when needed can result in delays. |

| Settlement Statement | A statement detailing the payout amount and beneficiary information. | Not reviewing the statement carefully may cause misunderstandings about the payout. |

| Tax Forms | Forms required for tax purposes depending on the policy and payout type. | Neglecting tax documentation can cause issues with the IRS or local tax authorities. |

How to Obtain a Death Certificate for Claim Submission

To secure a life insurance beneficiary payout, specific documents are essential, with the death certificate being the most critical. This certificate serves as official proof of the policyholder's passing and initiates the claim process.

You can obtain a death certificate from the vital records office in the state where the death occurred. Typically, submitting a completed application form and a government-issued ID is required to request this document.

Tips for Completing the Life Insurance Claim Form

Filing a life insurance claim requires submitting specific documents to ensure a smooth beneficiary payout. Key documents include a completed claim form, the original policy document, and the insured's death certificate.

When completing the life insurance claim form, provide accurate personal details of the beneficiary to avoid delays. Attach all required supporting documents such as a government-issued ID and proof of relationship to the insured. Double-check for signatures and avoid leaving any fields blank to expedite the claim process effectively.

Processing Times for Life Insurance Beneficiary Payouts

To process a life insurance beneficiary payout, key documents typically required include the original death certificate, the completed claim form, and proof of beneficiary identity such as a government-issued ID. Insurers may also request the original policy document and any additional forms specific to the claim.

Processing times for life insurance beneficiary payouts vary by insurer but generally range from two to six weeks after all documents have been submitted. Delays often occur if documentation is incomplete or if further investigation is necessary to verify the claim.

Dealing with Disputes Among Life Insurance Beneficiaries

Understanding the documents required for a life insurance beneficiary payout is crucial in ensuring a smooth process. Disputes among beneficiaries can delay or complicate the distribution of funds.

- Death Certificate - An official death certificate is mandatory to initiate the payout process and proves the insured person's demise.

- Policy Document - The original life insurance policy outlines the terms and beneficiaries, serving as a key reference in resolving disputes.

- Legal Documents - Wills, court orders, or beneficiary designation forms may be necessary to clarify rightful claims during disagreements among beneficiaries.

Tax Implications of Life Insurance Beneficiary Payouts

For life insurance beneficiary payouts, essential documents include the original policy, a certified copy of the death certificate, and a completed claim form. Tax implications vary depending on the type of policy and payout structure, with many life insurance proceeds generally exempt from federal income tax. You should consult a tax advisor to understand any potential estate or inheritance taxes that may apply to your specific situation.

What Documents are Needed for Life Insurance Beneficiary Payout? Infographic