To apply for homeowners insurance, you need to provide key documents such as a completed application form, proof of property ownership like a deed or mortgage statement, and recent home appraisal or inspection reports. Other essential documents include identification proof, previous insurance policy details, and information on home security features or renovations. These documents help insurers assess risk and determine accurate coverage and premiums.

What Documents are Needed to Apply for Homeowners Insurance?

| Number | Name | Description |

|---|---|---|

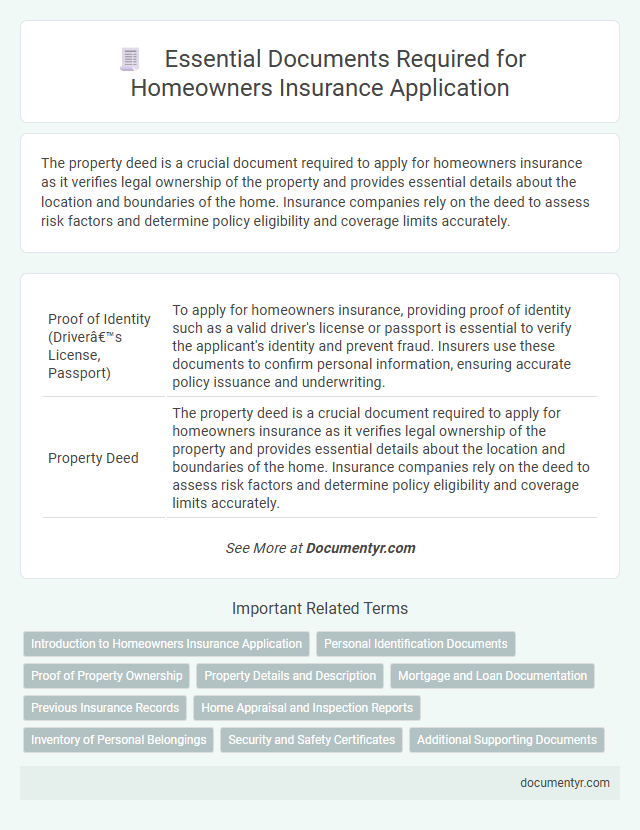

| 1 | Proof of Identity (Driver’s License, Passport) | To apply for homeowners insurance, providing proof of identity such as a valid driver's license or passport is essential to verify the applicant's identity and prevent fraud. Insurers use these documents to confirm personal information, ensuring accurate policy issuance and underwriting. |

| 2 | Property Deed | The property deed is a crucial document required to apply for homeowners insurance as it verifies legal ownership of the property and provides essential details about the location and boundaries of the home. Insurance companies rely on the deed to assess risk factors and determine policy eligibility and coverage limits accurately. |

| 3 | Mortgage Statement | A current mortgage statement is a critical document required to apply for homeowners insurance, as it verifies the loan balance and property details essential for underwriting. Insurers use this information to assess risk and determine coverage limits aligned with the property's insured value. |

| 4 | Previous Insurance Policy (if applicable) | When applying for homeowners insurance, submitting your previous insurance policy helps insurers assess your coverage history and identify any gaps or claims made. Providing this document can lead to more accurate risk evaluation and potentially lower premiums based on your prior coverage record. |

| 5 | Home Appraisal Report | A home appraisal report is a crucial document in the homeowners insurance application process, providing an objective valuation of the property's market value and condition. Insurers use this report to accurately assess risk and determine appropriate coverage limits and premiums. |

| 6 | Home Inspection Report | A home inspection report is a crucial document needed to apply for homeowners insurance as it details the property's condition, including structural integrity, electrical systems, plumbing, and potential hazards. Insurers use this report to assess risk accurately, determine coverage options, and set appropriate premium rates for the homeowner's policy. |

| 7 | Property Tax Records | Property tax records are essential documents when applying for homeowners insurance as they verify property ownership and provide accurate details about the home's assessed value, which insurers use to determine coverage limits and premiums. Submitting up-to-date property tax statements helps streamline the application process and ensures the insurance policy reflects the correct property information. |

| 8 | Purchase Agreement | The purchase agreement is a critical document required to apply for homeowners insurance as it verifies property ownership and sale details, including the purchase price and transaction date. Insurers use this agreement to assess coverage needs and confirm the property's legal status in the application process. |

| 9 | Renovation or Repair Receipts | Renovation or repair receipts are crucial documents when applying for homeowners insurance as they provide proof of improvements and maintenance that can affect the property's value and coverage needs. Insurers use these receipts to verify updates, determine replacement costs, and assess risk accurately for customized policy terms. |

| 10 | Building Plans or Blueprints | Building plans or blueprints are essential documents for applying for homeowners insurance, providing detailed information about the property's construction, layout, and materials used, which helps insurers assess risk accurately. These documents enable insurers to estimate rebuilding costs and determine appropriate coverage limits, ensuring the homeowner is adequately protected. |

| 11 | Security System Documentation | Security system documentation, including installation certificates and monitoring agreements, is essential for homeowners insurance applications to verify risk reduction measures. Insurers often require proof of alarm systems, surveillance cameras, or smart home security features to offer potential discounts and assess coverage terms accurately. |

| 12 | Personal Property Inventory List | A detailed Personal Property Inventory List is essential when applying for homeowners insurance, as it provides a comprehensive record of your belongings, including descriptions, purchase dates, and estimated values. Insurers rely on this documentation to accurately assess coverage needs and facilitate straightforward claims processing in case of loss or damage. |

| 13 | Photographs of Home and Belongings | Photographs of the home and valuable belongings are essential documents for applying for homeowners insurance, as they provide visual evidence of the property's condition and help determine accurate coverage. Detailed images of the exterior, interior, and any special features or upgrades assist insurers in assessing risk and verifying claims. |

| 14 | Homeowners Association (HOA) Documents | Homeowners Association (HOA) documents required to apply for homeowners insurance typically include the HOA bylaws, covenants, conditions, and restrictions (CC&Rs), as well as the HOA budget and financial statements. Insurers use these documents to assess community rules, property maintenance standards, and financial stability, which impact coverage terms and premiums. |

| 15 | Fire Safety Compliance Certificates | Fire safety compliance certificates are essential documents required to apply for homeowners insurance as they verify the property's adherence to local fire safety regulations, reducing insurer risk. Providing these certificates ensures faster policy approval and may result in lower premiums due to demonstrated fire hazard mitigation. |

| 16 | Flood Zone Certification (if applicable) | Homeowners insurance applications require key documents such as property deeds, proof of identity, and recent mortgage statements, with Flood Zone Certification specifically needed to verify flood risk when the property is located in a designated flood hazard area. This certification is crucial for determining mandatory flood insurance coverage to protect against potential water damage. |

| 17 | Claims History Report (CLUE Report) | A Claims History Report (CLUE Report) is essential when applying for homeowners insurance as it provides a detailed record of past claims filed on the property, helping insurers assess risk accurately. Homeowners should obtain and review their CLUE report to ensure all information is accurate, as discrepancies can impact premium rates and coverage approval. |

| 18 | Utility Bills (for proof of residence) | Utility bills such as electricity, water, or gas statements serve as essential proof of residence when applying for homeowners insurance, confirming the insured property's address. Insurers require these documents to verify residency and assess risk factors related to the home's location. |

Introduction to Homeowners Insurance Application

What documents are needed to apply for homeowners insurance? Providing detailed information is crucial for a smooth application process. Homeowners insurance protects your property against damages and liabilities, ensuring peace of mind.

Personal Identification Documents

Applying for homeowners insurance requires several key personal identification documents to verify your identity and secure the policy. These documents establish trust and ensure the application process proceeds smoothly.

- Government-issued ID - A valid passport or driver's license confirms your legal identity.

- Social Security Number (SSN) - Your SSN helps insurers perform background and credit checks.

- Proof of Residency - Utility bills or lease agreements verify your home address.

Providing accurate personal identification documents speeds up the homeowners insurance application and approval process.

Proof of Property Ownership

Proof of property ownership is essential when applying for homeowners insurance. This document verifies that you legally own the property requiring coverage.

Commonly accepted proof includes a deed, property tax bill, or mortgage statement. These documents confirm ownership and help insurers assess risk accurately. Providing clear proof expedites the application process and ensures proper policy issuance.

Property Details and Description

When applying for homeowners insurance, providing detailed property information is crucial to ensure accurate coverage and premium calculation. Insurers require specific documents that outline the characteristics and condition of the property.

- Property Deed or Title - This document verifies ownership and legal description of the home.

- Home Appraisal Report - An appraisal provides the current market value and condition assessment of the property.

- Property Survey - A survey outlines property boundaries and structural details important for underwriting.

Mortgage and Loan Documentation

When applying for homeowners insurance, mortgage and loan documentation are essential to verify ownership and loan details. Lenders typically require a copy of the mortgage agreement, including loan terms and property address, to ensure proper coverage. Providing these documents helps insurance companies assess risk and set accurate premiums for the homeowner policy.

Previous Insurance Records

Previous insurance records are essential when applying for homeowners insurance. These documents provide the insurer with information on your coverage history and any prior claims made. Having accurate records helps streamline the application process and may influence your premium rates.

Home Appraisal and Inspection Reports

Home appraisal and inspection reports play a crucial role in the homeowners insurance application process. These documents provide essential details about the property's value and condition to ensure accurate coverage.

- Home Appraisal Report - This document assesses the market value of your home, helping insurers determine the appropriate coverage amount.

- Inspection Report - A detailed evaluation of the property's structural integrity, systems, and potential risks to identify any existing issues.

- Completed Reports Requirement - Insurers often require recent and thorough appraisal and inspection reports before approving a homeowners insurance policy.

Inventory of Personal Belongings

An inventory of personal belongings is essential when applying for homeowners insurance. This document helps verify the contents of your home and supports claims in case of loss or damage.

Include detailed descriptions, purchase dates, and estimated values of your items to create an accurate inventory. Photographs or receipts can further strengthen the documentation for your insurance application.

Security and Safety Certificates

| Document Type | Description | Importance for Homeowners Insurance |

|---|---|---|

| Security Certificates | Certification of installed security systems such as alarms, surveillance cameras, and motion detectors verified by licensed security providers. | Proves presence of effective security measures, potentially lowering insurance premiums and reducing risk of theft or vandalism claims. |

| Safety Inspection Reports | Reports from certified inspectors covering fire alarms, smoke detectors, carbon monoxide detectors, and other safety equipment. | Validates adherence to safety standards, enhancing eligibility and coverage options by demonstrating risk mitigation efforts. |

| Fire Department Clearance | Official certification from local fire departments confirming compliance with fire safety codes and accessibility to fire suppression resources. | Confirms reduced fire risk, influencing insurer assessment and premium calculations favorably. |

| Building Permits and Code Compliance | Documents verifying that construction meets local building codes and safety regulations, including electrical and structural integrity assessments. | Ensures home safety standards are met, impacting insurer's risk evaluation and approval process. |

What Documents are Needed to Apply for Homeowners Insurance? Infographic