Employers need to provide essential documents such as a completed enrollment form, a list of eligible employees with their personal information, and proof of the company's legal status. Group health insurance applications often require tax identification numbers, federal employer identification numbers (FEIN), and detailed payroll information to determine premiums. Accurate documentation ensures smooth processing and compliance with insurance provider requirements.

What Documents Does an Employer Need for Group Health Insurance Enrollment?

| Number | Name | Description |

|---|---|---|

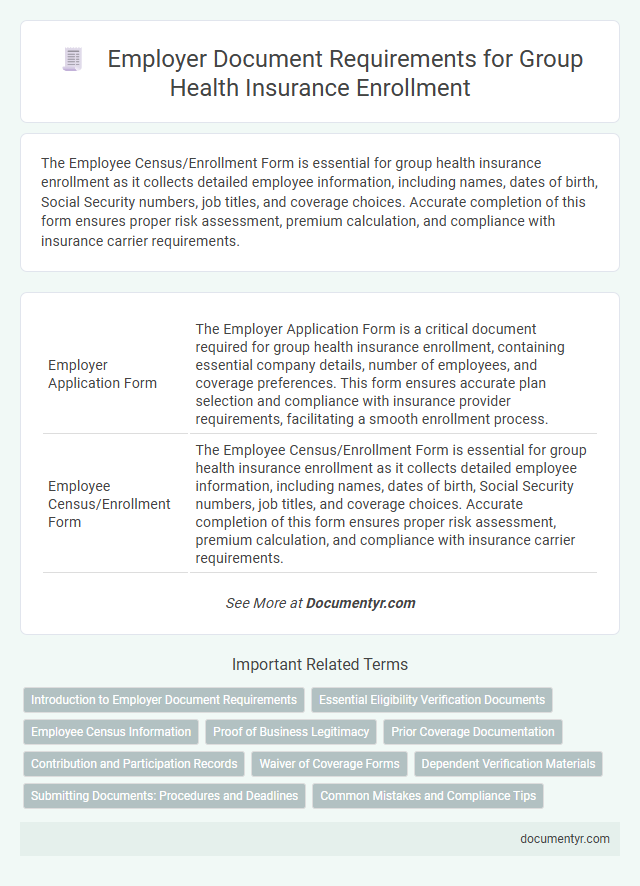

| 1 | Employer Application Form | The Employer Application Form is a critical document required for group health insurance enrollment, containing essential company details, number of employees, and coverage preferences. This form ensures accurate plan selection and compliance with insurance provider requirements, facilitating a smooth enrollment process. |

| 2 | Employee Census/Enrollment Form | The Employee Census/Enrollment Form is essential for group health insurance enrollment as it collects detailed employee information, including names, dates of birth, Social Security numbers, job titles, and coverage choices. Accurate completion of this form ensures proper risk assessment, premium calculation, and compliance with insurance carrier requirements. |

| 3 | Proof of Business Status (Business License, Articles of Incorporation, etc.) | Employers must provide proof of business status such as a valid business license or articles of incorporation when enrolling in group health insurance to verify the legitimacy of the company. These documents confirm the employer's legal existence and are critical for underwriting and compliance with insurer requirements. |

| 4 | Wage and Tax Statement (e.g., IRS Form 941 or DE-9C) | Employers need to submit wage and tax statements such as IRS Form 941 or state-specific forms like California's DE-9C to verify employee income and payroll taxes for group health insurance enrollment. These documents ensure accurate premium calculations and compliance with federal and state regulations during the enrollment process. |

| 5 | Employee Eligibility Verification | Employers must provide accurate employee eligibility verification documents such as completed enrollment forms, proof of employment status, and valid identification to ensure seamless group health insurance enrollment. Submission of wage reports and confirmation of full-time employment status also play a critical role in meeting insurer requirements. |

| 6 | Previous Carrier Statement (if applicable) | Employers must provide the previous carrier statement during group health insurance enrollment to verify prior coverage details, including enrollment dates, rates, and plan benefits. This document ensures seamless transition and accurate risk assessment for the new insurance provider. |

| 7 | Participation Agreement | Employers must provide a signed Participation Agreement to group health insurance providers, outlining the terms of coverage, employee eligibility, and employer responsibilities. This document ensures compliance with policy requirements and facilitates seamless enrollment of eligible employees into the group health plan. |

| 8 | Summary of Benefits and Coverage (SBC) Receipt | Employers must provide employees with the Summary of Benefits and Coverage (SBC) receipt, a standardized document that clearly outlines plan coverage, costs, and key features to ensure informed decision-making during group health insurance enrollment. The SBC receipt is essential for compliance with the Affordable Care Act, aiding transparency and protecting both employer and employee rights. |

| 9 | Waiver of Coverage Forms (for employees declining coverage) | Employers must collect Waiver of Coverage Forms from employees who decline group health insurance to document their voluntary refusal and maintain compliance with insurance regulations. These forms serve as official records to protect both the employer and insurer from liability and ensure accurate enrollment data. |

| 10 | Dependent Verification Documents (e.g., birth certificates, marriage certificates) | Employers must collect dependent verification documents such as birth certificates to confirm parent-child relationships and marriage certificates to validate spousal eligibility during group health insurance enrollment. These documents ensure accurate coverage and compliance with insurer requirements for dependent beneficiaries. |

| 11 | COBRA Continuation Coverage Notices | Employers must provide COBRA Continuation Coverage Notices to eligible employees, including the initial general notice within 90 days of group health plan coverage commencement and specific notices within 14 days after qualifying events such as termination or reduction in hours. These documents ensure compliance with federal regulations under the Consolidated Omnibus Budget Reconciliation Act, enabling employees to make informed decisions about continuing their group health insurance coverage. |

| 12 | Employer Identification Number (EIN) | An Employer Identification Number (EIN) is essential for group health insurance enrollment as it verifies the legal identity of the business and facilitates tax reporting. Insurance providers require the EIN to confirm the employer's eligibility and streamline the administrative process for group health plans. |

| 13 | Payroll Records | Employers must provide detailed payroll records, including employee identification, compensation details, and employment status, to accurately determine group health insurance eligibility and premium contributions. These records help insurers verify coverage tiers and ensure compliance with policy requirements for group health plans. |

| 14 | Broker of Record Letter (if using an insurance broker) | Employers must submit a Broker of Record Letter when using an insurance broker for group health insurance enrollment, authorizing the broker to act on their behalf and manage the policy. This document ensures clear communication between the insurer, broker, and employer, streamlining the enrollment process and maintaining compliance with insurance regulations. |

| 15 | ERISA Plan Document (if self-funded or required) | Employers offering self-funded group health insurance plans under ERISA must provide a detailed Plan Document outlining benefits, administration, and legal obligations, ensuring compliance with federal regulations. This document serves as the foundation for plan operations, claims processing, and participant rights, making it essential for enrollment and ongoing plan management. |

Introduction to Employer Document Requirements

Enrollment in group health insurance requires specific documentation from the employer to ensure compliance and accurate coverage. Understanding these requirements streamlines the application process and avoids delays.

Documents typically include the employer's tax identification number, proof of business existence, and employee census information. Accurate employee details, such as social security numbers and dates of birth, are necessary for enrollment. Your timely submission of these documents supports efficient processing and coverage activation.

Essential Eligibility Verification Documents

Employers must submit essential eligibility verification documents to enroll employees in group health insurance. These documents typically include employee application forms, proof of employment or payroll records, and signed waivers or consent forms. Accurate and complete documentation ensures smooth enrollment and compliance with insurance provider requirements.

Employee Census Information

Employee Census Information is crucial for group health insurance enrollment as it provides detailed data on all eligible employees. This information ensures accurate coverage and premium calculations by the insurer.

- Employee Names and Personal Details - Includes full names, dates of birth, and social security numbers to verify identity and eligibility.

- Employment Status - Specifies full-time or part-time status, hire dates, and job titles to determine coverage eligibility.

- Coverage Choices - Lists selected plan options, dependents, and coverage levels for accurate benefit administration.

Proof of Business Legitimacy

| Document Type | Description |

|---|---|

| Business License | Valid government-issued license verifying the legal operation of the business. |

| Employer Identification Number (EIN) | IRS-issued number used to identify the business entity for tax purposes. |

| Certificate of Incorporation | Official document confirming the formation and registration of a corporation. |

| Partnership Agreement | Legal contract outlining the roles and responsibilities within a partnership business structure. |

| State Tax ID Number | Identification number issued by the state for tax reporting and compliance. |

| Recent Tax Returns | Proof of ongoing business activity and compliance with tax regulations. |

| Articles of Organization | Document filed to establish a Limited Liability Company (LLC) with the state. |

| Proof of Payroll Account | Verification of an active payroll system, demonstrating employee compensation management. |

| Business Bank Account Statement | Official bank statement showing financial activity related to the business. |

Gathering these documents proves your business's legitimacy when enrolling in group health insurance, simplifying the verification process for insurers.

Prior Coverage Documentation

When enrolling in group health insurance, prior coverage documentation is essential for a seamless transition. Employers must collect proof of any existing health insurance plans held by employees to avoid coverage gaps.

This documentation typically includes previous insurance cards, policy numbers, and dates of coverage. Your ability to provide accurate prior coverage details helps streamline the enrollment process and ensures proper benefits application.

Contribution and Participation Records

What documents are required for group health insurance enrollment regarding contribution and participation records? Employers must provide detailed records of employee contributions and participation rates. These documents ensure accurate premium calculations and compliance with insurance provider requirements.

Waiver of Coverage Forms

Employers must collect specific documents for group health insurance enrollment to ensure accurate coverage and eligibility. Waiver of Coverage Forms are essential when employees choose to decline the offered insurance.

- Waiver of Coverage Form - This document confirms that an employee has voluntarily declined health insurance coverage offered by the employer.

- Employee Details - Personal information on the waiver form verifies the identity of the employee refusing coverage.

- Signature and Date - The employee's signed and dated waiver form serves as proof of informed consent to opt out of the group health plan.

Dependent Verification Materials

Employers must collect dependent verification materials to ensure eligible family members are accurately enrolled in group health insurance plans. Common documents include birth certificates, marriage certificates, and legal guardianship papers.

These documents confirm the relationship between the employee and their dependents, preventing unauthorized enrollment. Proper verification helps maintain compliance with insurance carrier requirements and avoids claim denials.

Submitting Documents: Procedures and Deadlines

Submitting documents for group health insurance enrollment requires strict adherence to specified procedures and deadlines. Timely and accurate submission ensures seamless coverage for your employees.

- Enrollment Forms - These must be fully completed and signed by eligible employees to validate their participation.

- Employee Information - Provide accurate details including Social Security numbers, birth dates, and dependent information for eligibility verification.

- Submission Deadlines - Employers must submit all required documents within the insurer's stipulated enrollment period to avoid coverage delays or denials.

Carefully reviewing and submitting these documents on time guarantees uninterrupted group health insurance benefits for your team.

What Documents Does an Employer Need for Group Health Insurance Enrollment? Infographic