To file a car insurance claim, essential documents typically include the insurance policy copy, the driver's license, and the vehicle registration certificate. Accident reports, police FIR (if applicable), and photographs of the damage are also crucial for verifying the claim. Receipts for repairs and medical bills must be submitted to facilitate smooth processing and timely settlement.

What Documents are Required for Car Insurance Claims?

| Number | Name | Description |

|---|---|---|

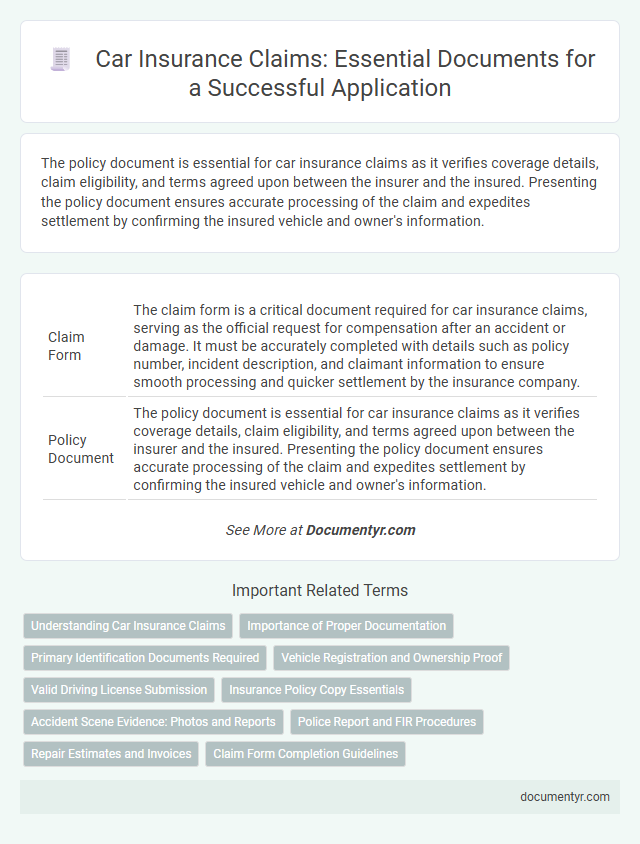

| 1 | Claim Form | The claim form is a critical document required for car insurance claims, serving as the official request for compensation after an accident or damage. It must be accurately completed with details such as policy number, incident description, and claimant information to ensure smooth processing and quicker settlement by the insurance company. |

| 2 | Policy Document | The policy document is essential for car insurance claims as it verifies coverage details, claim eligibility, and terms agreed upon between the insurer and the insured. Presenting the policy document ensures accurate processing of the claim and expedites settlement by confirming the insured vehicle and owner's information. |

| 3 | Vehicle Registration Certificate (RC) | The Vehicle Registration Certificate (RC) is a crucial document required for car insurance claims as it verifies ownership and details of the insured vehicle. Insurers use the RC to confirm the vehicle's identity, registration number, and ensure the claim is legitimate for the registered vehicle. |

| 4 | Driving License | A valid driving license is essential for processing car insurance claims as it verifies the policyholder's legal authorization to operate the vehicle. Insurance companies require a copy of the driving license to confirm driver eligibility and facilitate accurate claim assessment. |

| 5 | FIR/Police Report | A First Information Report (FIR) or police report is a crucial document for car insurance claims, especially in cases involving theft, accidents, or third-party damage. Submitting a detailed and authentic FIR helps validate the claim, enabling smoother processing and timely settlement by the insurance company. |

| 6 | Repair Estimate/Bill | A detailed repair estimate or bill from an authorized service center is crucial for processing car insurance claims, as it verifies the extent of damage and associated costs. These documents must be itemized and accurately reflect repairs needed to ensure timely reimbursement under the policy terms. |

| 7 | Photographs of Damages | Photographs of damages are essential documents for car insurance claims as they provide visual evidence of the vehicle's condition post-accident, facilitating accurate damage assessment by the insurer. Clear, timestamped images from multiple angles help expedite claim processing and support the verification of repair costs. |

| 8 | Insurance Premium Payment Receipt | Submitting a car insurance claim requires essential documents including the insurance premium payment receipt, which serves as proof of active policy coverage, ensuring claim validity. The receipt contains key details like policy number, payment date, and premium amount, critical for processing claims efficiently. |

| 9 | No Trace Report (for theft claims) | For car insurance theft claims, a No Trace Report is crucial as it serves as official confirmation from authorities that the vehicle has not been located since the theft. Alongside this report, policyholders must submit the insurance claim form, police FIR copy, vehicle registration documents, and a valid driving license to facilitate claim processing. |

| 10 | Discharge Voucher | A discharge voucher is a critical document in car insurance claims as it serves as proof of settlement between the insured and the insurer or service provider. This voucher confirms that the payment for repairs or medical expenses has been completed, ensuring a smooth and transparent claims process. |

| 11 | Identity Proof | Valid identity proof such as a government-issued photo ID (passport, driver's license, or Aadhaar card) is essential for processing car insurance claims and verifying the claimant's authenticity. Insurers require these documents to prevent fraud and ensure that the claim is filed by the legitimate policyholder or authorized party. |

| 12 | Address Proof | Address proof is a crucial document for car insurance claims, typically requiring a government-issued ID such as a utility bill, passport, or driver's license displaying the insured's current residence. Insurers verify this document to validate the policyholder's identity and ensure accurate claim processing aligned with the registered address. |

| 13 | Medical Report (for personal accident claims) | For car insurance claims involving personal accidents, the medical report is a critical document detailing the extent of injuries sustained and the treatment administered, which helps insurers assess the validity and severity of the claim. This report must be issued by a certified medical professional and include diagnostic findings, duration of hospitalization, prescribed medications, and prognosis to ensure accurate claim processing and timely compensation. |

| 14 | No Objection Certificate (if financed) | For car insurance claims involving financed vehicles, a No Objection Certificate (NOC) from the financing bank or financial institution is mandatory to process the claim and facilitate vehicle repairs or settlements. This document confirms the lender's consent, ensuring there are no outstanding disputes or penalties related to the insured car. |

| 15 | Tax Receipts of Vehicle | Tax receipts of the vehicle are essential documents for car insurance claims as they verify ownership and purchase details, helping insurers assess the claim's legitimacy. These receipts also assist in determining the accurate vehicle value, which influences the claim settlement amount. |

Understanding Car Insurance Claims

Understanding car insurance claims is essential for a smooth and timely settlement process. Knowing the required documents helps avoid delays and ensures your claim is processed efficiently.

For car insurance claims, essential documents include the completed claim form provided by the insurer, a valid driving license, and the vehicle registration certificate. Additionally, a copy of the insurance policy and the FIR or police report in case of accidents are required. Photographs of the vehicle damage and repair estimates may also be necessary to support the claim.

Importance of Proper Documentation

Proper documentation is crucial for a smooth and successful car insurance claim process. Ensuring all necessary documents are submitted helps avoid delays and claim rejections.

- Policy Document - Your car insurance policy acts as proof of coverage and outlines the terms and conditions for claim processing.

- Claim Form - A duly filled and signed claim form is required to officially initiate the claim with the insurance company.

- Accident Report - An official police report or accident statement validates the incident and supports the claim's authenticity.

Primary Identification Documents Required

Submitting a car insurance claim requires specific primary identification documents to verify the policyholder's identity. These documents ensure that the claim process is secure and legitimate.

- Driver's License - Serves as the main proof of identity and driving authorization.

- Vehicle Registration Certificate - Confirms ownership and vehicle details linked to the insurance policy.

- Policyholder's ID Proof - Official government-issued ID such as a passport or Aadhar card to validate personal identity.

Providing these primary identification documents expedites the approval and processing of car insurance claims.

Vehicle Registration and Ownership Proof

When filing a car insurance claim, presenting the vehicle registration document is essential. This document verifies the car's legal status and ensures the insurer can process the claim accurately.

Ownership proof, such as the original purchase invoice or title deed, confirms the claimant's legal rights to the vehicle. Insurers require this to prevent fraudulent claims and establish the legitimacy of the claim.

Valid Driving License Submission

```htmlA valid driving license is essential when filing a car insurance claim. This document verifies your legal eligibility to operate the vehicle involved in the incident.

Submitting your driving license ensures the insurance company can process your claim efficiently. Without this, claim approval may be delayed or denied.

```Insurance Policy Copy Essentials

Submitting a car insurance claim requires several key documents to ensure smooth processing. Among these, having a clear copy of the insurance policy is essential for verifying coverage details.

- Proof of Insurance Policy - A complete copy of the insurance policy outlines the terms, coverage, and limits applicable to the claim.

- Policy Number Verification - The policy number helps the insurer quickly locate your account and assess the claim status accurately.

- Policyholder Identification - The document must clearly show the policyholder's name and contact information to confirm ownership and eligibility.

Accident Scene Evidence: Photos and Reports

| Document | Description | Importance for Car Insurance Claims |

|---|---|---|

| Accident Scene Photos | Clear images capturing vehicle damage, road conditions, traffic signals, and surrounding environment at the accident location | Provides visual proof of the accident, helping insurers assess the extent of damage and validate the claim details |

| Police Accident Report | Official documentation filed by the responding police officer detailing the accident circumstances, involved parties, and witnesses | Establishes an authoritative account of the event, supporting claim legitimacy and liability assessment |

| Witness Statements | Written or recorded accounts from bystanders or other drivers who observed the accident | Strengthens the claim by corroborating accident details and supporting the claimant's version of events |

Police Report and FIR Procedures

Filing a police report is a crucial step when making a car insurance claim, as it provides an official record of the incident. The First Information Report (FIR) procedure involves reporting the accident to the local police station promptly, ensuring all details are accurately documented. Your insurance company requires this legal documentation to verify the claim and process it efficiently.

Repair Estimates and Invoices

What documents are required for car insurance claims related to repair estimates and invoices? Repair estimates from authorized service centers help insurers assess the damage accurately. Invoices confirm the actual repair costs and support the claim processing.

What Documents are Required for Car Insurance Claims? Infographic