Small businesses must provide key documents such as a completed insurance application form, proof of ownership or business registration, and financial statements to verify income and expenses. It is also essential to include details about existing safety protocols, employee information, and prior claims history when applying for liability insurance. Ensuring accurate and comprehensive documentation helps streamline the approval process and secures appropriate coverage for business liabilities.

What Documents Does a Small Business Need for Liability Insurance Application?

| Number | Name | Description |

|---|---|---|

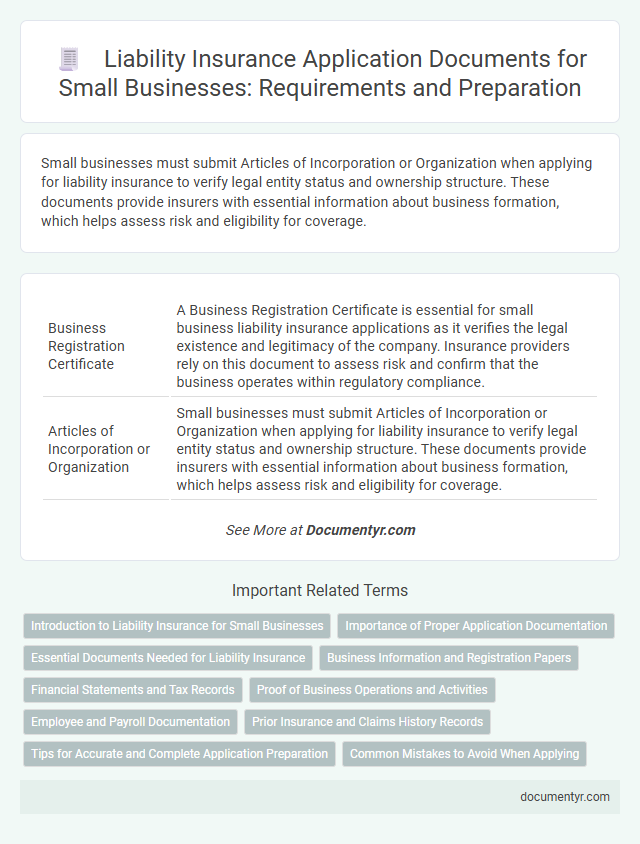

| 1 | Business Registration Certificate | A Business Registration Certificate is essential for small business liability insurance applications as it verifies the legal existence and legitimacy of the company. Insurance providers rely on this document to assess risk and confirm that the business operates within regulatory compliance. |

| 2 | Articles of Incorporation or Organization | Small businesses must submit Articles of Incorporation or Organization when applying for liability insurance to verify legal entity status and ownership structure. These documents provide insurers with essential information about business formation, which helps assess risk and eligibility for coverage. |

| 3 | Employer Identification Number (EIN) | A small business needs to provide its Employer Identification Number (EIN) as a key document when applying for liability insurance, as it uniquely identifies the business for tax and legal purposes. Including the EIN ensures accurate verification of the business entity and streamlines the underwriting process for liability coverage. |

| 4 | Business License | A valid business license is a crucial document required for a small business liability insurance application, as it verifies the legitimacy and legal operation of the business. Insurers use the business license to assess risk and ensure compliance with local regulations before issuing a liability insurance policy. |

| 5 | Previous Insurance Policies | Small businesses applying for liability insurance must provide copies of previous insurance policies to demonstrate their coverage history and risk management practices. These documents include past liability insurance declarations, claim histories, and any endorsements or exclusions that could impact the new policy's terms and premiums. |

| 6 | Claims History Report (Loss Runs) | Small businesses applying for liability insurance must provide a Claims History Report (Loss Runs) detailing previous insurance claims, including dates, amounts paid, and descriptions of incidents which help insurers assess risk accurately. This report is crucial for evaluating a business's claims trends and potential liabilities, ultimately influencing policy premiums and coverage terms. |

| 7 | Financial Statements | Small businesses must provide accurate financial statements, including balance sheets, income statements, and cash flow statements, to support their liability insurance application and demonstrate financial stability. These documents help insurers assess risk levels and determine appropriate coverage and premium rates. |

| 8 | Tax Identification Number (TIN) | A Tax Identification Number (TIN) is essential for a small business liability insurance application as it verifies the business's legal identity with federal tax authorities. Insurers require the TIN to process the application, assess risk profiles, and maintain accurate records for underwriting and claims management. |

| 9 | Description of Business Operations | A detailed description of business operations is essential for a small business liability insurance application, outlining the nature of services or products offered, daily activities, and workplace environment to accurately assess risk exposure. This document should include information on the number of employees, use of equipment, and any hazardous materials involved. |

| 10 | List of Business Locations | A small business applying for liability insurance must provide a detailed list of all business locations, including physical addresses and any additional sites where operations occur. Accurate documentation of each location ensures proper risk assessment and coverage tailored to the specific environments in which the business operates. |

| 11 | Employee List and Payroll Records | A small business applying for liability insurance must provide an accurate employee list detailing names, job titles, and roles to assess risk exposure. Comprehensive payroll records showing wages, hours worked, and employee classifications are crucial for underwriters to determine appropriate premium rates and coverage levels. |

| 12 | Proof of Professional Certifications or Licenses | Small businesses applying for liability insurance must provide proof of professional certifications or licenses to verify their compliance with industry standards and legal requirements. These documents help insurers assess the risk profile and ensure the business operates within regulated guidelines. |

| 13 | Contracts with Vendors or Clients | Small businesses must provide contracts with vendors or clients to demonstrate clear liabilities and responsibilities when applying for liability insurance, ensuring insurers assess risk accurately. These contracts typically detail terms of service, indemnity clauses, and payment agreements, which are critical for verifying coverage needs and limiting potential claims. |

| 14 | Lease Agreements | Lease agreements are critical documents required for a small business liability insurance application as they confirm the physical location of the business and outline the responsibilities for property maintenance and liabilities. Insurers assess these agreements to determine risk exposure related to the leased property, including potential hazards and contractual obligations that may affect coverage. |

| 15 | Equipment and Inventory Lists | Small businesses applying for liability insurance must provide detailed equipment and inventory lists to accurately assess risk and coverage needs. These documents include descriptions, values, purchase dates, and maintenance records of all business assets to ensure comprehensive protection against potential damages or losses. |

| 16 | Safety and Risk Management Policies | Small businesses applying for liability insurance must provide comprehensive safety and risk management policies, including documented workplace safety protocols, employee training records, and incident reporting procedures. These documents demonstrate the company's commitment to minimizing hazards and mitigating potential liabilities, thereby influencing underwriting decisions and premium rates. |

| 17 | Ownership and Management Structure Information | Small businesses must provide detailed ownership and management structure information, including names, roles, and ownership percentages of principals or partners, to accurately assess liability insurance risk. Documents such as partnership agreements, corporate bylaws, or articles of incorporation clarify the legal entity type and decision-making authorities essential for underwriting. |

| 18 | Vehicle Registration (if applicable) | Small businesses applying for liability insurance must provide vehicle registration documents for any company-owned vehicles to verify ownership and ensure accurate coverage. These documents confirm the vehicle's legal status and help insurers assess risk associated with business operations involving transportation. |

| 19 | Proof of Physical Address | A small business must provide proof of physical address such as a utility bill, lease agreement, or business license to complete a liability insurance application. This documentation verifies the location of operations, which is crucial for risk assessment and policy underwriting. |

| 20 | Trade Association Memberships (if applicable) | Trade association memberships can enhance a small business's liability insurance application by demonstrating industry commitment and adherence to best practices, often providing documentation such as membership certificates or codes of conduct compliance. Insurers may view these memberships as a risk mitigation factor, potentially influencing premium rates and coverage options. |

Introduction to Liability Insurance for Small Businesses

Liability insurance protects small businesses from financial losses due to legal claims or lawsuits. It covers bodily injury, property damage, and other liabilities arising during business operations.

- Business License - Verifies legal authorization to operate and establishes business legitimacy for the insurer.

- Financial Statements - Demonstrates the business's financial health and risk exposure for accurate premium calculation.

- Previous Insurance Records - Provides the insurer with history of past claims and coverage details to assess risk accurately.

Importance of Proper Application Documentation

Proper documentation is crucial when applying for small business liability insurance to ensure accurate risk assessment and coverage. Missing or incorrect documents can lead to application delays or denial of coverage.

Essential documents include business licenses, financial statements, and proof of previous insurance policies. Providing detailed information about business operations and employee roles helps insurers evaluate liability risks effectively. Accurate documentation ensures the small business receives appropriate coverage tailored to its specific needs.

Essential Documents Needed for Liability Insurance

Small businesses require specific documents to successfully apply for liability insurance. These essential documents verify the business's identity, operations, and risk factors.

- Business License - Confirms that the business is legally registered and authorized to operate in its location.

- Financial Statements - Demonstrates the company's financial health to assess risk and coverage needs.

- Proof of Previous Insurance - Provides the insurer with history of past coverage and claims for risk evaluation.

- Detailed Business Description - Outlines the nature of the business, including services and operations for accurate policy assessment.

- Safety Procedures Documentation - Shows implemented risk management practices to potentially lower insurance premiums.

Submitting these documents ensures a smooth and efficient liability insurance application process for small businesses.

Business Information and Registration Papers

Small businesses must provide detailed business information when applying for liability insurance, including the legal business name, type of ownership, and nature of operations. Accurate registration papers such as the business license, articles of incorporation, and state registration certificates are essential to verify the legitimacy of the company. Insurers use these documents to assess risk and ensure compliance with state and local regulations before issuing a liability insurance policy.

Financial Statements and Tax Records

Financial statements provide a detailed overview of a small business's financial health, including assets, liabilities, and cash flow. These documents help insurers assess the business's risk profile and set appropriate liability coverage limits.

Tax records offer proof of the business's income and compliance with tax laws, serving as a reliable validation of reported earnings. Insurers use these records to verify financial stability and evaluate potential liability exposure accurately.

Proof of Business Operations and Activities

Proof of business operations and activities is essential for a small business liability insurance application as it demonstrates the nature and scope of the business. Key documents include business licenses, invoices, and contracts that validate ongoing commercial activities. These documents help insurers assess risk levels and determine appropriate coverage for the business.

Employee and Payroll Documentation

What employee and payroll documents are required for a small business liability insurance application? You need accurate records such as employee payroll reports and tax filings. These documents verify your workforce details and payroll expenses essential for risk assessment.

Prior Insurance and Claims History Records

Small businesses applying for liability insurance must provide their prior insurance policy documents to demonstrate coverage history. These documents help insurers assess risk and determine appropriate premiums.

Claims history records are essential, detailing any past liability claims or lawsuits involving the business. Accurate claims information enables insurers to evaluate potential liabilities and offer tailored coverage options.

Tips for Accurate and Complete Application Preparation

Preparing the right documents is crucial for a smooth small business liability insurance application. Accurate and complete paperwork speeds up approval and ensures proper coverage.

- Business License - Proves your business is legally registered and operating within regulations.

- Financial Statements - Shows your business's financial health, which insurers use to assess risk.

- Details of Previous Claims - Provides transparency about past liabilities, impacting coverage options and premiums.

What Documents Does a Small Business Need for Liability Insurance Application? Infographic