To apply for an SBA small business loan, essential documents include personal and business financial statements, tax returns for the past three years, and a detailed business plan outlining the purpose of the loan. Lenders also require legal documents such as business licenses, articles of incorporation, and leases or contracts related to the business. Providing accurate and complete documentation ensures a smoother approval process and demonstrates the business's financial health and eligibility for the loan.

What Documents Must Be Provided for an SBA Small Business Loan?

| Number | Name | Description |

|---|---|---|

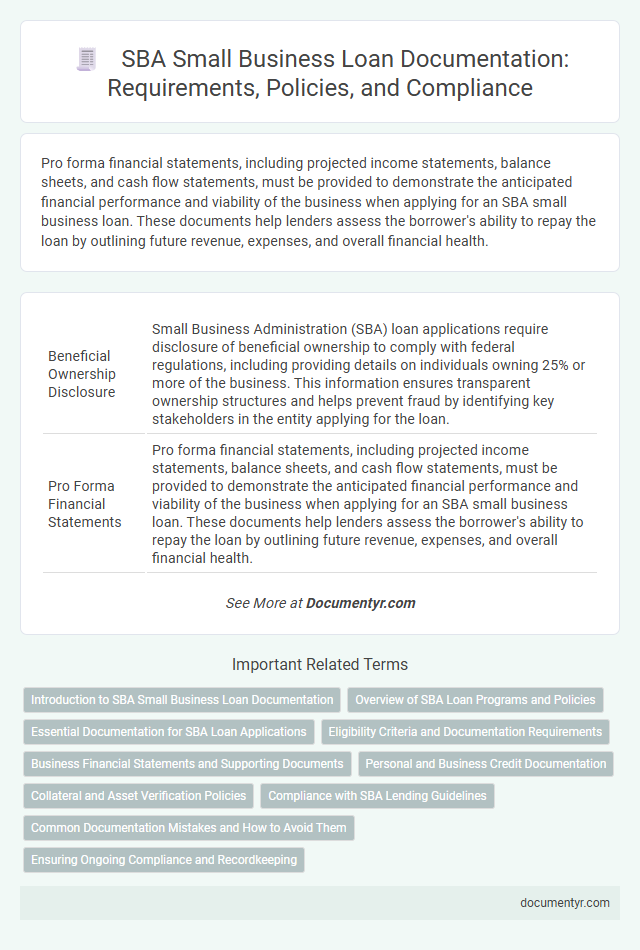

| 1 | Beneficial Ownership Disclosure | Small Business Administration (SBA) loan applications require disclosure of beneficial ownership to comply with federal regulations, including providing details on individuals owning 25% or more of the business. This information ensures transparent ownership structures and helps prevent fraud by identifying key stakeholders in the entity applying for the loan. |

| 2 | Pro Forma Financial Statements | Pro forma financial statements, including projected income statements, balance sheets, and cash flow statements, must be provided to demonstrate the anticipated financial performance and viability of the business when applying for an SBA small business loan. These documents help lenders assess the borrower's ability to repay the loan by outlining future revenue, expenses, and overall financial health. |

| 3 | Business Continuity Plan | A comprehensive Business Continuity Plan must be provided when applying for an SBA Small Business Loan to demonstrate the company's preparedness for operational disruptions. This document outlines risk mitigation strategies, recovery processes, and ensures sustained business operations under unforeseen circumstances, aligning with SBA loan requirements. |

| 4 | Environmental Impact Assessment | An Environmental Impact Assessment (EIA) report must be provided to ensure compliance with SBA regulations, demonstrating that the proposed project will not cause significant harm to the environment. This assessment includes details on potential effects on air quality, water resources, wildlife habitats, and compliance with federal environmental laws such as the National Environmental Policy Act (NEPA). |

| 5 | Loan Forgiveness Application (SBA PPP context) | To apply for loan forgiveness under the SBA Paycheck Protection Program (PPP), borrowers must submit the SBA Form 3508, 3508EZ, or 3508S along with payroll documentation, mortgage interest statements, lease agreements, and utility bills to verify the eligible use of funds. Accurate records of employee headcount, salaries, and operational expenses are essential to maximize forgiveness and comply with SBA requirements. |

| 6 | Digital Document Verification | Digital document verification for an SBA small business loan requires submission of digitized financial statements, tax returns, business licenses, and identity proofs through secure online portals. These digital files must comply with SBA guidelines for format and authenticity to facilitate faster approval and reduce manual processing errors. |

| 7 | Economic Injury Disaster Loan (EIDL) Supporting Documentation | Economic Injury Disaster Loan (EIDL) applications require submission of IRS tax returns, personal and business financial statements, and a detailed business income and expense schedule to verify economic injury. Borrowers must also provide documentation such as proof of identity, business ownership verification, bank statements, and a complete SBA loan application form to support eligibility and loan processing. |

| 8 | DUNS Number Certification | For an SBA Small Business Loan, providing a DUNS Number Certification is essential as it verifies the business's unique identifier in the Dun & Bradstreet database, facilitating accurate credit and background checks. This certification supports the lender's ability to assess the financial health and legitimacy of the small business applying for the loan. |

| 9 | E-signature Compliance | SBA small business loan applications require submission of financial statements, tax returns, business licenses, and personal identification documents with strict adherence to e-signature compliance ensuring legal validity and security. Compliance with the Electronic Signatures in Global and National Commerce (ESIGN) Act and Uniform Electronic Transactions Act (UETA) is essential for validating signed documents in SBA loan processing. |

| 10 | UBO (Ultimate Beneficial Owner) Declaration | For an SBA small business loan, the UBO (Ultimate Beneficial Owner) Declaration is a critical document that identifies individuals with significant ownership or control, ensuring compliance with anti-money laundering regulations. This declaration must include detailed information about each UBO's identity, ownership percentage, and control rights to verify transparency and eligibility for the loan program. |

Introduction to SBA Small Business Loan Documentation

What documents must be provided for an SBA small business loan? SBA loan applications require specific documentation to verify business legitimacy and financial stability. These documents help lenders assess eligibility and risk.

Overview of SBA Loan Programs and Policies

The Small Business Administration (SBA) offers various loan programs designed to support small businesses with flexible financing options. These programs require specific documentation to verify eligibility, business operations, and financial status. You must provide documents such as a business plan, financial statements, tax returns, and legal filings to complete your SBA loan application.

Essential Documentation for SBA Loan Applications

Applying for an SBA small business loan requires submitting specific documents to verify eligibility and financial stability. Providing comprehensive and accurate paperwork enhances the chances of loan approval.

- Personal Background and Financial Statement - Includes a resume and personal credit report to assess the borrower's credibility and financial history.

- Business Financial Statements - Consists of profit and loss statements, balance sheets, and cash flow reports to demonstrate business performance.

- Business Plan - Details the business model, market analysis, and loan purpose to support the loan application.

Eligibility Criteria and Documentation Requirements

To qualify for an SBA small business loan, your business must meet specific eligibility criteria including being a for-profit enterprise, operating in the United States, and having reasonable owner equity invested. The business must also demonstrate a need for the loan and the ability to repay it.

Required documentation includes financial statements, tax returns, personal background and financial statements of principal owners, and a business plan outlining the use of loan proceeds. Lenders may also request additional supporting documents such as licenses, leases, and collateral details to complete the application process.

Business Financial Statements and Supporting Documents

Business financial statements are crucial documents required for an SBA small business loan application. These statements include profit and loss statements, balance sheets, and cash flow statements, providing a clear snapshot of the company's financial health.

Supporting documents such as tax returns, bank statements, and accounts receivable aging reports further validate the financial data presented. Lenders use these documents to assess the business's ability to repay the loan and ensure compliance with SBA requirements.

Personal and Business Credit Documentation

| Document Type | Details | Purpose |

|---|---|---|

| Personal Credit Report | Recent credit report from major bureaus (Equifax, Experian, TransUnion) | Evaluates personal creditworthiness of the business owner(s) |

| Business Credit Report | Credit report from business credit reporting agencies like Dun & Bradstreet or Experian Business | Assesses the company's credit history and financial responsibility |

| Personal Financial Statement | Detailed financial status of the business owner, including assets, liabilities, income, and expenses | Provides insight into the personal financial strength supporting the loan application |

| Business Financial Statements | Balance sheets, profit and loss statements, cash flow statements for the past 2-3 years | Shows the financial health and operational performance of the business |

| Tax Returns | Personal and business tax returns for previous 2-3 years | Verifies income and tax filing history supporting both personal and business financial status |

| Credit Authorization Form | Signed consent allowing lender to pull credit reports and verify credit information | Authorizes the lender to assess credit history as part of underwriting |

Collateral and Asset Verification Policies

When applying for an SBA small business loan, providing accurate collateral and asset verification documents is essential. These documents demonstrate the value of your business assets and secure the loan.

Collateral requirements typically include property deeds, vehicle titles, or equipment appraisals that substantiate asset ownership and value. Asset verification policies mandate submission of financial statements, inventory lists, and proof of ownership for all collateral items. Lenders rely on these documents to assess risk and ensure compliance with SBA guidelines.

Compliance with SBA Lending Guidelines

Compliance with SBA lending guidelines requires submitting specific documents to ensure loan eligibility. Proper documentation streamlines the approval process for your SBA small business loan.

- Personal and Business Financial Statements - These documents demonstrate your financial health and ability to repay the loan.

- Tax Returns - Both personal and business tax returns for the past 2-3 years validate your income and financial stability.

- Business Licenses and Registrations - Legal proof of your business operation is mandatory to comply with SBA requirements.

Common Documentation Mistakes and How to Avoid Them

When applying for an SBA small business loan, applicants must provide essential documents such as financial statements, tax returns, business licenses, and a detailed business plan. Common documentation mistakes include incomplete forms, outdated financial information, and missing signatures, which can delay the approval process. To avoid these errors, carefully review all documents, ensure accuracy and completeness, and consult with a lender or financial advisor before submission.

What Documents Must Be Provided for an SBA Small Business Loan? Infographic