First-time home buyers must gather essential documents such as proof of income, including pay stubs and tax returns, to verify their financial stability. Lenders also require credit history reports and identification documents like a driver's license or passport to assess eligibility. Bank statements and employment verification letters are necessary to confirm funds and job security for loan approval.

What Documents are Necessary for First-Time Home Buyers’ Loan Application?

| Number | Name | Description |

|---|---|---|

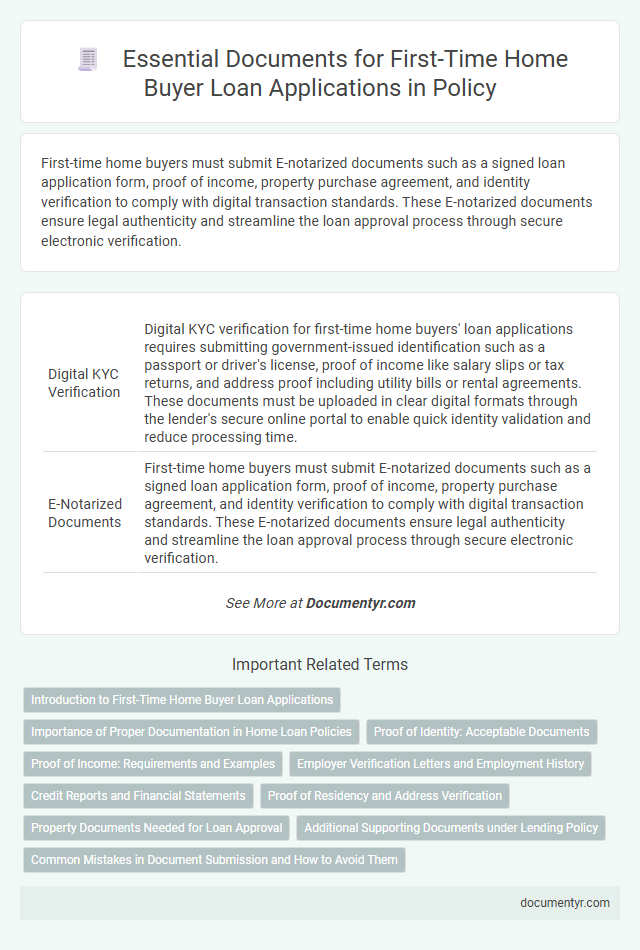

| 1 | Digital KYC Verification | Digital KYC verification for first-time home buyers' loan applications requires submitting government-issued identification such as a passport or driver's license, proof of income like salary slips or tax returns, and address proof including utility bills or rental agreements. These documents must be uploaded in clear digital formats through the lender's secure online portal to enable quick identity validation and reduce processing time. |

| 2 | E-Notarized Documents | First-time home buyers must submit E-notarized documents such as a signed loan application form, proof of income, property purchase agreement, and identity verification to comply with digital transaction standards. These E-notarized documents ensure legal authenticity and streamline the loan approval process through secure electronic verification. |

| 3 | Income Blockchain Records | First-time home buyers applying for loans must provide verifiable income blockchain records to ensure transparency and accuracy of financial information, which significantly enhances lender trust. These immutable digital income proofs streamline the verification process, reducing fraud risks and accelerating loan approval times. |

| 4 | Remote Online Mortgage Application (ROMA) | First-time home buyers applying through Remote Online Mortgage Application (ROMA) must provide government-issued identification, proof of income such as recent pay stubs or tax returns, credit history documentation, and details of the property purchase agreement. Lenders may also require bank statements, employment verification, and social security numbers to complete the loan application process remotely. |

| 5 | Employment API Authentication | Employment API authentication requires first-time home buyers to provide verified employment records, including current pay stubs, employer contact information, and signed authorization forms, ensuring accurate income verification during loan processing. This secure data exchange reduces fraud risks and expedites loan approval by connecting lenders directly with employers through authenticated API endpoints. |

| 6 | Smart Contract Deeds | Smart contract deeds streamline the loan application process for first-time home buyers by securely automating document verification, including identity proofs, income statements, and property titles. These blockchain-based deeds ensure transparency and reduce fraud, enabling lenders to efficiently validate borrower eligibility and property details. |

| 7 | AI-Generated Credit Summary | First-time home buyers must submit key documents including proof of income, identification, tax returns, and credit history reports. An AI-generated credit summary enhances the loan application process by providing lenders with an accurate, data-driven assessment of the applicant's creditworthiness and financial behavior. |

| 8 | VOE (Verification of Employment) API Token | First-time home buyers must provide a Verification of Employment (VOE) document, accessible through a secure VOE API token, to validate their employment status and income for loan approval. The VOE API token ensures real-time, authenticated data retrieval from employers, streamlining the loan application process and reducing risk for lenders. |

| 9 | Digital Asset Statement | First-time home buyers applying for a loan must provide a Digital Asset Statement detailing cryptocurrency holdings, digital wallets, and transaction histories to demonstrate financial stability. Lenders increasingly require verified records of digital assets to evaluate total asset value and liquidity in the loan approval process. |

| 10 | Synthetic Identity Screening Report | First-time home buyers must provide a Synthetic Identity Screening Report as part of their loan application to verify the authenticity of personal information and prevent identity fraud. This report cross-references data from multiple credit bureaus and public records, ensuring lenders assess accurate applicant profiles for responsible lending decisions. |

Introduction to First-Time Home Buyer Loan Applications

First-time home buyers face unique challenges when applying for a loan. Understanding the necessary documents streamlines the approval process and sets clear expectations.

Your loan application requires specific documentation such as proof of income, credit history, and identification. Lenders typically request bank statements, tax returns, and employment verification. Preparing these documents in advance increases the likelihood of a successful application.

Importance of Proper Documentation in Home Loan Policies

Proper documentation plays a crucial role in securing a home loan for first-time buyers. Ensuring all necessary documents are accurate and complete accelerates the approval process and reduces the risk of application rejection.

- Proof of Identity - Documents such as a passport, driver's license, or government-issued ID establish your legal identity for verification purposes.

- Income Verification - Salary slips, tax returns, and bank statements demonstrate your ability to repay the loan consistently.

- Property Documents - Legal ownership papers, sale agreement, and property tax receipts confirm the legitimacy and value of the property to be financed.

Proof of Identity: Acceptable Documents

What documents are necessary as proof of identity for first-time home buyers' loan application? Acceptable documents typically include government-issued photo IDs such as a passport, driver's license, or state identification card. These documents must be valid and current to verify the applicant's identity effectively.

Proof of Income: Requirements and Examples

Proof of income is a crucial requirement for first-time home buyers when applying for a loan. Lenders use this documentation to verify your ability to repay the mortgage.

Typical proof of income includes recent pay stubs, W-2 forms, and tax returns from the past two years. Self-employed applicants may need to provide profit and loss statements or 1099 forms.

Employer Verification Letters and Employment History

For first-time home buyers applying for a loan, employer verification letters play a critical role in confirming your current job status and income stability. Employment history documents provide lenders with a detailed record of your work experience, demonstrating consistent earnings and financial responsibility. These essential papers help establish your eligibility and strengthen your loan application.

Credit Reports and Financial Statements

First-time home buyers must submit essential documents when applying for a loan, with credit reports and financial statements being crucial for loan approval. These documents help lenders assess the applicant's financial health and creditworthiness effectively.

- Credit Reports - Provide a detailed history of an applicant's credit activity, including outstanding debts, payment history, and credit score.

- Financial Statements - Include income verification, asset details, and liabilities to demonstrate the borrower's ability to repay the loan.

- Document Accuracy - Ensuring all submitted reports and statements are accurate and current supports a smoother application process and favorable loan terms.

Submitting comprehensive credit reports and financial statements increases the likelihood of loan approval for first-time home buyers.

Proof of Residency and Address Verification

| Document Type | Purpose | Accepted Forms |

|---|---|---|

| Proof of Residency | Confirms that You live at the stated address, a key loan application requirement | Utility bills (electricity, water, gas), Lease agreements, Government-issued ID with address |

| Address Verification | Validates the physical location for property and eligibility criteria | Recent bank statements, Property tax receipts, Official mail from government agencies |

Property Documents Needed for Loan Approval

First-time home buyers must provide essential property documents to secure loan approval. Key documents verify property ownership, legal status, and compliance with local regulations.

Title deed, sale agreement, and property tax receipts are fundamental requirements. Survey reports and encumbrance certificates further establish the property's legitimacy for lending purposes.

Additional Supporting Documents under Lending Policy

First-time home buyers must provide additional supporting documents under the lending policy to strengthen their loan application. These documents include proof of income, a credit report, and verification of employment to ensure financial stability and creditworthiness. You should also submit bank statements and tax returns as part of the comprehensive documentation required.

What Documents are Necessary for First-Time Home Buyers’ Loan Application? Infographic