Filing a U.S. tax return electronically requires several key documents, including your Social Security number or Individual Taxpayer Identification Number (ITIN), W-2 forms from employers, and 1099 forms reporting other income sources. You must also have records of any deductions or credits you plan to claim, such as mortgage interest statements, education expenses, or health savings account contributions. Accurate and complete documentation ensures the IRS processes your electronic submission efficiently and minimizes the risk of errors or audits.

What Documents Are Required for Filing a U.S. Tax Return Electronically?

| Number | Name | Description |

|---|---|---|

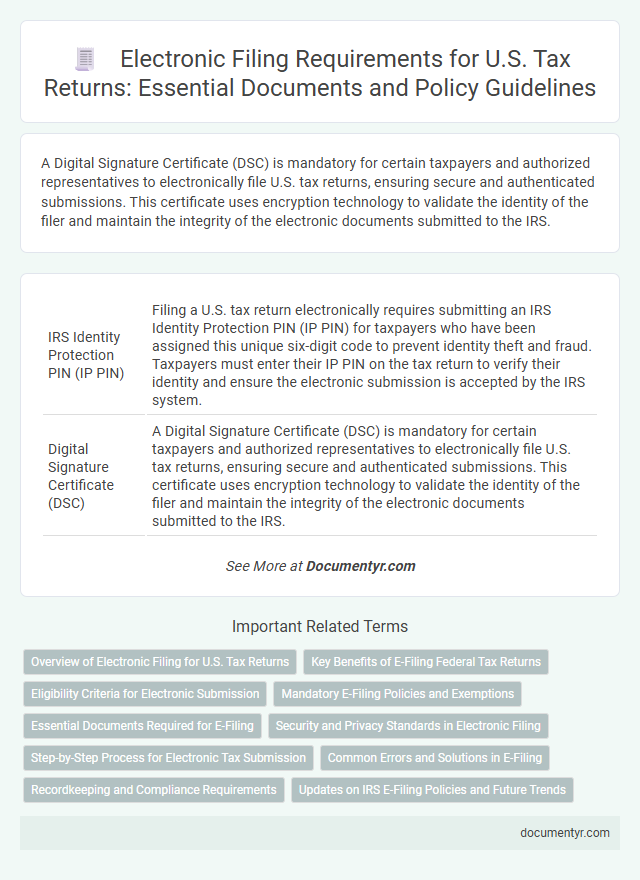

| 1 | IRS Identity Protection PIN (IP PIN) | Filing a U.S. tax return electronically requires submitting an IRS Identity Protection PIN (IP PIN) for taxpayers who have been assigned this unique six-digit code to prevent identity theft and fraud. Taxpayers must enter their IP PIN on the tax return to verify their identity and ensure the electronic submission is accepted by the IRS system. |

| 2 | Digital Signature Certificate (DSC) | A Digital Signature Certificate (DSC) is mandatory for certain taxpayers and authorized representatives to electronically file U.S. tax returns, ensuring secure and authenticated submissions. This certificate uses encryption technology to validate the identity of the filer and maintain the integrity of the electronic documents submitted to the IRS. |

| 3 | Taxpayer Authentication Records | Taxpayer authentication records required for filing a U.S. tax return electronically include a valid Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN), along with electronic signatures such as a Personal Identification Number (PIN) or Adjusted Gross Income (AGI) from the prior year's tax return. The IRS mandates these records to verify the identity of the taxpayer and ensure secure e-filing compliance. |

| 4 | Preparer Tax Identification Number (PTIN) | Filing a U.S. tax return electronically requires the tax preparer to have a valid Preparer Tax Identification Number (PTIN), which must be included on all electronically submitted returns. The PTIN ensures compliance with IRS regulations and enables accurate tracking and verification of tax preparers involved in the electronic filing process. |

| 5 | e-Filing Acknowledgment Receipt | The e-Filing Acknowledgment Receipt is a crucial document confirming the IRS has accepted your electronically filed tax return, typically containing a unique submission ID and timestamp. Taxpayers should retain this receipt as proof of filing and for reference in any subsequent IRS communications or audits. |

| 6 | Electronic Filing Identification Number (EFIN) | The Electronic Filing Identification Number (EFIN) is a crucial requirement for tax professionals submitting U.S. tax returns electronically, as it verifies the authorized e-file provider's identity with the IRS. To obtain an EFIN, applicants must submit a complete Form 8633 and pass a suitability check, ensuring compliance with IRS regulations and secure electronic submissions. |

| 7 | Summarized Virtual Currency Transaction Records | Summarized virtual currency transaction records, including dates of acquisition and sale, transaction amounts, and fair market values at the time of each transaction, are essential for accurately reporting capital gains or losses on a U.S. tax return filed electronically. The IRS requires taxpayers to provide these detailed summaries to ensure compliance with tax laws governing digital assets when submitting Form 8949 and Schedule D through e-filing platforms. |

| 8 | IRS Form 8879 (e-file Signature Authorization) | IRS Form 8879 (e-file Signature Authorization) is essential for electronically filing a U.S. tax return as it authorizes the electronic submission and serves as the taxpayer's digital signature. This document must be accurately completed and signed before e-filing to ensure compliance with IRS e-filing regulations and avoid processing delays. |

| 9 | Two-Factor Authentication Credentials | Two-factor authentication credentials are essential for securely accessing the IRS e-file system when filing a U.S. tax return electronically, ensuring protection against unauthorized access. Taxpayers must provide a combination of something they know, such as a password or PIN, and something they have, like a mobile device or authentication app, to comply with IRS security protocols. |

| 10 | Third-Party Designee Authorization Form | The Third-Party Designee Authorization Form (IRS Form 8879) is essential for taxpayers who authorize an individual other than themselves, such as a tax preparer, to electronically file their U.S. tax return. This form grants the designated person permission to sign the return electronically and allows the IRS to discuss the return with that individual if necessary. |

Overview of Electronic Filing for U.S. Tax Returns

E-filing U.S. tax returns offers a fast, secure, and accurate way to submit tax information to the IRS. Taxpayers must have specific documents ready to complete the electronic filing process successfully.

Required documents include a valid Social Security number or Individual Taxpayer Identification Number, W-2 forms reporting wages, and 1099 forms for other income sources. Taxpayers also need their prior year's tax return for reference and any records of deductions or credits, such as mortgage interest statements or education expenses. Software or online filing platforms often guide users through document collection to ensure accurate submission.

Key Benefits of E-Filing Federal Tax Returns

Filing your U.S. tax return electronically requires specific documents such as your W-2 forms, Social Security number, and last year's tax return. Electronic filing streamlines the submission process and ensures accuracy for faster processing.

- Faster Refunds - E-filing enables the IRS to process returns more quickly, often resulting in expedited tax refunds.

- Enhanced Accuracy - Electronic systems reduce errors by automatically checking for common mistakes before submission.

- Secure Submission - E-filing uses encryption to protect sensitive information, providing a safer alternative to paper filing.

Eligibility Criteria for Electronic Submission

To file a U.S. tax return electronically, you must have a valid Social Security number or Individual Taxpayer Identification Number. The IRS requires that your adjusted gross income falls within specific limits based on the tax year. Your tax return must be complete, accurate, and include all necessary schedules and forms for electronic submission eligibility.

Mandatory E-Filing Policies and Exemptions

| Document | Description | Relevance to Mandatory E-Filing | Exemptions |

|---|---|---|---|

| Form W-2 | Reports wages, tips, and other compensation from employers. | Essential for reporting income; must be included in electronic filings. | Not typically exempt; required unless self-employed without wages. |

| Form 1099 Series | Documents various income types such as freelance earnings, dividends, and interest. | Necessary to report income beyond wages for accurate e-filing. | Small filers with very low gross income may sometimes qualify for exemption from e-filing. |

| Form 1040 | The primary individual income tax return form. | Mandatory to submit electronically for most taxpayers under IRS e-filing requirements. | Certain taxpayers, such as those with complex returns or lacking internet access, may qualify for paper filing exemptions. |

| Form 8879 | IRS e-file signature authorization supporting electronic submission. | Required when electronically filing to validate the return. | Exemptions rarely granted; signature needed unless IRS grants special permission. |

| Supporting Schedules and Attachments | Include forms related to additional income, credits, or deductions, like Schedule C or Schedule SE. | Must be filed electronically along with the main return when applicable. | Exemptions may apply for specific forms in rare cases based on IRS guidelines. |

Essential Documents Required for E-Filing

Filing a U.S. tax return electronically requires specific essential documents to ensure accuracy and compliance. Key documents include your Social Security number or Taxpayer Identification Number, W-2 forms reporting your wages, and 1099 forms for other income sources. Having these documents ready helps streamline the e-filing process and reduces the risk of errors or delays in tax processing.

Security and Privacy Standards in Electronic Filing

Filing a U.S. tax return electronically requires specific documents such as your Social Security number, W-2 forms, and any 1099 income statements. Accurate identification ensures the IRS can securely match your electronic submission with official records.

Electronic filing systems adhere to stringent security and privacy standards, including data encryption and secure access protocols. These measures protect sensitive taxpayer information from unauthorized access during transmission and storage.

Step-by-Step Process for Electronic Tax Submission

Filing a U.S. tax return electronically requires specific documents to ensure accurate submission. The main documents include your W-2 forms, 1099s, and any relevant income statements.

You will need your Social Security number or Taxpayer Identification Number. Additionally, gather records of deductions, credits, and previous year's tax returns for reference.

Start by selecting an IRS-approved e-file provider or using tax preparation software. Input your personal information and financial data carefully to avoid errors.

Upload or enter your W-2 and 1099 forms as prompted by the software. Review all entered information before submitting to the IRS electronically for processing.

Common Errors and Solutions in E-Filing

What documents are required for filing a U.S. tax return electronically? The primary documents include your W-2 forms, 1099 forms, Social Security number, and last year's tax return if available. Ensuring these documents are accurate and complete helps prevent common e-filing errors like mismatched Social Security numbers or missing forms.

What are common errors encountered during electronic tax filing? Frequent mistakes include incorrect personal information, uploading wrong or incomplete forms, and failing to include required schedules. Using tax preparation software with built-in error checks can help identify and correct these issues before submission.

How can taxpayers avoid errors related to Social Security numbers in e-filing? Double-check that all Social Security numbers on forms match the Social Security cards exactly. Entering incorrect digits or transposing numbers can lead to rejected returns or processing delays.

What solutions exist for handling missing or incomplete tax documents in e-filing? Contact employers or financial institutions promptly to obtain corrected or missing W-2, 1099, or other tax documents. Filing an extension may be necessary if all documents are not received by the tax deadline.

How do software updates impact the accuracy of electronic tax filing? Up-to-date tax software reflects the latest IRS rules, forms, and limitations, reducing errors related to outdated information. Regularly updating software ensures compatibility with IRS e-file systems and prevents submission issues.

Recordkeeping and Compliance Requirements

Filing a U.S. tax return electronically requires specific documents to ensure accurate reporting and compliance with IRS regulations. Proper recordkeeping supports verification and audit processes for both taxpayers and tax professionals.

- Form W-2 - Employers provide this form to report wages and taxes withheld, essential for accurate income reporting.

- Form 1099 Series - These forms document various types of income such as interest, dividends, and freelance earnings.

- Supporting Financial Records - Receipts, bank statements, and expense documentation are necessary to substantiate deductions and credits claimed on the return.

What Documents Are Required for Filing a U.S. Tax Return Electronically? Infographic