Veterans must provide key documents such as a Certificate of Eligibility (COE) to prove military service, a DD214 form detailing discharge status, and financial records including pay stubs and tax returns for VA loan application. Lenders may also require a credit report and employment verification to assess loan eligibility. These documents ensure the veteran meets all requirements for the VA loan benefits and streamline the approval process.

What Documents Does a Veteran Need for VA Loan Application?

| Number | Name | Description |

|---|---|---|

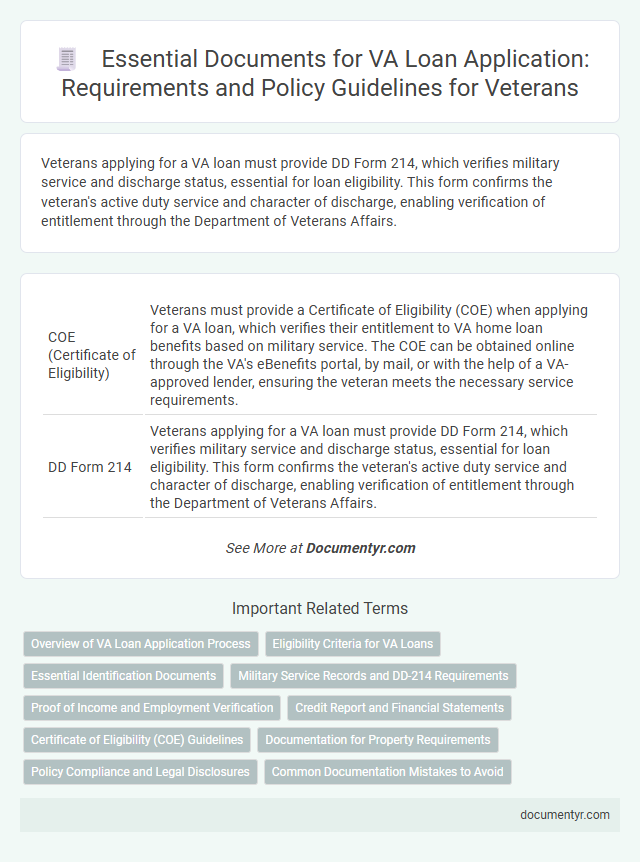

| 1 | COE (Certificate of Eligibility) | Veterans must provide a Certificate of Eligibility (COE) when applying for a VA loan, which verifies their entitlement to VA home loan benefits based on military service. The COE can be obtained online through the VA's eBenefits portal, by mail, or with the help of a VA-approved lender, ensuring the veteran meets the necessary service requirements. |

| 2 | DD Form 214 | Veterans applying for a VA loan must provide DD Form 214, which verifies military service and discharge status, essential for loan eligibility. This form confirms the veteran's active duty service and character of discharge, enabling verification of entitlement through the Department of Veterans Affairs. |

| 3 | VA Form 26-1880 | Veterans need to submit VA Form 26-1880, also known as the Request for a Certificate of Eligibility (COE), to verify their eligibility for a VA loan. This document is essential as it provides lenders with proof of the veteran's service history and entitlement to VA loan benefits. |

| 4 | Statement of Service | A veteran must provide a detailed Statement of Service as part of the VA loan application to verify active military service, including dates of service, rank, and discharge status. This crucial document ensures eligibility by confirming service requirements mandated by the Department of Veterans Affairs. |

| 5 | LES (Leave and Earnings Statement) | Veterans applying for a VA loan must provide critical documents, including the Leave and Earnings Statement (LES), which verifies current income and military service status. The LES serves as a primary income verification tool, essential for assessing loan eligibility and ensuring accurate financial evaluation. |

| 6 | VA Disability Award Letter | A VA Disability Award Letter is a crucial document for veterans applying for a VA loan, as it verifies the veteran's disability status and monthly compensation amount, which can impact eligibility and loan benefits. This letter, issued by the Department of Veterans Affairs, must be submitted alongside other required documents to confirm service-related disability status and ensure accurate assessment by lenders. |

| 7 | Entitlement Code | Veterans must provide their Certificate of Eligibility (COE) that includes the Entitlement Code when applying for a VA loan, as it verifies their eligibility and available loan benefits. The Entitlement Code determines the amount of VA loan guarantee the veteran can use, directly impacting loan approval and funding limits. |

| 8 | Residual Income Calculation Docs | Veterans applying for a VA loan must provide detailed residual income calculation documents, including recent pay stubs, tax returns for the past two years, and a completed Verification of Employment (VOE) form. Lenders also require bank statements and proof of any additional income to accurately assess the veteran's ability to cover monthly expenses after all debts are paid. |

| 9 | Automated Underwriting Findings | Veterans applying for a VA loan must provide Automated Underwriting Findings that include the Certificate of Eligibility (COE), credit reports, income verification such as W-2s or pay stubs, and residual income calculations to meet VA loan eligibility requirements. Submission of these documents through the VA's automated system ensures accurate assessment of loan approval conditions and compliance with VA lending policies. |

| 10 | Blue Button Health Record (My HealtheVet) | Veterans applying for a VA loan should include their Blue Button Health Record from My HealtheVet, which provides verified medical history and service-related health information essential for eligibility verification. This comprehensive health record supports timely and accurate processing of VA benefits by offering direct access to military medical documentation. |

Overview of VA Loan Application Process

The VA loan application process requires several key documents to verify eligibility and complete the request. Essential paperwork includes the Certificate of Eligibility (COE), proof of military service such as discharge papers, and financial documents like income statements. Gathering these documents early ensures a smoother and faster approval process for your VA loan application.

Eligibility Criteria for VA Loans

| Document | Description | Purpose |

|---|---|---|

| Certificate of Eligibility (COE) | Official document from the Department of Veterans Affairs | Proves the veteran meets eligibility criteria for a VA loan |

| DD Form 214 | Discharge papers detailing service history | Verifies length and type of military service for eligibility |

| Statement of Service | Document from the military branch confirming active duty status | Required for active duty service members applying for VA loans |

| Proof of Income | Recent pay stubs, tax returns, or employment verification | Demonstrates financial ability to repay the loan |

| Credit Report | Official credit history report | Assesses creditworthiness based on VA loan eligibility guidelines |

| Purchase Agreement | Contract between buyer and seller of the property | Confirms intent to use VA loan for home purchase |

Essential Identification Documents

What essential identification documents does a veteran need for a VA loan application? Veterans must provide a valid Certificate of Eligibility (COE) to prove their entitlement to VA loan benefits. A government-issued photo ID, such as a driver's license or passport, is also required to verify identity.

Are there specific military service records required for the VA loan process? Veterans should submit their DD-214 form, which details their military service and discharge status. This document helps establish eligibility and service duration for loan qualification.

Is proof of income necessary for the VA loan application? Applicants need to provide recent pay stubs, W-2 forms, or tax returns to demonstrate stable income. This financial documentation supports the lender's assessment of the veteran's repayment ability.

Military Service Records and DD-214 Requirements

Veterans applying for a VA loan must provide specific military service documents to verify eligibility. The most critical document is the DD-214, which details discharge status and service history.

The DD-214 confirms active duty service and character of discharge required for VA loan qualification. Military service records support the verification process by outlining service duration and duty assignments. Without these documents, the VA loan application cannot proceed efficiently.

Proof of Income and Employment Verification

Veterans must provide specific documents to verify their income and employment when applying for a VA loan. Accurate proof of income and employment verification ensures a smoother loan approval process.

- Recent Pay Stubs - Pay stubs from the last 30 days demonstrate current income and employment status.

- Employment Verification Letter - A letter from the employer confirms job position, length of employment, and salary details.

- Tax Returns - Tax returns from the past two years provide comprehensive income information, especially for self-employed veterans.

Credit Report and Financial Statements

When applying for a VA loan, you must provide specific documents to verify your creditworthiness and financial status. The credit report and financial statements are critical components in this verification process.

- Credit Report - This document shows your credit history, including outstanding debts and payment behavior, which the VA uses to assess your loan eligibility.

- Bank Statements - These statements provide evidence of your current financial resources and help prove your ability to cover down payments and closing costs.

- Income Verification - Pay stubs, tax returns, and employment letters confirm your income stability and support your loan repayment capacity.

Providing accurate and up-to-date credit reports and financial statements ensures a smoother VA loan application process.

Certificate of Eligibility (COE) Guidelines

Veterans must provide specific documents when applying for a VA loan, with the Certificate of Eligibility (COE) being essential. The COE verifies a veteran's eligibility based on service history and discharge status, streamlining the loan approval process.

- Certificate of Eligibility Verification - The COE confirms the veteran's service record and entitlement to VA home loan benefits.

- Application Methods - Veterans can obtain the COE online through the eBenefits portal, by mail, or with lender assistance.

- Required Information - To request a COE, veterans must provide details such as service dates, branch, and discharge status for accurate eligibility assessment.

Documentation for Property Requirements

Veterans applying for a VA loan must provide specific property documentation to verify eligibility and compliance with VA requirements. Essential documents include the Purchase Agreement, which outlines the terms of sale, and the Certificate of Reasonable Value (CRV), confirming the property's appraised value.

The VA also requires evidence of homeowners insurance to protect the investment and a clear title report ensuring no liens or disputes on the property. These documents guarantee that the real estate meets the VA's safety, security, and property standards before the loan is approved.

Policy Compliance and Legal Disclosures

Veterans applying for a VA loan must provide specific documents to ensure policy compliance and meet legal disclosure requirements. Key documents include the Certificate of Eligibility (COE), proof of military service, and valid identification.

Lenders also require income verification, credit reports, and a completed loan application to comply with VA guidelines. Proper submission of these documents protects veterans' rights and facilitates a smooth loan approval process.

What Documents Does a Veteran Need for VA Loan Application? Infographic