To open a youth bank account, you need a valid identification document such as a birth certificate or passport, proof of address like a utility bill or school report, and a completed application form provided by the bank. A parent or guardian's identification and consent may also be required depending on the bank's policy. Some banks may ask for a Social Security number or tax identification to comply with regulatory requirements.

What Documents Do You Need to Open a Youth Bank Account?

| Number | Name | Description |

|---|---|---|

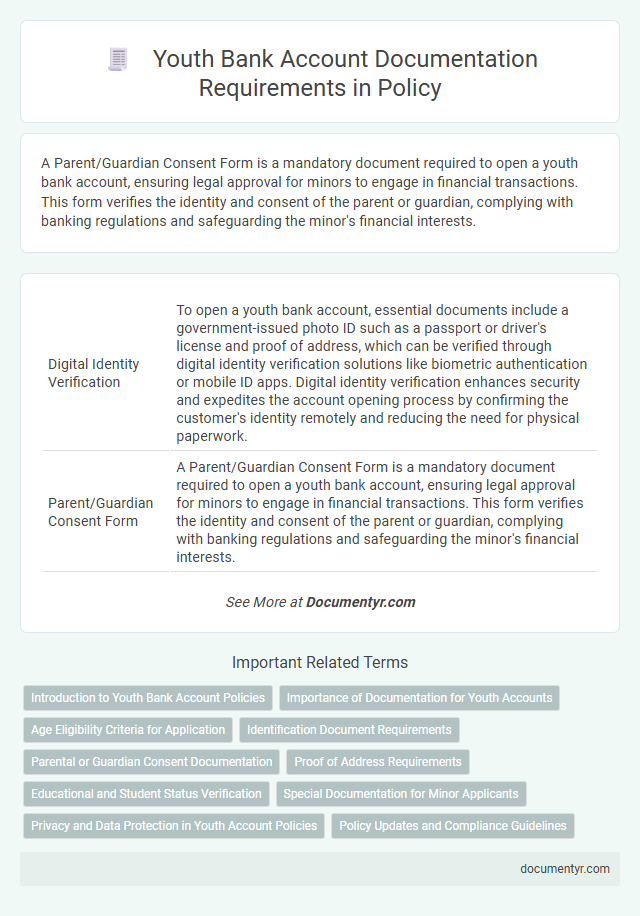

| 1 | Digital Identity Verification | To open a youth bank account, essential documents include a government-issued photo ID such as a passport or driver's license and proof of address, which can be verified through digital identity verification solutions like biometric authentication or mobile ID apps. Digital identity verification enhances security and expedites the account opening process by confirming the customer's identity remotely and reducing the need for physical paperwork. |

| 2 | Parent/Guardian Consent Form | A Parent/Guardian Consent Form is a mandatory document required to open a youth bank account, ensuring legal approval for minors to engage in financial transactions. This form verifies the identity and consent of the parent or guardian, complying with banking regulations and safeguarding the minor's financial interests. |

| 3 | KYC (Know Your Customer) Lite | To open a youth bank account, you typically need identification documents such as a birth certificate, school ID, or passport alongside proof of address like a utility bill or bank statement; KYC Lite processes require minimal documentation to verify identity while ensuring compliance with anti-money laundering regulations. Parental consent forms and guardian identification are also essential components in youth account KYC Lite protocols to safeguard minors' financial security. |

| 4 | e-Signature Authorization | To open a youth bank account, you must submit valid identification documents along with parental or guardian consent, which can be conveniently authorized using an e-signature authorization form. This digital approval ensures secure, efficient verification and compliance with banking policies tailored for minors. |

| 5 | Proof of Minor’s School Enrollment | Proof of minor's school enrollment is a crucial document often required to open a youth bank account, serving as verification of the child's current educational status. This can include a school ID, an enrollment letter, or a recent report card issued by an accredited educational institution. |

| 6 | Minor's Biometric Data | To open a youth bank account, providing the minor's biometric data such as fingerprint or facial recognition is often mandatory to ensure identity verification and enhance security. Banks require this biometric information alongside standard documents like the minor's birth certificate and parent or guardian consent forms to comply with regulatory policies. |

| 7 | Remote Onboarding Documents | Remote onboarding for a youth bank account typically requires a government-issued photo ID such as a passport or state ID, proof of address like a utility bill or bank statement, and a birth certificate to verify age. Some banks may also request parental or guardian consent forms and a Social Security number to complete the online verification process securely. |

| 8 | Dual Authentication Mandate | Opening a youth bank account requires documents like a birth certificate, proof of address, and identification for both the minor and guardian, aligned with the dual authentication mandate to ensure secure access. This dual authentication policy mandates verification through two independent credentials, enhancing fraud prevention and safeguarding youth financial data. |

| 9 | Youth Risk Assessment Declaration | To open a youth bank account, the Youth Risk Assessment Declaration is essential, detailing the applicant's understanding of financial responsibilities and potential risks associated with banking activities. This document helps banks evaluate the young customer's awareness of account usage, ensuring informed consent and compliance with regulatory requirements. |

| 10 | Age-Appropriate Data Privacy Acknowledgment | Youth bank accounts require a legal guardian's identification, the minor's birth certificate, and proof of address to ensure compliance with regulatory standards. An age-appropriate data privacy acknowledgment must be signed, outlining how the minor's personal information will be securely handled, stored, and shared in accordance with data protection laws. |

Introduction to Youth Bank Account Policies

Youth bank accounts offer tailored financial services designed for individuals under 18. Understanding the required documentation is essential to comply with banking policies.

Opening a youth bank account usually requires valid identification documents such as a birth certificate or passport. Proof of address is often necessary to verify residency, including utility bills or government-issued letters. Parental or guardian consent forms are mandatory to ensure legal authorization for minors to hold the account.

Importance of Documentation for Youth Accounts

Opening a youth bank account requires specific documentation to verify identity and eligibility. Proper documentation ensures compliance with banking regulations and protects both the minor and the financial institution.

- Proof of Identity - A government-issued ID such as a passport or birth certificate confirms the youth's legal identity.

- Proof of Address - Recent utility bills or official letters validate the residential address for account registration.

- Parental or Guardian Consent - A consent form or legal document from a parent or guardian authorizes account opening for minors.

Age Eligibility Criteria for Application

To open a youth bank account, applicants must typically be between the ages of 13 and 18 years. Proof of age is required, commonly through a birth certificate, passport, or government-issued ID. Parents or legal guardians may need to provide identification and consent depending on the bank's specific age eligibility policies.

Identification Document Requirements

Opening a youth bank account requires specific identification documents to verify your identity and eligibility. Banks have strict guidelines to ensure all submissions comply with regulatory standards and youth protection policies.

- Government-issued photo ID - A valid passport or national ID card confirms your identity and age.

- Proof of address - Utility bills or official correspondence dated within the last three months validate your residential address.

- Parental or guardian consent form - Required for account holders under the age of 18 to authorize account management.

Parental or Guardian Consent Documentation

To open a youth bank account, parental or guardian consent is essential to comply with legal requirements. Banks typically require a signed consent form or official letters from the parent or guardian confirming permission. You should prepare identification documents of the parent or guardian, such as a passport or driver's license, to verify consent validity.

Proof of Address Requirements

Opening a youth bank account requires providing valid proof of address to verify residency. Banks accept specific documents that confirm the applicant's current living address for account approval.

- Utility Bills - Recent utility bills such as electricity, water, or gas statements dated within the last three months are commonly accepted as proof of address.

- Government Correspondence - Official letters or notices from government agencies, including tax statements or benefit letters, serve as valid address verification documents.

- Bank Statements - Recent bank or credit card statements showing the applicant's name and address can be used to meet proof of address requirements.

Providing one or more of these documents ensures compliance with youth bank account opening policies and facilitates smooth account registration.

Educational and Student Status Verification

Opening a youth bank account requires specific documents to verify educational and student status. Proof such as a school ID card or an official letter from the educational institution is commonly accepted.

These documents confirm the applicant's eligibility for youth banking services and any associated benefits. Some banks may also request recent report cards or enrollment certificates as additional verification.

Special Documentation for Minor Applicants

| Document Type | Description | Purpose |

|---|---|---|

| Birth Certificate | Official record proving the applicant's date of birth and identity. | Confirms minor status and verifies identity for account eligibility. |

| Parental or Guardian Consent Form | Written authorization from a parent or legal guardian allowing account opening. | Provides legal permission for banking transactions on behalf of the minor. |

| Government-Issued ID of Parent/Guardian | Valid identification such as driver's license or passport belonging to the parent or guardian. | Verifies the identity of the adult responsible for the minor's account. |

| Social Security Number (SSN) or Tax Identification Number (TIN) | Unique identification number for tax and legal reporting purposes. | Required for regulatory compliance and to link the account to the minor. |

| Proof of Address | Documents such as utility bills or bank statements showing current residence of parent or guardian. | Confirms place of residence for account registration and communication. |

Privacy and Data Protection in Youth Account Policies

What documents are required to open a youth bank account with a focus on privacy and data protection? You typically need a valid photo ID, proof of address, and a birth certificate or guardian's ID to verify identity and legal guardianship. Youth account policies emphasize safeguarding personal information through secure data handling and strict privacy measures to protect your financial details.

What Documents Do You Need to Open a Youth Bank Account? Infographic