Non-citizens applying for a mortgage typically need to provide a valid passport, visa or residency permit, and proof of legal status in the country. Lenders often require additional documentation such as employment verification, income statements, and credit history. Policies may vary depending on the type of residency and lender requirements, so it is essential to check specific mortgage provider guidelines.

What Documents Does a Non-Citizen Need for a Mortgage Application?

| Number | Name | Description |

|---|---|---|

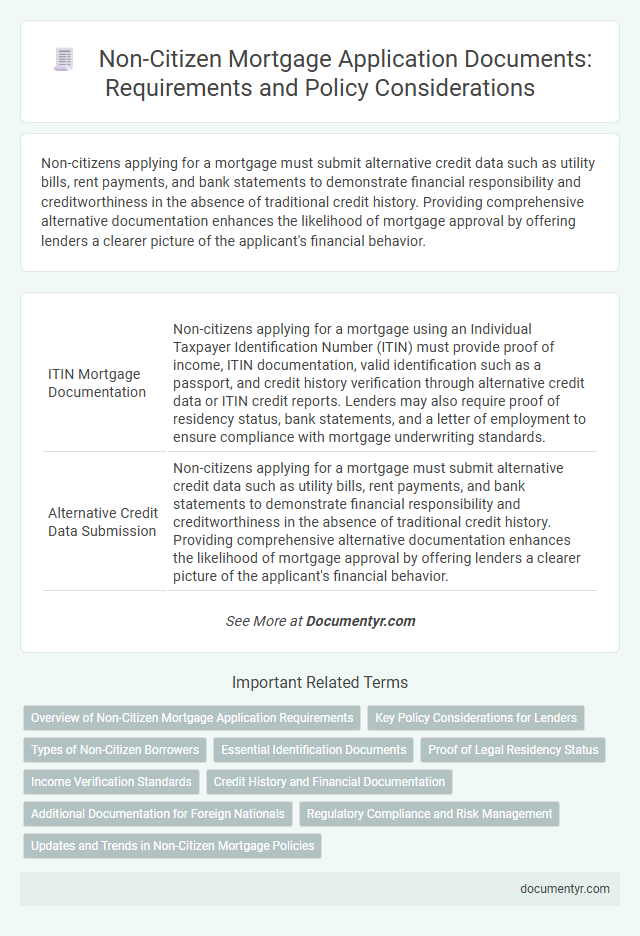

| 1 | ITIN Mortgage Documentation | Non-citizens applying for a mortgage using an Individual Taxpayer Identification Number (ITIN) must provide proof of income, ITIN documentation, valid identification such as a passport, and credit history verification through alternative credit data or ITIN credit reports. Lenders may also require proof of residency status, bank statements, and a letter of employment to ensure compliance with mortgage underwriting standards. |

| 2 | Alternative Credit Data Submission | Non-citizens applying for a mortgage must submit alternative credit data such as utility bills, rent payments, and bank statements to demonstrate financial responsibility and creditworthiness in the absence of traditional credit history. Providing comprehensive alternative documentation enhances the likelihood of mortgage approval by offering lenders a clearer picture of the applicant's financial behavior. |

| 3 | Foreign Income Verification | Non-citizens must provide foreign income verification documents such as foreign tax returns, translated and notarized pay stubs, or employer letters to substantiate their income for mortgage applications. Lenders often require these documents alongside valid immigration status and credit history to assess financial stability accurately. |

| 4 | U.S. Residency Evidence Packet | Non-citizen mortgage applicants must provide a U.S. Residency Evidence Packet that includes essential documents such as a valid visa, Permanent Resident Card (Green Card), Employment Authorization Document (EAD), and proof of consistent residence through utility bills or lease agreements. Accurate submission of these documents helps verify lawful residency status, ensuring compliance with lender requirements and federal regulations during the mortgage approval process. |

| 5 | Document Translation Certification | Non-citizens applying for a mortgage must provide certified translations of any documents not originally in English, ensuring accuracy and legal validity. Mortgage lenders typically require these translation certifications to verify the authenticity and completeness of documents such as identification, income statements, and credit reports. |

| 6 | Non-Permanent Resident Alien (NPRA) Status Proof | Non-Permanent Resident Aliens (NPRAs) must provide valid immigration documents such as a valid visa, Employment Authorization Document (EAD), or Form I-94 showing lawful admission status when applying for a mortgage. Lenders may also require a Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN) to verify identity and creditworthiness. |

| 7 | Consular ID Acceptance | Non-citizens applying for a mortgage typically need to provide a valid consular ID as proof of identity, which is increasingly accepted by lenders alongside government-issued passports or visas. This acceptance of consular IDs helps streamline the verification process and supports non-citizens in meeting documentation requirements for mortgage approval. |

| 8 | Cross-Border Credit Reports | Non-citizens applying for a mortgage must provide valid identification such as a passport, visa, and proof of legal residency, along with financial documents like tax returns and employment verification. Cross-border credit reports are essential to assess creditworthiness when domestic credit history is limited, as lenders require comprehensive data from international credit bureaus to evaluate financial stability and repayment risk. |

| 9 | Supplemental Visa Work Authorization | Non-citizens applying for a mortgage must provide a valid Supplemental Visa Work Authorization, such as an Employment Authorization Document (EAD), to verify legal employment status and income. This document, in combination with a valid visa and passport, ensures lenders assess the borrower's ability to repay the loan under U.S. immigration and lending regulations. |

| 10 | Digital Identity Verification (KYC) | Non-citizens applying for a mortgage must provide digital identity verification documents such as a valid passport, government-issued photo ID, and proof of current residency, which are essential for Know Your Customer (KYC) compliance to prevent fraud and ensure legal eligibility. Mortgage lenders also require digital submission of utility bills, tax records, or rental agreements linked to the applicant's verified identity to authenticate their financial history and residency status securely. |

Overview of Non-Citizen Mortgage Application Requirements

Non-citizens seeking a mortgage must provide specific documentation to verify identity, residency status, and financial stability. These requirements ensure lenders assess risk accurately while complying with legal regulations.

Key documents include a valid passport, visa or residency permit, and proof of income such as pay stubs or tax returns. Lenders may also request a Social Security Number or Individual Taxpayer Identification Number (ITIN) to confirm credit history. Providing accurate and complete information helps streamline the approval process for your mortgage application.

Key Policy Considerations for Lenders

Non-citizens applying for a mortgage must provide specific documentation as part of lender requirements to comply with regulatory and risk management policies. Lenders must carefully verify identity, legal residency, and financial status to ensure policy adherence and loan eligibility.

- Proof of Legal Residency - Non-citizens are required to submit valid visas, green cards, or work permits to verify lawful residence status.

- Tax Identification Documents - Submission of an Individual Taxpayer Identification Number (ITIN) or Social Security Number (SSN) is necessary for credit assessment and tax reporting.

- Income Verification - Lenders must obtain employment records, tax returns, and bank statements to assess repayment capacity and compliance with underwriting policies.

Types of Non-Citizen Borrowers

What documents does a non-citizen need for a mortgage application? Non-citizen borrowers typically must provide proof of legal residency and valid identification. Common document types include visa or permanent resident card, Social Security number, and income verification.

What types of non-citizen borrowers seek mortgages? Non-citizen borrowers generally fall into categories such as permanent residents, visa holders, and foreign nationals. Each category requires specific documentation to meet lender criteria and regulatory compliance.

Essential Identification Documents

Non-citizens must provide specific identification documents when applying for a mortgage. These essential documents verify identity and legal status to ensure compliance with lending policies.

- Valid Passport - Serves as the primary government-issued photo identification for identity verification.

- Visa or Residency Permit - Confirms lawful presence in the country and eligibility to enter into financial contracts.

- Social Security Number or Individual Taxpayer Identification Number (ITIN) - Required for credit checks and tax reporting purposes by lenders.

Proof of Legal Residency Status

Proof of legal residency status is a crucial document for non-citizens applying for a mortgage. This evidence confirms your right to live and work in the country, ensuring lenders of your eligibility.

Acceptable documents include a valid visa, permanent resident card, or an employment authorization document. These papers verify your legal presence and support the mortgage application process.

Income Verification Standards

Non-citizens applying for a mortgage must provide specific documents to meet income verification standards. These documents typically include recent pay stubs, W-2 forms, or tax returns to confirm stable income.

Lenders may also require proof of legal residency, such as a valid visa or green card, alongside documentation of employment history. Your consistent income documentation helps establish financial reliability for mortgage approval.

Credit History and Financial Documentation

Non-citizens applying for a mortgage must provide comprehensive credit history and financial documentation to qualify. These documents verify financial stability and creditworthiness essential for the loan approval process.

- Credit History Report - Requires a detailed credit report from recognized agencies, reflecting borrowing and repayment behavior.

- Proof of Income - Includes recent pay stubs, tax returns, or employment verification to demonstrate steady income.

- Bank Statements - Shows financial assets, savings, and transaction history to assess financial health.

Your accurate submission of these documents ensures a smoother mortgage application experience.

Additional Documentation for Foreign Nationals

| Document Type | Description | Purpose |

|---|---|---|

| Valid Passport | Official government-issued passport from the non-citizen's home country. | Proof of identity and nationality during mortgage application. |

| Visa or Residency Permit | Current visa, permanent resident card, or other legal authorization to stay in the country. | Verifies legal residence status for loan eligibility. |

| Social Security Number or ITIN | Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN). | Necessary for credit and tax reporting purposes related to the mortgage. |

| Proof of Income | Recent pay stubs, tax returns, or bank statements showing stable income. | Confirms financial ability to repay the mortgage loan. |

| Credit History | Credit reports, either domestic or from the non-citizen's country of origin, if available. | Used by lenders to assess creditworthiness and risk. |

| Additional Financial Documentation | Statements detailing assets, liabilities, and proof of funds for down payment. | Demonstrates overall financial stability and liquidity. |

| Power of Attorney (if applicable) | Legal authorization for a representative to handle mortgage-related processes. | Enables trusted parties to act on your behalf when needed. |

Regulatory Compliance and Risk Management

Non-citizens must provide valid immigration documentation such as a visa, green card, or employment authorization to comply with mortgage application regulations. Lenders require proof of income, tax returns, and Social Security or Individual Taxpayer Identification Number to assess financial risk accurately. Ensuring all documents meet regulatory standards helps manage risk and facilitates a smoother approval process for your mortgage application.

What Documents Does a Non-Citizen Need for a Mortgage Application? Infographic