Foreigners need to present a valid passport and proof of address when opening a US bank account. Additional documents such as a visa or employment authorization, Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN) may be required by some banks. Banks also commonly request a completed W-8BEN form to certify foreign status for tax purposes.

What Documents Does a Foreigner Need to Open a US Bank Account?

| Number | Name | Description |

|---|---|---|

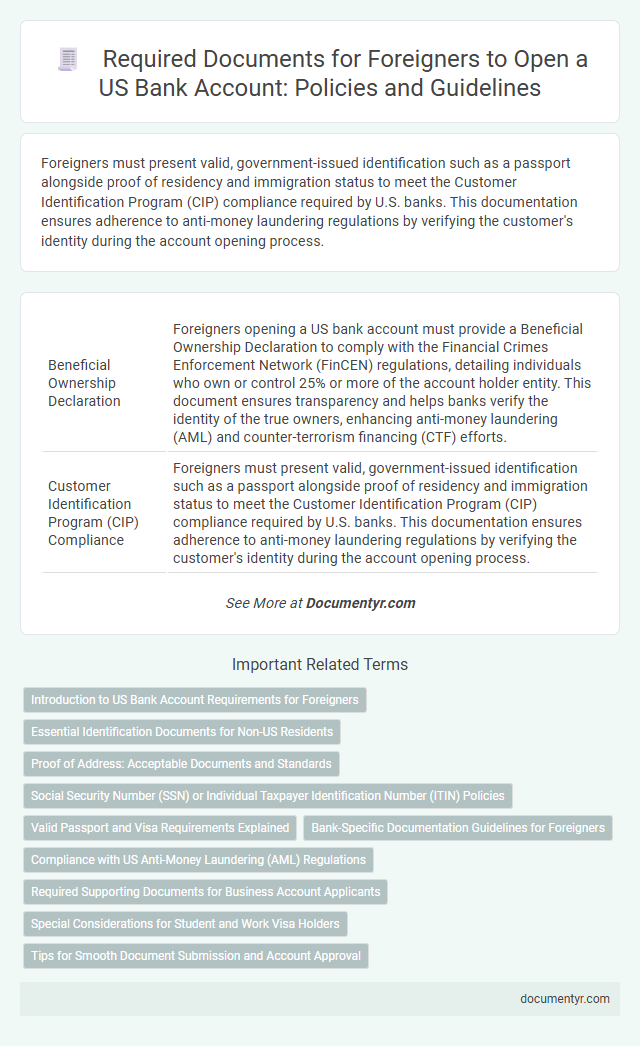

| 1 | Beneficial Ownership Declaration | Foreigners opening a US bank account must provide a Beneficial Ownership Declaration to comply with the Financial Crimes Enforcement Network (FinCEN) regulations, detailing individuals who own or control 25% or more of the account holder entity. This document ensures transparency and helps banks verify the identity of the true owners, enhancing anti-money laundering (AML) and counter-terrorism financing (CTF) efforts. |

| 2 | Customer Identification Program (CIP) Compliance | Foreigners must present valid, government-issued identification such as a passport alongside proof of residency and immigration status to meet the Customer Identification Program (CIP) compliance required by U.S. banks. This documentation ensures adherence to anti-money laundering regulations by verifying the customer's identity during the account opening process. |

| 3 | Enhanced Due Diligence (EDD) Documents | Foreigners need to provide Enhanced Due Diligence (EDD) documents such as valid passports, proof of address, and a valid visa or immigration status to open a US bank account. Banks may also require tax identification numbers, source of funds documentation, and potentially reference letters to comply with anti-money laundering (AML) regulations and verify the customer's identity thoroughly. |

| 4 | W-8BEN Form Submission | Foreigners opening a US bank account must submit a completed W-8BEN form to certify their foreign status and claim tax treaty benefits, ensuring compliance with IRS regulations. This document, along with a valid passport and proof of address, is essential for non-resident aliens to avoid automatic US tax withholding on interest income. |

| 5 | FATCA Self-Certification | Foreigners opening a US bank account must provide identification documents such as a valid passport and proof of address, along with a completed FATCA Self-Certification form to comply with the Foreign Account Tax Compliance Act regulations. This form helps financial institutions determine the account holder's tax residency status to ensure proper reporting to the IRS. |

| 6 | Non-Resident Alien Bank Account Packets | Non-resident aliens typically need a valid passport, proof of address, and an Individual Taxpayer Identification Number (ITIN) or Social Security Number (SSN) to open a US bank account. Banks may require additional documents such as a visa, immigration documents, and a completed Non-Resident Alien Bank Account Packet to verify identity and residency status. |

| 7 | Digital Identity Verification Tools | Foreigners need valid passports and secondary identification such as visas or residence permits to open a US bank account, with many banks now employing digital identity verification tools like biometric scanning and AI-driven document analysis for faster, secure processing. These technologies enhance compliance with anti-money laundering (AML) and know your customer (KYC) regulations, reducing fraud risks while enabling remote account opening. |

| 8 | Document Apostille Verification | Foreigners opening a US bank account must provide verified identification documents accompanied by an apostille certification to validate their authenticity internationally. The apostille ensures foreign-issued passports, birth certificates, or proof of address are officially recognized by US financial institutions, facilitating seamless account opening. |

| 9 | Source of Funds Documentation | A foreigner must provide source of funds documentation such as recent bank statements, employment contracts, or proof of income to comply with US bank account opening policies. These documents verify the legitimacy of the funds and satisfy anti-money laundering regulations enforced by financial institutions. |

| 10 | Remote/Online Notarization | Foreigners opening a US bank account remotely must provide a valid passport, proof of address, and a notarized copy of their identification documents via online notarization services compliant with state laws. Remote notarization ensures the authenticity of documents without physical presence, streamlining account opening for non-residents while meeting federal banking regulations and Know Your Customer (KYC) requirements. |

Introduction to US Bank Account Requirements for Foreigners

Opening a US bank account as a foreigner requires specific documentation to comply with federal regulations and ensure identity verification. Banks follow standardized procedures to facilitate account creation for non-residents while maintaining security and regulatory standards.

Essential documents typically include a valid passport, proof of address, and an Individual Taxpayer Identification Number (ITIN) or Social Security Number (SSN). Some banks may require additional paperwork such as a visa, employment authorization, or a reference letter from your home bank. Understanding these requirements helps foreigners navigate the process smoothly and avoid delays in accessing US banking services.

Essential Identification Documents for Non-US Residents

Foreigners opening a US bank account must provide specific identification documents to comply with federal regulations. These documents verify identity and residency status, ensuring secure and legal banking access.

- Valid Passport - The primary form of identification accepted to confirm the foreign individual's identity and citizenship.

- Visa or I-94 Form - Proof of lawful entry and legal status within the United States required by most banks.

- Secondary ID or Proof of Address - Documents such as a foreign driver's license, utility bills, or rental agreements to validate residency details.

Proof of Address: Acceptable Documents and Standards

Foreigners must provide proof of address to open a US bank account, which confirms their residential location. Banks require valid documents that clearly display the applicant's name and current address.

Acceptable proof of address includes utility bills, lease agreements, and bank statements issued within the last three months. Documents must be official, with consistent information matching the applicant's identity to meet federal banking standards.

Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN) Policies

| Document | Description | Requirement for Foreigners |

|---|---|---|

| Social Security Number (SSN) | A nine-digit number issued to U.S. citizens, permanent residents, and certain nonresident workers for tax reporting and identification. | Most U.S. banks require an SSN to open an account. Foreigners legally working or residing in the U.S. may obtain an SSN through the Social Security Administration. |

| Individual Taxpayer Identification Number (ITIN) | A tax processing number issued by the IRS to individuals who are not eligible for an SSN but require a U.S. taxpayer identification number. | Foreigners without an SSN can use an ITIN to open a bank account, especially for tax reporting purposes. ITIN is issued upon IRS approval of Form W-7. |

| Passport | A government-issued travel document that confirms identity and nationality of the foreign individual. | Valid passport is required for identity verification when opening a U.S. bank account. |

| Proof of Address | Documents such as utility bills, lease agreements, or bank statements showing the applicant's residential address. | Required to verify physical residence; U.S. or foreign address may be accepted depending on the bank. |

| Visa or Immigration Documentation | Documentation proving legal status in the U.S., such as a visa, permanent resident card, or work permit. | Necessary for banks to confirm legal presence in the country and comply with regulatory policies. |

Valid Passport and Visa Requirements Explained

Opening a US bank account as a foreigner requires presenting a valid passport as the primary form of identification. Banks rely on the passport to verify identity and citizenship status for compliance with federal regulations.

Visa requirements vary depending on the type of visa held by the foreign applicant. A valid visa must be presented along with the passport to confirm legal entry and authorized stay in the United States.

Bank-Specific Documentation Guidelines for Foreigners

Opening a US bank account as a foreigner requires specific documentation that varies by bank. Understanding these bank-specific guidelines ensures a smooth account setup process.

- Valid Passport - Most banks require a valid passport as the primary form of identification for foreigners.

- Proof of Address - Banks often ask for a local or foreign address document such as a utility bill or lease agreement.

- Tax Identification Number - Some banks require a Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN) for account opening.

Your bank may have additional requirements like a visa or reference letter, so verify all documents before applying.

Compliance with US Anti-Money Laundering (AML) Regulations

What documents does a foreigner need to open a US bank account while ensuring compliance with US Anti-Money Laundering (AML) regulations? Banks require valid identification such as a passport and proof of address to verify your identity and residency. Compliance with AML rules mandates additional documents like a Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN) to prevent illicit financial activities.

Required Supporting Documents for Business Account Applicants

Foreigners opening a US business bank account must provide key documents to verify their identity and business legitimacy. Required supporting documents include a valid passport, an Employer Identification Number (EIN) issued by the IRS, and formation documents such as Articles of Incorporation or a Certificate of Formation. Banks may also request an Operating Agreement, proof of address, and a US-based business license to complete the account setup process.

Special Considerations for Student and Work Visa Holders

Foreigners opening a US bank account must provide a valid passport, visa, and proof of address. Student visa holders should also present their I-20 form and enrollment verification. Work visa holders need to submit their I-797 Notice of Action or employment authorization documents for account approval.

What Documents Does a Foreigner Need to Open a US Bank Account? Infographic