First-time homebuyers need several essential documents to complete the purchase process, including proof of income such as pay stubs or tax returns, identification like a driver's license or passport, and credit history reports. Lenders also require bank statements to verify assets and savings for the down payment, along with employment verification letters to confirm job stability. Gathering these documents early streamlines mortgage approval and helps avoid delays during closing.

What Documents Are Needed to Buy a Home as a First-Time Buyer?

| Number | Name | Description |

|---|---|---|

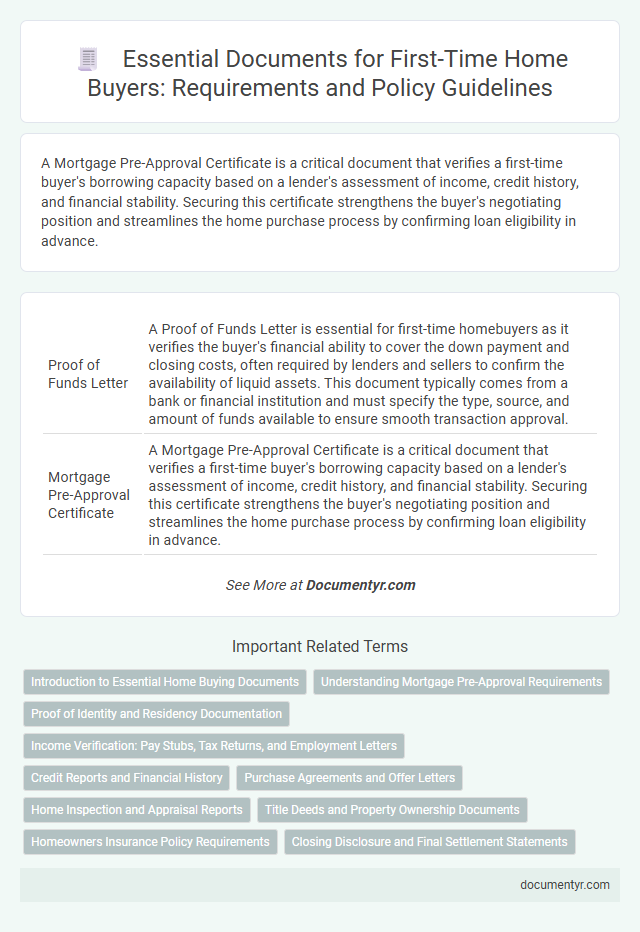

| 1 | Proof of Funds Letter | A Proof of Funds Letter is essential for first-time homebuyers as it verifies the buyer's financial ability to cover the down payment and closing costs, often required by lenders and sellers to confirm the availability of liquid assets. This document typically comes from a bank or financial institution and must specify the type, source, and amount of funds available to ensure smooth transaction approval. |

| 2 | Mortgage Pre-Approval Certificate | A Mortgage Pre-Approval Certificate is a critical document that verifies a first-time buyer's borrowing capacity based on a lender's assessment of income, credit history, and financial stability. Securing this certificate strengthens the buyer's negotiating position and streamlines the home purchase process by confirming loan eligibility in advance. |

| 3 | Gift Letter for Down Payment | A Gift Letter for a down payment is a critical document for first-time homebuyers, verifying that funds received are a genuine gift without repayment obligation. Lenders require this letter to confirm the source of funds, ensuring compliance with mortgage underwriting policies and preventing potential fraud. |

| 4 | Automated Underwriting System (AUS) Findings | First-time homebuyers must submit documents such as proof of income, employment verification, credit reports, and asset statements for evaluation by the Automated Underwriting System (AUS). AUS findings streamline loan approvals by assessing these documents and providing risk assessments to lenders, ensuring accurate and efficient mortgage underwriting. |

| 5 | Digital Asset Verification Statement | First-time homebuyers must provide a Digital Asset Verification Statement to confirm the authenticity and value of digital financial assets such as cryptocurrencies or digital wallets. This document ensures lenders can accurately assess the buyer's financial stability and source of funds in compliance with mortgage underwriting policies. |

| 6 | Employment Verification API Report | Employment Verification API Report is essential for first-time homebuyers to authenticate income and job stability, providing lenders with accurate employment data to assess loan eligibility. This automated report streamlines the application process, reducing delays and ensuring compliance with mortgage policy requirements. |

| 7 | Debt-to-Income (DTI) Ratio Statement | Lenders require a detailed Debt-to-Income (DTI) Ratio Statement to evaluate a first-time buyer's financial stability, typically including pay stubs, tax returns, and monthly debt obligations. This document helps determine the borrower's ability to manage mortgage payments alongside existing debts, ensuring compliance with housing loan policies. |

| 8 | Closing Disclosure (CD) Draft | First-time homebuyers must review the Closing Disclosure (CD) Draft, a critical document that outlines final loan terms, closing costs, and payment schedules, provided at least three business days before closing. This disclosure ensures transparency, allowing buyers to compare the CD Draft with the Loan Estimate to identify any discrepancies or unexpected fees before signing. |

| 9 | Remote Online Notarization (RON) Authorization | First-time homebuyers typically need a purchase agreement, proof of funds, identification, and mortgage documents, but Remote Online Notarization (RON) authorization now allows notarization of these documents digitally, enhancing convenience and efficiency. RON is legally endorsed in many states, enabling secure, remote execution of closing paperwork without in-person visits. |

| 10 | TransUnion VantageScore Credit Report | First-time homebuyers need a TransUnion VantageScore credit report to assess their creditworthiness accurately, which lenders use to determine mortgage eligibility and interest rates. This report includes detailed credit history, account status, and credit utilization, essential for loan approval and securing favorable home financing terms. |

Introduction to Essential Home Buying Documents

Buying a home for the first time requires careful preparation and understanding of key documents involved in the process. These essential home buying documents provide verification and protect your interests throughout the transaction.

- Proof of Income - Documents such as pay stubs, tax returns, or employment verification confirm your financial stability to lenders.

- Credit Report - A detailed report of your credit history helps assess your creditworthiness for mortgage approval.

- Pre-Approval Letter - Issued by a lender, this letter outlines the loan amount you qualify for, showing sellers your serious intent.

Understanding Mortgage Pre-Approval Requirements

What documents are needed to buy a home as a first-time buyer? Lenders require proof of income, employment history, and credit information to assess your financial stability. Mortgage pre-approval involves submitting pay stubs, tax returns, bank statements, and identification documents.

Proof of Identity and Residency Documentation

Proof of identity and residency documentation are essential for first-time home buyers to verify their eligibility and complete the purchase process. These documents help confirm who you are and where you live, ensuring compliance with legal and financial requirements.

- Government-issued ID - A valid passport or driver's license is required to verify your identity officially.

- Proof of residency - Utility bills, lease agreements, or bank statements must show your current address to confirm residency status.

- Social Security Number - This number is used for credit checks and tax purposes related to the home loan application.

Income Verification: Pay Stubs, Tax Returns, and Employment Letters

| Document Type | Description | Importance for First-Time Buyers |

|---|---|---|

| Pay Stubs | Recent pay stubs, usually from the last 30 days, showing regular income and salary details. | Demonstrates consistent income, crucial for mortgage approval and loan qualification. |

| Tax Returns | Federal tax returns for the past two years, including W-2 forms and 1099 statements. | Validates reported income over time, helping lenders assess financial stability and ability to repay. |

| Employment Letters | Official letter from current employer confirming job title, length of employment, and salary. | Provides evidence of stable employment, reinforcing borrower reliability to lenders. |

Credit Reports and Financial History

First-time homebuyers must provide accurate credit reports to lenders as part of the mortgage application process. These reports detail the buyer's credit score, outstanding debts, and payment history, which are critical for assessing loan eligibility. A thorough review of financial history, including income verification and previous loan records, supports the credit report and strengthens the buyer's qualification.

Purchase Agreements and Offer Letters

First-time homebuyers must understand the importance of purchase agreements and offer letters in the buying process. A purchase agreement is a legally binding contract that outlines the terms and conditions between the buyer and seller. Offer letters serve as formal proposals to purchase the property, often including the proposed price and contingencies.

Home Inspection and Appraisal Reports

Buying a home as a first-time buyer requires several critical documents to ensure informed decisions. Home inspection and appraisal reports are essential components of this process.

- Home Inspection Report - Provides a detailed analysis of the property's condition, identifying any potential repairs or safety issues.

- Appraisal Report - Determines the fair market value of the home, helping to confirm that the purchase price aligns with the property's worth.

- Document Verification - Ensures transparency and protects your investment by verifying that the home meets required standards and loan conditions.

These reports safeguard your interests and support a smooth mortgage approval process.

Title Deeds and Property Ownership Documents

Title deeds are essential documents required to prove legal ownership of a property when buying a home for the first time. These documents serve as official evidence that the seller has the right to transfer ownership to the buyer.

Property ownership documents include title deeds, land registration certificates, and any mortgage details linked to the home. First-time buyers must verify these documents to ensure the property is free from disputes or encumbrances. Confirming clear ownership through these papers protects buyers from legal complications post-purchase.

Homeowners Insurance Policy Requirements

First-time homebuyers must secure a homeowners insurance policy before closing on their new property. This insurance protects the buyer and lender from potential damages such as fire, theft, or natural disasters.

Lenders typically require proof of a comprehensive homeowners insurance policy that covers dwelling, personal property, and liability. The policy must be active and valid at the time of closing to meet loan approval requirements.

What Documents Are Needed to Buy a Home as a First-Time Buyer? Infographic