To complete the FAFSA, you need several important documents including your Social Security number, your federal income tax returns, W-2 forms, and other records of money earned. Students must also provide their driver's license number if applicable, and tax information for their parents if they are considered dependent. Having these documents ready ensures accurate and timely submission of the FAFSA form.

What Documents Are Needed for FAFSA Completion?

| Number | Name | Description |

|---|---|---|

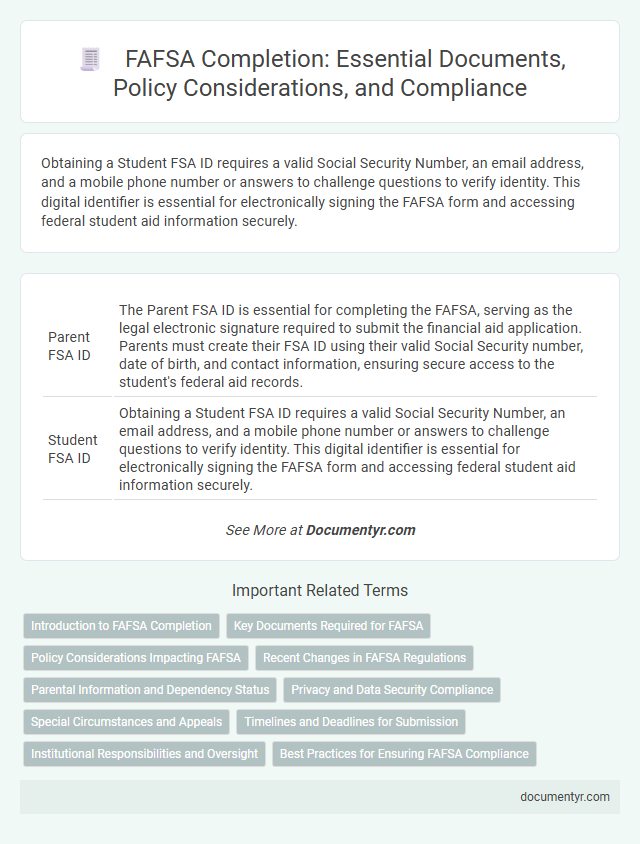

| 1 | Parent FSA ID | The Parent FSA ID is essential for completing the FAFSA, serving as the legal electronic signature required to submit the financial aid application. Parents must create their FSA ID using their valid Social Security number, date of birth, and contact information, ensuring secure access to the student's federal aid records. |

| 2 | Student FSA ID | Obtaining a Student FSA ID requires a valid Social Security Number, an email address, and a mobile phone number or answers to challenge questions to verify identity. This digital identifier is essential for electronically signing the FAFSA form and accessing federal student aid information securely. |

| 3 | IRS Data Retrieval Tool (DRT) Confirmation | The IRS Data Retrieval Tool (DRT) confirmation is essential for accurate FAFSA completion, as it securely transfers tax return information directly into the application, reducing errors and verification requests. Students and parents must ensure successful DRT usage and confirm the transferred data within the FAFSA to meet eligibility requirements and streamline the financial aid review process. |

| 4 | Non-Tax Filer Statement | The Non-Tax Filer Statement is required for FAFSA applicants who did not file a federal tax return and must provide proof of income or a written confirmation of non-filing status from the IRS. This document ensures accurate financial assessment for federal student aid eligibility when tax returns are unavailable. |

| 5 | Untaxed Income Documentation | FAFSA completion requires documentation of untaxed income such as child support received, veterans' noneducation benefits, and parental income earned from work in a family business or farm. Accurate reporting of untaxed income documentation ensures eligibility for federal student aid and prevents delays in application processing. |

| 6 | Asset Net Worth Disclosure | FAFSA completion requires detailed asset net worth disclosure, including current balances of savings, checking accounts, investments, and other real estate holdings excluding the primary residence. Accurate reporting of these financial assets is crucial for determining federal financial aid eligibility and ensuring compliance with FAFSA policy guidelines. |

| 7 | Medicaid Eligibility Proof | Medicaid eligibility proof for FAFSA completion requires official documentation such as a Medicaid benefits letter or a state Medicaid enrollment card that confirms the applicant's active enrollment status. Submitting valid Medicaid proof enables students to qualify for federal financial aid by verifying low-income status as per the U.S. Department of Education guidelines. |

| 8 | SNAP Benefit Letter | A SNAP Benefit Letter is a crucial document for FAFSA completion as it verifies eligibility for the Supplemental Nutrition Assistance Program, impacting the Expected Family Contribution calculation. FAFSA requires this letter to accurately assess financial need and determine qualification for federal student aid programs. |

| 9 | Orphan or Ward of the Court Certification | Orphan or Ward of the Court Certification for FAFSA completion requires official documentation such as a court order or a letter from the court verifying the student's status as an orphan or ward of the court. This certification ensures eligibility for specific federal aid programs targeting independent students without parental financial information. |

| 10 | Selective Service Registration Acknowledgement | Completing the FAFSA requires a Selective Service Registration Acknowledgement for males aged 18 to 25, verifying their registration status with the Selective Service System. This confirmation ensures eligibility for federal student aid and must be included alongside other required documentation such as Social Security number and tax returns. |

Introduction to FAFSA Completion

The Free Application for Federal Student Aid (FAFSA) is essential for accessing federal financial aid for college. Completing the FAFSA accurately requires specific documents to verify your financial and personal information.

- Social Security Number - This unique identifier is needed to confirm your identity and eligibility for federal aid.

- Federal Income Tax Returns - Recent tax documents provide necessary details about your and your family's income for financial assessment.

- Bank Statements and Records of Investments - These documents are required to report your assets, which influence your aid eligibility.

Key Documents Required for FAFSA

| Document | Description | Purpose |

|---|---|---|

| Social Security Number (SSN) | Unique nine-digit number issued by the Social Security Administration. | Identifies the applicant for federal student aid processing. |

| Alien Registration Number | Required if you are not a U.S. citizen but an eligible non-citizen. | Verifies eligibility for federal student aid. |

| Federal Income Tax Returns (1040, 1040A, or 1040EZ) | Documentation of income filed with the IRS from the previous year. | Used to report income and tax information accurately on the FAFSA form. |

| W-2 Forms and Other Records of Money Earned | Documents wage and income information from employers. | Supports income verification and financial accuracy. |

| Bank Statements | Records of checking, savings, and other financial accounts. | Documents available cash and savings used for financial assessment. |

| Investment Records | Statements for stocks, bonds, mutual funds, and other investments. | Supports accurate reporting of assets and net worth. |

| Records of Untaxed Income | Includes child support received, workers' compensation, and other untaxed income sources. | Ensures all income is accounted for FAFSA eligibility determination. |

| Driver's License | Government-issued identification. | Verifies identity during FAFSA submission, if applicable. |

| Parents' Financial Information | Tax returns, W-2 forms, and other income documentation if dependent. | Required to assess family income for dependent student aid determination. |

Policy Considerations Impacting FAFSA

Completing the FAFSA requires specific documentation to verify financial and personal information accurately. Policy considerations significantly influence which documents are mandatory and how they are used in the application process.

- Income Documentation - Tax returns and W-2 forms are required to verify earned income for FAFSA eligibility determination.

- Social Security Number Verification - Valid social security numbers must be provided to confirm identity and citizenship status under federal policy.

- Dependency Status Proof - Legal documents may be needed to establish whether the applicant is dependent or independent, affecting aid qualification.

Federal and state policies dictate the strict enforcement and verification processes of these documents to ensure fair allocation of financial aid resources.

Recent Changes in FAFSA Regulations

To complete the FAFSA, applicants must provide a valid Social Security number, federal income tax returns, and proof of citizenship or eligible noncitizen status. Recent changes in FAFSA regulations require students to include the 2023-2024 tax information for accurate financial assessment. Verification documents may be requested to confirm income or dependency status under updated federal guidelines.

Parental Information and Dependency Status

What parental information is required for FAFSA completion? FAFSA requires details such as your parents' Social Security numbers, dates of birth, and marital status. Income and tax information from your parents' recent tax returns must also be included.

How does dependency status affect the FAFSA process? Your dependency status determines whether parental information is needed. Dependent students must report parental data, while independent students provide only their own financial details.

Privacy and Data Security Compliance

Completing the FAFSA requires specific documents such as your Social Security Number, federal income tax returns, and records of untaxed income. These documents ensure accurate financial information for eligibility determination.

Privacy and data security compliance are critical when handling your sensitive information during the FAFSA process. The FAFSA system uses encryption and secure protocols to protect your data against unauthorized access or breaches.

Special Circumstances and Appeals

Completing the FAFSA often requires additional documentation for special circumstances and appeals to ensure accurate financial assessments. These documents help verify unique financial situations that are not reflected in the standard FAFSA data.

- Special Circumstances Documentation - Includes proof of loss of income, divorce, or death of a parent to address changes not captured in tax returns.

- Appeal Letters - Written explanations submitted to the financial aid office detailing why the original FAFSA information requires reconsideration.

- Supporting Financial Records - Bank statements, unemployment benefits, and other official documents that substantiate claims made in appeals or special circumstance requests.

Timelines and Deadlines for Submission

Completing the FAFSA requires specific documents such as your Social Security number, federal income tax returns, W-2 forms, and records of untaxed income. Gathering these documents early ensures a smoother application process.

FAFSA submissions typically open on October 1 each year, with deadlines varying by state and school. Meeting these deadlines is critical to maximize financial aid opportunities. Your timely submission guarantees consideration for federal, state, and institutional aid programs.

Institutional Responsibilities and Oversight

Institutions play a crucial role in verifying the accuracy of documents submitted for FAFSA completion. They must ensure all student information complies with federal guidelines to maintain eligibility for financial aid.

Verification processes typically involve review of income tax returns, identity proof, and dependency status documentation. Schools hold the responsibility to provide oversight and support to students throughout this process to prevent errors and fraud.

What Documents Are Needed for FAFSA Completion? Infographic