A home mortgage loan application requires essential documents such as proof of income, including recent pay stubs and tax returns, to verify financial stability. Applicants must also provide credit history reports and identification documents like a driver's license or passport for identity verification. Bank statements and employment verification letters are necessary to confirm assets and job security, ensuring a comprehensive evaluation by lenders.

What Documents are Needed for a Home Mortgage Loan Application?

| Number | Name | Description |

|---|---|---|

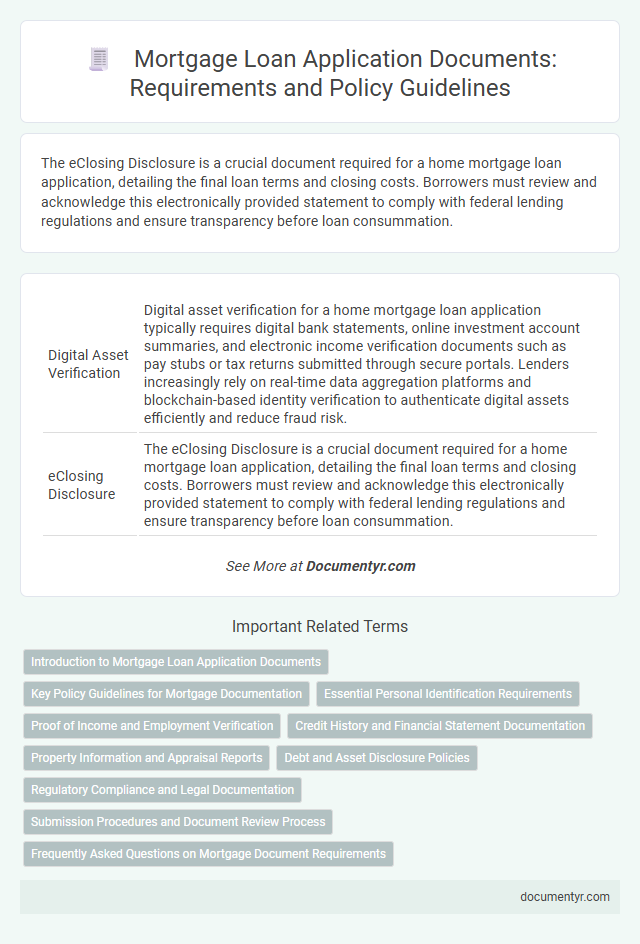

| 1 | Digital Asset Verification | Digital asset verification for a home mortgage loan application typically requires digital bank statements, online investment account summaries, and electronic income verification documents such as pay stubs or tax returns submitted through secure portals. Lenders increasingly rely on real-time data aggregation platforms and blockchain-based identity verification to authenticate digital assets efficiently and reduce fraud risk. |

| 2 | eClosing Disclosure | The eClosing Disclosure is a crucial document required for a home mortgage loan application, detailing the final loan terms and closing costs. Borrowers must review and acknowledge this electronically provided statement to comply with federal lending regulations and ensure transparency before loan consummation. |

| 3 | Remote Online Notarization (RON) Certificate | A Remote Online Notarization (RON) certificate is essential for verifying digital signatures on mortgage documents during a home loan application, ensuring legal compliance and authenticity in a fully remote process. Lenders require a valid RON certificate to approve electronic notarizations, streamlining document approval and reducing processing time. |

| 4 | Blockchain Property Title | A home mortgage loan application requires property title documents verified through blockchain technology to ensure authenticity and prevent fraud. Blockchain-based titles offer a secure, transparent record that streamlines the verification process for lenders and borrowers. |

| 5 | Automated Income Verification (AIV) | Automated Income Verification (AIV) streamlines the mortgage loan application process by securely retrieving income data directly from verified financial sources, eliminating the need for traditional paperwork like pay stubs and tax returns. This technology enhances accuracy and speeds up loan approvals by accessing real-time employment and income information from payroll providers, tax authorities, and banking institutions. |

| 6 | Non-Traditional Credit Documentation | Non-traditional credit documentation for a home mortgage loan application includes utility bills, rent payments, and bank statements that demonstrate consistent financial behavior in the absence of conventional credit scores. Lenders also consider proof of regular payment for services like insurance, phone bills, and childcare, which help validate creditworthiness outside traditional credit reports. |

| 7 | Alternative Asset Statements | Alternative asset statements, including detailed records of cryptocurrency holdings, precious metals, and private equity investments, serve as critical documentation for home mortgage loan applications when traditional bank statements are unavailable or insufficient. These statements must be verified, comprehensive, and reflect consistent asset values to support a borrower's financial strength and increase loan approval likelihood. |

| 8 | Employment Gap Explanation Letter | An Employment Gap Explanation Letter is a critical document in a home mortgage loan application, providing lenders with clarity on any periods of unemployment or career breaks to assess borrower stability. This letter should outline the reasons for the gap, steps taken during the gap, and how the applicant's employment status has since been secured or improved. |

| 9 | Gig Economy Income Records | Lenders require detailed income documentation for gig economy workers applying for home mortgage loans, including tax returns from the past two years, 1099 forms, profit and loss statements, and bank statements verifying consistent deposits. Providing comprehensive records of fluctuating income helps underwrite the loan by demonstrating financial stability and the ability to repay. |

| 10 | Source-of-Funds Blockchain Ledger | A home mortgage loan application requires verified proof of source-of-funds, which can be streamlined using a blockchain ledger to authenticate transaction history and prevent fraud. This decentralized ledger provides immutable records of income, savings, or asset transfers, ensuring transparency and compliance with lending policies. |

Introduction to Mortgage Loan Application Documents

What documents are required for a home mortgage loan application? Lenders need specific paperwork to assess your financial stability and creditworthiness. These documents include income verification, asset statements, and identification proof.

Key Policy Guidelines for Mortgage Documentation

| Document Type | Purpose | Key Policy Guidelines |

|---|---|---|

| Proof of Income | Verify applicant's ability to repay the loan | Include recent pay stubs covering at least 30 days, W-2 forms for the past two years, and tax returns if self-employed. Consistency in income documentation is mandatory to meet underwriting standards. |

| Credit History | Assess creditworthiness and risk profile | Obtain a full credit report from major credit bureaus. Verify absence of outstanding liens or unresolved judgments. Documentation must comply with fair lending laws and privacy regulations. |

| Employment Verification | Confirm employment status and stability | Provide employer contact information and signed verification forms. Policies require verification within 10 days prior to loan approval. |

| Asset Documentation | Establish source of down payment and reserves | Submit recent bank statements, retirement account statements, and gift letters if applicable. Documentation must demonstrate lawful sourcing of funds per policy guidelines. |

| Property Documentation | Validate property value and ownership | Include appraisal reports completed by licensed appraisers and title insurance commitments. Compliance with loan-to-value ratio policies is essential. |

| Identification Documents | Confirm borrower identity | Provide government-issued photo ID such as driver's license or passport. Policies require these documents to prevent fraud and ensure regulatory compliance. |

Essential Personal Identification Requirements

Essential personal identification requirements for a home mortgage loan application include a valid government-issued photo ID such as a passport or driver's license. Lenders also require a Social Security number to verify credit history and employment status. Proof of residency, like a utility bill or lease agreement, is necessary to confirm the applicant's current address.

Proof of Income and Employment Verification

Proof of income is a crucial document for a home mortgage loan application, demonstrating the borrower's ability to repay the loan. Common forms of proof include recent pay stubs, W-2 forms, and tax returns from the past two years.

Employment verification confirms the borrower's current job status and income stability. Lenders often require a verification letter from the employer or direct confirmation through a third-party service.

Credit History and Financial Statement Documentation

Applying for a home mortgage loan requires specific documentation to verify your financial stability and creditworthiness. Key documents focus on credit history and financial statement evidence to support your application.

- Credit Report - A detailed report from credit bureaus showing your credit score and past borrowing behavior.

- Bank Statements - Recent statements verifying available funds and cash flow over the past few months.

- Tax Returns - Copies of your filed tax returns for the last two years to confirm consistent income.

Property Information and Appraisal Reports

Submitting accurate property information and appraisal reports is essential for a successful home mortgage loan application. These documents verify the value and condition of the property securing your mortgage.

- Property Deed - This document proves ownership and details the legal description of the property.

- Recent Appraisal Report - A professional appraisal provides an unbiased estimate of the property's market value.

- Property Tax Statements - These statements confirm the assessed value and tax obligations of the property.

Debt and Asset Disclosure Policies

Debt and asset disclosure policies require comprehensive documentation for a home mortgage loan application. You must provide recent bank statements, investment account summaries, and details of outstanding debts such as credit cards, student loans, and auto loans. Accurate disclosure ensures proper assessment of financial stability and eligibility.

Regulatory Compliance and Legal Documentation

Home mortgage loan applications require comprehensive documentation to ensure regulatory compliance and legal accountability. Essential documents verify the applicant's identity, financial status, and ability to repay the loan.

Key documents include government-issued identification, proof of income such as pay stubs or tax returns, and credit history reports. Lenders also require property appraisal reports and title insurance to comply with real estate regulations. Legal documentation like the loan estimate, closing disclosure, and promissory note protect both borrower and lender under federal and state laws.

Submission Procedures and Document Review Process

Submitting a home mortgage loan application requires several key documents to verify income, identity, and creditworthiness. Commonly requested documents include recent pay stubs, tax returns, bank statements, and government-issued identification.

The submission process typically involves uploading these documents via a secure online portal or delivering them to the lender's office. The lender's review process includes verifying the accuracy and completeness of all documents before moving forward with loan approval.

What Documents are Needed for a Home Mortgage Loan Application? Infographic