To register a small business in California, you need to gather essential documents such as your completed Articles of Incorporation or Organization, a Federal Employer Identification Number (EIN) from the IRS, and the Statement of Information form. Additionally, depending on your business type, you may require specific licenses or permits issued by state or local agencies. Ensuring all necessary documents are accurate and submitted promptly helps streamline the registration process and maintain compliance with California state regulations.

What Documents Are Needed to Register a Small Business in California?

| Number | Name | Description |

|---|---|---|

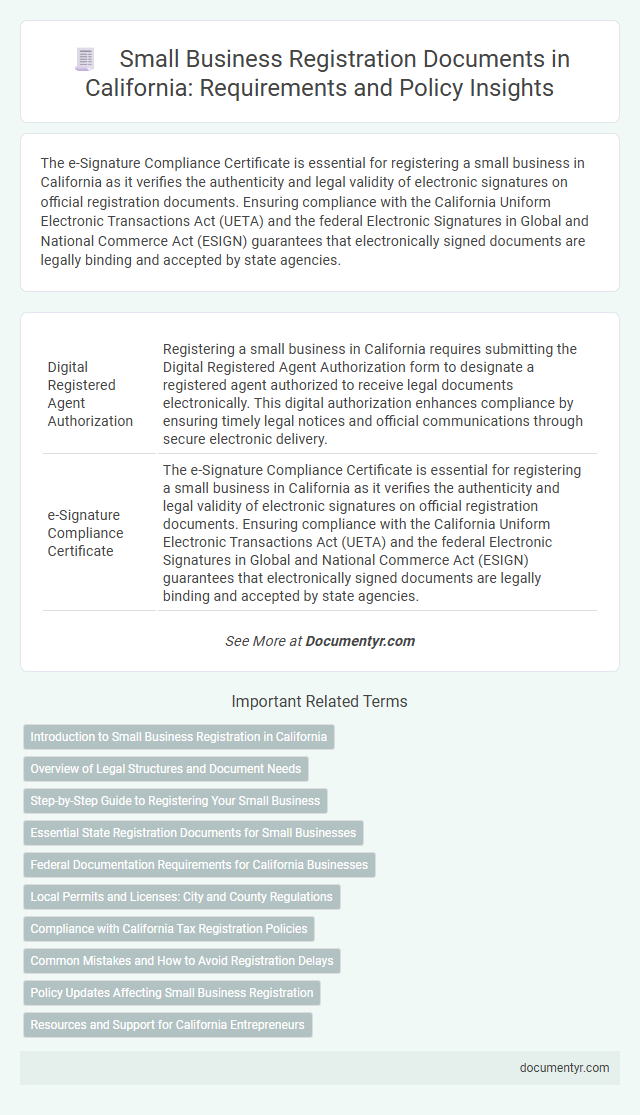

| 1 | Digital Registered Agent Authorization | Registering a small business in California requires submitting the Digital Registered Agent Authorization form to designate a registered agent authorized to receive legal documents electronically. This digital authorization enhances compliance by ensuring timely legal notices and official communications through secure electronic delivery. |

| 2 | e-Signature Compliance Certificate | The e-Signature Compliance Certificate is essential for registering a small business in California as it verifies the authenticity and legal validity of electronic signatures on official registration documents. Ensuring compliance with the California Uniform Electronic Transactions Act (UETA) and the federal Electronic Signatures in Global and National Commerce Act (ESIGN) guarantees that electronically signed documents are legally binding and accepted by state agencies. |

| 3 | Beneficial Ownership Information Report | California small businesses must file a Beneficial Ownership Information Report detailing individuals owning 25% or more of the company to comply with state transparency laws. This report helps the California Secretary of State verify the identities of key owners during the business registration process. |

| 4 | Social Equity Ownership Statement | A Social Equity Ownership Statement is required for small businesses in California applying for licenses in regulated industries to demonstrate ownership by individuals from socially and economically disadvantaged communities. This document supports compliance with state social equity programs aimed at promoting diversity and inclusion in business ownership. |

| 5 | Online Filing Confirmation Receipt | The Online Filing Confirmation Receipt serves as a vital proof of submission when registering a small business in California, verifying that all required documents such as the Articles of Incorporation, Statement of Information, and applicable fees have been successfully filed with the California Secretary of State. This receipt must be retained for record-keeping and future reference in legal, tax, and compliance matters. |

| 6 | Environmental Disclosure Addendum | Registering a small business in California requires submitting several key documents, including the Environmental Disclosure Addendum, which provides critical information on the environmental impact of the business operations. This addendum ensures compliance with California's environmental regulations by disclosing potential environmental risks and sustainability practices relevant to the business location and industry. |

| 7 | Virtual Business Address Agreement | A Virtual Business Address Agreement is essential for registering a small business in California as it provides a legitimate business address required for official correspondence and compliance with state regulations. This document must clearly state the owner's name, business name, address, and terms of use to ensure validity during the registration process with the California Secretary of State. |

| 8 | California Data Privacy Acknowledgment | Registering a small business in California requires submitting key documents such as the Articles of Incorporation or Organization, a completed Statement of Information, and obtaining an Employer Identification Number (EIN). Businesses must also provide a California Data Privacy Acknowledgment to comply with the California Consumer Privacy Act (CCPA), ensuring customer data protection and privacy rights are upheld. |

| 9 | Remote Notarization Attestation | To register a small business in California, key documents include the Articles of Incorporation or Organization, the Statement of Information, and the Remote Notarization Attestation form, which verifies the authenticity of notarized documents submitted remotely. The Remote Notarization Attestation must comply with California's remote online notarization laws, ensuring digital signatures and electronic seals are valid for business registration. |

| 10 | Minority Small Business Certification Form | To register a small business in California, the Minority Small Business Certification Form is essential for verifying ownership by socially and economically disadvantaged individuals, enabling access to state-sponsored contracts and resources. This certification requires submission of proof of minority status, business ownership, and control documents, aligning with the California Department of General Services' eligibility criteria. |

Introduction to Small Business Registration in California

Registering a small business in California requires several essential documents to ensure compliance with state regulations. Understanding the necessary paperwork is crucial for a smooth registration process.

You need to gather documents such as the completed Articles of Incorporation or Organization, a valid government-issued ID, and a Federal Employer Identification Number (EIN) from the IRS. Additional paperwork may include a Fictitious Business Name Statement if operating under a trade name, and any necessary licenses or permits specific to your industry. Having these documents prepared streamlines your business registration and legal compliance within California.

Overview of Legal Structures and Document Needs

Registering a small business in California requires selecting a legal structure such as sole proprietorship, partnership, LLC, or corporation. Each structure demands specific documents, including formation paperwork like Articles of Incorporation for corporations or Articles of Organization for LLCs. Your registration process also involves obtaining an Employer Identification Number (EIN) and necessary permits or licenses based on your industry.

Step-by-Step Guide to Registering Your Small Business

Registering a small business in California requires specific documents to ensure legal compliance and proper operation. Key documents include the articles of incorporation, operating agreement, and federal employer identification number (EIN).

The first step involves choosing a business structure like LLC, corporation, or sole proprietorship, then filing the relevant formation documents with the California Secretary of State. Next, obtain necessary permits and licenses based on your industry and location to complete the registration process.

Essential State Registration Documents for Small Businesses

Registering a small business in California requires specific state documents to ensure legal compliance. These essential documents establish your business identity and authorize operations within the state.

- Articles of Incorporation or Organization - This document officially creates a corporation or LLC by registering the business name and structure with the California Secretary of State.

- Fictitious Business Name Statement (DBA) - Required if the business operates under a name different from the owner's legal name, filed with the county clerk's office.

- Seller's Permit - Issued by the California Department of Tax and Fee Administration, this permit allows businesses to collect sales tax on taxable goods and services.

Completing these registration documents is crucial for legally operating and protecting your small business in California.

Federal Documentation Requirements for California Businesses

Registering a small business in California requires specific federal documentation to ensure compliance with government regulations. These documents are essential for tax purposes, employee identification, and legal operation within the United States.

- Employer Identification Number (EIN) - Issued by the IRS, the EIN is necessary for tax reporting and hiring employees in California.

- Federal Tax Forms - Businesses must complete forms such as SS-4 to apply for an EIN and report income to the IRS.

- Business Licenses and Permits - Certain federal licenses may be required for regulated industries to operate legally within California.

Local Permits and Licenses: City and County Regulations

Registering a small business in California requires obtaining specific local permits and licenses depending on your city and county regulations. These documents ensure your business operates legally within the local jurisdiction.

Common permits include health permits, zoning clearances, and signage approvals, which vary by location. Contacting the city or county clerk's office helps identify the exact requirements based on your business type and location.

Compliance with California Tax Registration Policies

Registering a small business in California requires specific documents to ensure compliance with the state's tax registration policies. Understanding these documentation requirements helps you avoid legal complications and facilitates smooth business operations.

- Fictitious Business Name Statement - This document is necessary if you operate under a name different from your legal business name and must be filed with the county clerk.

- California Seller's Permit - Required for businesses selling tangible goods, this permit registers you for state sales tax collection and reporting with the California Department of Tax and Fee Administration (CDTFA).

- Employer Identification Number (EIN) - Issued by the IRS, an EIN is essential for tax reporting and is often needed to register with California tax agencies, even for sole proprietors hiring employees.

Common Mistakes and How to Avoid Registration Delays

To register a small business in California, essential documents include the Articles of Incorporation or Organization, a completed Statement of Information, and any required permits or licenses specific to your industry. Common mistakes include submitting incomplete forms, missing signatures, and incorrect business addresses, which frequently cause registration delays. Ensuring all documents are accurately filled out, reviewed, and submitted on time can help avoid these common pitfalls and streamline the registration process.

Policy Updates Affecting Small Business Registration

What recent policy updates affect the documents needed to register a small business in California? California now requires an updated Statement of Information form alongside the standard Articles of Incorporation or Organization. New regulations mandate proof of a valid business address and compliance with local zoning laws for all small business registrations.

What Documents Are Needed to Register a Small Business in California? Infographic