Durable medical equipment (DME) coverage typically requires a detailed prescription from a licensed healthcare provider that specifies the medical necessity of the equipment. Supporting medical records, including physician notes and test results, must confirm the patient's condition and need for the equipment. Insurance providers may also request prior authorization forms and proof of equipment cost estimates to complete the coverage approval process.

What Documents are Required for Durable Medical Equipment Coverage?

| Number | Name | Description |

|---|---|---|

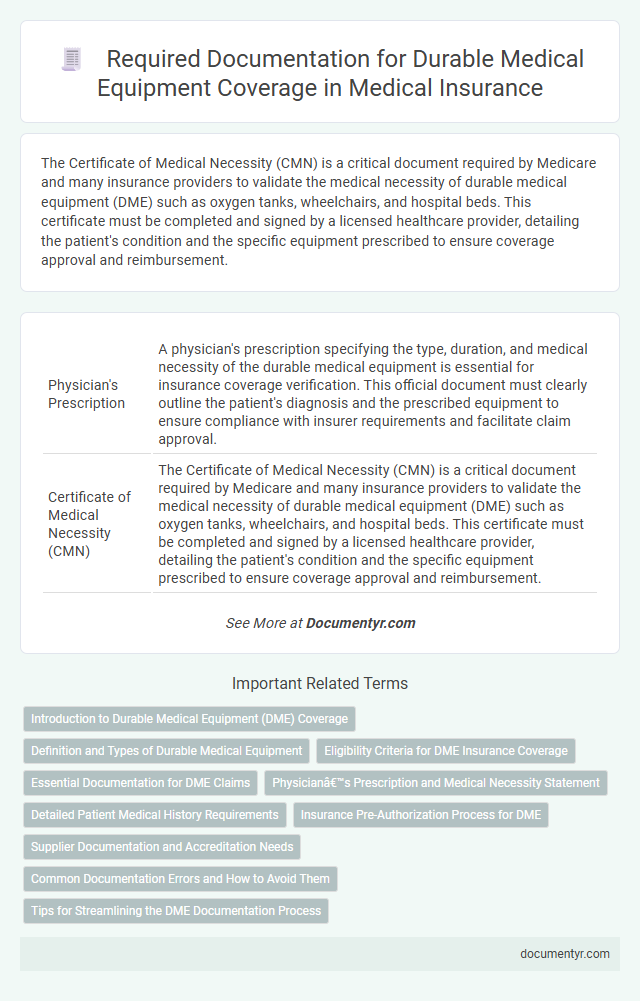

| 1 | Physician's Prescription | A physician's prescription specifying the type, duration, and medical necessity of the durable medical equipment is essential for insurance coverage verification. This official document must clearly outline the patient's diagnosis and the prescribed equipment to ensure compliance with insurer requirements and facilitate claim approval. |

| 2 | Certificate of Medical Necessity (CMN) | The Certificate of Medical Necessity (CMN) is a critical document required by Medicare and many insurance providers to validate the medical necessity of durable medical equipment (DME) such as oxygen tanks, wheelchairs, and hospital beds. This certificate must be completed and signed by a licensed healthcare provider, detailing the patient's condition and the specific equipment prescribed to ensure coverage approval and reimbursement. |

| 3 | Detailed Written Order (DWO) | A Detailed Written Order (DWO) is essential for durable medical equipment (DME) coverage, specifying the patient's diagnosis, prescribed equipment, and the prescribing physician's information to ensure compliance with Medicare and insurance requirements. This document must include detailed descriptions such as the item name, model number, anticipated usage, and the clinical rationale supporting medical necessity to validate the equipment's appropriateness for the patient's condition. |

| 4 | Face-to-Face Evaluation Report | A Face-to-Face Evaluation Report must include detailed clinical findings and justification from a qualified healthcare provider to support the necessity of durable medical equipment (DME). This report is essential for insurance approval, documenting the patient's medical condition and the direct benefits expected from the prescribed equipment. |

| 5 | Health Insurance Card | A valid health insurance card is essential for durable medical equipment (DME) coverage as it verifies the insured status and facilitates claim processing. Insurers use the information on the health insurance card, including policy number and group ID, to confirm eligibility and coordinate benefits for DME reimbursement. |

| 6 | Prior Authorization Form | The Prior Authorization Form is a crucial document required for Durable Medical Equipment (DME) coverage, serving as formal approval from insurance providers before equipment is dispensed. This form typically includes detailed information about the patient's medical condition, the prescribed equipment, and the supporting clinical documentation to justify medical necessity. |

| 7 | Proof of Identity | Proof of identity for durable medical equipment coverage typically requires a government-issued photo ID, such as a driver's license or passport, to verify the applicant's identity. Healthcare providers and insurance companies may also request Social Security numbers or medical identification cards to ensure accurate patient matching and eligibility verification. |

| 8 | Patient Medical Records | Patient medical records must include detailed physician orders, diagnostic test results, and clinical notes documenting the medical necessity of the durable medical equipment (DME). These records serve as critical evidence to justify coverage approval from insurance providers for DME. |

| 9 | Supplier’s Documentation | Supplier's documentation for durable medical equipment coverage must include a detailed patient assessment, proof of medical necessity, and a supplier's invoice specifying the equipment type, quantity, and price. Accurate documentation from the supplier ensures compliance with insurance requirements and facilitates timely reimbursement. |

| 10 | Signed Assignment of Benefits | A Signed Assignment of Benefits form is essential for durable medical equipment (DME) coverage, authorizing the healthcare provider to bill the insurance company directly for the cost of equipment. This document ensures timely claims processing and reduces out-of-pocket expenses for patients by confirming insurer payment responsibility. |

| 11 | Insurance Authorization Letter | An Insurance Authorization Letter is essential for Durable Medical Equipment (DME) coverage as it verifies that the insurance provider approves the purchase or rental of the equipment based on a physician's prescription. This letter typically includes patient details, specific DME codes, and the duration of coverage, ensuring the medical equipment claim aligns with insurance policy requirements. |

| 12 | Delivery and Setup Receipt | The delivery and setup receipt is a critical document required for Durable Medical Equipment (DME) coverage as it verifies that the equipment was received and properly installed at the patient's location. This receipt must include detailed information such as the date of delivery, a description of the equipment, patient and supplier details, and confirmation of setup or installation to ensure insurance reimbursement and compliance with Medicare or Medicaid policies. |

| 13 | Receipt of Delivery Confirmation | Receipt of delivery confirmation is essential for durable medical equipment coverage as it verifies that the patient has received the prescribed equipment. Insurance providers typically require this document along with the physician's prescription and proof of medical necessity to approve and process claims efficiently. |

| 14 | Manufacturer’s Product Information | Manufacturer's product information, including detailed specifications and FDA approval status, is essential for durable medical equipment (DME) coverage to verify compliance with safety and efficacy standards. Insurers require this documentation to assess the equipment's suitability for prescribed medical treatments and ensure reimbursement eligibility. |

| 15 | Treatment Plan | A detailed treatment plan from a licensed healthcare provider is essential for durable medical equipment (DME) coverage and must include the patient's diagnosis, prescribed equipment type, expected duration of use, and specific medical necessity. This documentation ensures compliance with insurance requirements and facilitates timely approval and reimbursement. |

| 16 | Progress Notes | Progress notes documenting the patient's medical condition, treatment plan, and response to therapy are essential for durable medical equipment (DME) coverage approval. These notes must clearly justify the medical necessity of the prescribed equipment, detailing functional impairments and clinical progress. |

| 17 | Medicaid or Medicare Enrollment Forms | Medicaid and Medicare enrollment forms must include detailed patient information, physician prescriptions, and proof of medical necessity to qualify for durable medical equipment coverage. These documents ensure compliance with federal and state regulations, streamlining the approval process and facilitating timely access to essential medical devices. |

| 18 | Durable Medical Equipment Benefit Form | The Durable Medical Equipment Benefit Form is essential for documenting medical necessity and must include detailed physician prescriptions and specific equipment codes to secure insurance coverage. Accurate completion of this form, with patient information and treatment justification, ensures compliance with healthcare provider requirements and expedites approval for durable medical equipment reimbursement. |

| 19 | Financial Responsibility Agreement | A Financial Responsibility Agreement is essential for durable medical equipment (DME) coverage as it outlines the patient's obligations regarding payment, ensuring transparency between the provider and insurer. This document typically includes detailed cost estimates, insurance coverage limits, and the patient's consent to assume responsibility for any non-covered expenses. |

| 20 | Equipment Maintenance Agreement | An Equipment Maintenance Agreement is essential for durable medical equipment coverage, as it ensures ongoing functionality and safety compliance required by insurance providers such as Medicare and Medicaid. This document typically details service schedules, repair responsibilities, and cost coverage, forming a critical part of the claims process to verify equipment reliability and prevent service interruptions. |

Introduction to Durable Medical Equipment (DME) Coverage

Durable Medical Equipment (DME) coverage provides insurance benefits for medically necessary equipment that assists patients in managing health conditions. Understanding the documentation required is essential for obtaining this coverage efficiently.

- Physician's Prescription - A formal order from a licensed healthcare provider specifying the required DME and medical necessity.

- Medical Records - Detailed patient history and clinical notes supporting the need for the equipment.

- Insurance Claim Form - Properly completed forms submitted to the insurer for coverage approval.

Accurate and complete documentation expedites the approval process and ensures proper reimbursement for Durable Medical Equipment.

Definition and Types of Durable Medical Equipment

| Topic | Details |

|---|---|

| Definition of Durable Medical Equipment (DME) | Durable Medical Equipment refers to medical devices and equipment prescribed by a healthcare provider for long-term use. These items assist individuals with medical conditions or disabilities in performing daily activities or managing health more effectively. DME must be reusable, medically necessary, and suitable for home use. |

| Types of Durable Medical Equipment |

|

| Required Documents for DME Coverage | You will need a valid prescription from your healthcare provider specifying the type and necessity of the equipment. Additional documentation may include medical records, proof of medical condition, and prior authorization forms depending on your insurance provider's requirements. Detailed invoices and billing statements might also be necessary for claim processing. |

Eligibility Criteria for DME Insurance Coverage

Durable Medical Equipment (DME) coverage requires specific documentation to verify eligibility. These documents ensure that the equipment is medically necessary and appropriate for the patient's condition.

Primary documents include a detailed prescription or written order from a licensed healthcare provider specifying the type and duration of the required equipment. Medical records supporting the diagnosis and the need for the equipment are essential to confirm eligibility criteria. Proof of insurance coverage and authorization forms may also be required to process DME claims efficiently.

Essential Documentation for DME Claims

Essential documentation for Durable Medical Equipment (DME) coverage includes a detailed prescription from a licensed healthcare provider specifying the equipment type and medical necessity. Medical records supporting the diagnosis and demonstrating the need for the equipment are crucial for claim approval. You must also provide a completed DME claim form and proof of prior authorization when required by the insurance plan.

Physician’s Prescription and Medical Necessity Statement

Durable Medical Equipment (DME) coverage requires specific documentation to ensure approval. A Physician's Prescription is essential, detailing the type of equipment needed for your health condition.

The Medical Necessity Statement must clearly explain why the equipment is required based on your medical diagnosis. These documents demonstrate the necessity for the equipment and support insurance claims effectively.

Detailed Patient Medical History Requirements

Detailed patient medical history is critical for securing durable medical equipment (DME) coverage. Insurance providers require comprehensive documentation to evaluate the necessity and appropriateness of the requested equipment.

- Diagnosis Records - Precise medical diagnoses related to the patient's condition are necessary to justify the equipment's use.

- Treatment History - Documentation of previous and ongoing treatments helps demonstrate the need for durable medical equipment.

- Functional Limitations - Detailed reports on how the medical condition affects daily activities support the coverage request.

Insurance Pre-Authorization Process for DME

What documents are required for durable medical equipment (DME) coverage through the insurance pre-authorization process? Insurance companies typically require a physician's prescription and a detailed medical necessity form. These documents demonstrate the need for DME and ensure coverage approval.

Supplier Documentation and Accreditation Needs

Durable Medical Equipment (DME) coverage requires detailed supplier documentation to ensure compliance with insurance and Medicare regulations. Your supplier must provide valid accreditation certificates, including accreditation from organizations like The Joint Commission or the Accreditation Commission for Health Care (ACHC). Proper documentation verifies the supplier's eligibility and helps secure timely coverage approval for essential medical equipment.

Common Documentation Errors and How to Avoid Them

Durable Medical Equipment (DME) coverage requires precise documentation to ensure successful claim processing. Understanding common documentation errors helps you avoid delays and denials.

- Incomplete Physician Orders - Missing signatures or dates on physician orders often cause claim rejections.

- Insufficient Medical Necessity Proof - Lack of detailed clinical notes demonstrating the need for the equipment leads to coverage denial.

- Incorrect or Missing Patient Information - Errors in patient identification details can result in processing delays or claim denials.

What Documents are Required for Durable Medical Equipment Coverage? Infographic