Submitting out-of-network insurance reimbursement claims requires specific documentation to ensure coverage and payment. Essential documents typically include the itemized medical bills detailing the services provided, the valid receipt of payment, and a completed claim form from your insurance provider. Including a detailed letter of medical necessity from your healthcare provider can further support the claim by justifying the need for out-of-network care.

What Documents Are Required for Out-of-Network Insurance Reimbursement?

| Number | Name | Description |

|---|---|---|

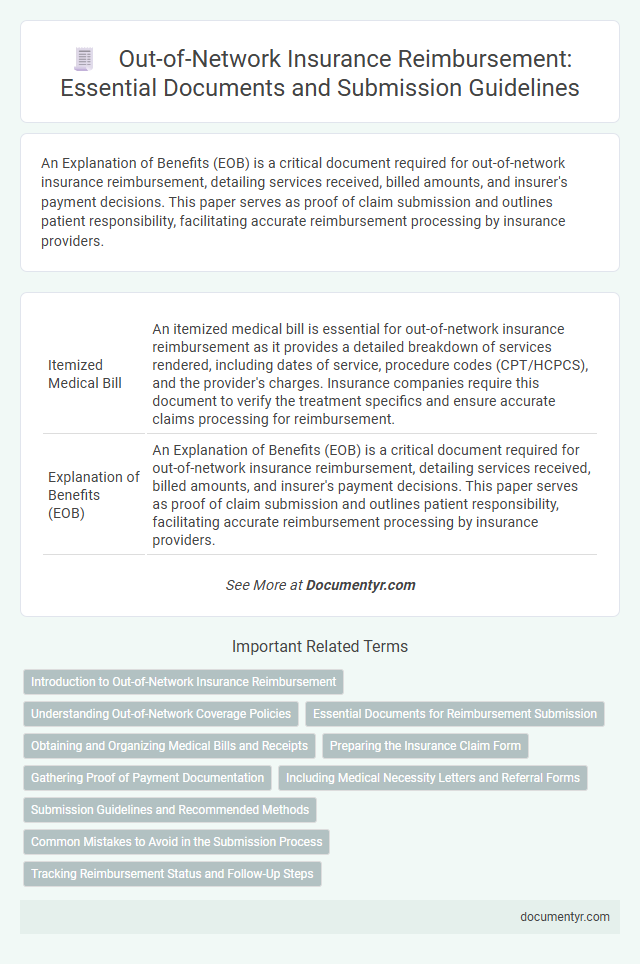

| 1 | Itemized Medical Bill | An itemized medical bill is essential for out-of-network insurance reimbursement as it provides a detailed breakdown of services rendered, including dates of service, procedure codes (CPT/HCPCS), and the provider's charges. Insurance companies require this document to verify the treatment specifics and ensure accurate claims processing for reimbursement. |

| 2 | Explanation of Benefits (EOB) | An Explanation of Benefits (EOB) is a critical document required for out-of-network insurance reimbursement, detailing services received, billed amounts, and insurer's payment decisions. This paper serves as proof of claim submission and outlines patient responsibility, facilitating accurate reimbursement processing by insurance providers. |

| 3 | Claim Form (Insurance Specific) | The claim form, specific to each insurance provider, is essential for out-of-network insurance reimbursement and must be accurately completed with patient information, provider details, and itemized medical services. Submitting the insurance-specific claim form ensures proper processing and increases the likelihood of timely reimbursement. |

| 4 | Proof of Payment (Receipts, Bank Statement) | For out-of-network insurance reimbursement, providing detailed proof of payment such as itemized receipts and bank statements is crucial to validate the medical expenses incurred. These documents must clearly show the date, amount paid, and service provider to ensure accurate claim processing and avoid reimbursement delays. |

| 5 | Referral or Pre-Authorization (if applicable) | Referral or pre-authorization documentation is critical for out-of-network insurance reimbursement, as many insurers require evidence of prior approval before services are rendered. Submitting a copy of the referral or pre-authorization letter ensures compliance with policy terms and facilitates timely claim processing. |

| 6 | Provider’s Tax ID Number | For out-of-network insurance reimbursement, submitting the provider's Tax ID number is essential as it verifies the healthcare provider's legal business identity with the insurer. This number ensures accurate processing of claims and helps prevent delays or denials in reimbursement. |

| 7 | Provider’s National Provider Identifier (NPI) | For out-of-network insurance reimbursement, submission of the Provider's National Provider Identifier (NPI) is essential for accurate claim processing and verification of the healthcare professional's credentials. The NPI ensures that providers are correctly identified in the insurance system, facilitating timely reimbursement for medical services delivered outside the insured network. |

| 8 | Diagnosis Codes (ICD-10) | Accurate Diagnosis Codes (ICD-10) are essential for out-of-network insurance reimbursement as they provide standardized medical classifications that justify the necessity of treatment. Submitting detailed medical records, including physician notes and test results linked to these codes, ensures proper claim processing and increases the likelihood of reimbursement approval. |

| 9 | Procedure Codes (CPT/HCPCS) | Procedure codes such as CPT (Current Procedural Terminology) and HCPCS (Healthcare Common Procedure Coding System) are essential documents for out-of-network insurance reimbursement, as they precisely identify the medical services provided. Accurate submission of these codes ensures proper processing of claims and maximizes the likelihood of receiving reimbursement from insurance providers. |

| 10 | Patient Identification Information (ID Copy) | Providing a clear copy of the patient's identification, such as a government-issued ID or insurance card, is essential for out-of-network insurance reimbursement to verify identity and match records accurately. This documentation ensures proper processing of claims by confirming the patient's eligibility and linking the services to the correct insured individual. |

| 11 | Assignment of Benefits Form (if required) | An Assignment of Benefits (AOB) form is essential for out-of-network insurance reimbursement when a patient authorizes their insurer to pay the healthcare provider directly. This document ensures that claims are processed smoothly by transferring the payment rights, minimizing out-of-pocket expenses and expediting claim settlements. |

| 12 | Letter of Medical Necessity (if requested) | A Letter of Medical Necessity (LMN) is often required for out-of-network insurance reimbursement to justify the medical need for specific treatments or services unavailable in-network. This document must be detailed, including the patient's diagnosis, treatment plan, and explanation of why in-network options are inadequate, to support claim approval. |

| 13 | Out-of-Network Waiver or Exception Request (if applicable) | Submitting an Out-of-Network Waiver or Exception Request requires detailed documentation including a physician's letter of medical necessity, proof of in-network unavailability, and the patient's insurance policy details. Accurate completion and timely submission of these documents significantly increase the likelihood of successful reimbursement for out-of-network medical services. |

Introduction to Out-of-Network Insurance Reimbursement

Out-of-network insurance reimbursement involves submitting claims for medical services received from providers not contracted with your insurance plan. Understanding the necessary documents is crucial to ensure smooth processing of your reimbursement.

You need specific paperwork to support your claim, including detailed medical bills and proof of payment. These documents verify the treatments received and help insurance companies evaluate your eligibility for reimbursement.

Understanding Out-of-Network Coverage Policies

What documents are required for out-of-network insurance reimbursement? Patients need to submit detailed medical records, itemized bills, and proof of payment to file a claim. Understanding specific coverage policies helps ensure accurate and timely reimbursement.

Essential Documents for Reimbursement Submission

Submitting an out-of-network insurance reimbursement claim requires specific essential documents to ensure prompt processing. These documents verify the medical services received and support your eligibility for reimbursement.

The primary documents include the itemized medical bill, proof of payment, and the detailed statement of services from the healthcare provider. A completed claim form provided by your insurance company is also necessary to initiate the reimbursement process.

Obtaining and Organizing Medical Bills and Receipts

Obtaining and organizing medical bills and receipts is essential for out-of-network insurance reimbursement. Gather detailed invoices from healthcare providers, including dates of service, procedure codes, and payment amounts. Maintain a systematic record of all receipts and bills to streamline the claims submission process and ensure accurate reimbursement.

Preparing the Insurance Claim Form

Preparing the insurance claim form accurately is crucial for out-of-network insurance reimbursement. Proper documentation ensures timely processing and reduces the risk of claim denial.

- Completed Claim Form - Submit the insurer's specific out-of-network claim form fully filled with patient and provider information.

- Itemized Receipts - Attach detailed receipts or invoices specifying dates of service, procedures performed, and charges incurred.

- Proof of Payment - Provide evidence of payment made to the healthcare provider, such as canceled checks or credit card statements.

Gathering Proof of Payment Documentation

To obtain out-of-network insurance reimbursement, gathering proof of payment documentation is essential. This includes receipts, invoices, and bank statements showing the transaction details.

Ensure all documents clearly display the provider's name, date of service, and amount paid. Your proof of payment must align with the insurance claim to avoid delays. Keep copies of all paperwork for your records and future correspondence with your insurance company.

Including Medical Necessity Letters and Referral Forms

Understanding the necessary documents for out-of-network insurance reimbursement is crucial for a smooth claims process. Properly prepared medical necessity letters and referral forms are often required to justify the treatment received.

- Medical Necessity Letter - This document from your healthcare provider explains why the treatment or service is essential for your health condition.

- Referral Form - A referral from your primary care physician may be needed to confirm that specialist care was approved or recommended.

- Itemized Billing Statement - Detailed billing that lists the services provided, dates, and costs helps the insurance company verify the claim.

Submission Guidelines and Recommended Methods

Out-of-network insurance reimbursement requires specific documentation, including itemized medical bills, detailed receipts, and a completed claim form. Submission guidelines often mandate that all documents be clear, legible, and accurately reflect the services provided. You should submit your claim via the insurer's preferred methods such as online portals, certified mail, or fax to ensure timely processing.

Common Mistakes to Avoid in the Submission Process

| Document Required | Description | Common Mistakes to Avoid |

|---|---|---|

| Itemized Medical Bill | Detailed invoice listing services, procedures, codes, dates, and provider information. | Submitting a summary bill instead of an itemized one; missing procedure codes or dates. |

| Proof of Payment | Receipt or bank statement showing payment made to the out-of-network provider. | Uploading unclear or incomplete proof; submitting documents without patient name or payment details. |

| Insurance Claim Form | Form provided by the insurance company, properly completed with patient and provider details. | Failing to fill all required fields; incorrect or mismatched information; missing signatures. |

| Referral or Pre-Authorization | Document from primary insurer authorizing out-of-network care, if required by the policy. | Neglecting to include referral or pre-authorization when mandatory; submitting expired documents. |

| Medical Records or Service Reports | Notes, test results, and service descriptions supporting medical necessity of treatment. | Omitting essential medical documentation; submitting incomplete or non-legible records. |

| Explanation of Benefits (EOB) | Statement from insurance explaining claim processing, payments, or denials. | Failing to attach the EOB; disregarding insurer feedback in the EOB for corrections. |

What Documents Are Required for Out-of-Network Insurance Reimbursement? Infographic