To file for unemployment benefits in California, you need to provide identification documents such as a valid government-issued ID and your Social Security number. Employment history details including recent employer information, dates of employment, and wages earned are essential to verify your claim. Additionally, bank account information is required for direct deposit of benefit payments.

What Documents Are Needed to File for Unemployment Benefits in California?

| Number | Name | Description |

|---|---|---|

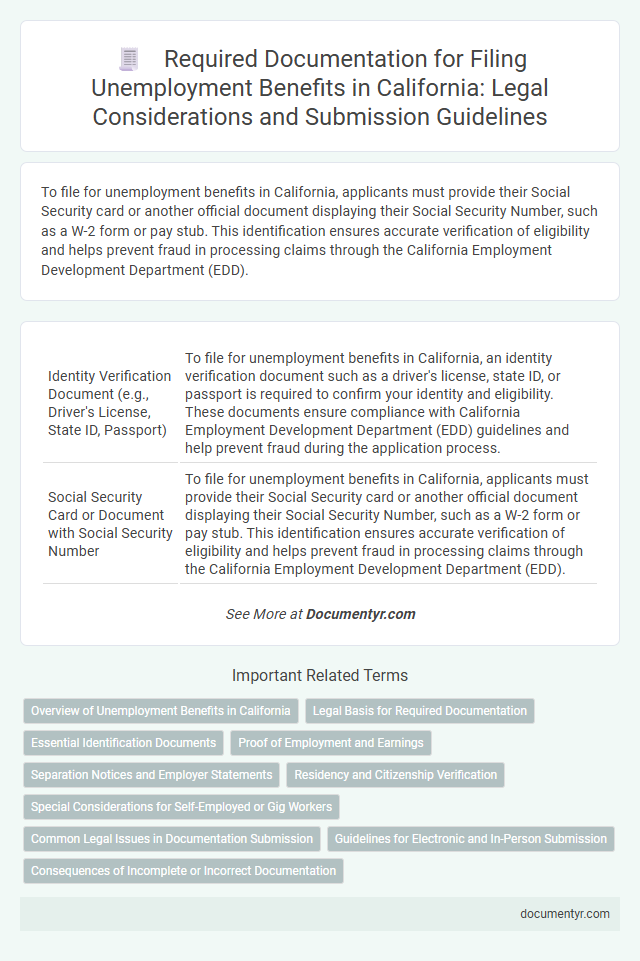

| 1 | Identity Verification Document (e.g., Driver's License, State ID, Passport) | To file for unemployment benefits in California, an identity verification document such as a driver's license, state ID, or passport is required to confirm your identity and eligibility. These documents ensure compliance with California Employment Development Department (EDD) guidelines and help prevent fraud during the application process. |

| 2 | Social Security Card or Document with Social Security Number | To file for unemployment benefits in California, applicants must provide their Social Security card or another official document displaying their Social Security Number, such as a W-2 form or pay stub. This identification ensures accurate verification of eligibility and helps prevent fraud in processing claims through the California Employment Development Department (EDD). |

| 3 | Proof of Employment (e.g., Recent Pay Stubs, W-2, 1099 Form) | To file for unemployment benefits in California, applicants must provide proof of employment such as recent pay stubs, W-2 forms, or 1099 forms to verify prior earnings and employment history. These documents help the Employment Development Department (EDD) determine eligibility and calculate benefit amounts accurately. |

| 4 | Alien Registration Number (if not a U.S. citizen) | To file for unemployment benefits in California as a non-U.S. citizen, you must provide your Alien Registration Number (A-Number) along with documentation such as your Employment Authorization Document (EAD), valid visa, or permanent resident card. These documents verify your legal work status and eligibility for benefits under California's Employment Development Department (EDD) guidelines. |

| 5 | Work Authorization Document (if applicable) | Filing for unemployment benefits in California requires submitting a valid Work Authorization Document such as an Employment Authorization Document (EAD) or valid visa to prove legal work status. The California Employment Development Department (EDD) mandates this documentation alongside proof of prior employment and identification to process claims for eligible non-citizen applicants. |

| 6 | Employer Information (e.g., Name, Address, Phone Number, Last Date of Work) | When filing for unemployment benefits in California, essential employer information includes the employer's full name, physical address, and contact phone number to verify employment details. Providing the last date of work is critical for accurate benefit eligibility and claim processing. |

| 7 | Proof of Wages (e.g., Wage Statements, Earnings Records) | Proof of wages for filing unemployment benefits in California requires wage statements such as pay stubs, W-2 forms, or earnings records from employers, confirming your income during the base period. These documents verify your employment history and earnings to determine eligibility and benefit amounts under California's Employment Development Department (EDD) guidelines. |

| 8 | Bank Account Information (for Direct Deposit) | When filing for unemployment benefits in California, providing accurate bank account information is essential for setting up direct deposit payments, which ensures faster and more secure receipt of funds. Claimants must supply their bank's routing number and their personal account number to avoid delays in benefit disbursement. |

| 9 | Separation Notice or Letter from Employer (if available) | A Separation Notice or Letter from the Employer, detailing reasons for job termination and separation date, is crucial when filing for unemployment benefits in California as it verifies employment status and supports your claim. Submitting this document expedites the processing of your application by providing the California Employment Development Department (EDD) with essential information about your job separation. |

| 10 | Union Membership Card (if applicable) | A Union Membership Card may be required to verify your employment status and union affiliation when filing for unemployment benefits in California, ensuring eligibility under union-negotiated terms. Providing this card along with your Social Security number, proof of income, and employer information facilitates a smoother claims process with the California Employment Development Department (EDD). |

Overview of Unemployment Benefits in California

Unemployment benefits in California provide financial assistance to workers who have lost their jobs through no fault of their own. The program aims to support individuals during periods of unemployment while they seek new employment opportunities.

- Eligibility Requirements - Applicants must have earned sufficient wages in their base period and be actively seeking work to qualify for benefits.

- Benefit Amount - Weekly payment amounts vary based on previous earnings, with a maximum set by the California Employment Development Department (EDD).

- Filing Process - Claimants need to submit specific documents such as proof of identity, employment history, and separation details when applying for benefits.

Legal Basis for Required Documentation

Filing for unemployment benefits in California requires specific documents mandated by state law to verify eligibility and identity. The California Employment Development Department enforces these documentation requirements under the Unemployment Insurance Code.

- Proof of Identity - Legal statutes demand valid government-issued identification such as a driver's license or passport to confirm your identity.

- Employment History - Employers must provide detailed wage and separation information in compliance with California Labor Code to establish your work history and reason for unemployment.

- Social Security Number - Submission of a valid Social Security number is essential under federal and state regulations to track benefit claims and tax information.

Essential Identification Documents

Filing for unemployment benefits in California requires specific essential identification documents to verify your identity and eligibility. Providing accurate documentation helps ensure timely processing of your claim.

- Valid Government-Issued ID - A California driver's license, state ID card, or U.S. passport is needed to confirm your identity.

- Social Security Number (SSN) - Your SSN is required for identity verification and to cross-check employment records.

- Proof of California Residency - Documents such as a utility bill or rental agreement with your name and address establish your state residency.

Having these essential identification documents ready will streamline your unemployment benefits application process in California.

Proof of Employment and Earnings

| Document Type | Description | Purpose |

|---|---|---|

| Proof of Employment | Recent pay stubs or employment verification letters from former employers | Confirms your prior employment history and employer details required for claim validation |

| W-2 Forms | Wage and Tax Statement from the previous tax year(s) | Verifies total earnings reported to the IRS, supporting the claim of earned income |

| Form 1099 | 1099-MISC or 1099-NEC forms if you were an independent contractor or freelancer | Documents non-employee earnings necessary for benefit calculation |

| Pay stubs | Detailed pay statements showing wages earned and hours worked | Demonstrates recent earnings and employment period to determine eligibility |

| Employer's Contact Information | Name, address, and phone number of all employers in the past 18 months | Required for the California Employment Development Department (EDD) to verify employment |

Separation Notices and Employer Statements

Separation notices and employer statements are crucial documents required to file for unemployment benefits in California. These documents provide proof of employment termination and detail the reasons for separation, which the Employment Development Department uses to determine eligibility. Ensure you have these records ready to support your application and expedite the claims process.

Residency and Citizenship Verification

To file for unemployment benefits in California, verifying your residency and citizenship is essential. You must provide documents that prove you live in California and are legally allowed to work in the United States.

Acceptable residency documents include a California driver's license, utility bills, or rental agreements. Citizenship verification can be established with a U.S. passport, birth certificate, or permanent resident card.

Special Considerations for Self-Employed or Gig Workers

Filing for unemployment benefits in California requires key documents such as your Social Security number, proof of employment, and income statements. Self-employed or gig workers must provide additional evidence like tax returns, 1099 forms, and bank statements to verify earnings. These special considerations help accurately assess eligibility and benefit amounts for non-traditional workers.

Common Legal Issues in Documentation Submission

Filing for unemployment benefits in California requires submitting specific documents to verify identity, employment history, and eligibility. Common documents include a government-issued photo ID, Social Security number, and recent pay stubs or W-2 forms.

Legal issues often arise from incomplete or inaccurate documentation, leading to claim delays or denials. Discrepancies in employer information or missing proof of income can trigger audits or requests for additional documents. Claimants must ensure all paperwork is accurate and consistent to avoid complications during the review process.

Guidelines for Electronic and In-Person Submission

What documents are needed to file for unemployment benefits in California? Claimants must provide proof of identity, recent work history, and earnings records. These documents include a government-issued ID, Social Security number, and employer details.

How should these documents be submitted when filing for unemployment benefits in California? The Employment Development Department (EDD) allows electronic submission via their online portal for faster processing. In-person submissions are accepted at local EDD offices but require appointments and adherence to COVID-19 safety protocols.

Are there specific guidelines for electronic document uploads when applying for California unemployment benefits? Uploaded files should be in accepted formats such as PDF, JPEG, or PNG and must be clear and legible for verification. Large files or poor image quality can delay claim approval.

What should applicants expect during in-person document submission for California unemployment claims? Applicants need to bring original documents or certified copies for verification by EDD staff. Masks and social distancing measures may be enforced depending on current health guidelines.

What Documents Are Needed to File for Unemployment Benefits in California? Infographic