Forming an LLC requires filing the Articles of Organization with the state, which outlines the company's basic information such as name, address, and members. An Operating Agreement, though not always mandatory, is crucial for defining the management structure and ownership roles. Obtaining an Employer Identification Number (EIN) from the IRS is necessary for tax purposes and opening a business bank account.

What Documents are Required for an LLC Formation?

| Number | Name | Description |

|---|---|---|

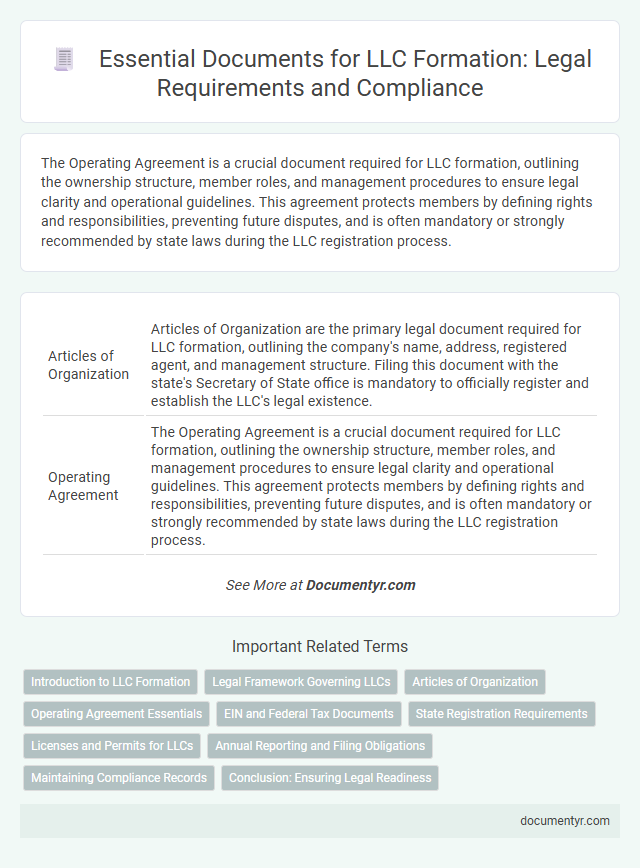

| 1 | Articles of Organization | Articles of Organization are the primary legal document required for LLC formation, outlining the company's name, address, registered agent, and management structure. Filing this document with the state's Secretary of State office is mandatory to officially register and establish the LLC's legal existence. |

| 2 | Operating Agreement | The Operating Agreement is a crucial document required for LLC formation, outlining the ownership structure, member roles, and management procedures to ensure legal clarity and operational guidelines. This agreement protects members by defining rights and responsibilities, preventing future disputes, and is often mandatory or strongly recommended by state laws during the LLC registration process. |

| 3 | Member/Manager Resolutions | Member/Manager resolutions are essential documents in LLC formation that outline decisions regarding management structure, member roles, and key operational policies. These resolutions serve as formal records approving initial business actions, such as appointing managers, authorizing bank accounts, and adopting the operating agreement, ensuring legal compliance and internal governance clarity. |

| 4 | Certificate of Organization | The Certificate of Organization is a crucial document required for forming an LLC, serving as the official filing that establishes the company's existence with the state. This document typically includes important information such as the LLC's name, registered agent, business address, and management structure, ensuring compliance with state regulations. |

| 5 | EIN (Employer Identification Number) Application | An EIN (Employer Identification Number) application requires submitting Form SS-4 to the IRS, which includes the LLC's legal name, address, and responsible party's Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN). This identification number is essential for opening business bank accounts, filing taxes, and hiring employees under the LLC structure. |

| 6 | Initial Report/Statement of Information | The Initial Report or Statement of Information is a mandatory document required during the LLC formation process, providing essential details such as the LLC's registered agent, management structure, and primary business address. Filing this document with the state ensures compliance with statutory regulations and facilitates official communication. |

| 7 | Name Reservation Application | The Name Reservation Application is a crucial document required for LLC formation, ensuring the desired business name is unique and compliant with state regulations. This application typically includes the proposed LLC name, the applicant's contact information, and a reservation fee, protecting the name for a specified period during the registration process. |

| 8 | Registered Agent Consent Form | The Registered Agent Consent Form is a crucial document required for LLC formation, as it confirms the designated agent's agreement to receive legal and tax documents on behalf of the company. This form ensures compliance with state regulations by officially appointing a registered agent with a physical address within the state of LLC registration. |

| 9 | Business License Application | A business license application for LLC formation typically requires the Articles of Organization, operating agreement, federal Employer Identification Number (EIN), and proof of registered agent appointment. State-specific forms, identification documents of LLC members, and applicable fees must also be submitted to comply with local government regulations. |

| 10 | Publication Affidavit (if required) | A Publication Affidavit is a legal document required in certain states to confirm that a newly formed LLC has published a notice of its formation in designated local newspapers for a specified period, ensuring public awareness and transparency. This affidavit must be submitted to the state's business filing agency as proof of compliance with publication laws to complete the LLC formation process. |

| 11 | IRS Form SS-4 | To form an LLC and obtain an Employer Identification Number (EIN), submitting IRS Form SS-4 is essential for tax identification and compliance purposes. This form collects critical details about the LLC's structure, ownership, and business operations required by the Internal Revenue Service. |

| 12 | State Tax Registration Forms | State tax registration forms for LLC formation typically include the Employer Identification Number (EIN) application, state-specific tax registration certificates, and sales tax permits required by the Department of Revenue. These documents ensure the LLC complies with state tax obligations, enabling proper payroll tax withholding, sales tax collection, and income tax reporting. |

| 13 | Professional Licenses (if applicable) | Professional licenses must be submitted during LLC formation if the business involves regulated professions such as healthcare, law, or engineering, ensuring compliance with state-specific licensing boards. Failure to provide valid professional licenses can result in delayed approval or denial of the LLC registration by the Secretary of State. |

| 14 | Foreign LLC Registration (if operating out-of-state) | Foreign LLC registration requires submitting a Certificate of Authority or Foreign Qualification along with a certified copy of the original Articles of Organization from the home state, a completed application form, and payment of state-specific filing fees. Additional documentation may include a registered agent designation and proof of good standing from the LLC's formation state. |

| 15 | Franchise Tax Registration | Franchise tax registration for LLC formation requires submitting the Certificate of Formation and completing the Franchise Tax Account registration with the state tax authority. Essential documents include the Articles of Organization, a completed Franchise Tax Report, and payment of the initial franchise tax fee. |

Introduction to LLC Formation

| Document | Description | Purpose |

|---|---|---|

| Articles of Organization | Legal document filed with the state to officially create the LLC. | Establishes the existence of the LLC and includes basic information such as the company name, address, and registered agent. |

| Operating Agreement | Internal document outlining the management structure and operating procedures of the LLC. | Defines member roles, voting rights, profit distribution, and dispute resolution within the LLC. |

| Registered Agent Consent | Document confirming that an individual or entity agrees to act as the LLC's registered agent. | Ensures the LLC has a designated contact for receiving official state correspondence and legal documents. |

| Initial Report | State-specific filing that includes detailed information about the LLC's members and management. | Some states require this report shortly after formation to maintain updated records. |

| Employer Identification Number (EIN) Application | Form submitted to the IRS to obtain a tax identification number for the LLC. | Required for tax purposes, hiring employees, opening bank accounts, and other financial activities. |

| Business Licenses and Permits | Various documents that grant permission to legally operate in specific industries or locations. | Ensures compliance with local, state, and federal regulations relevant to the LLC's business activities. |

Legal Framework Governing LLCs

The legal framework governing LLCs varies by jurisdiction, but commonly includes state-specific statutes that outline formation requirements. Key documents must comply with these regulations to ensure lawful establishment and operation.

Articles of Organization are essential for LLC formation, serving as the primary filing with the state's business registry. An Operating Agreement is also critical to define member roles, management structure, and operational procedures.

Articles of Organization

Articles of Organization is the primary document required for forming a Limited Liability Company (LLC). This document establishes the LLC's existence by outlining its basic information and structure.

Your Articles of Organization must include the LLC's name, registered agent, business address, and management structure. Filing this document with the state is a mandatory step to legally register the LLC.

Operating Agreement Essentials

Forming an LLC requires specific documents to establish its legal and operational framework. The Operating Agreement is a crucial document that outlines the internal management and member responsibilities of the LLC.

- Purpose of Operating Agreement - Defines the roles, rights, and duties of members and managers within the LLC.

- Ownership Structure - Specifies each member's ownership percentage and capital contributions.

- Management and Voting Procedures - Details how decisions are made and the process for member voting.

An Operating Agreement ensures clarity in operations and helps prevent disputes among LLC members.

EIN and Federal Tax Documents

Forming an LLC requires several critical documents, with a strong emphasis on obtaining an Employer Identification Number (EIN) and preparing federal tax documents. These elements ensure legal compliance and facilitate the company's tax responsibilities.

- Employer Identification Number (EIN) - A unique nine-digit number issued by the IRS used to identify the LLC for tax purposes.

- IRS Form SS-4 - The application form submitted to obtain an EIN from the Internal Revenue Service.

- Federal Tax Classification Documents - Documentation that defines the LLC's tax status, such as choosing to be taxed as a sole proprietorship, partnership, or corporation.

State Registration Requirements

State registration requirements for LLC formation vary but commonly include filing the Articles of Organization with the Secretary of State. You must provide the LLC name, registered agent information, and the principal business address. Some states also require an Operating Agreement and an Employer Identification Number (EIN) for official compliance.

Licenses and Permits for LLCs

What licenses and permits are required for LLC formation? Obtaining the correct licenses and permits is essential to legally operate your LLC. The specific requirements depend on your business type and location, covering federal, state, and local regulations.

Annual Reporting and Filing Obligations

Forming an LLC involves submitting several essential documents, with annual reporting and filing obligations being critical for maintaining good standing. Understanding these requirements helps ensure compliance and avoids penalties or administrative dissolution.

- Articles of Organization - This foundational document officially registers the LLC with the state and outlines its basic structure.

- Annual Report - Most states require LLCs to file an annual report that updates ownership and contact information, along with paying a filing fee.

- State-Specific Compliance Filings - Certain states mandate additional reports or renewals, such as franchise tax returns or biennial statements, to maintain active LLC status.

Maintaining Compliance Records

Forming an LLC requires several key documents, including the Articles of Organization, Operating Agreement, and Employer Identification Number (EIN). Maintaining compliance records is essential to ensure your LLC meets state regulations and remains in good standing. Regularly updating meeting minutes, ownership changes, and annual reports supports ongoing legal compliance and protects your business interests.

What Documents are Required for an LLC Formation? Infographic