Lenders typically require proof of income, such as recent pay stubs, tax returns, and W-2 forms, to verify your financial stability during a mortgage loan application. You must also provide identification documents like a valid driver's license or passport to confirm your identity. Additionally, documents related to your assets, debts, and credit history are essential to assess your ability to repay the loan.

What Documents Are Required for a Mortgage Loan Application?

| Number | Name | Description |

|---|---|---|

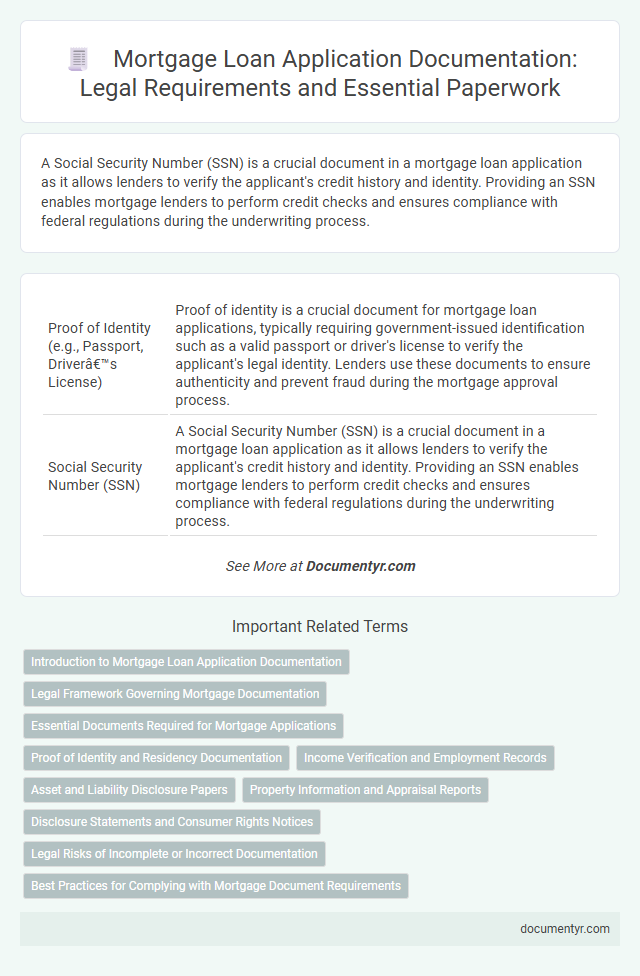

| 1 | Proof of Identity (e.g., Passport, Driver’s License) | Proof of identity is a crucial document for mortgage loan applications, typically requiring government-issued identification such as a valid passport or driver's license to verify the applicant's legal identity. Lenders use these documents to ensure authenticity and prevent fraud during the mortgage approval process. |

| 2 | Social Security Number (SSN) | A Social Security Number (SSN) is a crucial document in a mortgage loan application as it allows lenders to verify the applicant's credit history and identity. Providing an SSN enables mortgage lenders to perform credit checks and ensures compliance with federal regulations during the underwriting process. |

| 3 | Proof of Income (e.g., Pay Stubs, W-2 Forms) | Proof of income is a critical component of a mortgage loan application, typically requiring recent pay stubs covering at least 30 days and W-2 forms from the past two years to verify consistent earnings. Lenders may also request additional documentation such as tax returns, profit and loss statements for self-employed applicants, or Social Security and pension income statements to ensure accurate income assessment. |

| 4 | Tax Returns (2 Years) | Mortgage loan applications require tax returns from the past two years to verify the applicant's income and ensure financial stability, providing detailed documentation such as W-2 forms, 1099s, and any additional income sources reported to the IRS. Lenders use these tax returns to assess consistent earnings, evaluate debt-to-income ratios, and confirm the accuracy of the financial information submitted in the application. |

| 5 | Bank Statements (2-3 Months) | Bank statements from the past 2-3 months are essential for a mortgage loan application as they provide verifiable proof of consistent income, spending habits, and financial stability. Lenders analyze these documents to assess the applicant's ability to manage monthly mortgage payments and detect any irregularities or undisclosed debts. |

| 6 | Employment Verification Letter | An Employment Verification Letter is a crucial document for a mortgage loan application, confirming the applicant's current job status, income, and tenure with the employer. Lenders rely on this letter to assess financial stability and ensure the borrower has a reliable source of income to repay the mortgage. |

| 7 | Credit Report Authorization | A mortgage loan application requires a credit report authorization to enable lenders to assess the applicant's credit history and financial responsibility accurately. This document grants permission for the lender to access credit bureaus, ensuring thorough evaluation of credit scores, outstanding debts, and payment history essential for loan approval. |

| 8 | Asset Statements (e.g., Retirement, Investment Accounts) | Asset statements, including retirement and investment account statements, are critical documents in mortgage loan applications as they verify the borrower's financial stability and liquid assets. Lenders analyze detailed records such as 401(k), IRA balances, brokerage account statements, and recent transaction histories to assess the applicant's ability to cover down payments, closing costs, and reserves. |

| 9 | Debt/Loan Statements | Debt and loan statements, including recent credit card balances, auto loans, student loans, and personal loans, are essential for mortgage loan applications to verify the applicant's outstanding obligations. Lenders use these documents to assess debt-to-income ratios and evaluate overall financial responsibility. |

| 10 | Purchase Agreement or Sales Contract | The Purchase Agreement or Sales Contract serves as a critical document in a mortgage loan application, detailing the terms, property description, and agreed purchase price essential for lender evaluation. This contract verifies the buyer's commitment and enables the lender to assess the property's eligibility and compliance with loan conditions. |

| 11 | Gift Letter (if applicable) | A Gift Letter is required when funds for a mortgage down payment originate from a gift, confirming the money is a non-repayable gift from a relative or eligible donor. This document must include the donor's name, relationship to the borrower, gift amount, and a statement that repayment is not expected, ensuring compliance with lender and underwriting guidelines. |

| 12 | Rental History or Lease Agreement | Rental history or a signed lease agreement is essential in a mortgage loan application to demonstrate consistent housing payments and establish creditworthiness. Lenders require these documents to verify your rental payment record, ensuring financial reliability and stability before approving the mortgage. |

| 13 | Proof of Down Payment Funds | Proof of down payment funds for a mortgage loan application typically includes bank statements, gift letters, or investment account statements showing the availability and source of the funds. Lenders require these documents to verify that the borrower has legitimate and sufficient funds to cover the required down payment. |

| 14 | Homeowners Insurance Information | Mortgage loan applications require detailed homeowners insurance information, including the insurance policy declarations page, proof of premium payment, coverage limits, and the insurer's contact details. Lenders must verify this documentation to ensure adequate property protection and compliance with loan conditions. |

| 15 | Divorce Decree (if applicable) | A Divorce Decree is a critical document in a mortgage loan application when applicable, as it provides proof of legal separation and outlines financial responsibilities such as alimony or child support that may impact debt-to-income ratios. Lenders require this document to accurately assess borrower's financial obligations and ensure compliance with loan qualification criteria. |

| 16 | Bankruptcy/Foreclosure Documents (if applicable) | Bankruptcy and foreclosure documents required for a mortgage loan application typically include discharge papers, schedules of assets and liabilities, court orders, and statements explaining the circumstances and resolution of the financial distress. Providing these documents helps lenders assess credit risk and verify the applicant's financial rehabilitation and stability post-bankruptcy or foreclosure. |

| 17 | Self-Employment Documentation (e.g., Profit & Loss Statement, 1099s) | Lenders require self-employed mortgage applicants to provide comprehensive documentation, including a detailed Profit & Loss Statement and copies of 1099 forms to verify income consistency and business profitability. These documents help underwriters assess financial stability and ensure compliance with loan qualification criteria. |

| 18 | Residence History (Previous Addresses) | Mortgage lenders typically require a detailed residence history for the past two to three years, including previous addresses with corresponding dates of occupancy to verify stability and identity. Providing accurate documentation such as lease agreements, utility bills, or prior mortgage statements helps expedite the application process and ensures compliance with underwriting standards. |

| 19 | Letter of Explanation (if required) | A Letter of Explanation is often required during a mortgage loan application to clarify discrepancies or unusual circumstances in an applicant's credit report, employment history, or financial documentation. This document provides lenders with detailed context to assess risk and verify the accuracy of the information submitted. |

Introduction to Mortgage Loan Application Documentation

Applying for a mortgage loan involves submitting various essential documents that verify your financial status and identity. Understanding these documentation requirements streamlines the approval process and ensures compliance with lending regulations.

- Proof of Income - Documents like pay stubs, tax returns, and W-2 forms demonstrate your ability to repay the loan.

- Credit History - Credit reports provide lenders with insight into your financial reliability and past borrowing behavior.

- Identification Verification - Government-issued IDs confirm your identity and legal eligibility for the mortgage application.

Legal Framework Governing Mortgage Documentation

Understanding the legal framework governing mortgage documentation is crucial for a successful loan application. You must comply with specific legal requirements to ensure all submitted documents are valid and enforceable.

- Title Deed Verification - This document establishes property ownership and is legally required to secure a mortgage.

- Income Proof Compliance - Legal standards mandate the provision of accurate income statements to assess repayment ability.

- Disclosure Statements - Laws require lenders to provide complete disclosure of loan terms, ensuring transparency and borrower protection.

Essential Documents Required for Mortgage Applications

Applying for a mortgage loan requires submitting specific essential documents to verify financial stability and identity. These documents ensure lenders assess the applicant's ability to repay the loan accurately.

- Proof of Income - Includes recent pay stubs, tax returns, and W-2 forms to demonstrate consistent earnings.

- Credit Report - Provides detailed credit history and credit score to evaluate borrowing reliability.

- Identification Documents - Typically a government-issued ID and Social Security number to confirm the applicant's identity.

Submitting these core documents expedites the mortgage approval process and reduces potential delays.

Proof of Identity and Residency Documentation

What proof of identity is required for a mortgage loan application? Typically, you must provide a valid government-issued photo ID such as a passport or driver's license. These documents verify your identity and prevent fraud during the loan process.

What residency documentation do lenders require for mortgage applications? Lenders often ask for utility bills, lease agreements, or property tax statements to confirm your current address. Providing accurate residency proof helps establish stability and eligibility for the loan.

Income Verification and Employment Records

Income verification and employment records are essential documents required for a mortgage loan application. Lenders use these documents to assess your ability to repay the loan.

Common income verification documents include recent pay stubs, W-2 forms, and tax returns. Employment records such as an employment verification letter or contact information for your employer help confirm job stability.

Asset and Liability Disclosure Papers

Asset and liability disclosure papers are critical documents required for a mortgage loan application. These papers provide a detailed overview of your financial position, including bank statements, investment accounts, and outstanding debts.

Mortgage lenders use asset disclosures to verify your ability to cover the down payment and closing costs. Liability disclosures help assess your debt-to-income ratio, affecting loan approval and terms. Accurate and up-to-date documentation ensures a smoother application process.

Property Information and Appraisal Reports

Property information is crucial for a mortgage loan application, including the property's address, legal description, and purchase agreement details. Lenders require an appraisal report to verify the property's market value and ensure it meets loan criteria. The appraisal must be conducted by a certified appraiser and typically includes a detailed analysis of the property's condition and comparable sales data.

Disclosure Statements and Consumer Rights Notices

Disclosure statements are essential documents in a mortgage loan application, providing transparent information about loan terms, fees, and borrower obligations. Consumer rights notices inform applicants of their legal protections and rights during the mortgage process, ensuring informed decision-making. Lenders must supply these documents to comply with federal regulations and promote ethical lending practices.

Legal Risks of Incomplete or Incorrect Documentation

Submitting a mortgage loan application requires precise documentation such as proof of income, identification, credit history, and property details. These documents establish your financial stability and legal eligibility for the loan.

Incomplete or incorrect documentation can lead to delays, loan denial, or even legal repercussions. Ensuring accuracy protects you from potential fraud allegations and compliance issues with lending regulations.

What Documents Are Required for a Mortgage Loan Application? Infographic