A mortgage application requires essential documents such as proof of income, including recent pay stubs, tax returns, and bank statements, to verify financial stability. Identification documents like a valid driver's license or passport confirm the applicant's identity, while credit reports help lenders assess creditworthiness. Additionally, property-related documents such as the purchase agreement and appraisal report are critical to determine the loan amount and property value.

What Documents are Necessary for a Mortgage Application?

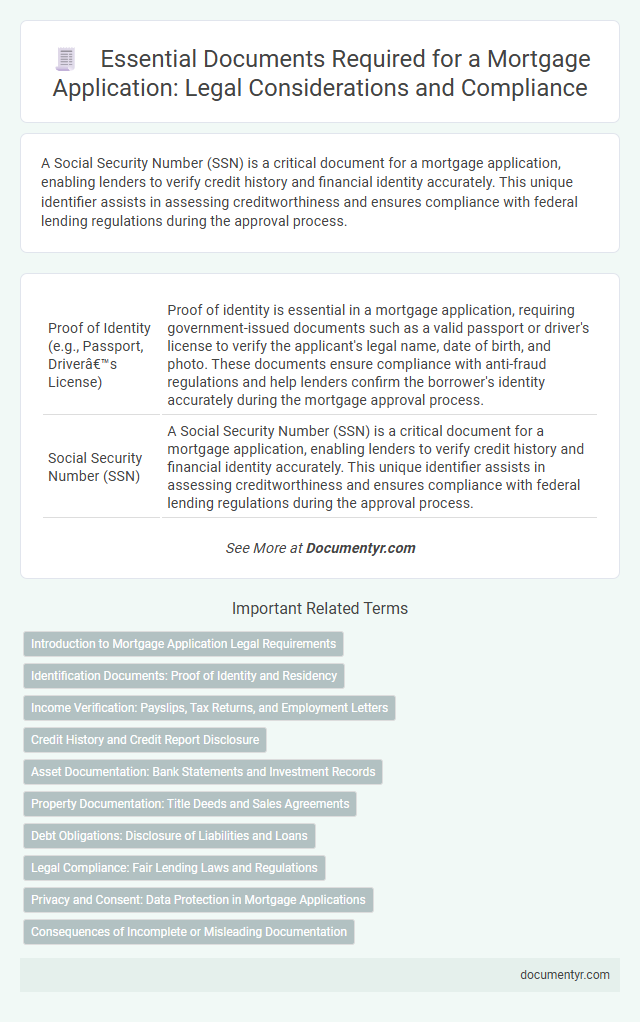

| Number | Name | Description |

|---|---|---|

| 1 | Proof of Identity (e.g., Passport, Driver’s License) | Proof of identity is essential in a mortgage application, requiring government-issued documents such as a valid passport or driver's license to verify the applicant's legal name, date of birth, and photo. These documents ensure compliance with anti-fraud regulations and help lenders confirm the borrower's identity accurately during the mortgage approval process. |

| 2 | Social Security Number (SSN) | A Social Security Number (SSN) is a critical document for a mortgage application, enabling lenders to verify credit history and financial identity accurately. This unique identifier assists in assessing creditworthiness and ensures compliance with federal lending regulations during the approval process. |

| 3 | Proof of Legal Residency (if applicable) | Proof of legal residency is essential for a mortgage application and typically includes documents such as a valid visa, permanent resident card, or naturalization certificate, demonstrating lawful presence in the country. Lenders require this verification to ensure compliance with immigration laws and confirm the borrower's eligibility for a mortgage loan. |

| 4 | Recent Pay Stubs | Recent pay stubs provide lenders with up-to-date evidence of your income, verifying your employment status and financial stability as part of the mortgage application process. These documents typically cover the last 30 days and are crucial for assessing your ability to meet monthly mortgage payments. |

| 5 | W-2 Forms (last 2 years) | Lenders require W-2 forms from the last two years to verify consistent income and employment stability during the mortgage application process. These documents provide essential proof of wages earned, helping to assess the borrower's ability to repay the loan. |

| 6 | Tax Returns (last 2 years) | Tax returns for the last two years are essential in a mortgage application as they provide detailed income verification and help lenders assess financial stability and repayment capability. These documents must include all schedules and W-2 forms to ensure comprehensive income evaluation. |

| 7 | Bank Statements (last 2-3 months) | Bank statements from the last 2-3 months are essential for a mortgage application as they verify income stability, track regular expenses, and identify any outstanding debts, providing lenders with a clear financial snapshot. These documents help confirm the borrower's ability to manage monthly payments and assess overall financial health during the loan approval process. |

| 8 | Employment Verification Letter | An Employment Verification Letter is a critical document for a mortgage application, confirming the applicant's current employment status, job title, and income. Lenders use this letter to assess financial stability and ensure the borrower's ability to repay the mortgage loan. |

| 9 | Proof of Additional Income (e.g., bonuses, alimony, child support) | Proof of additional income for a mortgage application requires documents such as recent pay stubs showing bonuses, court orders or legal agreements for alimony and child support, as well as bank statements or tax returns verifying consistent receipt. Lenders often require at least two years of documented income history to assess stability and eligibility accurately. |

| 10 | Asset Statements (e.g., retirement, investment accounts) | Asset statements, including retirement accounts like 401(k)s and IRAs, as well as investment accounts such as stocks and mutual funds, are essential documents for mortgage applications to verify financial stability and liquidity. Lenders require detailed statements typically covering the last two to three months to assess the applicant's ability to cover down payments and closing costs. |

| 11 | Debt Statements (e.g., credit cards, loans) | Debt statements, including recent credit card bills and loan statements, are essential documents in a mortgage application as they provide a clear record of existing liabilities and monthly obligations. Lenders analyze these statements to assess debt-to-income ratio, ensuring applicants have the financial capacity to manage new mortgage payments alongside current debts. |

| 12 | Credit Report | A credit report is a crucial document for a mortgage application, providing lenders with a detailed history of your credit behavior, including payment history, outstanding debts, and credit inquiries. This report allows mortgage lenders to assess your creditworthiness and the risk involved in approving your loan. |

| 13 | Purchase Agreement (if available) | A Purchase Agreement is a critical document in a mortgage application, detailing the terms and conditions of the property sale, including the purchase price and contingencies, providing lenders with proof of the transaction's legitimacy. Alongside income verification and credit reports, the Purchase Agreement helps underwriters assess risk and determine loan approval. |

| 14 | Gift Letter (if using gift funds) | A Gift Letter is a crucial document when using gift funds for a mortgage application, verifying that the money provided is a gift and not a loan that requires repayment. This letter must include the donor's name, address, relationship to the borrower, the exact gift amount, and a statement confirming no repayment is expected, ensuring compliance with lender requirements. |

| 15 | Rental History or Landlord Reference | Mortgage applications typically require a detailed rental history or a landlord reference to verify consistent payment behavior and tenant reliability. This documentation often includes previous lease agreements, rent payment receipts, and contact information for landlords to confirm timely occupancy and financial responsibility. |

| 16 | Divorce Decree (if applicable) | A Divorce Decree is essential for mortgage applications when applicable, as it verifies changes in financial obligations and property ownership that impact loan eligibility. Lenders use this document to assess alimony, child support payments, and asset division, ensuring accurate evaluation of the applicant's financial status. |

| 17 | Bankruptcy Discharge Papers (if applicable) | Bankruptcy discharge papers are essential for mortgage applications as they verify the legal release from debt obligations, demonstrating financial recovery and responsibility to lenders. Providing these documents, along with credit reports and income verification, helps substantiate a borrower's creditworthiness during the mortgage underwriting process. |

| 18 | Homeowners Insurance Information | Homeowners insurance information is essential for a mortgage application to demonstrate protection against property damage and liability risks, ensuring the lender's investment is secured. This includes the insurance policy declarations page, proof of payment, and contact details of the insurance provider, verifying active coverage and policy limits. |

| 19 | Proof of Down Payment | Proof of down payment for a mortgage application typically requires bank statements, gift letters, or confirmation letters from financial institutions to verify the source and availability of funds. Lenders need clear documentation to ensure the down payment complies with loan requirements and is not borrowed unlawfully. |

| 20 | Personal Identification Affidavit (if required) | A Personal Identification Affidavit may be required during a mortgage application to verify the applicant's identity when standard identification documents are unavailable or insufficient. This affidavit usually includes notarized statements confirming personal details and residency, serving as a legally recognized proof to satisfy lender requirements. |

Introduction to Mortgage Application Legal Requirements

Understanding the legal requirements for a mortgage application is crucial to ensure a smooth approval process. Gathering the appropriate documents helps verify your financial and personal information accurately.

- Proof of Identity - Valid identification such as a passport or driver's license is required to confirm your identity.

- Income Verification - Documents like pay stubs, tax returns, and employment letters are necessary to verify your financial stability.

- Credit Information - Credit reports and related statements provide insights into your creditworthiness and repayment history.

Identification Documents: Proof of Identity and Residency

Mortgage applications require essential identification documents to verify your identity and residency. Proof of identity typically includes a government-issued photo ID such as a passport or driver's license. Proof of residency can be established with utility bills or a lease agreement showing your current address.

Income Verification: Payslips, Tax Returns, and Employment Letters

Income verification is a critical part of the mortgage application process, requiring documents such as payslips, tax returns, and employment letters. These documents provide lenders with evidence of your financial stability and ability to repay the loan.

Payslips typically show your current earnings and employment status, while tax returns offer a comprehensive view of your annual income. Employment letters confirm your position and length of employment, boosting lender confidence in your application.

Credit History and Credit Report Disclosure

What documents are necessary to prove credit history for a mortgage application? Lenders require a detailed credit report to assess your financial reliability and borrowing behavior. This report includes your credit score, payment history, and outstanding debts essential for mortgage approval.

Why is credit report disclosure important in the mortgage application process? Disclosing your credit report allows lenders to verify your creditworthiness and identify any potential risks. Accurate disclosure helps streamline the approval process and ensures transparency between the borrower and lender.

Asset Documentation: Bank Statements and Investment Records

Asset documentation plays a crucial role in a mortgage application by verifying your financial stability. Bank statements provide a detailed record of your income, expenses, and saved funds over time. Investment records showcase additional financial resources, helping lenders assess your ability to repay the loan.

Property Documentation: Title Deeds and Sales Agreements

| Document Type | Description | Importance in Mortgage Application |

|---|---|---|

| Title Deeds | Title deeds prove legal ownership of the property. They contain essential information such as the property's legal description, ownership history, and any liens or encumbrances. | Title deeds confirm that the property is free from legal issues and can be used as collateral for the mortgage. Lenders require clear and undisputed title ownership to approve financing. |

| Sales Agreements | Sales agreements are contracts between the buyer and seller that outline terms and conditions of the property sale, including the purchase price, deposit, and closing date. | These documents verify the agreed purchase details and commitment to the transaction. Lenders rely on sales agreements to assess the transfer of ownership and validate the mortgage amount. |

| Ensuring You provide accurate and complete property documentation is crucial for a smooth and successful mortgage application process. | ||

Debt Obligations: Disclosure of Liabilities and Loans

When applying for a mortgage, full disclosure of all debt obligations is crucial to assess financial stability. Lenders require detailed documentation of liabilities and existing loans to evaluate credit risk accurately.

- Credit Card Debt Statements - Provide recent statements showing outstanding balances and minimum monthly payments.

- Existing Loan Agreements - Submit documentation for auto loans, personal loans, or student loans with remaining balances and payment schedules.

- Liability Disclosures - Include details of any other financial obligations such as alimony, child support, or other recurring debts.

Legal Compliance: Fair Lending Laws and Regulations

Mortgage applications require specific documents to ensure compliance with fair lending laws and regulations. These documents verify the borrower's identity, income, and financial stability to prevent discrimination and promote transparency.

Essential documents include government-issued identification, proof of income such as pay stubs or tax returns, and credit history reports. Lenders must also provide disclosures that meet the requirements outlined in the Equal Credit Opportunity Act (ECOA) and the Truth in Lending Act (TILA).

Privacy and Consent: Data Protection in Mortgage Applications

Mortgage applications require several key documents, including proof of income, identification, and credit history. Privacy and consent are critical, as sensitive personal data is collected and processed during this process.

Your data protection rights ensure that mortgage lenders must obtain explicit consent before accessing or sharing personal information. Compliance with regulations such as GDPR safeguards your privacy throughout the application. Transparent data handling procedures protect against unauthorized use or breaches.

What Documents are Necessary for a Mortgage Application? Infographic