Lenders typically require proof of identity, income verification such as recent pay stubs or tax returns, and credit history reports to assess home loan eligibility. Additional documents may include bank statements, employment verification letters, and details of existing debts or liabilities. Preparing accurate and complete documentation expedites the loan approval process and ensures compliance with regulatory requirements.

What Documents Are Needed for a Home Loan Approval?

| Number | Name | Description |

|---|---|---|

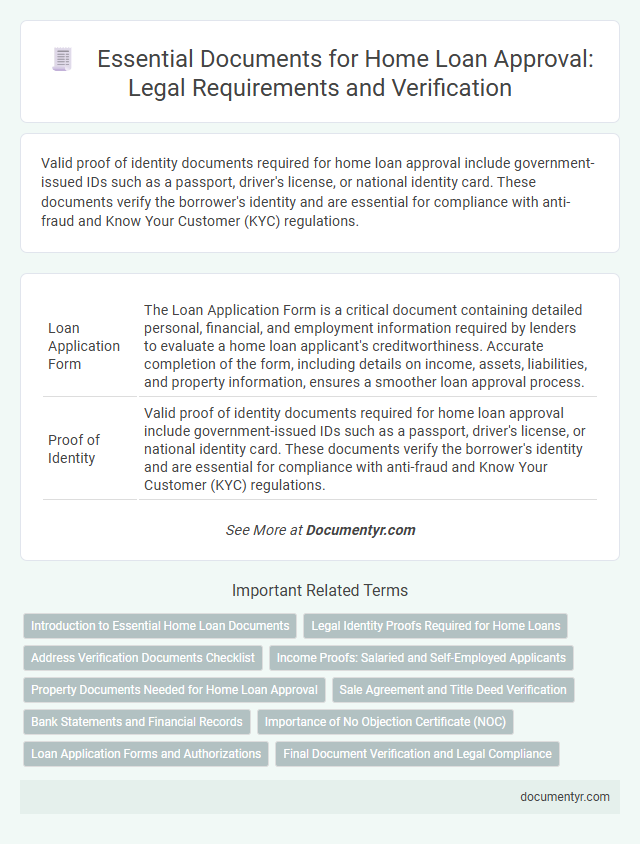

| 1 | Loan Application Form | The Loan Application Form is a critical document containing detailed personal, financial, and employment information required by lenders to evaluate a home loan applicant's creditworthiness. Accurate completion of the form, including details on income, assets, liabilities, and property information, ensures a smoother loan approval process. |

| 2 | Proof of Identity | Valid proof of identity documents required for home loan approval include government-issued IDs such as a passport, driver's license, or national identity card. These documents verify the borrower's identity and are essential for compliance with anti-fraud and Know Your Customer (KYC) regulations. |

| 3 | Proof of Address | Proof of address documents required for home loan approval typically include recent utility bills, bank statements, rental agreements, or government-issued ID cards displaying the current residential address. Lenders use these documents to verify the borrower's residence, ensuring eligibility and reducing fraud risks in the mortgage application process. |

| 4 | Proof of Income | Proof of income documents required for home loan approval typically include recent pay stubs, W-2 forms, tax returns for the last two years, and bank statements showing consistent deposits. Self-employed applicants must provide profit and loss statements, 1099 forms, and possibly business bank statements to verify stable income. |

| 5 | Salary Slips | Salary slips are essential documents for home loan approval as they provide verified proof of income and employment stability, which lenders assess to determine creditworthiness and repayment capacity. Typically, banks require the last three to six months of salary slips to evaluate the applicant's regular income flow and ensure consistent financial standing. |

| 6 | Bank Statements | Bank statements are essential for home loan approval as they provide lenders with detailed insights into the applicant's financial stability, income consistency, and spending habits over the past 3 to 6 months. These documents verify the borrower's ability to manage monthly mortgage payments by showcasing regular deposits, bill payments, and overall cash flow. |

| 7 | Income Tax Returns (ITR) | Income Tax Returns (ITR) serve as a critical document for home loan approval, providing lenders with verified proof of a borrower's income and financial stability over recent years. Submitting at least two to three years of ITR copies helps establish consistent income patterns and supports creditworthiness assessment by banks and financial institutions. |

| 8 | Form 16 | Form 16 is a critical document for home loan approval as it verifies the applicant's income and tax deductions, serving as proof of employment and financial stability. Lenders require the latest Form 16 to assess salary consistency and evaluate the borrower's repayment capacity accurately. |

| 9 | Employment Verification Letter | An employment verification letter is a critical document for home loan approval as it confirms the borrower's current job status, income, and length of employment, which lenders use to assess financial stability and repayment ability. This letter, typically provided by the employer on official letterhead and signed by an authorized representative, must clearly state the borrower's job title, salary, and employment duration. |

| 10 | Business Proof (for self-employed) | Lenders require self-employed applicants to provide comprehensive business proof, including profit and loss statements, balance sheets, and tax returns for at least the past two years to verify stable income. Additional documentation such as business registration certificates, bank statements, and client contracts may also be requested to assess financial health and business continuity. |

| 11 | Profit & Loss Statement (for self-employed) | A Profit & Loss Statement is crucial for self-employed individuals applying for a home loan, as it provides lenders with a detailed overview of income, expenses, and net profit, demonstrating financial stability. Lenders typically require this statement for at least the past two years, often accompanied by tax returns and bank statements to verify the accuracy of reported earnings. |

| 12 | Balance Sheet (for self-employed) | Self-employed individuals must provide a comprehensive balance sheet detailing assets, liabilities, and net worth to demonstrate financial stability for home loan approval. Lenders rely on this balance sheet to assess business health and repayment capacity in conjunction with tax returns and profit-and-loss statements. |

| 13 | Title Deed of Property | The Title Deed of Property is a crucial document for home loan approval as it establishes legal ownership and confirms the property is free from liens or disputes. Lenders require an original, clear, and duly registered Title Deed to verify the property's authenticity and ensure it can serve as collateral for the loan. |

| 14 | Sale Agreement | A Sale Agreement is a crucial document required for home loan approval as it confirms the terms and conditions agreed upon between the buyer and seller, including the property price, payment schedule, and possession date. Lenders review the Sale Agreement to verify property ownership, transaction legitimacy, and to assess risks before sanctioning the loan amount. |

| 15 | Property Tax Receipts | Property tax receipts are essential documents for home loan approval as they verify the applicant's ownership and confirm that property taxes are paid up to date, ensuring clear title and no outstanding dues. Lenders rely on recent property tax receipts to assess property legitimacy and reduce risk before sanctioning the loan. |

| 16 | Encumbrance Certificate | An Encumbrance Certificate is a critical document for home loan approval as it verifies the property is free from legal liabilities or mortgages, ensuring clear ownership transfer. Lenders require this certificate to assess any existing claims on the property, safeguarding their investment and confirming title clarity before sanctioning the loan. |

| 17 | Approved Building Plan | An approved building plan is essential for home loan approval as it verifies compliance with local zoning laws and construction standards, ensuring the property's legality and safety. Lenders require this document to assess the property's value and confirm that the construction project meets all regulatory approvals, reducing financial and legal risks. |

| 18 | Occupancy Certificate | An Occupancy Certificate is a vital document confirming that a property complies with all building codes and regulations, ensuring it is safe for habitation. Lenders require the Occupancy Certificate during home loan approval to verify the property's legal status and eligibility for financing. |

| 19 | NOC from Builder/Society | A No Objection Certificate (NOC) from the builder or society is a critical document required for home loan approval, confirming there are no pending dues or legal disputes related to the property. This certificate ensures the lender that the property is free from encumbrances and the ownership transfer is valid, facilitating a smoother loan sanction process. |

| 20 | Allotment Letter | The allotment letter is a crucial document for home loan approval as it verifies the buyer's allocation of a residential property from a builder or developer, establishing legal ownership rights. Lenders require this letter alongside identity proof, income statements, and property papers to assess the applicant's eligibility and the property's authenticity. |

| 21 | Power of Attorney (if applicable) | A valid Power of Attorney (POA) document is required for home loan approval when the applicant authorizes another individual to act on their behalf, ensuring legal consent for all loan-related transactions. The POA must be notarized and clearly specify the lender-related powers granted, aligning with the bank's compliance requirements to validate the loan application. |

| 22 | Passport Size Photographs | Passport size photographs are a crucial part of the home loan approval process, typically requiring two to four recent photos to verify the applicant's identity. These photographs must meet specific size and background criteria set by lending institutions to ensure they are accepted without delays. |

| 23 | PAN Card | A PAN Card is a crucial document for home loan approval as it verifies the borrower's identity and financial history with the Income Tax Department. Lenders use the PAN Card to assess creditworthiness by cross-checking income, tax returns, and preventing fraudulent applications. |

| 24 | Aadhar Card (or equivalent national ID) | Aadhar Card or an equivalent national ID is essential for home loan approval as it serves as a primary document for identity and address verification, ensuring compliance with KYC (Know Your Customer) regulations. Lenders require this document to authenticate the borrower's identity, validate residency status, and prevent fraud during the loan sanction process. |

| 25 | Credit Report | A detailed credit report is essential for home loan approval as it provides lenders with a comprehensive history of the applicant's creditworthiness, including payment history, outstanding debts, and credit inquiries. Accurate credit reports from major credit bureaus like Equifax, Experian, or TransUnion help lenders assess risk and determine loan eligibility. |

Introduction to Essential Home Loan Documents

Securing a home loan requires submitting specific legal and financial documents to verify eligibility. Understanding these essential documents streamlines the approval process and ensures compliance with lender requirements.

- Proof of Identity - Valid government-issued identification confirms your identity for legal and financial verification.

- Income Statements - Recent pay stubs, tax returns, or bank statements demonstrate your financial stability and repayment capacity.

- Property Documents - Legal papers such as the title deed and sale agreement verify the property details and ownership.

Legal Identity Proofs Required for Home Loans

Legal identity proofs are crucial for home loan approval to verify your authenticity and eligibility. Lenders require verified documents that establish your identity clearly and legally.

- Government-Issued Photo ID - Documents like a passport, driver's license, or Aadhaar card provide essential photo identification.

- PAN Card - This serves as proof of identity and is mandatory for financial transactions related to loans.

- Voter ID Card - Useful in confirming your legal identity and residency details for the loan application.

Address Verification Documents Checklist

Address verification documents are essential for home loan approval as they confirm your residential details. Commonly accepted documents include utility bills, rental agreements, passport, voter ID, and Aadhaar card. Ensure these documents are valid and updated to avoid delays in the loan processing.

Income Proofs: Salaried and Self-Employed Applicants

What income proofs are required for home loan approval for salaried applicants? Salaried individuals must provide salary slips for the last three to six months and Form 16 or income tax returns for the past two years. Bank statements showing salary credits also strengthen the verification process.

Which income documents do self-employed applicants need to submit for home loan approval? Self-employed individuals should submit profit and loss statements, balance sheets for the last two years, and income tax returns. Additional proof like GST returns or business license may be required depending on the lender's criteria.

Property Documents Needed for Home Loan Approval

Property documents play a crucial role in the approval process of a home loan. Lenders require verified ownership and legal compliance to ensure the property's legitimacy.

- Title Deed - Confirms the legal ownership of the property and is essential for verifying the seller's right to sell.

- Sale Agreement - Details the terms and conditions agreed upon by the buyer and seller for the transaction.

- Encumbrance Certificate - Certifies the property is free from any legal dues or mortgages that might affect ownership.

Ensuring these documents are accurate and complete accelerates the home loan approval process significantly.

Sale Agreement and Title Deed Verification

For home loan approval, the sale agreement is a critical document that outlines the terms and conditions agreed upon by the buyer and seller. This agreement provides proof of the transaction and ensures transparency in the property sale process.

Title deed verification confirms the legal ownership of the property and helps lenders assess any existing encumbrances or disputes. Proper verification of the title deed is essential to secure the loan and prevent future ownership issues.

Bank Statements and Financial Records

| Document Type | Purpose | Details Required |

|---|---|---|

| Bank Statements | Verify income and financial stability | Typically last 2-3 months of statements showing deposits, withdrawals, and balances |

| Financial Records | Assess overall financial health and ability to repay | Includes tax returns, pay stubs, investment statements, and proof of additional income sources |

| Additional Notes | Consistency and clarity | Your bank statements and financial records must reflect consistent income and accurate information to strengthen the home loan approval process |

Importance of No Objection Certificate (NOC)

Securing a home loan requires submitting several essential documents, including proof of identity, income statements, property papers, and the No Objection Certificate (NOC). The NOC is a crucial document that certifies the property is free from any legal disputes or claims.

The importance of the No Objection Certificate lies in its ability to assure the lender that the property has clear ownership and no pending liabilities. Without this certificate, your home loan approval process may face significant delays or rejection.

Loan Application Forms and Authorizations

Loan application forms are essential documents required for home loan approval. They provide detailed information about your financial status, employment, and personal details necessary for the lender's evaluation.

Authorizations allow the lender to verify your credit history, employment, and other relevant information. These documents give permission to access credit reports and confirm income sources. Submitting accurate and complete forms ensures a smoother loan approval process.

What Documents Are Needed for a Home Loan Approval? Infographic