To file for unemployment benefits, you need to gather essential documents including your Social Security number, recent pay stubs or proof of income, and your identification such as a driver's license or state ID. Employers' contact information and separation details like your termination letter or reason for leaving are also required. Having these documents ready ensures a smooth and timely application process for unemployment claims.

What Documents Are Needed to File for Unemployment Benefits?

| Number | Name | Description |

|---|---|---|

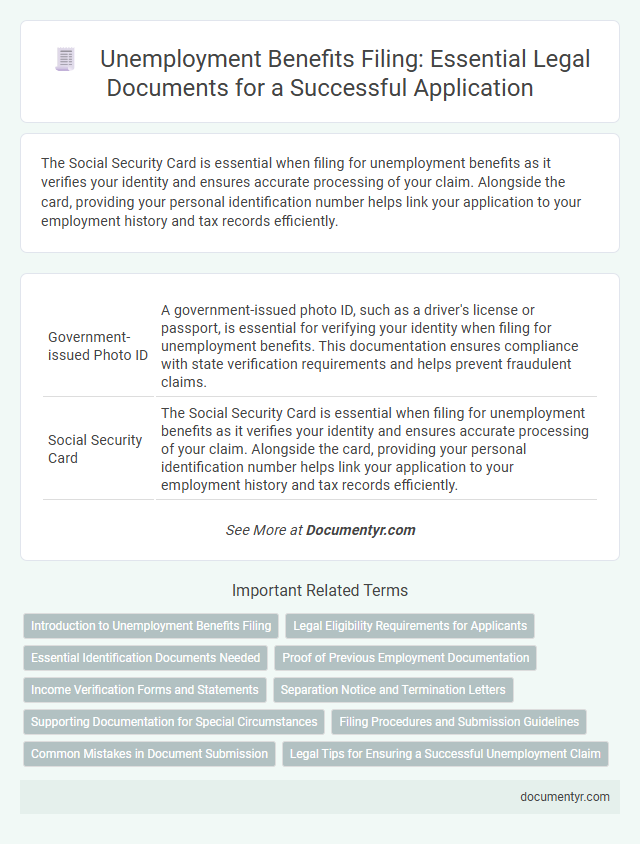

| 1 | Government-issued Photo ID | A government-issued photo ID, such as a driver's license or passport, is essential for verifying your identity when filing for unemployment benefits. This documentation ensures compliance with state verification requirements and helps prevent fraudulent claims. |

| 2 | Social Security Card | The Social Security Card is essential when filing for unemployment benefits as it verifies your identity and ensures accurate processing of your claim. Alongside the card, providing your personal identification number helps link your application to your employment history and tax records efficiently. |

| 3 | Proof of Citizenship or Legal Residency | To file for unemployment benefits, individuals must provide official documentation verifying citizenship or legal residency, such as a U.S. passport, birth certificate, permanent resident card (Green Card), or valid visa with employment authorization. These documents authenticate the applicant's legal right to work and qualify for unemployment compensation under state and federal guidelines. |

| 4 | Recent Pay Stubs | Recent pay stubs are essential for filing unemployment benefits as they verify your earnings and employment history over the past weeks or months. These documents help determine eligibility and calculate the benefit amount based on your reported income. |

| 5 | Employer Separation Notice | An Employer Separation Notice, also known as a Notice of Separation or Separation Letter, is a critical document required to file for unemployment benefits as it verifies the reason for job separation and dates of employment. This document ensures the unemployment agency accurately evaluates eligibility by confirming whether the separation was voluntary, involuntary, or due to misconduct. |

| 6 | Employment History (last 18–24 months) | To file for unemployment benefits, you need detailed employment history covering the last 18 to 24 months, including employer names, addresses, phone numbers, dates of employment, and reasons for separation. Accurate records such as pay stubs, W-2 forms, and tax documents from this period help verify your claim and ensure timely processing. |

| 7 | Employer Contact Information | Essential documents for filing unemployment benefits include detailed employer contact information such as the company's name, address, phone number, and the supervisor's name, which facilitates verification of employment. Accurate employer contact details help expedite claim processing and ensure timely communication between the unemployment office and the employer. |

| 8 | Proof of Address | To file for unemployment benefits, proof of address is required to establish residency within the state where the claim is filed; acceptable documents typically include a utility bill, lease agreement, or government-issued mail displaying the claimant's name and current address. This documentation ensures accurate processing of claims and eligibility verification in accordance with state-specific unemployment insurance regulations. |

| 9 | Bank Account Information (for direct deposit) | To file for unemployment benefits, individuals must provide accurate bank account information, including the bank's routing number and account number, to enable direct deposit of payments. Ensuring these details are correct prevents delays in receiving benefits and fosters efficient processing by state unemployment agencies. |

| 10 | Alien Registration Number (if not a U.S. citizen) | To file for unemployment benefits as a non-U.S. citizen, you must provide your Alien Registration Number (A-Number) along with your Social Security Number and proof of employment history. The Alien Registration Number verifies your immigration status, ensuring eligibility under federal and state unemployment insurance programs. |

| 11 | DD-214 (if ex-military) | To file for unemployment benefits, claimants must provide proof of identity, Social Security number, and recent employment history, with ex-military applicants specifically required to submit their DD-214 form to verify discharge status and service dates. The DD-214 is crucial for establishing eligibility and ensuring accurate benefit determinations for veterans transitioning to civilian employment. |

| 12 | SF-8 or SF-50 (if federal employee) | To file for unemployment benefits, federal employees must provide either the SF-8 form, which details their separation from service, or the SF-50 form, which verifies their federal employment history and status. These documents are essential for confirming eligibility and calculating benefit amounts within the federal unemployment system. |

| 13 | Work Authorization Document (non-citizen workers) | Non-citizen workers must provide a valid Work Authorization Document, such as an Employment Authorization Document (EAD) issued by U.S. Citizenship and Immigration Services (USCIS), to file for unemployment benefits. This document verifies legal eligibility to work in the United States and is essential alongside other identification and wage verification records. |

| 14 | Wage and Tax Statement (W-2 or 1099 form) | To file for unemployment benefits, providing accurate Wage and Tax Statements such as W-2 or 1099 forms is crucial as they verify your earnings and employment history. These documents enable state agencies to determine eligibility and calculate the appropriate benefit amount. |

| 15 | Union Membership Card (if applicable) | To file for unemployment benefits, applicants must provide a Union Membership Card if applicable, as it verifies eligibility through union-affiliated employment. This document supports claims by confirming active union status, which may affect benefit qualification and employer contribution records. |

Introduction to Unemployment Benefits Filing

Filing for unemployment benefits requires specific documentation to verify eligibility and expedite the claim process. Understanding the essential documents can help applicants avoid delays and ensure accurate filing.

- Personal Identification - Valid government-issued ID such as a driver's license or passport is necessary to confirm the claimant's identity.

- Employment History - Recent pay stubs, employer contact information, and details of previous employment are required to establish work history and earnings.

- Reason for Unemployment - Documentation explaining the job separation, like a layoff notice or termination letter, must be provided to determine eligibility criteria.

Legal Eligibility Requirements for Applicants

| Document | Description | Legal Requirement |

|---|---|---|

| Proof of Identity | Valid government-issued ID such as a driver's license, passport, or state ID card. | Confirms applicant's identity to prevent fraud and verify eligibility. |

| Social Security Number (SSN) | Official Social Security card or a document containing the SSN. | Required for employment verification and tax record matching. |

| Employment History | Recent pay stubs, W-2 forms, or employer contact information covering the last 18 months. | Demonstrates sufficient work history and earnings to meet benefit qualifications. |

| Reason for Unemployment | Separation notice, layoff letter, or documented termination reason. | Legal criteria require unemployment to be involuntary and not due to misconduct. |

| Work Authorization | Proof of the legal right to work in the United States such as a green card or work visa. | Only legally authorized workers are eligible for unemployment benefits. |

| Contact Information | Current mailing address, phone number, and email address. | Ensures proper communication and delivery of benefit information. |

Essential Identification Documents Needed

Filing for unemployment benefits requires submitting specific identification documents to verify your identity and eligibility. These essential documents ensure accurate processing of your claim.

- Social Security Card - Verifies your Social Security number, which is critical for record matching and benefit allocation.

- Government-Issued Photo ID - Confirms your identity through a driver's license or passport, ensuring the claimant is the rightful recipient.

- Proof of Residency - Documents such as utility bills or rental agreements establish your state residency for benefit eligibility purposes.

Having these identification documents ready streamlines your unemployment benefits application process.

Proof of Previous Employment Documentation

What proof of previous employment documentation is required to file for unemployment benefits? Employers typically provide a W-2 form or pay stubs that verify your work history and income. These documents help confirm eligibility and ensure accurate benefit calculations.

Income Verification Forms and Statements

Income verification is a crucial component when filing for unemployment benefits. Commonly required documents include recent pay stubs, W-2 forms, or tax returns to confirm prior earnings.

These income verification forms and statements help unemployment agencies determine eligibility and benefit amounts. Accurate and up-to-date income records expedite the claims process and prevent delays.

Separation Notice and Termination Letters

When filing for unemployment benefits, submitting a Separation Notice is essential as it provides official proof of job loss. Termination Letters detail the reasons for your dismissal and support your claim by clarifying employment status. These documents help verify eligibility and expedite the application process efficiently.

Supporting Documentation for Special Circumstances

Filing for unemployment benefits requires specific supporting documentation, especially in special circumstances such as disability, military service, or separation due to domestic violence. Examples include medical records, military discharge papers, and restraining orders to validate eligibility.

Providing accurate and thorough documentation helps ensure timely processing and reduces the risk of claim denial. Proof of prior employment, identification, and correspondence from employers may also be necessary to support your claim in these situations.

Filing Procedures and Submission Guidelines

Filing for unemployment benefits requires specific documents to verify your identity and employment history. Understanding the filing procedures and submission guidelines ensures a smooth application process.

- Proof of Identity - A valid government-issued ID such as a driver's license or passport is required to confirm your identity.

- Employment Records - Recent pay stubs, W-2 forms, or employment termination notices are necessary to establish your work history and reason for unemployment.

- Submission Methods - Documents can typically be submitted online through the state's unemployment portal or mailed directly to the unemployment office according to provided guidelines.

Common Mistakes in Document Submission

Filing for unemployment benefits requires submitting specific documents, including proof of identity, recent pay stubs, and separation notices from your employer. Missing or incorrect paperwork can delay your claim processing time significantly.

Common mistakes in document submission include submitting expired identification, incomplete separation forms, or failing to provide updated contact information. Double-checking the accuracy and completeness of each document prevents unnecessary delays. Proper organization and timely submission improve the chances of a swift approval.

What Documents Are Needed to File for Unemployment Benefits? Infographic