A small business loan application typically requires financial statements, including profit and loss reports, balance sheets, and cash flow statements to demonstrate the business's financial health. Personal and business tax returns from the past two to three years are essential to verify income and assess repayment ability. Lenders also often request a detailed business plan, ownership documents, and legal agreements, such as leases or contracts, to evaluate the business's operations and stability.

What Documents Are Necessary for a Small Business Loan Application?

| Number | Name | Description |

|---|---|---|

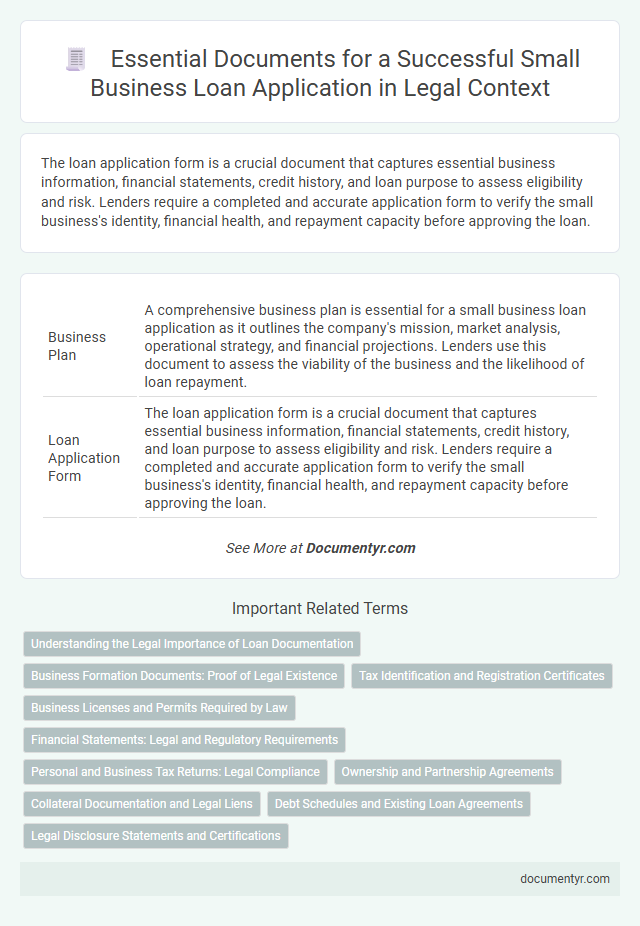

| 1 | Business Plan | A comprehensive business plan is essential for a small business loan application as it outlines the company's mission, market analysis, operational strategy, and financial projections. Lenders use this document to assess the viability of the business and the likelihood of loan repayment. |

| 2 | Loan Application Form | The loan application form is a crucial document that captures essential business information, financial statements, credit history, and loan purpose to assess eligibility and risk. Lenders require a completed and accurate application form to verify the small business's identity, financial health, and repayment capacity before approving the loan. |

| 3 | Personal Identification (e.g., Passport, Driver’s License) | Personal identification documents such as a valid passport or driver's license are essential for verifying the identity of the small business owner during a loan application process. Lenders require these IDs to comply with legal regulations and ensure the applicant's authenticity before approving financing. |

| 4 | Business License or Registration | A valid business license or registration document is essential for a small business loan application, verifying the legal authorization to operate. Lenders require this documentation to confirm the legitimacy and compliance of the business with local, state, or federal regulations. |

| 5 | Articles of Incorporation or Organization | Articles of Incorporation or Organization serve as critical legal documents proving a small business's formal establishment and legitimacy, often required by lenders during the loan application process. These documents verify the business structure and provide essential information such as the company's name, purpose, and registered agent, ensuring compliance with state regulations and facilitating creditworthiness assessment. |

| 6 | Employer Identification Number (EIN) | An Employer Identification Number (EIN) is a critical document required for small business loan applications as it serves as the business's federal tax identification number. Lenders use the EIN to verify the legitimacy of the business and its tax history, making it essential for establishing creditworthiness and processing the loan efficiently. |

| 7 | Business Tax Returns (2–3 years) | Business tax returns from the past 2 to 3 years are essential for small business loan applications as they provide lenders with a verified record of income, expenses, and profitability, demonstrating financial stability and repayment capability. These documents help assess the business's creditworthiness by verifying earnings and ensuring compliance with tax regulations. |

| 8 | Personal Tax Returns (2–3 years) | Personal tax returns from the past 2-3 years serve as critical documentation in a small business loan application, providing lenders with a clear picture of the owner's financial stability and income history. These records validate the applicant's ability to repay the loan by verifying consistent earnings and financial responsibility over multiple years. |

| 9 | Financial Statements (Profit and Loss Statement, Balance Sheet) | Financial statements, including a detailed Profit and Loss Statement and an up-to-date Balance Sheet, are essential for a small business loan application as they provide lenders with critical insights into the company's revenue streams, expenses, assets, liabilities, and overall financial health. Accurate and professionally prepared financial documents demonstrate the business's creditworthiness and ability to repay the loan, significantly influencing the lender's decision-making process. |

| 10 | Bank Statements (Business and Personal, 6–12 months) | Bank statements, both business and personal, covering the past 6 to 12 months are crucial for a small business loan application as they demonstrate cash flow stability and financial health to lenders. These documents provide detailed insights into income, expenses, and overall fiscal management, helping assess creditworthiness and repayment ability. |

| 11 | Accounts Receivable and Payable Aging Reports | Accounts receivable and payable aging reports are critical documents in a small business loan application, providing lenders with detailed insight into the company's cash flow and credit management by categorizing outstanding invoices and bills based on their due dates. These reports demonstrate the business's ability to manage incoming payments and obligations, directly influencing the lender's assessment of financial health and repayment capacity. |

| 12 | Debt Schedule | A detailed debt schedule listing all outstanding debts, including loan amounts, interest rates, payment terms, and creditors, is essential for a small business loan application to assess financial obligations and risk. This document provides lenders with a clear overview of existing liabilities, helping determine the borrower's capacity to manage additional debt. |

| 13 | Collateral Documentation | Collateral documentation for a small business loan application typically includes detailed asset titles, such as real estate deeds, vehicle registrations, and equipment ownership papers, proving the borrower's ability to secure the loan. Lenders also require recent appraisals or valuations to assess collateral worth and lien releases to confirm the absence of existing claims on the assets. |

| 14 | Ownership and Affiliation Documentation | Ownership and affiliation documentation for a small business loan application typically includes personal identification, business licenses, partnership agreements, and articles of incorporation. Lenders require proof of ownership structure and related affiliations to assess liability and financial responsibility accurately. |

| 15 | Lease Agreements or Property Deeds | Lease agreements or property deeds serve as critical collateral documentation in small business loan applications, demonstrating the business's secured assets and financial stability. Lenders require these documents to verify ownership or rental terms, ensuring the property can back the loan and reduce lending risk. |

| 16 | Business Insurance Documents | Business insurance documents required for a small business loan application typically include proof of general liability insurance, property insurance, and workers' compensation coverage. Lenders require these documents to assess risk management practices and ensure the business is protected against potential liabilities during the loan period. |

| 17 | Resumes of Business Owners/Management | Resumes of business owners and management are essential for a small business loan application as they demonstrate the team's expertise, industry experience, and leadership capabilities. Detailed resumes provide lenders with confidence in the business's ability to execute its plans and manage financial responsibilities effectively. |

| 18 | Franchise Agreements (if applicable) | Franchise agreements are essential documents for a small business loan application, outlining the legal relationship between the franchisor and franchisee, including obligations, fees, and territorial rights. Lenders review these agreements to assess business stability, revenue potential, and compliance with franchise terms, influencing loan approval and terms. |

| 19 | Partnership Agreements (if applicable) | Partnership agreements are crucial for small business loan applications involving multiple owners, detailing each partner's roles, ownership percentages, and profit-sharing arrangements to ensure clear legal and financial responsibilities. Lenders require these documents to assess the business structure and verify the legitimacy and stability of the partnership. |

| 20 | Commercial Contracts and Agreements | Commercial contracts and agreements are essential documents for a small business loan application, demonstrating the business's revenue streams, client relationships, and operational commitments. Lenders require executed contracts, purchase orders, and service agreements to assess the stability and predictability of business income and creditworthiness. |

Understanding the Legal Importance of Loan Documentation

Securing a small business loan requires submitting specific legal documents to establish credibility and comply with lender requirements.

Understanding the legal importance of loan documentation ensures proper risk management and protects both borrower and lender rights throughout the loan process.

- Business Financial Statements - These documents provide proof of the company's financial health and ability to repay the loan.

- Legal Business Structure Documentation - Documents such as Articles of Incorporation or Partnership Agreements verify the legal identity and ownership of the business.

- Loan Agreement - This binding contract outlines the terms and conditions, safeguarding legal obligations and protections for both parties.

Business Formation Documents: Proof of Legal Existence

Business formation documents serve as essential proof of legal existence when applying for a small business loan. Lenders require these documents to verify that the business is officially registered and compliant with legal standards.

- Articles of Incorporation - These documents establish a corporation's legal existence and outline its structure.

- Operating Agreement - This agreement defines the ownership and operational procedures for an LLC.

- Business License - A government-issued license confirming the business is authorized to operate within a specific jurisdiction.

Submitting accurate business formation documents enhances the credibility of a loan application and facilitates lender approval.

Tax Identification and Registration Certificates

Applying for a small business loan requires specific documentation to verify your business identity and legitimacy. Tax identification and registration certificates are critical to this process, proving your business is legally recognized and compliant with tax regulations.

- Employer Identification Number (EIN) - This federal tax ID is essential for identifying your business to the IRS and is required for most loan applications.

- Business Registration Certificate - Issued by your state or local government, this document confirms that your business is officially registered and authorized to operate.

- State Tax Registration Certificate - Demonstrates your business is registered for state tax purposes, which lenders often require to verify tax compliance.

Business Licenses and Permits Required by Law

Small business loan applications require specific documentation to verify the legitimacy and compliance of the business. Among the most critical documents are business licenses and permits mandated by local, state, or federal authorities.

These licenses and permits demonstrate that the business operates legally within its industry and jurisdiction. Lenders use these documents to assess risk and ensure the business meets all regulatory requirements before approving a loan.

Financial Statements: Legal and Regulatory Requirements

Financial statements are essential documents for a small business loan application, serving as evidence of your business's financial health. Legal and regulatory requirements mandate that these statements, including balance sheets, income statements, and cash flow statements, comply with Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS). Lenders rely on these accurate and compliant financial reports to assess risk and ensure transparency during the loan approval process.

Personal and Business Tax Returns: Legal Compliance

Personal and business tax returns are critical documents required during a small business loan application process. These tax returns provide lenders with verified financial information to assess your creditworthiness and the stability of your business.

Submitting accurate and complete tax returns ensures compliance with legal regulations and demonstrates transparency to the lender. Failure to provide these documents can result in delays or denial of your loan application due to incomplete legal compliance.

Ownership and Partnership Agreements

Ownership and partnership agreements are critical documents for a small business loan application as they outline the legal structure and ownership distribution. These agreements provide lenders with clarity on decision-making authority and profit-sharing among business partners, ensuring transparency and risk assessment. Including detailed and signed agreements strengthens the loan application by demonstrating stable and organized business governance.

Collateral Documentation and Legal Liens

What collateral documentation is required for a small business loan application? Lenders need proof of assets that can secure the loan, such as real estate, equipment, or inventory. Proper documentation includes titles, deeds, and appraisals to verify the value and ownership of collateral.

How do legal liens affect your small business loan application? Legal liens indicate existing claims against your assets, impacting lender risk assessment. You must provide lien releases or detailed information on outstanding liens to ensure clarity during the loan review process.

Debt Schedules and Existing Loan Agreements

Debt schedules are crucial documents in a small business loan application, detailing all current debts, payment amounts, and schedules. Lenders use this information to assess the business's existing financial obligations and repayment capacity.

Existing loan agreements provide a comprehensive view of the terms, interest rates, and covenants associated with current loans. These documents help lenders evaluate any potential risks or conflicts with new financing. Including accurate debt schedules and loan agreements can improve the chances of loan approval by demonstrating transparency and financial responsibility.

What Documents Are Necessary for a Small Business Loan Application? Infographic