An executor must gather the original will, death certificate, and the decedent's financial records, including bank statements, insurance policies, and property deeds for probate. Court forms required to open probate and inventory the estate are also essential. These documents help establish the executor's authority and facilitate the accurate distribution of assets.

What Documents Does an Executor Need for Probate?

| Number | Name | Description |

|---|---|---|

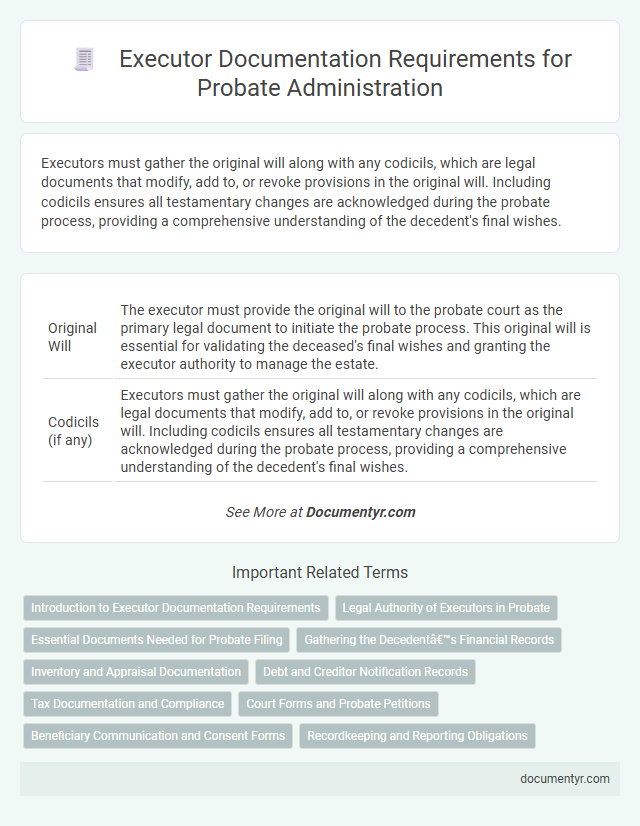

| 1 | Original Will | The executor must provide the original will to the probate court as the primary legal document to initiate the probate process. This original will is essential for validating the deceased's final wishes and granting the executor authority to manage the estate. |

| 2 | Codicils (if any) | Executors must gather the original will along with any codicils, which are legal documents that modify, add to, or revoke provisions in the original will. Including codicils ensures all testamentary changes are acknowledged during the probate process, providing a comprehensive understanding of the decedent's final wishes. |

| 3 | Death Certificate | An executor needs the certified death certificate as a fundamental document to initiate the probate process, providing legal proof of the decedent's passing. This official record is required by courts and financial institutions to activate the will, settle debts, and distribute assets according to the estate plan. |

| 4 | Probate Application Form | The executor must complete the Probate Application Form, which includes the original will, the death certificate, and an inventory of the deceased's assets. This form is submitted to the probate court to legally validate the will and authorize the executor to administer the estate. |

| 5 | Executor’s Identification (ID) | An executor needs valid identification documents such as a government-issued photo ID, Social Security card, and proof of residency to verify their identity during the probate process. Courts require these IDs to confirm the executor's legitimacy and to prevent fraud while administering the decedent's estate. |

| 6 | Affidavit of Executor | An Affidavit of Executor is a critical document required during probate that verifies the executor's authority to manage and distribute the deceased's estate. This affidavit typically includes the executor's personal details, relationship to the deceased, and sworn confirmation of their appointment by the will or court. |

| 7 | Inventory of Assets and Liabilities | An executor needs a comprehensive inventory of assets and liabilities to facilitate the probate process, including detailed documentation of real estate, bank accounts, personal property, investment portfolios, outstanding debts, and any pending financial obligations. This inventory ensures accurate estate valuation and compliance with court requirements for the orderly distribution of assets. |

| 8 | List of Beneficiaries and Heirs | An executor needs a comprehensive list of beneficiaries and heirs to probate the estate, including full names, addresses, and their relationship to the deceased, which ensures accurate distribution of assets. This list often accompanies the deceased's will and is essential for validating claims and facilitating communication during the probate process. |

| 9 | Letters Testamentary (once granted) | Letters Testamentary serve as the official document issued by the probate court that authorizes an executor to administer the deceased's estate, providing legal authority to collect assets, pay debts, and distribute property according to the will. Executors must present the Letters Testamentary to financial institutions, government agencies, and other parties to validate their role and initiate probate processes effectively. |

| 10 | Funeral Bills and Receipts | Executors must collect all funeral bills and receipts as essential probate documents to verify and settle expenses from the deceased's estate accurately. These records support claims for reimbursement and ensure transparent accounting during the probate process. |

| 11 | Title Deeds (Real Estate) | Executors require original title deeds and property ownership documents to verify real estate assets during probate, ensuring the deceased's estate is accurately inventoried and legally transferred. These documents establish clear ownership, assist in property valuation, and facilitate the smooth processing of probate courts and title transfers. |

| 12 | Bank Account Statements | An executor needs bank account statements to provide a detailed record of the deceased's financial transactions, verify account balances, and identify assets for probate. These statements assist in determining outstanding debts, closing accounts, and distributing funds according to the will or state law. |

| 13 | Share Certificates | Share certificates are crucial documents an executor must gather for probate to prove ownership of company shares and facilitate their proper transfer or valuation during estate administration. These certificates serve as official evidence of the decedent's stock holdings, enabling accurate asset inventory and assisting in resolving shareholder rights within the probate process. |

| 14 | Life Insurance Policies | Executors must locate original life insurance policies and contact the insurance company to obtain necessary claim forms and verify beneficiary information for probate proceedings. These documents are crucial to ensure proper distribution of benefits according to the decedent's wishes and state probate laws. |

| 15 | Vehicle Titles and Registrations | Executors must gather the vehicle titles and registrations of the deceased to transfer ownership legally during probate, ensuring clear proof of entitlement. These documents are crucial to update or retitle vehicles, settle any outstanding liens, and comply with state DMV requirements. |

| 16 | Debts and Liability Statements | Executors must collect all debts and liability statements, including creditor claims, loan agreements, and outstanding bills, to accurately assess the estate's financial obligations during probate. Detailed documentation of liabilities ensures proper debt settlement and protects the executor from personal liability. |

| 17 | Tax Returns and Records | Executors must gather all relevant tax returns and financial records, including income tax returns, estate tax returns (Form 706), and gift tax returns, to accurately file the decedent's final taxes and the estate's tax obligations. Detailed documentation of transactions, bank statements, and previous tax filings ensures compliance with IRS regulations and facilitates the probate process. |

| 18 | Marriage Certificate (if applicable) | An executor must include the marriage certificate when submitting probate documents to establish the legal relationship between the deceased and their spouse, which can affect the distribution of assets. This document helps validate spousal rights and ensures accurate processing of the estate according to probate laws. |

| 19 | Birth Certificates (if applicable) | Executors must present original or certified copies of the deceased's birth certificate when required to verify identity and validate family relationships during probate proceedings. This document is crucial in establishing legal heirs, especially if the will is contested or if no will exists. |

| 20 | Letters of Administration (if no will) | Executors handling probate must obtain Letters of Administration when no valid will exists to officially grant them authority to manage the deceased's estate. This legal document, issued by the probate court, empowers the administrator to collect assets, pay debts, and distribute property in accordance with intestacy laws. |

| 21 | Court Fee Payment Receipts | Court fee payment receipts are essential documents an executor must obtain to verify that all probate-related fees have been paid to the court, ensuring compliance with legal procedures. These receipts serve as official proof of transaction and are often required for submitting probate applications and finalizing estate administration. |

| 22 | Notices to Creditors | Executors must provide Notices to Creditors as part of the probate process to inform potential claimants of the decedent's death and allow them to submit valid claims against the estate within a specified timeframe. These notices are typically published in local newspapers and filed with the court to fulfill legal requirements and protect the estate from undisclosed debts. |

| 23 | Renunciation of Executor (if applicable) | The renunciation of executor is a formal legal document required when an appointed executor decides to decline their role in administering an estate, which must be submitted to the probate court to proceed with the appointment of an alternate executor. This document ensures clear legal authority transfer, preventing delays in probate and safeguarding the estate's proper management under jurisdictional probate laws. |

| 24 | Trust Deeds (if applicable) | Executors handling probate must gather Trust Deeds to verify the decedent's assets held in trust and ensure proper distribution according to the trust terms. These documents are essential for validating the trust's provisions and preventing probate delays or disputes. |

Introduction to Executor Documentation Requirements

Executors play a crucial role in managing and distributing a deceased person's estate. Understanding the necessary documentation is essential for a smooth probate process.

Key documents include the original will, the death certificate, and probate application forms. These papers verify the executor's authority and provide legal proof to manage estate affairs.

Legal Authority of Executors in Probate

An executor must provide specific legal documents to establish their authority in probate court. These documents validate your role and empower you to administer the deceased's estate.

The primary document required is the original will, along with the death certificate. The executor must also file a petition for probate to obtain the court's legal authority. Once approved, the court issues Letters Testamentary or Letters of Administration, which serve as official proof of the executor's legal authority to act on behalf of the estate.

Essential Documents Needed for Probate Filing

Filing for probate requires several essential documents to ensure a smooth legal process. These documents validate the executor's authority and the estate's details.

- Death Certificate - An official copy of the decedent's death certificate is necessary to prove the passing officially.

- Will - The original will must be presented to establish the decedent's intentions for asset distribution.

- Petition for Probate - A legal form submitted to start the probate process and request court approval for the executor's role.

- Inventory of Assets - A detailed list of the estate's assets submitted for court review during probate.

- Letters Testamentary or Letters of Administration - Court-issued documents granting the executor legal authority to manage the estate.

Gathering the Decedent’s Financial Records

Gathering the decedent's financial records is a crucial step for an executor during the probate process. These documents provide a clear picture of the deceased's assets, liabilities, and financial status.

Key financial records include bank statements, investment account summaries, and records of outstanding debts. Executors must also collect insurance policies, tax returns, and property deeds to ensure all assets are accounted for accurately.

Inventory and Appraisal Documentation

What documents does an executor need for probate related to inventory and appraisal? Executors must gather a detailed inventory of the deceased's assets, including real estate, bank accounts, and personal property. Accurate appraisals performed by certified professionals are essential to determine the fair market value of these assets for probate court.

Debt and Creditor Notification Records

Executors must gather specific debt and creditor notification records to ensure proper probate administration. These documents help identify and settle outstanding debts of the deceased accurately.

- List of Known Creditors - A detailed inventory of all creditors with outstanding claims against the estate to facilitate notification and debt settlement.

- Proof of Creditor Notification - Copies of mailing receipts or certified letters sent to creditors confirming that debt claims have been officially communicated.

- Debt Statements and Account Balances - Recent statements or account summaries from lenders, credit card companies, and service providers showing current debt amounts owed by the decedent.

Tax Documentation and Compliance

| Document Type | Description | Purpose in Probate | Tax Compliance Importance |

|---|---|---|---|

| Death Certificate | Official record of the deceased's death issued by a government authority. | Required to start the probate process and notify tax authorities. | Confirms date of death for determining fiscal responsibilities and tax deadlines. |

| Last Will and Testament | Legal document describing distribution of assets and appointment of executor. | Guides asset distribution and validates executor authority. | Helps calculate estate taxes and prepare necessary tax returns accurately. |

| Federal Estate Tax Return (Form 706) | U.S. federal tax form filed for estates exceeding the exemption threshold. | Filed to determine estate tax liabilities and report asset values. | Ensures compliance with federal estate tax obligations and prevents penalties. |

| State Estate or Inheritance Tax Returns | State-specific tax forms assessing estate or inheritance taxes. | Required in states imposing estate or inheritance taxes. | Maintains compliance with state tax laws and avoids interest or fines. |

| Final Income Tax Returns | Federal and state income tax returns for the deceased's final tax year. | Filed to report income earned by the deceased up to the date of death. | Ensures correct payment of income taxes and closes out tax accounts. |

| Income Tax Returns for the Estate | Tax returns filed on behalf of the decedent's estate for income generated post-death. | Required for estate income exceeding filing thresholds after death. | Maintains compliance with ongoing income tax responsibilities of the estate. |

| Supporting Financial Records | Bank statements, asset appraisals, receipts, and transaction records. | Used to verify asset values and expenses related to estate administration. | Critical for accurate tax reporting and substantiation during audits. |

| Tax Clearance Certificate | Document issued by tax authorities confirming payment of all required taxes. | May be required before asset distribution or sale of estate property. | Protects executor and beneficiaries from future tax liabilities and penalties. |

Court Forms and Probate Petitions

When managing an estate, an executor must gather specific legal documents to initiate probate. These documents primarily include court forms and probate petitions required by the jurisdiction's probate court.

- Probate Petition - This form formally requests the court to recognize your authority as the executor and begin the probate process.

- Death Certificate - An official copy is necessary to validate the decedent's passing and must accompany the probate petition.

- Inventory and Appraisal Forms - These documents list and value the decedent's assets to inform the court and creditors about the estate's contents.

Submitting these documents accurately ensures your probate case proceeds smoothly and complies with legal requirements.

Beneficiary Communication and Consent Forms

An executor must gather essential documents such as the original will, death certificate, and beneficiary communication and consent forms to initiate probate effectively. Beneficiary communication forms ensure that all heirs are informed about the probate process, their rights, and the distribution timeline. Consent forms from beneficiaries streamline the probate proceedings by confirming their agreement to the will's terms and reducing potential disputes.

What Documents Does an Executor Need for Probate? Infographic