To buy a house in Texas, essential documents include the signed purchase agreement, proof of financing such as a mortgage approval or pre-approval letter, and the seller's property disclosure form. Buyers must also provide identification, such as a government-issued ID, and, upon closing, receive the title deed and closing statement detailing transaction costs. Title insurance and inspection reports are recommended to ensure clear ownership and property condition.

What Documents Are Needed to Buy a House in Texas?

| Number | Name | Description |

|---|---|---|

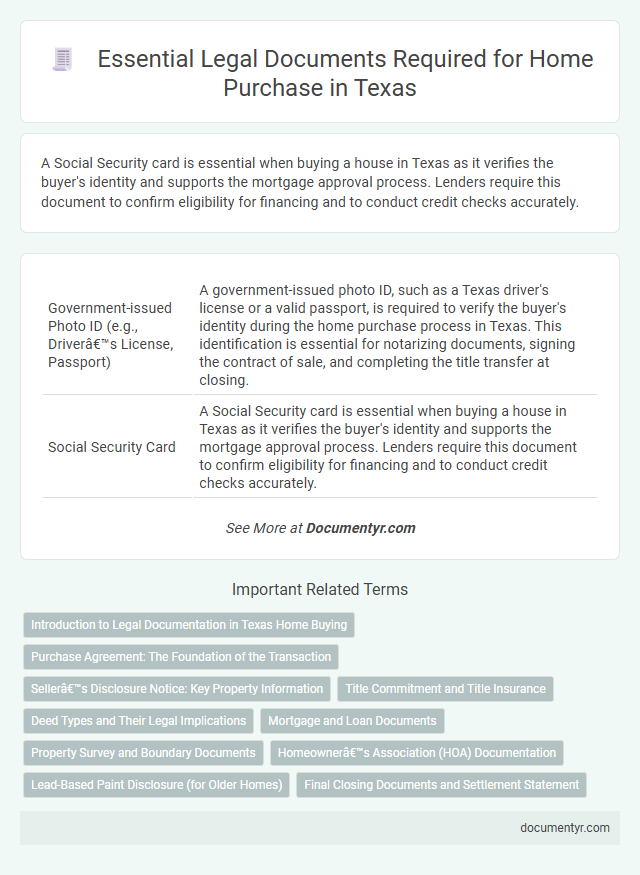

| 1 | Government-issued Photo ID (e.g., Driver’s License, Passport) | A government-issued photo ID, such as a Texas driver's license or a valid passport, is required to verify the buyer's identity during the home purchase process in Texas. This identification is essential for notarizing documents, signing the contract of sale, and completing the title transfer at closing. |

| 2 | Social Security Card | A Social Security card is essential when buying a house in Texas as it verifies the buyer's identity and supports the mortgage approval process. Lenders require this document to confirm eligibility for financing and to conduct credit checks accurately. |

| 3 | Proof of Income (Pay Stubs, Tax Returns, W-2s/1099s) | Proof of income in Texas home buying typically includes pay stubs, tax returns, and W-2 or 1099 forms to verify the buyer's financial stability and ability to repay the mortgage. Lenders require these documents to assess income consistency and comply with Texas real estate financing regulations. |

| 4 | Bank Statements | Bank statements are crucial when buying a house in Texas as they verify financial stability and income consistency to lenders and sellers. These documents typically include recent monthly statements for at least two to three months, showcasing sufficient funds for down payments, closing costs, and other related expenses. |

| 5 | Credit Report Authorization | Credit report authorization is a critical document in Texas home purchases, allowing lenders to verify the buyer's credit history and assess financial stability. This authorization typically accompanies the loan application, ensuring compliance with federal laws such as the Fair Credit Reporting Act (FCRA). |

| 6 | Pre-Approval Letter or Loan Commitment Letter | A Pre-Approval Letter or Loan Commitment Letter is essential when buying a house in Texas, demonstrating the buyer's financial ability to secure a mortgage and strengthening their offer. Lenders issue these documents after verifying income, credit history, and employment, providing sellers confidence in the buyer's purchasing power. |

| 7 | Purchase Agreement (Sales Contract) | The Purchase Agreement, or Sales Contract, is a legally binding document outlining the terms and conditions between buyer and seller in a Texas real estate transaction, including purchase price, contingencies, and closing date. This contract is essential for securing the property and facilitating title transfer, inspections, and financing arrangements. |

| 8 | Earnest Money Deposit Receipt | The Earnest Money Deposit Receipt in Texas serves as a crucial document confirming the buyer's commitment and the initial deposit made toward purchasing a property, protecting both parties during the transaction. This receipt outlines the amount held in escrow and the terms under which the deposit is refundable or forfeited, ensuring legal clarity and trust in the home buying process. |

| 9 | Property Disclosures (Seller’s Disclosure Notice) | The Seller's Disclosure Notice is a crucial document in Texas real estate transactions, requiring sellers to disclose known property defects, past repairs, and environmental hazards. Providing accurate property disclosures ensures compliance with Texas Property Code and protects both buyers and sellers from future legal disputes. |

| 10 | Title Commitment/Title Report | A Title Commitment or Title Report in Texas provides a detailed summary of the property's current ownership status, existing liens, encumbrances, and any title defects that may affect the buyer's rights. This document is essential for ensuring clear title transfer and protecting the buyer from potential legal disputes during the home purchase process. |

| 11 | Homeowners Insurance Proof | Homebuyers in Texas must provide proof of homeowners insurance to finalize a property purchase, ensuring the home is protected against damages from events such as fires, storms, and theft. This insurance document is typically required by lenders before closing to safeguard their investment and confirm the buyer's readiness to assume property risks. |

| 12 | Appraisal Report | The appraisal report is a critical document in the Texas home-buying process, providing an unbiased estimate of the property's market value to protect buyers and lenders. This report, prepared by a licensed appraiser, ensures that the home's sale price aligns with its fair market value and is often required by mortgage lenders before finalizing the loan. |

| 13 | Home Inspection Report | The home inspection report is a critical document required when buying a house in Texas, detailing the condition of the property's structure, electrical systems, plumbing, and HVAC to identify potential issues before purchase. Buyers use this report to negotiate repairs or price adjustments, ensuring informed decision-making and legal protection in the transaction. |

| 14 | Closing Disclosure | The Closing Disclosure is a critical document in Texas home purchases, detailing loan terms, closing costs, and monthly payments to ensure transparency for buyers. Texas buyers must review and sign this document at least three business days before closing, fulfilling federal requirements and preventing last-minute surprises. |

| 15 | Mortgage/Loan Documents | Mortgage pre-approval letters, loan application forms, credit reports, and income verification documents such as pay stubs and tax returns are essential to secure financing when buying a house in Texas. Lenders also require the Loan Estimate, Closing Disclosure, and proof of homeowners insurance to finalize the mortgage process. |

| 16 | Deed (Warranty Deed, Special Warranty Deed, or Trustee’s Deed) | A deed, such as a Warranty Deed, Special Warranty Deed, or Trustee's Deed, is essential when buying a house in Texas as it legally transfers ownership from the seller to the buyer. Each type of deed offers varying levels of protection and guarantees regarding the property's title, with the Warranty Deed providing the broadest warranty against title defects. |

| 17 | Survey or Existing Survey Affidavit | A Survey or Existing Survey Affidavit is a critical document in Texas real estate transactions, providing precise property boundary details and identifying any easements or encroachments that may affect ownership. This survey ensures legal clarity, preventing future disputes by confirming that the property lines align with those recorded in the title deed. |

| 18 | Settlement Statement (ALTA or HUD-1) | The Settlement Statement, either ALTA or HUD-1, is a crucial document in Texas real estate transactions, detailing all financial terms, including closing costs, loan fees, and payments between buyers and sellers. This statement ensures transparency and compliance with Texas property laws, providing a comprehensive record for both parties involved in the home purchase. |

| 19 | Property Tax Statements | Property tax statements are essential documents in the home buying process in Texas, providing detailed information on current tax obligations and assessments tied to the property. Buyers must review these statements to understand the annual tax rates, any outstanding tax liabilities, and potential tax exemptions that may affect the overall cost of ownership. |

| 20 | Homeowner Association (HOA) Documents (if applicable) | Homebuyers in Texas must obtain Homeowner Association (HOA) documents, including the HOA disclosure packet, bylaws, covenants, conditions, and restrictions (CC&Rs), financial statements, and meeting minutes to understand fees, rules, and community regulations. These documents are crucial for legal compliance and to ensure the buyer is aware of any obligations or restrictions before closing the property purchase. |

| 21 | Power of Attorney (if signing on behalf of another party) | A notarized Power of Attorney document is essential when signing home purchase agreements or closing documents on behalf of another party in Texas, ensuring legal authorization and adherence to state laws. This document must clearly specify the grantor's consent and the agent's powers related to the real estate transaction. |

| 22 | Affidavits (Identity, Marital Status, etc.) | Affidavits such as Identity Affidavits and Marital Status Affidavits are crucial documents in the Texas home buying process, verifying the buyer's legal identity and marital condition to ensure clear title transfer and compliance with state laws. These affidavits protect both parties by affirming that no undisclosed spouses or identity discrepancies could affect property ownership rights. |

| 23 | Utility Bills (for address verification, if requested) | Utility bills such as electricity, water, or gas statements serve as essential documents for address verification during the home buying process in Texas, ensuring accurate identification of the buyer's current residence. Lenders or title companies may request recent utility bills to confirm the buyer's legal address and facilitate the closing procedure. |

| 24 | Repair Receipts or Contractor Invoices (if repairs negotiated) | Repair receipts or contractor invoices serve as crucial evidence in Texas real estate transactions when repair costs have been negotiated between buyer and seller, ensuring transparency and accurate adjustment of the home's sale price. These documents must detail services performed, materials used, and costs incurred to validate the agreed-upon repairs and protect the financial interests of both parties during the closing process. |

Introduction to Legal Documentation in Texas Home Buying

Buying a house in Texas requires specific legal documents to ensure a smooth transaction. Understanding these documents helps protect your rights and facilitates compliance with state laws.

Key documents include the purchase agreement, title documents, and loan paperwork. Familiarity with these legal requirements is essential for a successful home purchase in Texas.

Purchase Agreement: The Foundation of the Transaction

In Texas, the purchase agreement serves as the cornerstone document in any real estate transaction. It outlines the terms and conditions agreed upon by the buyer and seller, ensuring a legally binding commitment.

- Purchase Agreement Definition - This contract specifies the price, property details, and contingencies for the sale.

- Legal Significance - It creates enforceable obligations for both parties to complete the transaction under agreed terms.

- Essential Inclusions - The agreement includes timelines, financing arrangements, and disclosures required by Texas law.

The purchase agreement is indispensable for protecting the interests of buyers and sellers throughout the home buying process in Texas.

Seller’s Disclosure Notice: Key Property Information

When buying a house in Texas, the Seller's Disclosure Notice is a crucial document that provides key property information. This notice informs the buyer about any known defects or issues with the property.

The Seller's Disclosure Notice covers important details such as structural problems, plumbing and electrical systems, and environmental hazards. Sellers are legally required to complete this form honestly and thoroughly to protect the buyer. Reviewing this document helps buyers make informed decisions and avoid unexpected expenses after closing.

Title Commitment and Title Insurance

What documents are essential for buying a house in Texas? A Title Commitment is required to outline the terms under which a title company will insure the property. Title Insurance protects you and your lender against potential ownership disputes or liens.

Deed Types and Their Legal Implications

Purchasing a house in Texas requires specific legal documents, including the deed that transfers property ownership. Common deed types include warranty deeds, which guarantee clear title, and quitclaim deeds, which transfer ownership without warranties. Understanding these deed types is crucial for protecting your property rights and avoiding future legal disputes.

Mortgage and Loan Documents

Buying a house in Texas requires several essential mortgage and loan documents to secure your financing. Understanding these documents helps streamline the home purchasing process and ensures compliance with state regulations.

- Loan Application (Form 1003) - This standard document collects detailed borrower information needed to evaluate creditworthiness and loan eligibility.

- Loan Estimate - Provides an outline of estimated interest rates, monthly payments, and closing costs, allowing you to compare loan options effectively.

- Mortgage Note - A legal agreement outlining loan terms, repayment schedule, and borrower obligations binding you to repay the loan under Texas laws.

Property Survey and Boundary Documents

When buying a house in Texas, a property survey is essential to establish the precise boundaries of the land. This document helps identify any encroachments, easements, or discrepancies that could affect property ownership.

Boundary documents in Texas include plats, metes and bounds descriptions, and prior survey reports, which collectively define the property's legal limits. Obtaining accurate boundary documentation ensures clear title transfer and protects buyers from future disputes.

Homeowner’s Association (HOA) Documentation

When purchasing a home in Texas within a community governed by a Homeowner's Association (HOA), certain documents are essential to review. These documents provide information on fees, rules, and the overall management of the HOA, ensuring buyers are fully informed.

- HOA Covenants, Conditions, and Restrictions (CC&Rs) - This document outlines the rules and regulations that homeowners must follow within the community.

- HOA Financial Statements - These statements reveal the financial health of the HOA, including budgets, reserves, and past expenditures.

- HOA Meeting Minutes - Recent meeting minutes offer insight into ongoing issues, community plans, and board decisions affecting homeowners.

Lead-Based Paint Disclosure (for Older Homes)

| Document | Description | Importance |

|---|---|---|

| Lead-Based Paint Disclosure | A federally mandated disclosure for homes built before 1978, informing buyers about potential lead-based paint hazards. Sellers must provide known information and any records or reports about lead-based paint. | Ensures buyers are aware of health risks associated with lead exposure. Required by the Residential Lead-Based Paint Hazard Reduction Act (Title X). Failure to comply can lead to legal penalties. |

| Texas Real Estate Contract | The standard form used to outline terms and conditions of the home purchase agreement. | Legally binding document that governs the transaction. |

| Seller's Disclosure Notice | Details any known material defects or issues with the property that could affect its value or safety. | Protects buyer by providing transparency about the home's condition. |

| Title Commitment and Title Insurance | Confirms ownership and any liens or encumbrances on the property. Title insurance protects buyers from future claims. | Essential for ensuring clear title and legal ownership transfer. |

| Loan Approval Documents | Includes mortgage pre-approval or commitment letter showing financing terms. | Required to confirm buyer's ability to pay for the house. |

What Documents Are Needed to Buy a House in Texas? Infographic