To start an LLC in Florida, you must file the Articles of Organization with the Florida Department of State, Division of Corporations. This document includes key information such as the LLC's name, principal address, registered agent details, and member or manager information. Additionally, obtaining an Employer Identification Number (EIN) from the IRS and creating an Operating Agreement is essential for legal and operational purposes.

What Documents Are Needed to Start an LLC in Florida?

| Number | Name | Description |

|---|---|---|

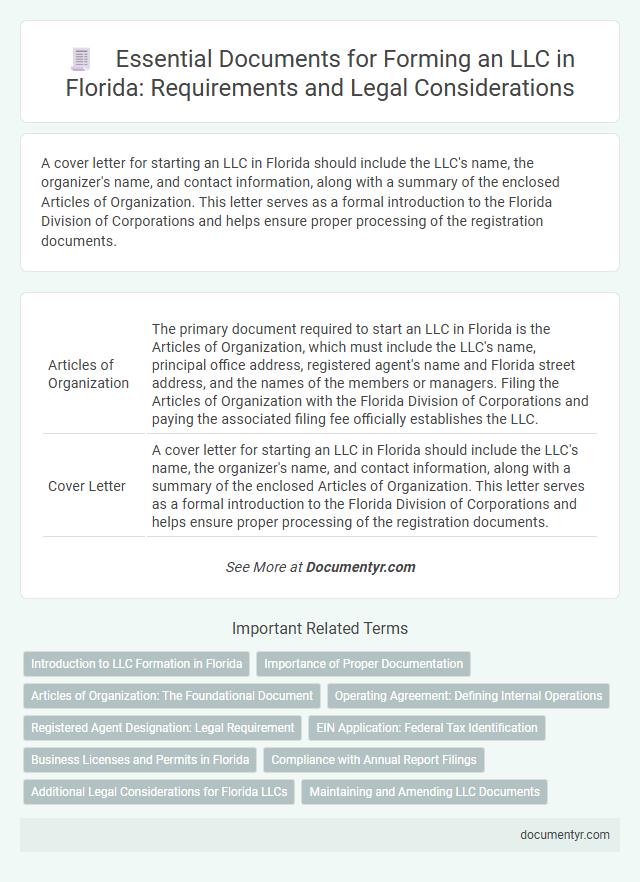

| 1 | Articles of Organization | The primary document required to start an LLC in Florida is the Articles of Organization, which must include the LLC's name, principal office address, registered agent's name and Florida street address, and the names of the members or managers. Filing the Articles of Organization with the Florida Division of Corporations and paying the associated filing fee officially establishes the LLC. |

| 2 | Cover Letter | A cover letter for starting an LLC in Florida should include the LLC's name, the organizer's name, and contact information, along with a summary of the enclosed Articles of Organization. This letter serves as a formal introduction to the Florida Division of Corporations and helps ensure proper processing of the registration documents. |

| 3 | Operating Agreement | An Operating Agreement is a crucial document for forming an LLC in Florida, outlining ownership structure, management roles, and operational procedures. While not mandatory by Florida law, this agreement helps prevent conflicts and provides clear guidelines for members' rights and responsibilities. |

| 4 | Registered Agent Consent Form | Forming an LLC in Florida requires submitting the Articles of Organization along with a Registered Agent Consent Form, which confirms the designated agent's agreement to accept legal documents on behalf of the LLC. The Registered Agent Consent Form is vital for maintaining compliance with Florida Department of State regulations and ensuring timely receipt of service of process and official correspondence. |

| 5 | Name Reservation Application (if applicable) | To start an LLC in Florida, entrepreneurs may need to file a Name Reservation Application if they want to ensure the business name is secured before submitting the Articles of Organization; this application is optional but recommended to avoid name conflicts. The Name Reservation Application is submitted to the Florida Division of Corporations, and it reserves the chosen LLC name for 120 days while the formal registration process is completed. |

| 6 | Certificate of Status (Good Standing, if converting or foreign LLC) | To start an LLC in Florida, you must file the Articles of Organization with the Florida Department of State and obtain a Certificate of Status (Good Standing) if converting an existing business or registering a foreign LLC. The Certificate of Status verifies the LLC's compliance with state regulations and is essential for legal recognition and operation in Florida. |

| 7 | EIN (Employer Identification Number) Application | To start an LLC in Florida, obtaining an Employer Identification Number (EIN) from the IRS is essential for tax reporting, hiring employees, and opening business bank accounts. The EIN application requires submitting Form SS-4 online or by mail, providing key details such as LLC name, formation date, and the responsible party's social security number. |

| 8 | Business License Application (Local/County) | To start an LLC in Florida, a Business License Application must be filed with the local county or municipality where the LLC will operate, ensuring compliance with zoning and business regulations. This application typically requires details such as the LLC's name, registered agent, business location, and the nature of the business activities. |

| 9 | Florida LLC Annual Report (for future compliance) | To maintain good standing and ensure future compliance for a Florida LLC, filing the Florida LLC Annual Report is mandatory each year with the Florida Department of State. This report updates ownership details and business information and must be submitted by May 1st annually to avoid late fees or administrative dissolution. |

| 10 | Professional Licenses (if applicable) | Starting an LLC in Florida requires obtaining professional licenses if the business operates in regulated fields such as healthcare, accounting, or real estate, ensuring compliance with state licensing boards. These licenses must be verified and submitted along with the Articles of Organization and the registered agent information to the Florida Division of Corporations. |

Introduction to LLC Formation in Florida

What documents are needed to start an LLC in Florida? Forming a Limited Liability Company (LLC) in Florida requires submitting the Articles of Organization to the Florida Division of Corporations. This legal document officially creates your LLC and includes essential information such as the company name, principal address, and registered agent details.

Is an Operating Agreement necessary for a Florida LLC? While Florida state law does not mandate an Operating Agreement, having one is highly recommended to outline ownership roles and operating procedures. This internal document helps protect members' interests and provides clarity for managing the LLC.

Do you need an Employer Identification Number (EIN) to open your LLC bank account? The EIN, issued by the Internal Revenue Service (IRS), serves as the LLC's federal tax identification number. Obtaining an EIN is required for tax reporting and is essential for opening business bank accounts and hiring employees.

Importance of Proper Documentation

Starting an LLC in Florida requires specific legal documents to ensure compliance with state regulations. Proper documentation serves as the foundation for your business's legal standing and operational framework.

The primary document needed is the Articles of Organization, which officially registers your LLC with the Florida Department of State. Additionally, an Operating Agreement is crucial as it outlines the ownership structure and management policies, protecting members' rights.

Articles of Organization: The Foundational Document

Starting an LLC in Florida requires filing the Articles of Organization with the Florida Department of State. This document officially establishes the LLC as a legal entity recognized by the state.

The Articles of Organization include essential information such as the LLC's name, principal office address, and the registered agent's contact details. Filing this foundational document is the first and most crucial step in forming an LLC in Florida.

Operating Agreement: Defining Internal Operations

Starting an LLC in Florida requires several key documents, with the Operating Agreement being essential to define internal operations. This document outlines management structure, member roles, and profit distribution to ensure smooth business functioning.

- Operating Agreement - Specifies member responsibilities and governance procedures within the LLC.

- Articles of Organization - Officially registers the LLC with the Florida Department of State.

- Federal EIN - Obtained from the IRS for tax identification and hiring employees.

Registered Agent Designation: Legal Requirement

| Document | Description | Purpose |

|---|---|---|

| Articles of Organization | Official form filed with the Florida Department of State to formally create the LLC. | Establishes the LLC's legal existence in Florida. |

| Registered Agent Designation | Document naming a Florida-registered agent authorized to receive legal and tax documents on behalf of the LLC. | Required by Florida law to maintain a registered agent with a physical address in the state for service of process. |

| Operating Agreement | Internal document outlining the LLC's ownership structure and management rules. | Not mandatory in Florida but strongly recommended to define your LLC's operational framework. |

| Federal Employer Identification Number (EIN) | Issued by the IRS, used to identify the business for tax purposes. | Necessary for hiring employees, opening bank accounts, and filing taxes. |

Registered Agent Designation: Legal Requirement

Every LLC in Florida must designate a registered agent when submitting the Articles of Organization. Your registered agent must have a physical address in Florida and be available during normal business hours. This requirement ensures that official government communications and legal documents can be reliably delivered to your LLC. Failure to maintain a registered agent may result in administrative dissolution of your LLC. Selecting a qualified registered agent safeguards compliance and helps protect your business interests.

EIN Application: Federal Tax Identification

To start an LLC in Florida, certain documents are essential, including the Articles of Organization and the EIN application. The EIN, or Employer Identification Number, acts as a Federal Tax Identification used by the IRS to identify your business for tax purposes.

The EIN application is submitted via IRS Form SS-4 and is required for hiring employees, opening a bank account, and filing taxes. Obtaining an EIN grants your LLC a unique identifier for all federal tax-related activities. This process is usually completed online, providing immediate confirmation of your Federal Tax Identification.

Business Licenses and Permits in Florida

To start an LLC in Florida, securing the appropriate business licenses and permits is essential for legal operation. Requirements vary based on the LLC's industry, location, and activities, including local business tax receipts and state-specific permits. Entrepreneurs must consult Florida's Department of Business and Professional Regulation and local government agencies to ensure compliance with all licensing and permitting obligations.

Compliance with Annual Report Filings

To start an LLC in Florida, you must file the Articles of Organization with the Florida Department of State. Compliance with annual report filings is essential to maintain active status, requiring submission each year by May 1st. Failure to file the annual report results in administrative dissolution and potential loss of good standing.

Additional Legal Considerations for Florida LLCs

Starting an LLC in Florida requires careful attention to specific legal documents and compliance matters. Understanding additional legal considerations ensures your LLC operates smoothly under Florida law.

- Articles of Organization - Official filing document submitted to the Florida Division of Corporations to legally form the LLC.

- Operating Agreement - Internal document outlining ownership, management structure, and operational guidelines of the LLC.

- Annual Report - Mandatory yearly submission to maintain active status and good standing with the state of Florida.

What Documents Are Needed to Start an LLC in Florida? Infographic