A real estate closing in Texas requires several key documents, including the deed, title insurance policy, loan documents, and the closing disclosure form. Buyers and sellers must also provide identification, the purchase agreement, and property tax statements. Ensuring all documents are accurate and complete is essential for a smooth and legally compliant transaction.

What Documents Are Required for a Real Estate Closing in Texas?

| Number | Name | Description |

|---|---|---|

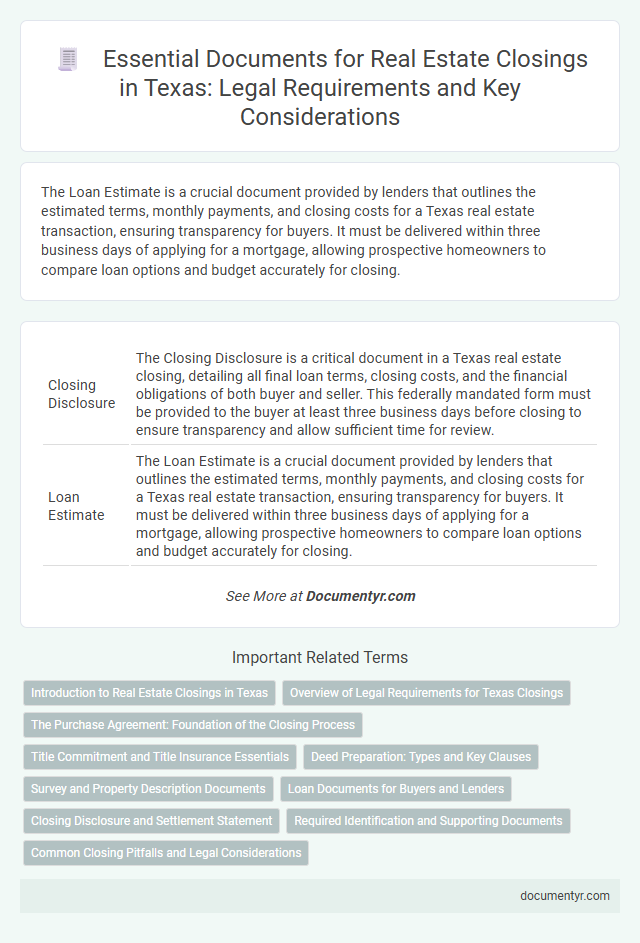

| 1 | Closing Disclosure | The Closing Disclosure is a critical document in a Texas real estate closing, detailing all final loan terms, closing costs, and the financial obligations of both buyer and seller. This federally mandated form must be provided to the buyer at least three business days before closing to ensure transparency and allow sufficient time for review. |

| 2 | Loan Estimate | The Loan Estimate is a crucial document provided by lenders that outlines the estimated terms, monthly payments, and closing costs for a Texas real estate transaction, ensuring transparency for buyers. It must be delivered within three business days of applying for a mortgage, allowing prospective homeowners to compare loan options and budget accurately for closing. |

| 3 | Deed | The deed, a critical document in a Texas real estate closing, must be a properly executed and notarized warranty deed or grant deed that transfers ownership from the seller to the buyer, clearly describing the property's legal description. This document ensures the buyer receives clear title and is a key requirement to finalize the transfer and record the transaction with the county clerk. |

| 4 | Promissory Note | The promissory note is a crucial document in Texas real estate closings, serving as a legally binding promise by the buyer to repay the loan under agreed terms. This note outlines the loan amount, interest rate, payment schedule, and consequences of default, ensuring clarity and enforceability in the transaction. |

| 5 | Deed of Trust | The Deed of Trust is a critical document in Texas real estate closings, serving as security for the lender by transferring legal title of the property to a trustee until the loan is paid. This document must be accurately drafted, notarized, and recorded with the county clerk to ensure the enforceability of the mortgage lien and clear title transfer during the closing process. |

| 6 | Bill of Sale | The Bill of Sale is a crucial document in a Texas real estate closing, serving as legal proof of the transfer of personal property included in the sale, such as appliances or fixtures. This document must clearly describe the items being transferred and be signed by both buyer and seller to ensure a smooth transaction and protect both parties' interests. |

| 7 | Title Commitment | A Title Commitment in Texas real estate closings serves as a crucial document providing a preliminary report of the property's title status, listing any liens, encumbrances, or restrictions. This document ensures all parties are informed of potential title issues before finalizing the transaction, protecting buyers and lenders from future legal claims. |

| 8 | Title Insurance Policy | The Title Insurance Policy is a critical document in a Texas real estate closing, providing protection against potential title defects and disputes that may arise after the transaction. This policy ensures the buyer and lender are safeguarded against losses from liens, encumbrances, or ownership issues that were not discovered during the title search. |

| 9 | Survey | A current boundary survey prepared by a licensed Texas surveyor is essential for a real estate closing to verify property lines and identify easements or encroachments. This survey ensures accurate legal descriptions and supports title insurance requirements throughout the closing process. |

| 10 | Property Tax Certificate | The Property Tax Certificate is a crucial document in a Texas real estate closing, verifying that all property taxes have been paid or are current, which protects both buyer and seller from outstanding tax liabilities. This certificate, issued by the county tax office, ensures the property is free from tax liens and is typically required before the closing process can be finalized. |

| 11 | Homeowner’s Insurance Proof | Homeowner's insurance proof is a critical document required for a real estate closing in Texas to ensure the property is protected against potential damages or losses from hazards. Lenders mandate this insurance verification to confirm the buyer has secured adequate coverage before the transaction finalizes, protecting both the homeowner and the lender's investment. |

| 12 | HOA Documents | HOA documents required for a real estate closing in Texas include the current declaration of covenants, conditions, and restrictions (CC&Rs), bylaws, and rules and regulations, which outline the property's governance and homeowner obligations. Sellers must also provide the resale certificate containing financial statements and any pending assessments, essential for buyers to understand the HOA's financial health and potential liabilities. |

| 13 | Buyer’s Identification | Buyers must provide a valid government-issued photo identification, such as a Texas driver's license or passport, to verify their identity during a real estate closing in Texas. This ensures compliance with state regulations and helps prevent fraud in the transaction. |

| 14 | Seller’s Identification | Sellers in a Texas real estate closing must provide valid government-issued photo identification, such as a driver's license or passport, to verify their identity and ensure compliance with state regulations. This identification is critical for notarizing documents and completing the transaction securely and legally. |

| 15 | Affidavit of Title | The Affidavit of Title is a crucial document in a Texas real estate closing that affirms the seller's legal ownership and guarantees the property is free of liens or encumbrances. This sworn statement protects the buyer and lender by confirming clear title and disclosing any potential legal issues affecting the property. |

| 16 | Settlement Statement | The Settlement Statement, also known as the Closing Disclosure, is a critical document required for a real estate closing in Texas, detailing all financial transactions between the buyer, seller, and lender. This document ensures transparency by itemizing loan terms, closing costs, taxes, and fees, and must be reviewed and signed by all parties prior to the finalization of the property transfer. |

| 17 | Lender’s Closing Instructions | Lender's Closing Instructions in Texas real estate transactions outline specific documentation requirements such as the loan commitment letter, title insurance policy, and a HUD-1 Settlement Statement to ensure compliance with lender guidelines. These instructions also mandate verification of buyer identification, appraisal reports, and final loan disclosures to facilitate a smooth closing process. |

| 18 | Payoff Statement (for seller’s mortgage) | A Payoff Statement is a crucial document in a Texas real estate closing, detailing the exact amount needed to fully satisfy the seller's mortgage with the lender. This statement must be obtained by the seller's title company or closing agent to ensure the seller's mortgage is properly paid off and released at closing. |

| 19 | Release of Lien | The release of lien is a critical document in Texas real estate closings, ensuring that any existing claims or encumbrances on the property are formally removed before ownership transfers. This document protects both buyers and lenders by confirming that previous liens, such as mortgages or tax debts, have been fully satisfied and discharged. |

| 20 | IRS Form 1099-S | IRS Form 1099-S is required in Texas real estate closings to report gross proceeds from the sale or exchange of real estate to the Internal Revenue Service, ensuring compliance with federal tax regulations. The closing attorney or title company typically handles the filing of Form 1099-S, which must include details such as the seller's taxpayer identification number, the date of closing, and the gross proceeds amount. |

| 21 | General Warranty Deed or Special Warranty Deed | A General Warranty Deed in Texas guarantees the seller holds clear title to the property, transferring full ownership to the buyer with protections against any past claims, while a Special Warranty Deed limits this guarantee to only claims arising during the seller's ownership. Both documents are essential for real estate closings in Texas as they establish legal ownership and ensure the buyer's rights are protected against title defects. |

Introduction to Real Estate Closings in Texas

Real estate closings in Texas involve finalizing the legal transfer of property ownership between buyer and seller. This process requires several important documents to ensure a smooth and legally binding transaction.

- Promissory Note - Outlines the buyer's promise to repay the mortgage loan under agreed terms.

- Deed of Trust - Secures the loan by placing a lien on the property, protecting the lender's interest.

- Settlement Statement - Details all financial transactions and closing costs involved in the sale.

You must prepare these critical documents to successfully complete your Texas real estate closing.

Overview of Legal Requirements for Texas Closings

Real estate closings in Texas require strict adherence to legal documentation to ensure a valid transfer of property ownership. Understanding the essential documents helps streamline your closing process and avoid delays.

- Title Policy - This document verifies the property's ownership status and any liens or encumbrances affecting it.

- Deed - The legal instrument that officially transfers ownership from the seller to the buyer in Texas.

- Closing Disclosure - A detailed statement outlining all costs involved in the transaction, required by Texas law to be provided before closing.

The Purchase Agreement: Foundation of the Closing Process

The Purchase Agreement serves as the foundation of the real estate closing process in Texas, outlining the terms and conditions agreed upon by the buyer and seller. This legally binding document details essential information such as the sale price, property description, financing arrangements, and timelines for inspections and closing. Having a clear and comprehensive Purchase Agreement ensures a smoother transaction and protects the interests of all parties involved.

Title Commitment and Title Insurance Essentials

| Document | Description | Importance |

|---|---|---|

| Title Commitment | A preliminary report issued by the title company outlining the current ownership and any liens, encumbrances, or defects affecting the property's title. | Ensures the buyer receives clear ownership and identifies issues to resolve before closing. |

| Title Insurance Policy | A policy protecting the buyer and lender against losses from title defects, liens, or disputes arising after closing. | Provides financial protection and peace of mind over the property's title validity. |

| Property Deed | The official legal document transferring ownership from seller to buyer. | Confirms and records the change of ownership with county records post-closing. |

| Closing Statement (HUD-1 or Closing Disclosure) | Details all costs, fees, and financial terms related to the transaction for both buyer and seller. | Ensures clarity on all amounts due at closing and prevents financial disputes. |

| Loan Documents | Papers related to mortgage financing, including promissory notes and deeds of trust. | Formalizes the loan agreement and secures the lender's interest in the property. |

Deed Preparation: Types and Key Clauses

Deed preparation is a crucial step in a real estate closing in Texas, ensuring proper legal transfer of property ownership. Understanding the types of deeds and key clauses helps protect your interests in the transaction.

- General Warranty Deed - This deed provides the buyer with the broadest protection, guaranteeing clear title free from any claims or encumbrances.

- Special Warranty Deed - Offers limited protection, covering only defects that arose during the seller's ownership period.

- Key Clauses in Deeds - Essential clauses include the grantor and grantee names, legal description of the property, and the habendum clause defining ownership rights.

Survey and Property Description Documents

In Texas real estate closings, survey and property description documents are essential for verifying the exact boundaries and legal details of the property. A current land survey provides a precise map that outlines property lines, easements, and any encroachments, protecting both buyer and seller from future disputes.

The property description document, often found in the deed, uses legal terms to define the property's dimensions and location within county records. Accurate property descriptions ensure the transaction aligns with title insurance requirements and state regulations, securing ownership rights under Texas law.

Loan Documents for Buyers and Lenders

Loan documents are essential for buyers and lenders during a real estate closing in Texas. These documents verify the terms of the mortgage agreement and ensure compliance with state regulations.

You will need to provide the promissory note, deed of trust, and loan application among other paperwork. Lenders typically require disclosures such as the Good Faith Estimate and the Closing Disclosure to detail loan costs and terms.

Closing Disclosure and Settlement Statement

In Texas real estate closings, the Closing Disclosure and the Settlement Statement are essential documents. These papers provide a detailed account of all costs and terms involved in the transaction.

The Closing Disclosure outlines the final loan terms and closing costs for the buyer, ensuring transparency. Texas law requires lenders to provide this document at least three days before closing. The Settlement Statement complements this by itemizing all fees and payments from both buyer and seller, facilitating a smooth financial exchange during closing.

Required Identification and Supporting Documents

What documents are required for a real estate closing in Texas regarding identification and supporting paperwork? You must provide a government-issued photo ID, such as a driver's license or passport, to verify your identity. Supporting documents may include the closing disclosure, proof of homeowners insurance, and any lender-required paperwork.

What Documents Are Required for a Real Estate Closing in Texas? Infographic